Let me be honest with you.

While everyone was chasing memecoins and getting rekt on leverage...

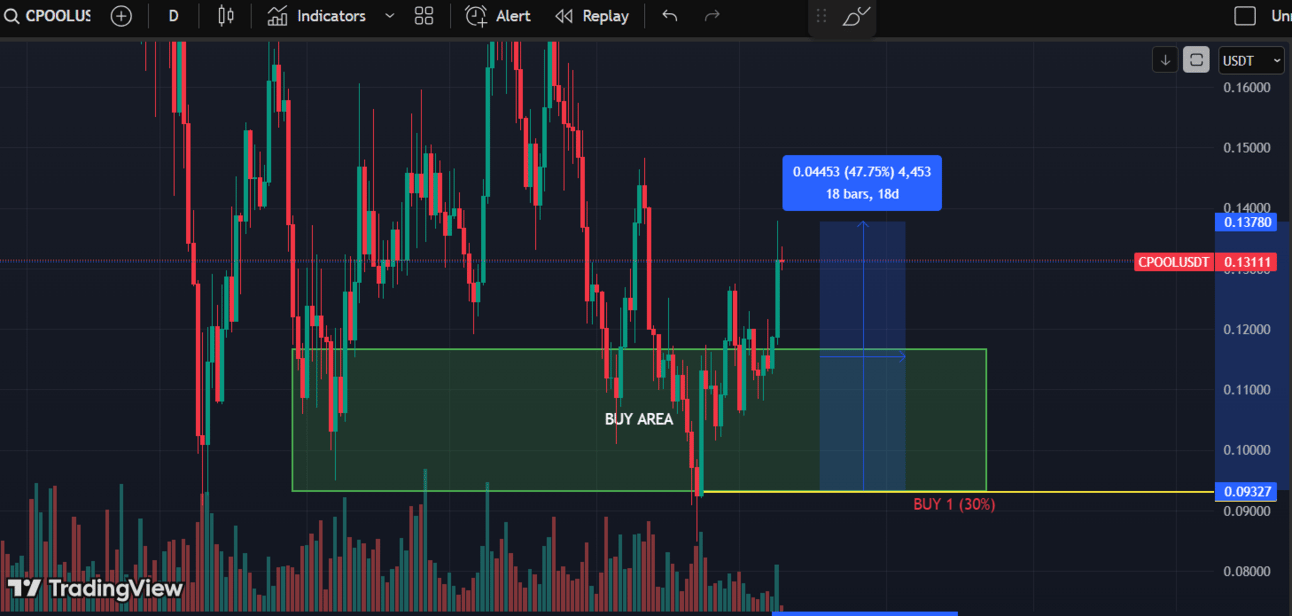

I was quietly accumulating $CPOOL at 0.09.

Entry was given on May 19th.

Jun 24 we entered. (we hit a small SL before this 2nd entry)

Today? $0.132.

47% gains in 3 weeks

But here's the thing - this isn't about bragging.

This is about showing you what happens when you understand narratives before the crowd.

THE $CPOOL THESIS: WHY I WENT ALL-IN ON RWA INFRASTRUCTURE

Real-World Assets (RWA) is the next trillion-dollar wave.

And $CPOOL? They're not just riding the wave.

They're building the infrastructure.

The Numbers Don't Lie

Clearpool by the numbers:

•$809,899,357 in loans originated

•$79,350,839 Total Value Locked

•153,785,682 CPOOL tokens staked

•Multi-chain deployment (Ethereum, Optimism, Mantle, Avalanche, Flare)

But here's what caught my attention in May:

The institutional adoption was accelerating while retail was still sleeping.

The Ozean Catalyst

June 28th announcement: Partnership with Hex Trust to launch Ozean.

This isn't just another partnership. This is Clearpool building a dedicated blockchain for RWA yield.

What Ozean means:

•Direct institutional access to tokenized real-world assets

•Yield generation on previously illiquid assets

•Bridge between TradFi and DeFi at scale

The timing was perfect. I called the entry at $0.09 because I saw this coming.

