It’s a cycle, and those who’ve been through it know how explosive things can get once we’re in the bull stage. Right now, we’re in the accumulation phase, and if you’re serious about capitalizing on the next big run, the most critical thing is to buy before that bull market truly takes off.

But here’s the tricky part: Many people love to throw around the phrase “buy the dip.” You’ve probably heard it a hundred times, but no one seems to really break down how you actually go about doing it. Everyone talks about waiting for the perfect low, but how do you know when that low is here? The answer is, you can’t — at least not with certainty.

So, let’s change that. I’m going to lay out a comprehensive playbook on how to buy the dips the right way, and this will give you a practical, actionable approach that’s way better than just guessing. This is how I’ve been navigating the market, and it’s kept me grounded even through massive volatility. Let’s dive in.

1/ “Buying the Dip” Means More Than Timing the Perfect Low

Most people think buying the dip is as simple as making one big purchase when they believe the market has bottomed. The reality? It’s a lot more complicated than that. You can’t predict the exact bottom — nobody can. So, instead of trying to nail it with a single purchase, we need a better, more calculated approach.

Think of it like this: When the market dips, it doesn’t just dip once. You might see several mini dips on the way down before the market finds its footing. That’s why guessing the perfect dip is a losing game for most people.

2/ What Should You Buy?

The first step in buying dips successfully is knowing what to buy. This is critical because not all assets bounce back equally in a bull market. Some altcoins will give you 10x returns, while others might fade into irrelevance.

Right now, a few key narratives are dominating the space — AI, RWAs (real-world assets), Memecoins, and DeFi. These are the areas you should focus on. For instance, in the AI space, look for tokens tied to real utility and innovation. In Memecoins, keep an eye on community engagement and virality.

Here’s what I do: I spend at least an hour scanning through tokens on platforms like @CryptoRank_io. I look for projects with solid charts, active communities, and meaningful utility — unless, of course, we’re talking about Memecoins, where community hype is the primary driver.

For example, during the last cycle, I identified a small AI token that had a strong team and active development. I entered it early, and over the next few months, it gave me a 5x return.

