Bull Market — Case For 2025 Top

It’s July 2025, and Bitcoin has shot past $100k.

Retail investors are flooding in, and altseason is heating up.

Is this just a dream or the real thing? With strong macro trends and technical analysis to back it up, it’s looking like reality to me.

In this post, I’m diving into two critical areas to make the case for a market peak in 2025:

1. Macro Analysis

2. Technical Analysis (TA)

Macro gives us the big picture, while TA maps out the journey.

Why the second half of 2025?

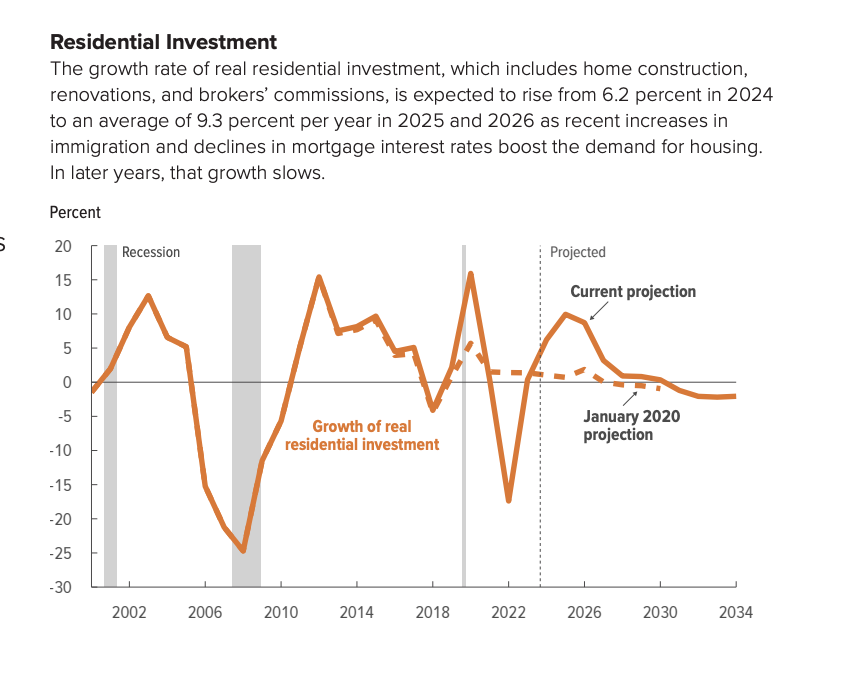

1/ Growth in Residential Investment:

Yes, really. Real estate is a massive asset class, with money pouring in from all angles. It influences liquidity trends, including home construction, renovations, and broker commissions.

Expectations are for residential investment to jump from 6.2% in 2024 to an average of 9.3% annually through 2025–2026, driven by factors like rising immigration and lower mortgage rates. This points to a peak in 2025.

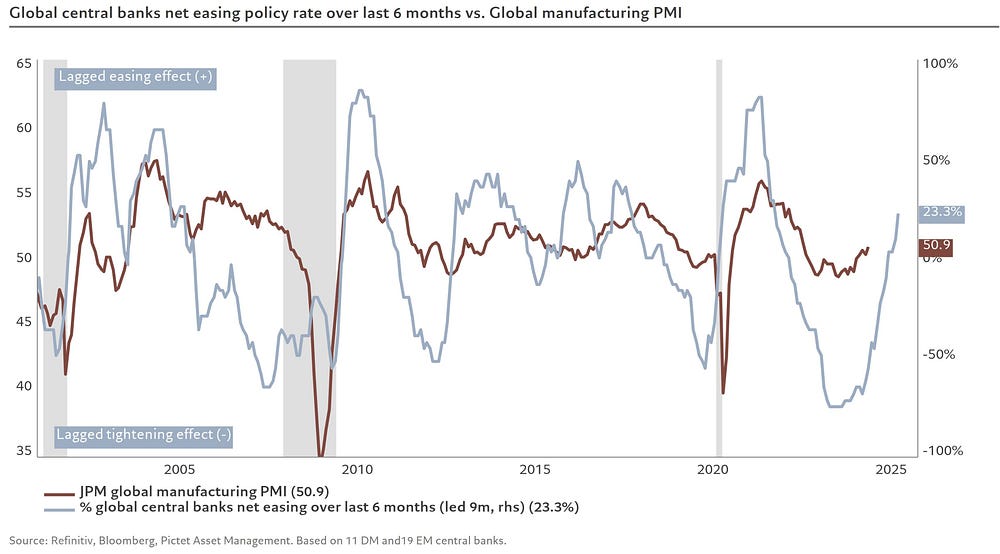

2/ Global Central Bank Easing:

Central banks are likely to cut rates to manage debt and stave off growth slowdowns. The result? A surge in liquidity.