THE INFRASTRUCTURE PLAY FRAMEWORK

Here's exactly how I identified $CPOOL as a winner:

1. NARRATIVE TIMING

Past: DeFi 1.0 was about basic lending/borrowing Present: DeFi 2.0 is about real-world asset integration

Future: Trillion-dollar TradFi assets moving on-chain

$CPOOL positioned perfectly at the intersection.

2. REVENUE MODEL ANALYSIS

Unlike most DeFi tokens that rely on inflationary rewards, CPOOL generates real revenue:

•Lending fees from institutional borrowers

•Staking rewards backed by actual protocol revenue

•Cross-chain bridge fees as they expand

Sustainable tokenomics = sustainable price appreciation.

3. INSTITUTIONAL ADOPTION METRICS

This is where most retail gets it wrong. They look at price. I look at adoption.

May 2025 signals I tracked:

•BlockFills announced as new borrower

•ArtWise partnership for art-backed loans (8-20% yields)

•Solv Protocol integration expanding

•Hex Trust partnership in development

When institutions start using your protocol, price follows.

THE TECHNICAL SETUP THAT SEALED THE DEAL

Chart analysis on May 19th:

•Support: $0.085 (previous resistance turned support)

•Resistance: $0.12 (major level from 2024)

•Volume: Accumulation pattern with institutional-sized orders

•RSI: Oversold but showing divergence

•200-day MA: $0.117 - price trading below but showing strength

My entry strategy:

•30% position at $0.09

•30% position at $0.085 (if it dipped)

•40% reserved for breakout above $0.12

Risk management:

•Stop loss: $0.075 (below key support)

•First target: $0.13 (current level - ACHIEVED)

•Second target: $0.18 (next major resistance)

•Moon target: $0.25+ (if RWA narrative explodes)

WHAT'S DRIVING THE CURRENT PUMP

Recent catalysts pushing $CPOOL higher:

1. Ozean Launch Momentum

The RWA blockchain is moving from concept to reality. Institutional interest is accelerating.

2. Art-Backed Lending

Partnership with ArtWise opens $1.7 trillion art market to DeFi. Blue-chip art as collateral with 70% LTV ratios.

3. Stablecoin Infrastructure

Building $USDX and T-Pool with Hex Trust. This positions them as infrastructure for the stablecoin economy.

4. Cross-Chain Expansion

Multi-chain strategy paying off. Higher yields on Optimism (11.46%) and Mantle (13.04%) attracting capital.

The flywheel is spinning faster.

THE BIGGER RWA PICTURE

Why RWA is inevitable:

Traditional finance has $400+ trillion in assets sitting idle.

DeFi has proven it can generate superior yields through efficiency.

The bridge between them = generational wealth opportunity.

Clearpool's moat:

•First-mover advantage in institutional DeFi

•Regulatory compliance (KYC/AML)

•Proven track record ($809M loans)

•Strategic partnerships with licensed custodians

This isn't speculation. This is infrastructure for the future of finance.

THE OTHER RWA PLAYS I'M WATCHING

I will be sharing my other coins in due time, but you can see them instantly in my 9-5 Traders.

The ones who win? They manage risk first, chase gains second.

My 9-5 Traders saw this coming weeks ago.

They know exactly why I picked $CPOOL over 1,000 other altcoins.

They know the specific metrics I use to identify infrastructure plays before they explode.

They know the exact price levels where I'm taking profits and where I'm adding more.

Most importantly - they know what's coming next.

The RWA narrative is just getting started. And $CPOOL is positioned to capture the biggest piece of this trillion-dollar pie.

If you're still guessing which altcoins to buy while the smart money is already positioned, you're already behind.

My 9-5 Traders don't chase pumps. We position before them.

👉 Join 9-5 Traders now - Next alpha drops this week

We don't trade hopium. We trade infrastructure, adoption, and inevitable trends.

Let's turn this bull cycle into your exit plan.

-Victor