Crypto Twitter is buzzing, investors are hopeful, and the charts from past cycles paint an optimistic picture.

But let me level with you: when the entire market expects the same outcome, the market tends to disappoint. It’s like a crowded trade — everyone piling in, convinced they’re ahead of the curve, but when the momentum flips, they all rush for the exits at once. I’ve seen it happen too many times.

I’m still irresponsibly long on crypto, don’t get me wrong (who doesn’t want that generational wealth?). But as entrepreneurs and investors, we’ve got to be smart — think critically and plan for both the good and the bad. Over the past few months, I’ve seen a few signs that make me a bit uneasy, and I believe it’s important we address them.

Here are 3 major events that, in my opinion, could completely upend the narrative and send us spiraling into a cold bear market. Stick with me, and I’ll walk you through why it’s essential we keep our eyes open.

1/ China’s Real Estate Bubble Could Burst 📉

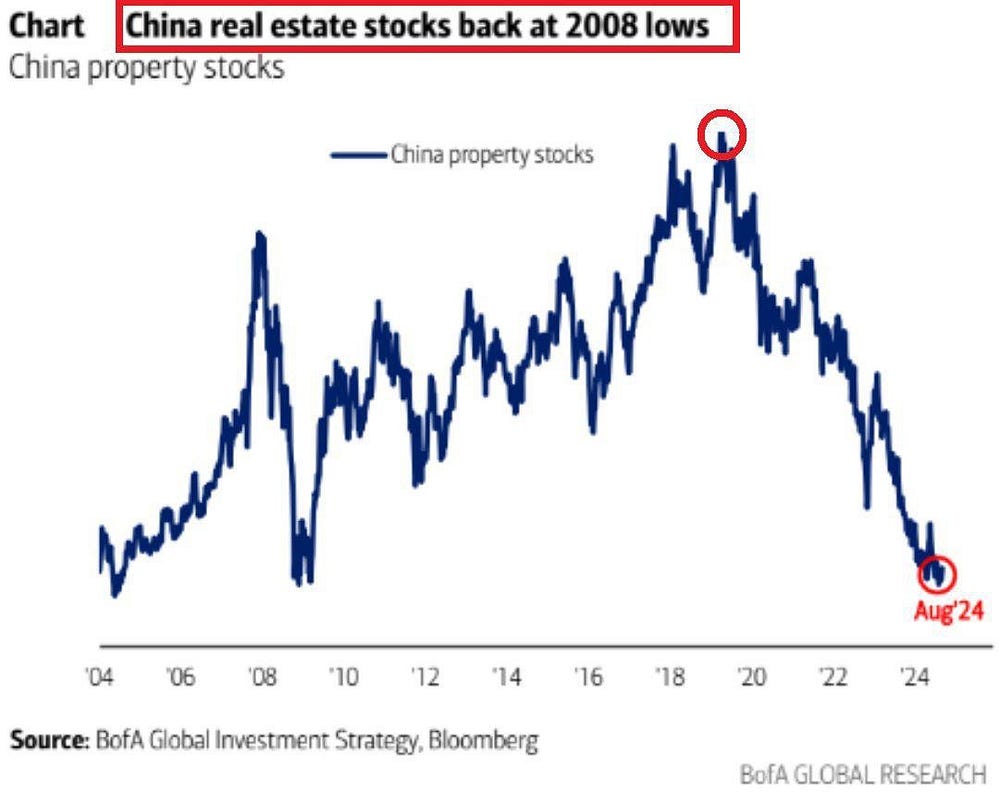

Remember last year when Evergrande filed for bankruptcy? If you were in the market then, you probably recall the chaos it caused — a 20% BTC dump practically overnight. That wasn’t some small blip on the radar; it was a serious wake-up call for anyone watching global markets.

Now fast forward to today — 2024. Things haven’t just stayed bad in China’s real estate sector, they’ve worsened. Evergrande was just the tip of the iceberg. The entire Chinese real estate market has reached levels that are on par with the 2008 global financial crisis.