Purchasing Managers’ Index (PMI) to Peak in H2 2025

Current debt projections suggest PMI will peak in the latter half of 2025, likely aligning with the climax of the bull run.

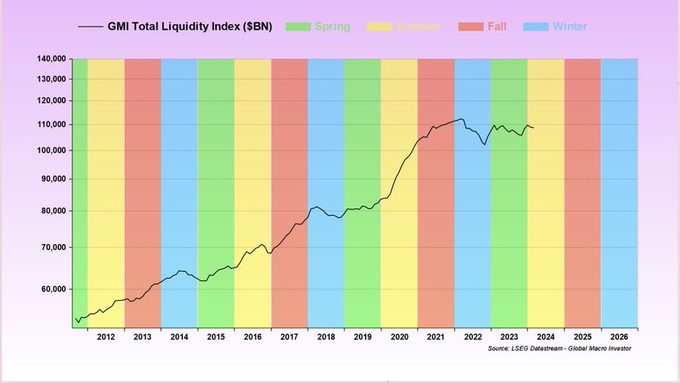

The 4-Year Global Liquidity Cycle

This fits into the observed 4-year global liquidity cycle since 2008. Bull market peaks tend to coincide with the fall phase of this cycle, which is expected in mid-2025.

TA Overview

In TA, larger timeframes provide more reliable trends. The principle of “when in doubt, zoom out” is key here. We’ll look at Bitcoin’s patterns across previous cycles.

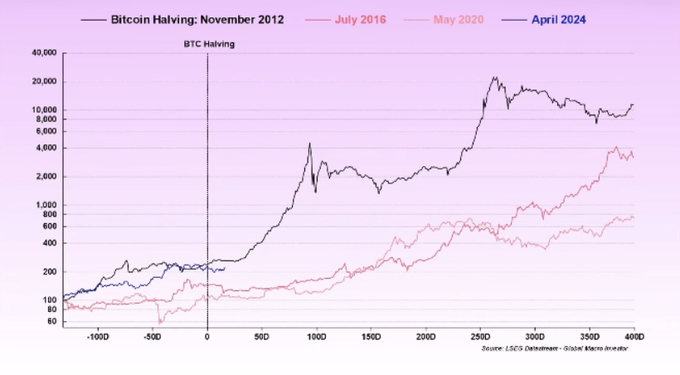

Why 4-Year Cycles?

Bitcoin historically moves through bull and bear markets every four years, coinciding with:

- The global liquidity cycle (since 2008)

- Bitcoin halving events (starting in 2012)

- Election seasons (2008, 2012, etc.)

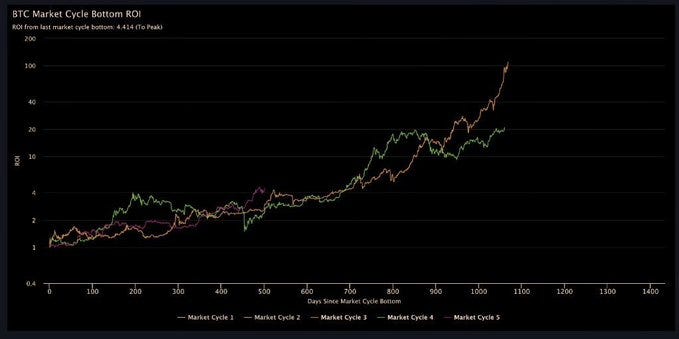

Bitcoin ROI From Cycle Low:

Looking at Bitcoin’s return on investment from its cycle low offers a valuable perspective. This current cycle shows more growth potential compared to past ones.

Bitcoin ROI After Market Cycle Peak:

From the April 2021 peak, current data indicates we are ahead of previous cycles. Historically, Bitcoin should be down about 60% from its all-time high at this stage, roughly around $30k.