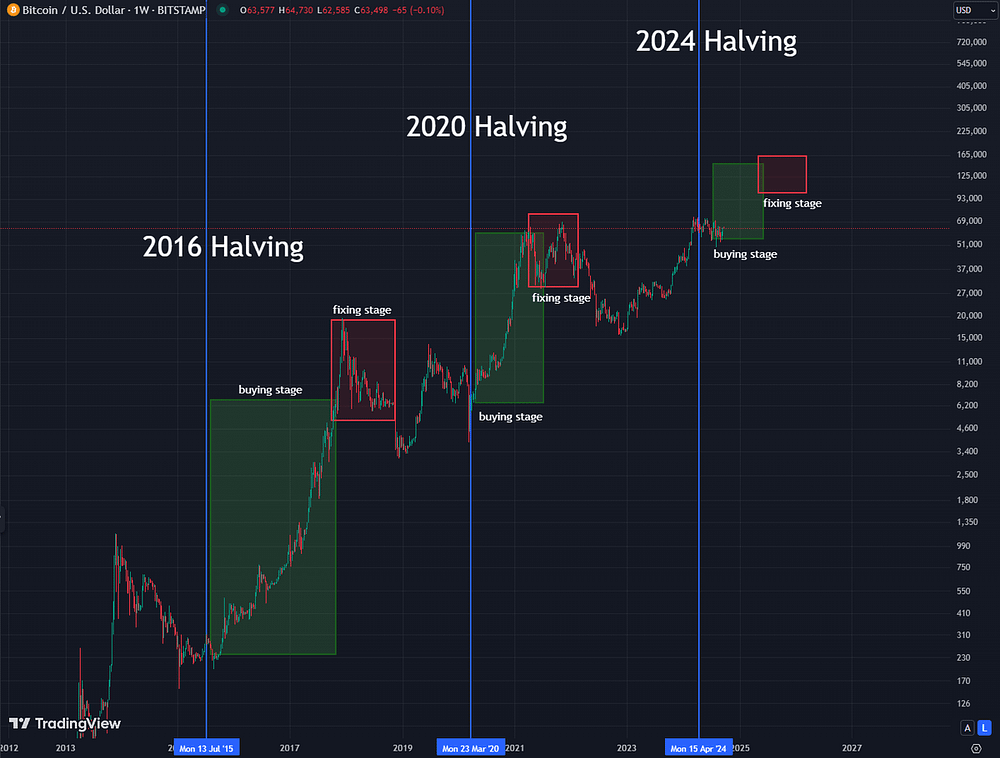

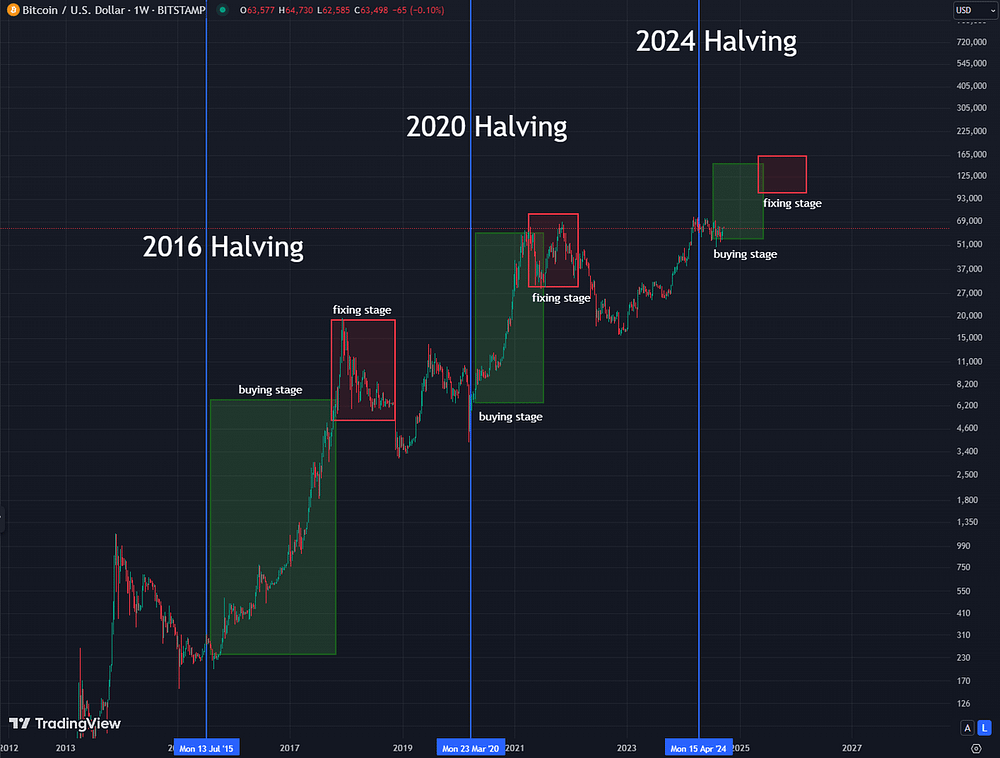

Historically, about a year after every Bitcoin halving, we’ve seen the crypto market go absolutely parabolic. It’s a cycle, and those who’ve been through it know how explosive things can get once we’re in the bull stage. Right now, we’re in the accumulation phase, and if you’re serious about capitalizing on the next big run, the most critical thing is to buy before that bull market truly takes off.

But here’s the tricky part: Many people love to throw around the phrase “buy the dip.” You’ve probably heard it a hundred times, but no one seems to really break down how you actually go about doing it. Everyone talks about waiting for the perfect low, but how do you know when that low is here? The answer is, you can’t — at least not with certainty.

So, let’s change that. I’m going to lay out a comprehensive playbook on how to buy the dips the right way, and this will give you a practical, actionable approach that’s way better than just guessing. This is how I’ve been navigating the market, and it’s kept me grounded even through massive volatility. Let’s dive in.