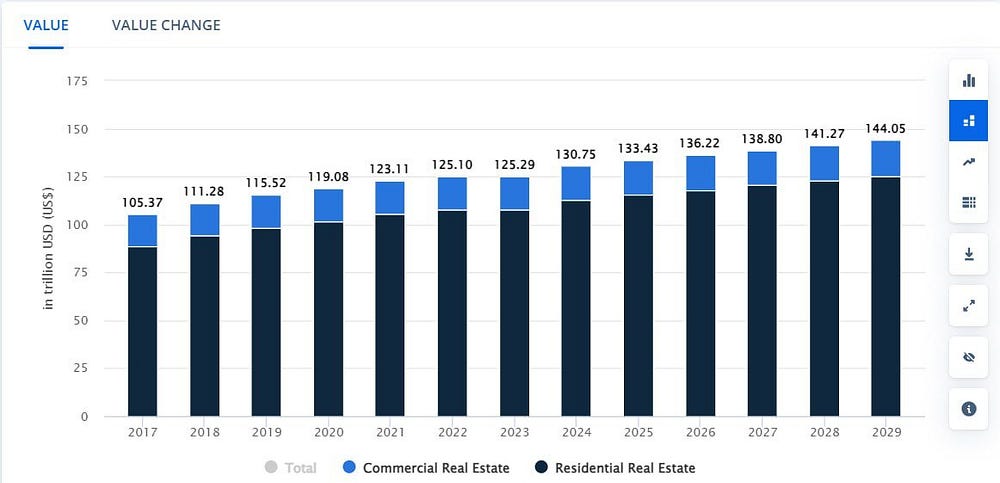

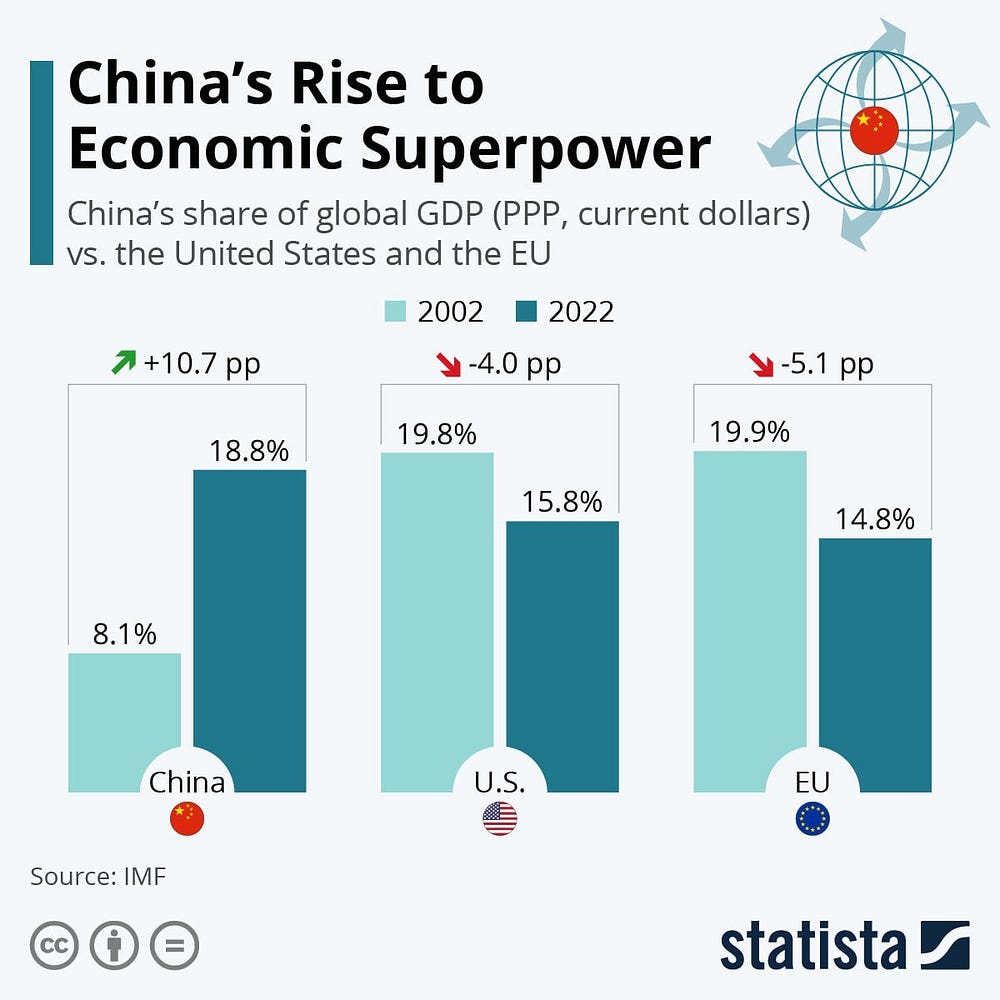

Let’s break it down for a moment. Back in 2008, the US housing crisis dragged the whole world into a recession. The US GDP made up 23% of the global economy at the time. Today, China’s GDP accounts for 18% of global GDP. That’s a massive chunk of the world’s economic engine, and right now, it’s sputtering. If this bubble bursts, the repercussions could be just as catastrophic as 2008 — we’re talking a 50%–60% dump in the stock market, which means crypto is going down with it.