A Potential Peak in Q4 2025?

Unlike previous cycles, new Bitcoin ATHs have occurred before the halving. We’ve also seen an extended consolidation below prior ATHs. Based on past patterns, a peak in Q4 2025 is plausible.

Bitcoin ROI After Halving Event:

Current post-halving consolidation is normal. Historically, peaks occur at least 200 days after the halving.

Getting Detailed:

Adhering to the 4-year cycle, a peak could still be distant. Historically, cycles span 33–35 months from low to high, suggesting October 2025 could be the exact peak.

Will It Be Smooth?

Probably not. A significant gap between the 10-month moving average and the price indicates potential corrections.

The Case for a 2024 Top:

Despite strong evidence for a 2025 peak, it’s not a certainty. Some argue for a peak later in 2024 or even that we’ve already peaked. Here are 4 points.

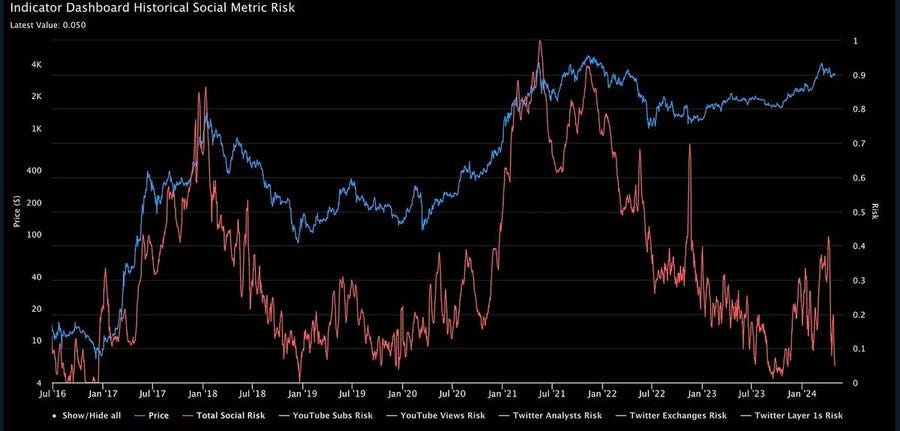

Right now, even with Bitcoin hitting new highs, social risk remains incredibly low. This is crucial for altcoins because their growth heavily depends on social buzz. The current lack of mainstream attention on altcoins suggests they have limited growth potential. While Bitcoin might be gearing up for a super cycle, altcoins could lose steam quickly, especially as they become more saturated.

However, this could change if retail interest picks up again. Early acceptance of an ETH ETF, further tokenization efforts by traditional finance, or a surge in memecoins could reignite interest.

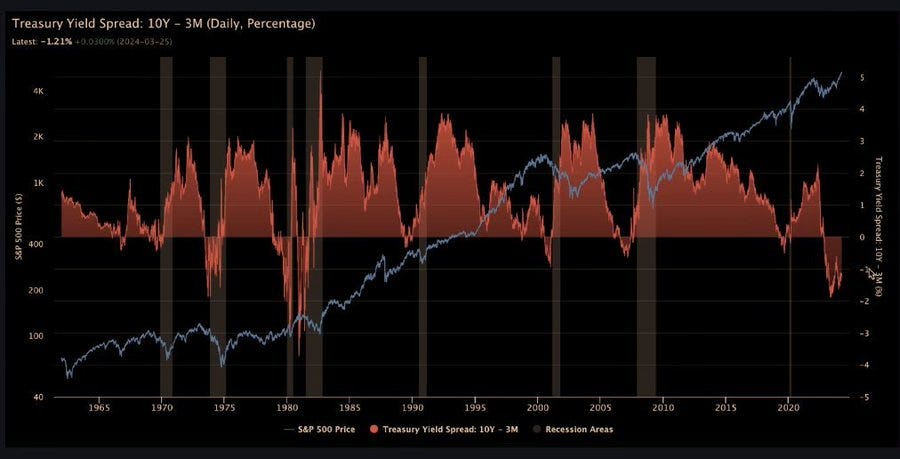

2. Treasury Yield Spreads:

Treasury yield spreads are key indicators of economic cycles. Historically, inverted yield curves have signaled upcoming recessions. By analyzing past cycles with similar conditions, we can gain insights into what might happen next:

1. Post-WWII 1948: Significant money printing and economic struggles led to a peak in June, during an election year.

2. Year of 1966: A bear market followed by a rally resulted in a recession and a market top in December.

3. The Dotcom Bubble 2000: Peaked in March, sharply declined in April, and saw a rally until Q3 before a recession.

Each of these peaks occurred during election years, similar to what we might see in 2024.

