But is it really time to FOMO into trades? Here’s why I’m still cautious, and how I’m preparing for the rest of this bull run.

Let me break this down from the perspective of an entrepreneur, especially if you’ve got crypto investments in play. We’re in a period of high volatility, and while a lot of people are rushing in, I believe this is the time to think strategically. After all, running a business and navigating the crypto market have more in common than you might think: both require patience, foresight, and disciplined decision-making.

The Fed’s Rate Cuts: Why Everyone is Buzzing

The Fed recently made headlines by cutting rates by a hefty 50 basis points, and almost immediately, Bitcoin shot up past $64K. Now, to be honest, seeing Bitcoin rise this fast after a rate cut isn’t surprising to me. We’ve seen similar patterns in the past — when money becomes cheaper to borrow, investors tend to flock to riskier assets like crypto. The prospect of cheaper capital tends to fuel speculative bets, and right now, crypto is the market’s risk-on favorite.

But if you’ve been in the game for a while — especially as a business owner and investor — you know that not all that glitters is gold. Just because Bitcoin’s price spiked doesn’t mean we’re in the clear for a full-blown bull run.

In fact, there’s a lot of hype around this rally. Jerome Powell has even hinted that more rate cuts could be on the horizon, potentially another 50 basis points by the year’s end. For crypto investors, this might seem like an invitation to dive in. But before you do, ask yourself: What does this really mean for the broader market?

Why I’m Staying Cautious: The $64,900 Barrier

Bitcoin may have surged, but let’s zoom out and look at the bigger picture. Right now, Bitcoin’s sitting just under $64,900 — a critical resistance level. Until we see Bitcoin break past $64,900 and hold above that level, I’m not calling this the start of a confirmed bull market.

Think about it like this: Imagine you’re running a business, and you’ve just hit your best sales week ever. That’s great! But one week’s worth of sales doesn’t make for a sustainable business. Similarly, Bitcoin hitting $64K doesn’t mean we’re out of the woods yet. We need to see consistent price action, and right now, I’m not ready to commit.