3/ “Buying the Dip” Means More Than Timing the Perfect Low

Most people think buying the dip is as simple as making one big purchase when they believe the market has bottomed. The reality? It’s a lot more complicated than that. You can’t predict the exact bottom — nobody can. So, instead of trying to nail it with a single purchase, we need a better, more calculated approach.

Think of it like this: When the market dips, it doesn’t just dip once. You might see several mini dips on the way down before the market finds its footing. That’s why guessing the perfect dip is a losing game for most people.

4/ What Should You Buy?

The first step in buying dips successfully is knowing what to buy. This is critical because not all assets bounce back equally in a bull market. Some altcoins will give you 10x returns, while others might fade into irrelevance.

Right now, a few key narratives are dominating the space — AI, RWAs (real-world assets), Memecoins, and DeFi. These are the areas you should focus on. For instance, in the AI space, look for tokens tied to real utility and innovation. In Memecoins, keep an eye on community engagement and virality.

Here’s what I do: I spend at least an hour scanning through tokens on platforms like @CryptoRank_io. I look for projects with solid charts, active communities, and meaningful utility — unless, of course, we’re talking about Memecoins, where community hype is the primary driver.

For example, during the last cycle, I identified a small AI token that had a strong team and active development. I entered it early, and over the next few months, it gave me a 5x return.

5/ Diversification Is Key

Let’s say you’ve identified a few high-potential tokens across these hot narratives. The next step is diversification. Going all-in on one coin or narrative is incredibly risky. Even in a bullish market, projects can fail, and narratives can shift rapidly.

For example, instead of betting all your money on just AI tokens, you could spread your portfolio like this:

1 AI altcoin

2 RWAs

3 Memecoins

This kind of diversification ensures that if one narrative underperforms, the others might still provide solid returns. Personally, I like to diversify across sectors that I believe will gain traction during the next bull run.

6/ Timing the Buying Stage

Timing is everything in crypto. Typically, we see a pattern that follows the Bitcoin halving: within 18 months, Bitcoin reaches a new all-time high (ATH). Right now, we’re in the accumulation phase, which means it’s time to start positioning yourself for the next run.

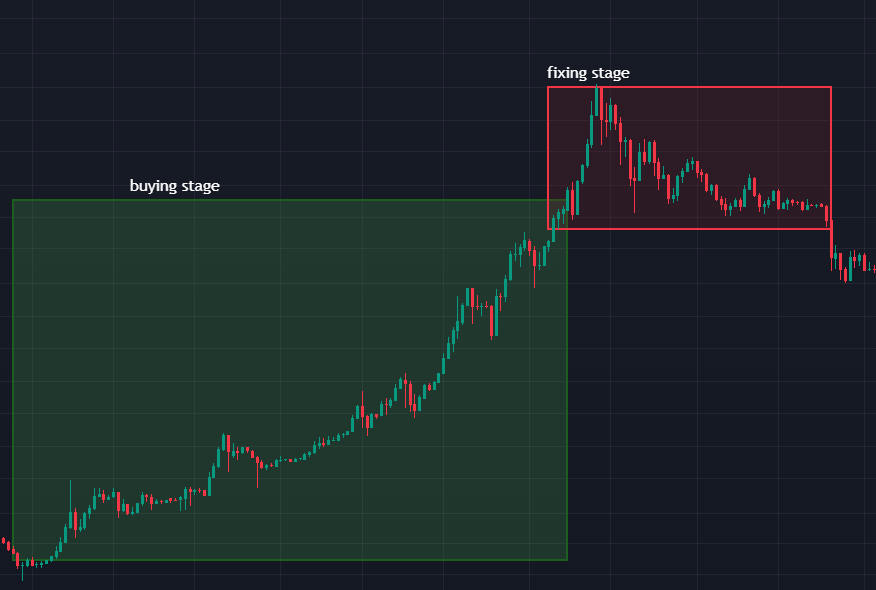

In my experience, the market gives us two distinct phases:

Buying (Accumulation Phase): This is where we are now, and it’s crucial to build positions during this time.

Fixing (Profit-Taking Phase): This is where you lock in gains once the market peaks.

