It’s 2024, and the future of global finance is already taking shape. China has long had its sights set on disrupting the global financial system, and now, they’ve made their boldest move yet.

While the world thought China was cracking down on crypto, it turns out they were actually building their strategy to replace the US dollar’s global dominance with their own digital currency.

For crypto investors and entrepreneurs, especially those with an eye on how international developments shape the markets, China’s masterplan is something you need to pay close attention to.

As someone who’s been trading and investing in crypto for years, I’ve seen the ebbs and flows of regulatory action.

But what’s happening with China? It’s on another level.

This could be the biggest geopolitical financial move of our time, and if you’re not positioning yourself accordingly, you might miss out on one of the most significant financial shifts of the century.

Let’s dive deeper into China’s strategy, how they’ve gone from banning crypto to becoming the second-largest Bitcoin mining hub, and what their digital yuan means for the global economy — and for those of us in the crypto space.

The Early Days: Banning Crypto But Not the Blockchain

In 2017, China shocked the crypto world by banning crypto exchanges and Initial Coin Offerings (ICOs). A massive blow to a growing crypto market, right? It seemed like the death knell for crypto adoption in one of the world’s largest economies. Then, in 2021, they doubled down, banning all crypto trading and mining activities. On the surface, this seemed like a clear message: China didn’t want anything to do with crypto.

But was that really the case?

Despite the ban, by 2023, Chinese crypto investors made $1.15 billion in crypto gains, and China remains the world’s second-largest Bitcoin mining hub. If China was so intent on eliminating crypto, how is this possible? This wasn’t about the eradication of crypto — it was about control. China didn’t want decentralized crypto threatening their centralized power.

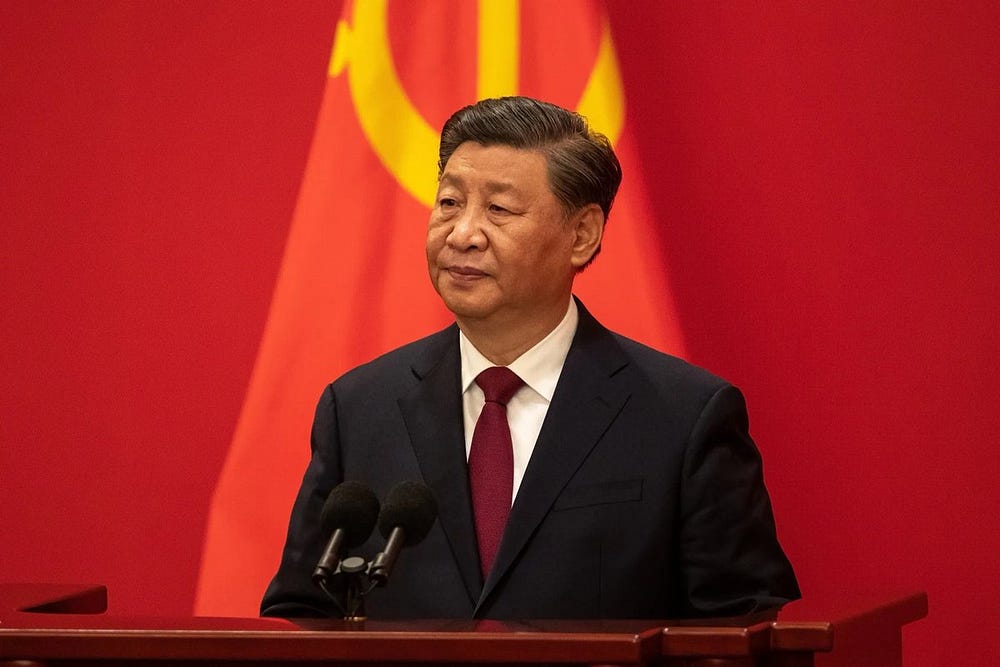

China’s strategy became clearer in 2019 when President Xi Jinping announced that China must “seize the opportunity” in blockchain technology. And they did. Today, China has 500+ blockchain projects registered with the government, and Alibaba has filed more than 90 blockchain patents, more than any other company globally.

Why Blockchain? Why Now? China’s Global Play

At first glance, you might wonder — why all the blockchain development? Why would China ban decentralized crypto only to pour resources into blockchain? The answer lies in one word: power.

China isn’t interested in blockchain just because it’s innovative or cool. It’s about using blockchain to reshape the global financial system. Their true target is the US dollar and the Western-dominated financial system that relies on it. The digital yuan, China’s official digital currency, is their weapon of choice.

What Is the Digital Yuan? A Centralized Answer to Crypto

So, what exactly is the digital yuan? Unlike Bitcoin or Ethereum, which are decentralized and operate outside the control of any government, the digital yuan is fully centralized and controlled by China’s central bank. Think of it as digital cash — it has the same value as the physical yuan, but it’s programmable, trackable, and can be fully controlled by the government.

The key here is control. China can bypass international sanctions and reduce its dependence on the US dollar through the digital yuan. But it’s more than just about avoiding sanctions. The digital yuan gives China unprecedented financial control over its citizens and businesses, and even foreign entities that engage with China.

