You know the feeling: you check the charts, and a coin you’ve been watching suddenly spikes 20%. Your heart races, your mind screams, “I can’t miss this!” You dive in, only to watch the price drop moments later.

Sound familiar? That’s FOMO—fear of missing out—and it’s one of the most expensive mistakes a trader can make.

Here’s why FOMO happens:

You see someone bragging about their gains on social media.

A coin is trending, and it feels like everyone is making money but you.

The market moves fast, and you convince yourself you need to act now.

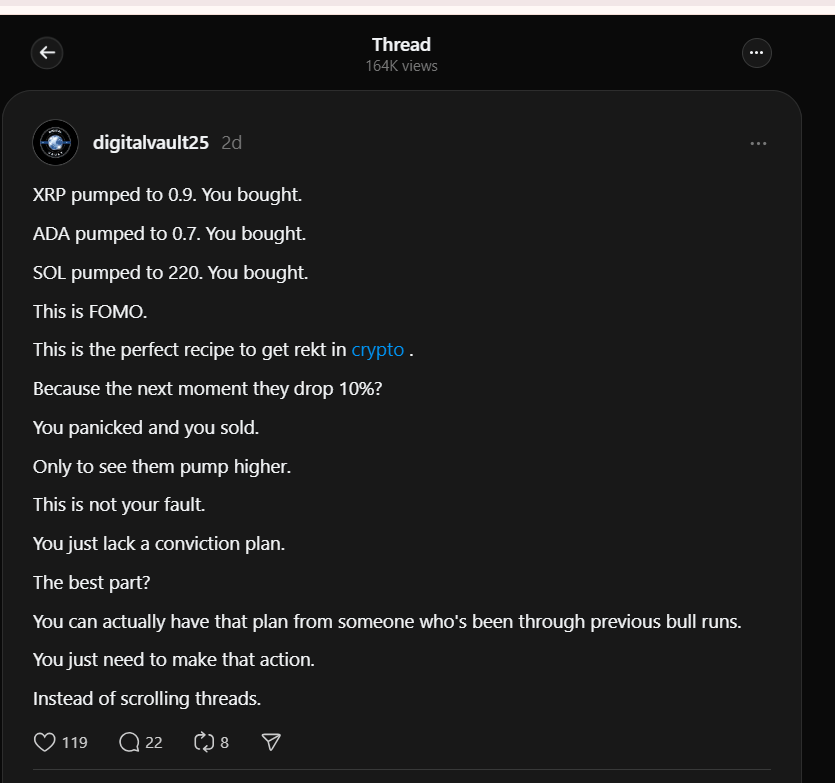

I wrote a thread on FOMO and 164K views on it.

This shows the majority of people actually resonates with it.

But FOMO doesn’t just hurt your portfolio—it wrecks your mindset. Every rushed decision chips away at your confidence. Instead of trading with clarity, you’re chasing shadows, trying to “catch up.”

Let me tell you about my early days as a trader. I’d fall for every pump, convinced I was one trade away from hitting it big. I’d jump in without a plan, hoping for the best. Spoiler alert: it didn’t work.

It wasn’t until I built a system that I turned things around. Instead of reacting emotionally, I started trading strategically. That’s when the profits began to stack up.

Here’s what I learned—and what I’ll teach you:

1. The Market Always Gives You Another Chance

That coin you missed? It wasn’t your golden ticket—it was just one of many opportunities the market will offer. FOMO thrives on the lie that if you don’t act now, you’ll never succeed. The truth? Opportunities are everywhere, but they reward the prepared, not the desperate.

Here’s an example: Back in 2021, I watched Ethereum explode from $1,000 to $2,000 within weeks. I panicked, thinking I had missed the boat, and bought at the top. What happened next? A correction. ETH dropped back to $1,500, and I was stuck holding bags. If I’d just waited, I could’ve bought at a better price and avoided stress.

Instead of chasing, focus on positioning. Every market cycle brings new opportunities. Missed Bitcoin at $20K? The altcoin market might give you another shot. Missed a trending coin? A new narrative like AI, gaming, or decentralized social media will emerge. If you’re patient and strategic, you’ll always find another entry.

2. Planning Always Beats Panicking

When you trade without a plan, you’re playing roulette with your portfolio. Reacting to every tweet, pump, or crash makes you a slave to the market. A solid plan is your roadmap—it tells you:

When to buy and when to sell.

How much risk to take.

How to protect yourself if the market moves against you.

Let me share a story. In my early days, I saw a new token on Twitter hyped as “the next 100x.” Without researching, I bought in. Within hours, the token dumped, and I lost 30% of my capital. I had no plan—just hope. Compare that to today: I set clear entry points based on technicals and fundamentals, define my risk tolerance, and know when to take profit. It’s a game-changer.

Planning removes guesswork. For example, if you’re swing trading, use tools like moving averages or Fibonacci retracements to pinpoint entry levels. Set stop-losses to minimize downside, and stick to your targets. No more emotional exits or panic buying. Just execution.

3. Patience = Profit

The best trades aren’t made in a frenzy—they’re the ones that simmer, waiting for the right moment. Swing trading embodies this principle. Instead of chasing hype, you position yourself for the high-probability moves that others overlook.

Think of it like fishing. You don’t cast your line into every ripple in the water. You wait for the perfect spot where you’re most likely to catch something worthwhile. The same applies to trading. Some of the best setups take days or weeks to materialize. If you rush, you’ll miss the bigger picture.

Take Bitcoin in late 2022. The price oscillated between $18K and $25K for months. Impatient traders jumped in on every small breakout, only to get stopped out by pullbacks. Patient traders? They waited for the clear breakout above $25K and rode the wave to $30K and beyond.

Patience doesn’t mean inaction—it means disciplined action. Use your time to analyze setups, research projects, and refine your strategy. When the right opportunity appears, you’ll be ready to act with confidence.

Trade Smarter, Not Faster

This is exactly why I developed my trading system: to help traders avoid the emotional traps that kill portfolios and learn to trade with clarity and purpose.

In my course, you’ll discover how to:

Eliminate FOMO by following a proven, repeatable system that keeps you grounded, even in volatile markets.

Identify the best entry and exit points using data-driven methods—not guesswork or hype.

Build unshakable confidence in your trades, so you never feel the need to chase pumps or panic sell.

This isn’t just about making money—it’s about transforming the way you think and act as a trader. When you trade with a system, you stop reacting emotionally and start executing strategically.

No more second-guessing. No more FOMO. Just consistent results.

If you’re tired of chasing shadows and want to master the art of intentional trading, now’s the time to act. Are you ready to trade smarter and finally achieve clarity? Let’s make it happen.

No FOMO. No stress. Just results.

In my course, I’ll show you how to:

Avoid emotional traps like FOMO by following a proven trading system.

Identify the right entry and exit points based on data, not hype.

Build confidence in your trades, so you never feel the need to chase the market again.

This isn’t just about learning to trade—it’s about rewiring how you think about trading. Once you trade with a system, you stop reacting emotionally and start acting intentionally.

For $87/month (with a 3-month commitment), you’ll get access to a step-by-step swing trading framework that fits into your busy schedule.

Don’t let FOMO drain your potential.

Join the 9-5 Traders Community now and start trading with confidence.

The next great trade isn’t something you chase—it’s something you’re ready for. Let me help you prepare.

See you inside,

Victor