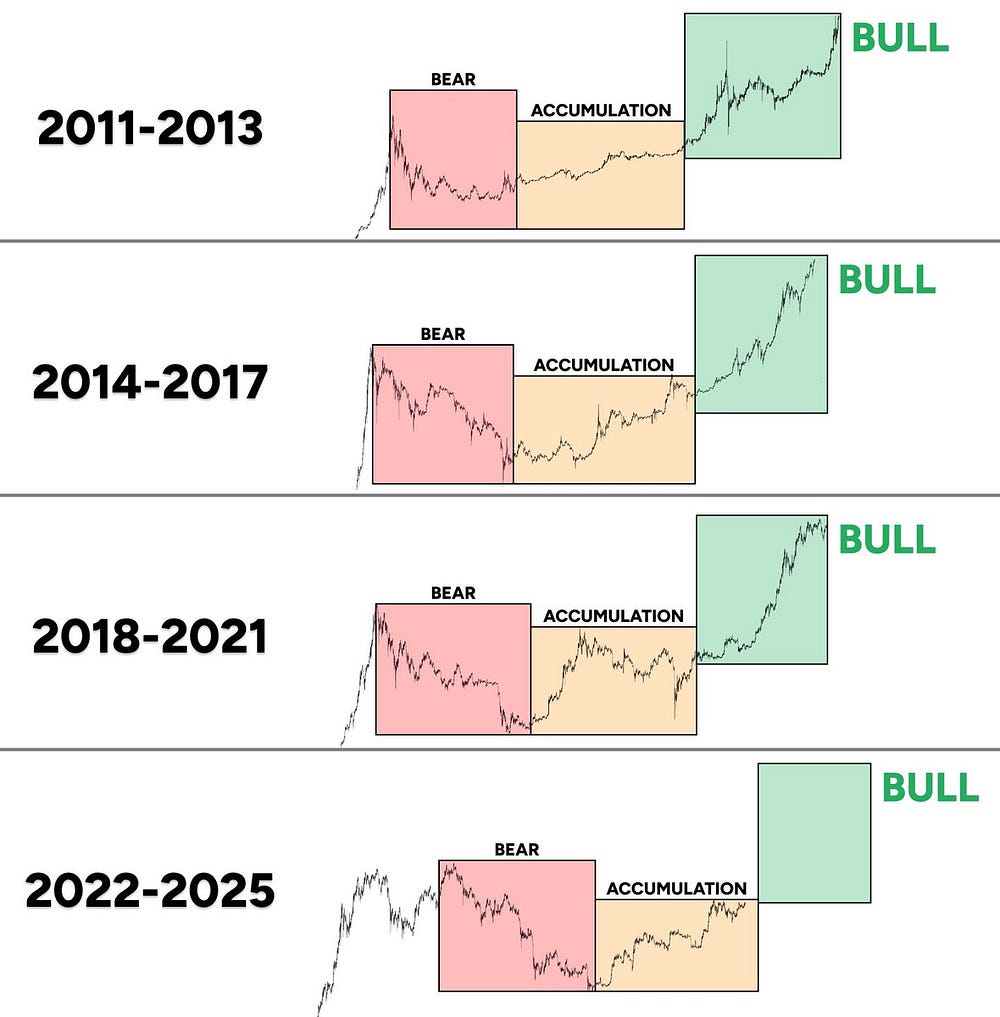

This reminds me of early 2021, when Bitcoin was floating around $40–50K. Everyone was calling for $100K back then, and yet we saw a sharp pullback in the months following. Just because Bitcoin has momentum doesn’t mean it’s invincible.

A Look at the Macro Picture: Lessons from History

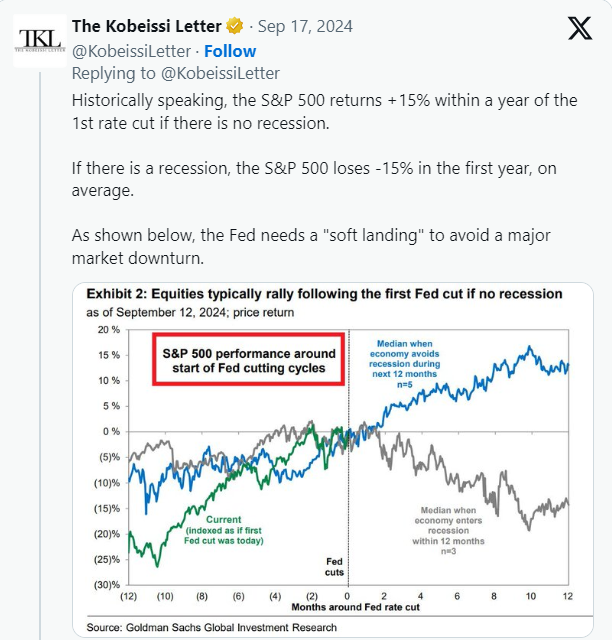

Now, let’s take a step back and look at what the Fed’s actions really mean. Rate cuts like these often signal a looming recession, and that’s where things get tricky. Historically, when the Fed cuts rates by 200 basis points or more in a year, a recession tends to follow. We’ve already seen 50 basis points slashed, and Powell’s hinted at more. It’s making a lot of entrepreneurs — especially those invested in traditional markets — nervous.

But here’s the thing: while rate cuts often precede recessions, the timing is never immediate. Recessions can take months, even years, to fully unfold. The Fed is projecting a total of 150 basis points in cuts by the end of 2025, which is less aggressive than the market anticipated. This means we might not see the full economic impact until late 2025 or 2026.

If you’ve ever run a business during uncertain economic times, you’ll know that timing is everything. I remember back in 2020, during the pandemic crash, a lot of entrepreneurs (myself included) had to make snap decisions. Some of us cut costs, others pivoted entirely. In the crypto world, the same principles apply. Just because you see short-term volatility doesn’t mean it’s time to FOMO in.

Why I’m Not Betting on a Recession Just Yet

Now, some crypto bears are sounding the alarm, saying these rate cuts are a precursor to a major recession. But here’s the thing: even though rate cuts often lead to recessions, they don’t always happen immediately. Out of the last 13 rate cut cycles, 8 led to a recession within 12 months. But when you remove major outliers like the 2008 financial crisis or the 2020 COVID crash, the odds drop to a 50/50 chance.

And let’s be real — timing a recession is like timing the crypto market: almost impossible to do perfectly. As entrepreneurs, we know that the only thing we can really control is our reaction to the markets, not the markets themselves.

What Am I Watching? Unemployment and Global Liquidity

So, what metrics am I watching to make my next move? For starters, unemployment. Jerome Powell has been crystal clear: as long as unemployment stays below 4.4%, they won’t rush into more aggressive cuts. Right now, unemployment is hovering around 4%, which suggests we’re not on the brink of disaster just yet.