This isn’t just speculation either. The parallels are too glaring to ignore. In 2008, banks were overleveraged, and no one saw the collapse coming until it was too late. Similarly, China’s real estate firms have been borrowing at unsustainable levels, and their GDP slowdown is sending shockwaves through the economy. For those of us invested in crypto, this could spell trouble.

In my own investments, I’ve been preparing for the worst by keeping a percentage of my portfolio in stablecoins — just in case the market does see a steep drop. Liquidity is king when uncertainty is this high, and being prepared to buy the fear is critical.

But again, this is just one piece of the puzzle…

2/ The Yen Carry Trade Unwind 💥

Now, let’s shift our attention to something that might sound complicated but is crucial: the Yen carry trade. You might remember that this was one of the catalysts for the August 5th crash earlier this year, but if you thought it was over, think again — it’s still in play, and it could have even more devastating effects going forward.

For years, Japan had near-zero or even negative interest rates. This allowed global investors to borrow yen for almost nothing and then invest those borrowed funds in higher-yielding markets — like US equities or crypto. It’s essentially free leverage, and it’s been inflating markets for a long time.

But that easy money faucet has been turned off. For the first time in 17 years, the Bank of Japan (BOJ) hiked interest rates. What happens next? Investors are forced to sell their assets, whether it’s stocks, bonds, or even crypto, to convert back into yen and pay off those loans. This mass liquidation was one of the reasons crypto dumped so hard in August.

But here’s where it gets interesting — and a bit scary. Yen/USD is now higher than it was back in August, and the BOJ has hinted that more rate hikes could be on the way. Japan’s economy isn’t slowing down as much as expected, which means the BOJ could tighten even further. And if they do, we could see another wave of asset selling — and guess which asset class is going to feel it the hardest?

Yep, crypto. The global markets are interconnected in ways that we often overlook, and what happens in Japan has a direct impact on liquidity in US markets and, by extension, the crypto markets.

For me, this is why having a diversified portfolio matters more than ever. Yes, I’m still long on crypto, but I’ve been paying close attention to global macro trends and making sure I’ve got exposure to non-correlated assets. It’s all about hedging your bets, especially when the macro backdrop is this uncertain.