3. The April & Q4 Pattern:

April has historically been pivotal in election years, often aligning with Bitcoin halving events. The market tends to form a local top in April, surpassing this peak in Q4 to reach the cycle top. This pattern was evident in April and Q4 of 2013 and 2021. If this year follows suit, we might see a similar trend in 2024. However, to avoid front-loading the cycle, we shouldn’t see a local high before Q4.

4. Rate Cuts + BTC Dominance:

This section requires careful consideration, as it outlines a complex but important scenario:

1. Anticipated Rate Cuts: The first rate cut is expected in June, with the market anticipating three cuts, similar to 2019.

2. Impact on Crypto Dynamics: Historically, rate cuts and rising Bitcoin dominance lead to a cooling period lasting about six months.

3. Why Does BTC Dominance Fall? The slowdown in Bitcoin after rate cuts is due to capital redistribution at the end of a rate-hiking cycle.

4. Capital Redistribution Effects: Capital shifts towards riskier, smaller-cap assets, driven by expectations of looser monetary policy.

5. Market Correction Mechanisms: This shift can destabilize the market, causing corrections and exposing reliance on blue-chip assets for stability and growth.

6. Crypto Market Response: ALT/BTC pairs may bottom out, while ALT/USD pairs decline, similar to patterns seen in September 2019. Bitcoin generally remains stable, outperforming altcoins.

7. Forecasting Market Trends: If the market doesn’t cool off in Q3/Q4, it suggests the changes were anticipated, potentially leading to a market top in 2024 due to front-running and speculation overload.

Conclusion:

Before diving into the analysis, consider the strong case for a 2025+ peak in my earlier part of this post. The data and patterns discussed here highlight potential scenarios, but the ever-evolving market dynamics mean we must stay adaptable and ready for shifts in trends.

Key points to note:

Likely macro peak in H2 2025

- Driven by central bank easing and increased liquidity

- Bitcoin’s 4-year cycle supports a 2025 peak

- Possible but less likely peak in 2024

- Summer consolidation is a healthy sign

So, where does this leave us?

Navigating through these indicators, it’s clear that both macro and technical analyses paint a compelling picture for a peak in late 2025. However, the market is inherently unpredictable, and there are always variables that could shift the timeline. Here are a few additional thoughts:

Potential Wildcards:

Geopolitical Events: Unforeseen geopolitical events could drastically impact global markets, either accelerating or delaying the peak.

Technological Advancements: Breakthroughs in blockchain technology or major shifts in how cryptocurrencies are utilized could influence market dynamics.

Regulatory Changes: New regulations, either restrictive or supportive, could significantly alter the crypto landscape.

Investor Sentiment:

The psychology of investors plays a crucial role. Fear and greed cycles can cause sharp deviations from expected patterns. Keeping an eye on sentiment indicators can provide additional insights.

Alternative Scenarios:

While a peak in H2 2025 seems likely, we shouldn’t ignore alternative scenarios:

Early Peak: If economic conditions improve rapidly or if there’s a sudden influx of institutional investment, we might see an earlier peak, possibly in late 2024.

Extended Cycle: Conversely, if growth is more gradual, we could see the cycle extend beyond 2025, especially if central banks delay rate cuts.

Risk Management:

Regardless of predictions, it’s essential to have a solid risk management strategy. Diversifying investments, setting stop-losses, and being prepared for volatility can help navigate these uncertain waters.

Looking Ahead:

As we move closer to the anticipated peak, continuously updating our analysis with the latest data will be crucial. Staying adaptable and open to new information will be key to making informed decisions.

In summary, while the evidence points towards a significant peak in late 2025, the crypto market is anything but predictable. By considering a range of scenarios and maintaining a flexible approach, we can better prepare for whatever the market throws our way.

Credits: @intocryptoverse , @DistilledCrypto (twitter)

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)