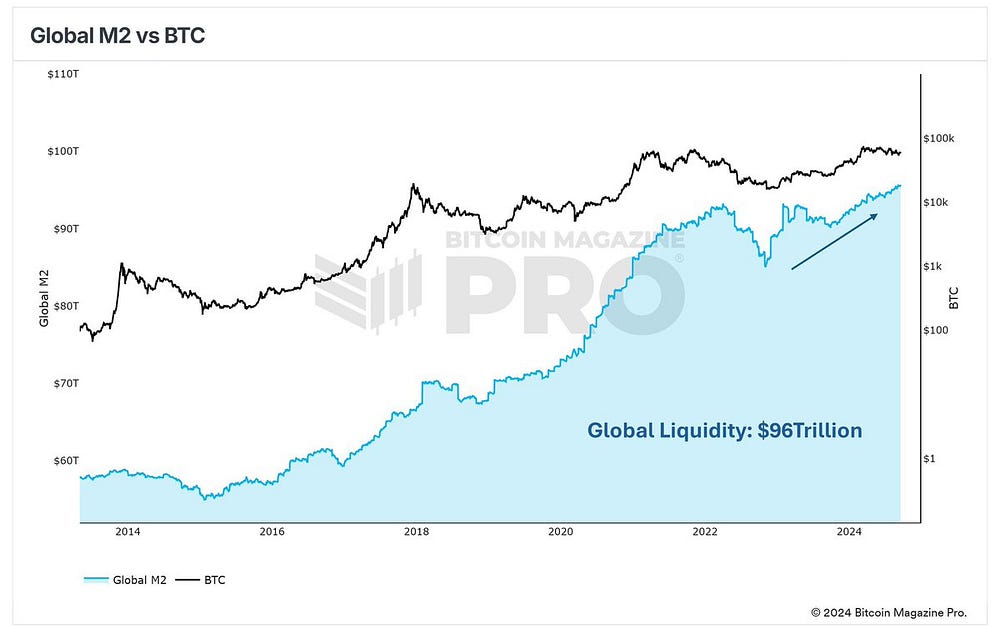

Another critical factor is the M2 money supply, which measures global liquidity. Historically, when the M2 money supply rises, Bitcoin tends to follow suit. Just a few days ago, global M2 hit an all-time high. That’s a bullish signal in my book, and if you’ve been around since the 2020 bull run, you’ll know what happens when liquidity floods the market — Bitcoin rallies hard.

For those of you managing both a business and a crypto portfolio, this is the equivalent of seeing a surge in demand for your products but knowing you still need to manage your supply chain and costs. Just because demand is high doesn’t mean you should overextend yourself.

My Strategy: Patience, Not Panic

So, what’s my game plan? Am I selling everything? Absolutely not. But I’m not going all-in on trades just because Bitcoin broke $64K either. Here’s what I’m doing instead:

Hold Core Positions: I’m holding strong on Bitcoin, Ethereum, and a few other top assets like Solana. These are my core holdings, and I’m not panicking.

No Leverage: Volatility is too high for me to take on leverage right now. I’ve seen too many entrepreneurs wiped out by overextending, both in their businesses and their investments. It’s just not worth the risk.

DCA Into Strong Sectors: I’m dollar-cost-averaging (DCA) into specific sectors I believe will outperform in the next cycle — memecoins, AI-related tokens, and select Layer 1s like Kaspa and Fantom.

Keep My Cool: This is the most important part. As business owners, we know that patience is key. Just like it takes time to scale a business, it takes time for markets to stabilize. I’m not making any rash decisions right now.

Final Thoughts: Timing Is Everything

The key takeaway here is this: yes, Bitcoin is rallying after the rate cuts, but that doesn’t mean it’s time to FOMO into trades. We need to see Bitcoin break past $64,900-$65,000 for a real bull run to take shape. Until then, I’m staying cautious, watching the macro trends, and keeping my eye on unemployment and liquidity metrics.

As entrepreneurs, we understand that timing is crucial. Just like you wouldn’t blow your entire marketing budget after one good week of sales, you shouldn’t throw all your capital into Bitcoin just because it’s had a good week.

In the coming months, patience and strategy will be your best allies. Keep an eye on the macro trends, avoid the hype, and most importantly, stay disciplined in both your business and your investments.

So, how are you preparing your portfolio? Let’s ride this wave smartly, together.

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)