If you remember the 2021 bull run, you’ll recall that the hype didn’t peak until nearly 18 months after the 2020 halving. So, don’t get impatient — this is a marathon, not a sprint.

7/ How to Buy — Dollar-Cost Averaging (DCA)

Now, here’s where things get interesting — how you buy. This is the part that separates the winners from the losers. The mistake many people make is they take their entire portfolio, buy all at once, and then cross their fingers for big profits. It rarely works that way.

Instead, I use a dollar-cost averaging (DCA) strategy. Here’s how it works:

Say I have $1,000 to invest. Instead of throwing all of that into Bitcoin or altcoins at once, I split it into chunks.

First buy: $200

Second buy: $200

Third buy: $300

Fourth buy: $300

This helps to spread out my purchases and lowers my average buy price, especially when the market takes multiple dips. The goal is to avoid going all-in at once and catching multiple layers of dips over time.

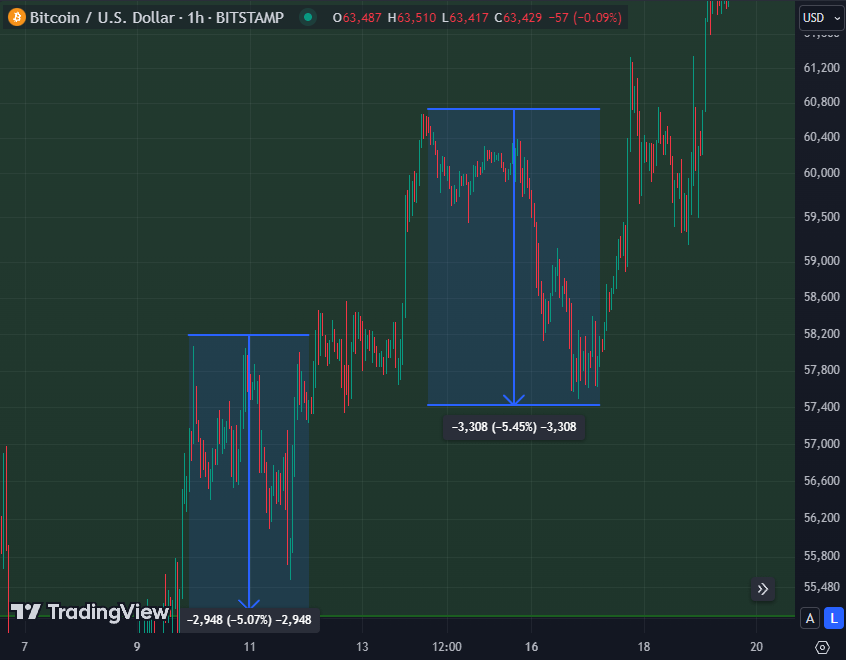

8/ When Exactly to Buy

Now, timing those purchases is the tricky part. Personally, I prefer to make a buy every time Bitcoin drops by 5–7%. For example, if Bitcoin drops 5%, I’ll make my first buy. If it drops another 6%, I’ll make a second buy, and so on.

This method helps me avoid the stress of trying to predict the exact bottom and allows me to systematically capture a better average price over time.

9/ The Bigger Picture

At the end of the day, the goal isn’t just to buy the dips — it’s to do it smartly and with a plan. That means having a strategy for taking profits, managing your risk, and staying emotionally grounded through market volatility.

Personally, I always have a take-profit plan in place before I make any investments. I also make sure I’m only investing money I can afford to lose because, in crypto, the unexpected can happen.

10/ Putting It All Together

By now, we’ve covered the essentials:

What to buy: High-potential altcoins in key narratives like AI, RWA, Meme, and DeFi.

When to buy: During the accumulation phase leading up to the next bull run.

How to buy: Using a DCA strategy to spread out your purchases and avoid buying all at once.

This playbook has kept me grounded in the market, and it can do the same for you. With the next Bitcoin halving coming, the opportunity is right in front of us — don’t miss out.

How are you preparing your portfolio for the next cycle?

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)