3/ The US Labor Market is Flashing Recession Warnings ⚠️

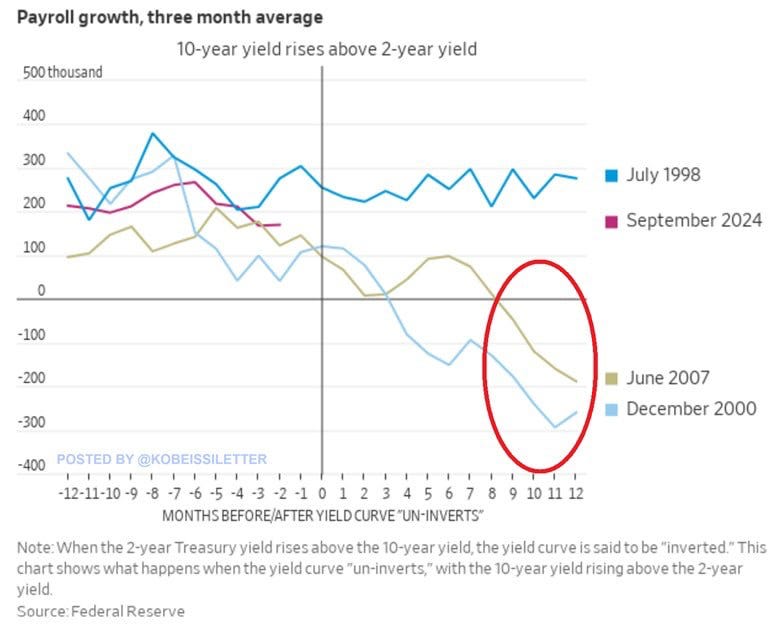

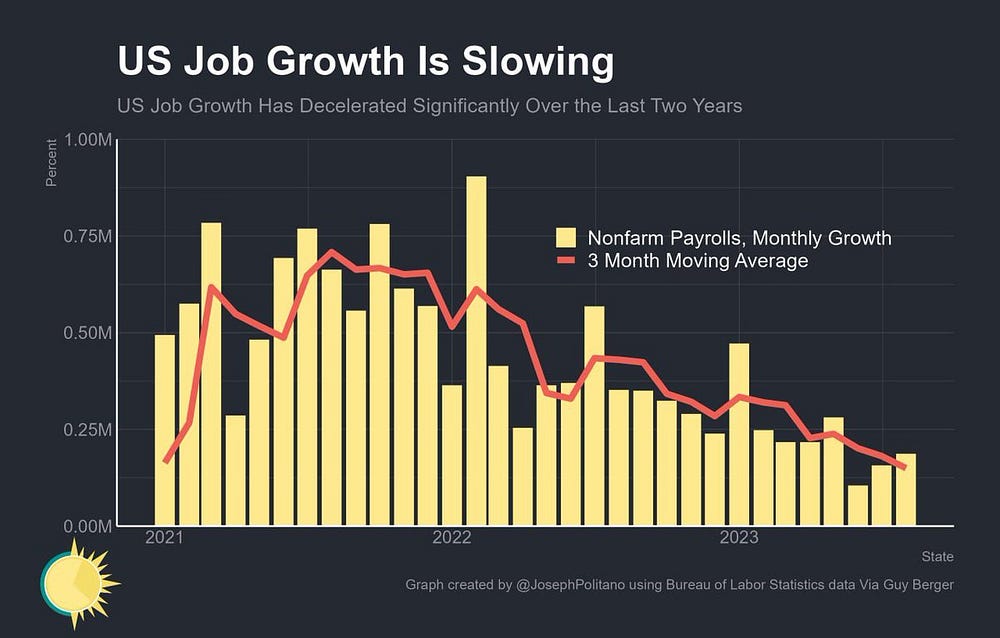

Let’s talk about the US labor market, because I think this is where things could really get dicey. Recently, the yield curve — one of the most reliable recession indicators — flipped positive after 565 consecutive days of inversion. If that sounds like a bunch of technical jargon, let me simplify: when the yield curve flips like this, it usually means a recession is coming.

In fact, over the past 45 years, each time the yield curve has turned positive after inversion, it’s been followed by significant job losses within 12 months. In 2000, the US economy saw an average monthly job decline of 280,000 within a year of the yield curve flipping. In 2007, the numbers weren’t quite as bad but still significant, with 190,000 jobs lost per month over the same time period.

Why does this matter to us? Simple: a weakening US labor market spells trouble for all risk assets, including crypto. Job losses lead to reduced consumer spending, lower economic output, and ultimately, a reduction in the amount of capital flowing into speculative markets like ours.

On top of that, non-farm payrolls and unemployment surveys are showing alarming trends. Response rates have dropped from 63% to 43% in non-farm payrolls and from 90% to 70% in unemployment surveys over the past decade. Job openings data is equally worrying, with response rates sinking from 65% to just 33%.

The takeaway? The labor market is likely weaker than the headlines suggest, and when job losses accelerate, the impact on crypto could be swift and severe.

So, What Comes First: Bull Run or Recession? 🤔

Look, I’m not here to be the bearer of bad news. I still believe there’s a good chance we see one more bull run before the recession hits. Governments love to kick the can down the road with quantitative easing, rate cuts, and money printing, and those tools could help prop up markets for a while longer.

But here’s my advice: don’t get caught up in the supercycle hype. Recession is a question of when, not if. Timing the top is always tricky, but one thing I’ve learned from years of investing is that it’s better to take profits when things are euphoric than to hold on for that elusive “last leg up” that may never come.

In my own portfolio, I’m playing it cautiously. I’m still bullish, but I’m watching these macro risks closely. I’m taking some chips off the table when everyone else is greedy, and I’m ready to buy when the fear kicks in. After all, the best opportunities often come during times of panic, not euphoria.

Stay smart, stay liquid, and most importantly, stay prepared.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)