Let’s break this down with an example. Imagine you’re an international company doing business with China. Instead of using the traditional SWIFT system, which runs through US-controlled infrastructure, you’ll use China’s digital yuan. Not only does this bypass US influence, but China now has the ability to track and control every transaction that occurs in digital yuan.

The Power of Central Bank Digital Currencies (CBDCs)

China isn’t alone in exploring the possibilities of CBDCs (Central Bank Digital Currencies), but they are far ahead of the curve. Today, 35% of the world’s CBDCs are already running on China’s blockchain network. This is significant because CBDCs allow governments to have complete control over the financial system in ways that were previously impossible.

Take, for example, the ability to censor transactions. With CBDCs, China can decide who gets to spend their money, where they can spend it, and how much they can spend. This level of control is unheard of in the traditional banking system. According to reports, 78% of central banks globally can’t guarantee privacy with their digital currencies. Imagine living in a world where every financial move you make is under government surveillance. That’s the future China is shaping with their digital yuan.

A Financial Revolution in the Making

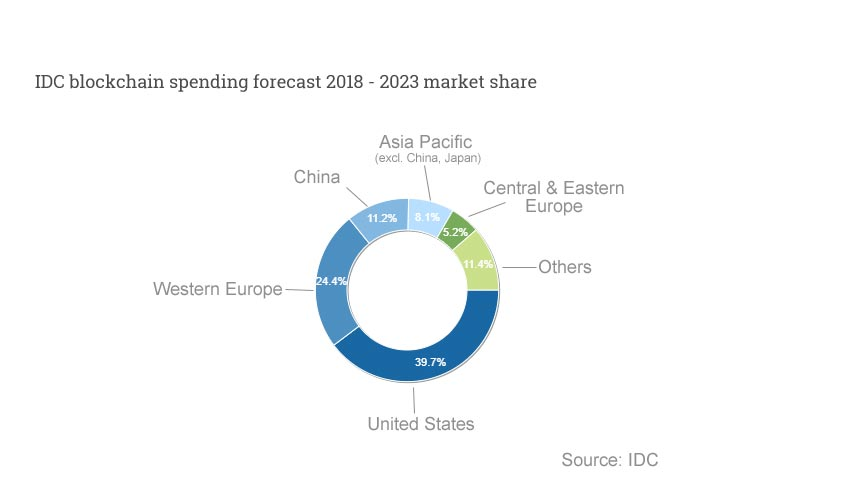

While China banned decentralized cryptocurrencies, they didn’t turn their back on blockchain. Instead, they adopted a centralized form of the technology to serve their broader strategic goals. By 2025, China’s blockchain market is projected to reach $2.5 billion, and the digital yuan pilots have already gained 261 million users, with over $13.8 billion in transactions. That’s a staggering amount of activity for a currency that’s still in its early stages.

This shift isn’t just a domestic play — China’s push for the digital yuan is part of a broader goal to challenge the US dollar’s dominance in global trade and diplomacy. Right now, the US dollar accounts for around 59% of global foreign exchange reserves, making it the most dominant currency in the world. But if China can get more countries to adopt the digital yuan for trade and cross-border payments, they could significantly reduce the dollar’s influence on the global stage.

Global Implications: The Race for Digital Currency Supremacy

China’s rapid development in CBDCs is forcing the rest of the world to take action. As of now, 114 countries are exploring CBDCs, and 11 countries have already launched their own digital currencies. The US Federal Reserve is testing its own system called “FedNow” for instant payments, but the reality is that the US is playing catch-up.

What does this mean for the global economy? It means we’re heading into a world where digital currencies could become the norm, and whoever leads in this space will have enormous influence over global trade. For crypto investors, this is a double-edged sword. On the one hand, decentralized currencies like Bitcoin may see increased demand as an alternative to government-controlled digital currencies. On the other hand, countries with CBDCs may seek to restrict or regulate decentralized cryptos even more tightly to maintain control.

The Future of Finance and Power Dynamics

China’s rise in blockchain and CBDCs will have a profound impact on international trade, monetary policy, and geopolitics. As entrepreneurs and crypto investors, we need to understand how these developments will affect the future of finance. The race for digital currency supremacy is underway, and it’s reshaping the way the world does business.

To stay ahead, we need to pay attention to the shifting power dynamics. Just as China’s early moves to ban crypto were misunderstood, their current strategy could easily be misinterpreted by those who aren’t paying close attention. If China succeeds in making the digital yuan a key player in global trade, the US dollar’s dominance could weaken, and with that, the entire global financial system could shift.

What This Means for Investors

For those of us already invested in crypto, China’s masterplan should serve as a wake-up call. The move toward CBDCs could create new opportunities for decentralized cryptocurrencies as people seek alternatives to government-controlled currencies. But it also means increased regulation and scrutiny for decentralized projects.

If you’re investing in crypto, now is the time to stay informed and vigilant. The financial revolution that China is leading will reshape the markets, and being caught off guard could cost you. As the digital yuan and other CBDCs gain traction, we may see more volatility in the crypto markets, but we’ll also see new opportunities emerge. By understanding the broader geopolitical context, we can position ourselves to capitalize on these shifts.

The future of finance is digital, and China is leading the charge. But as with any revolution, the winners will be those who can navigate the complexities and come out on top.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)