I just finished reading through Coinbase’s 30+ page report on how crypto hedge funds generate alpha, and let me tell you — there’s a lot to unpack. If you’re like me, diving into a report like this can feel a bit overwhelming, so I’m breaking it down to make it more digestible. This isn’t just about hedge funds — these insights can seriously level up your investment game, whether you’re deep into crypto or just starting out.

The Big Picture

The report digs deep into the strategies that active hedge funds use to outperform the market, and it’s clear: active management in crypto can indeed beat a passive approach, but only if you know what you’re doing. The main takeaways? Managing risk effectively, timing your moves, and having a solid strategy are crucial. This applies to everyone from individual investors to large-scale funds.

Passive vs. Active Strategy: Which One’s for You?

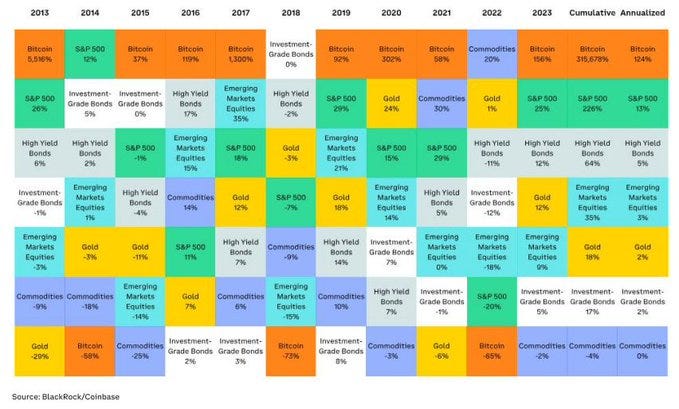

Here’s something I’ve always believed: if you can’t outperform Bitcoin ($BTC) over a significant period, say a year or more, you might want to rethink your approach. The report backs this up — benchmarking your performance against $BTC is essential. Bitcoin has been the best-performing asset in 8 of the last 11 years, with an annualized return of 124% since 2013. It’s the gold standard (or should I say, the digital gold standard).

But here’s the kicker: most investors might actually be better off just dollar-cost averaging (DCAing) into Bitcoin during bear markets. I remember when I first started in crypto, trying to outsmart the market with every trade. Spoiler alert: I didn’t. The lesson? Sometimes, the best strategy is the simplest one — consistent investments in a solid asset like Bitcoin.

Hedge Fund Performance vs. Bitcoin

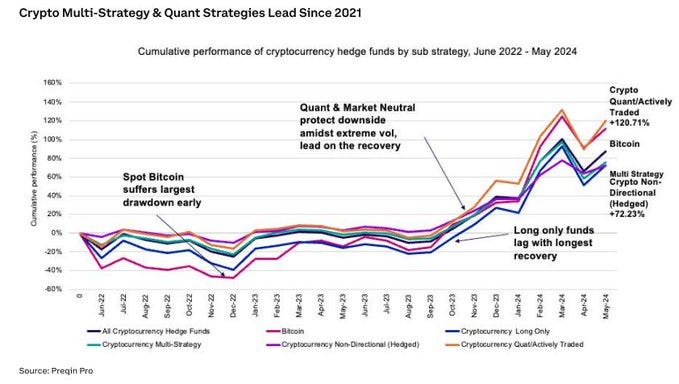

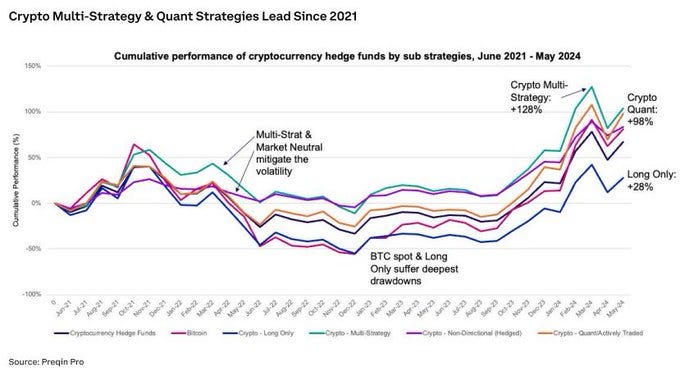

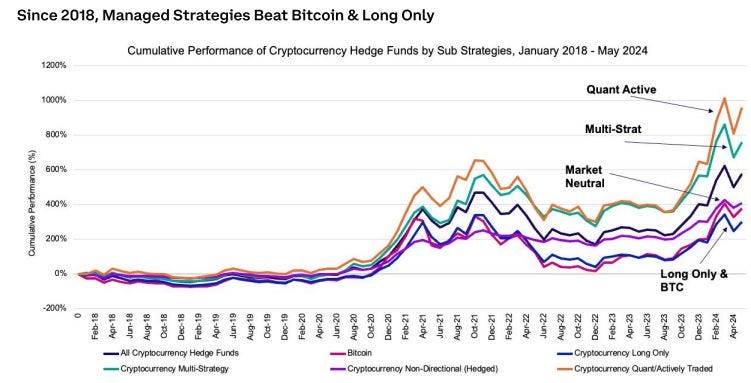

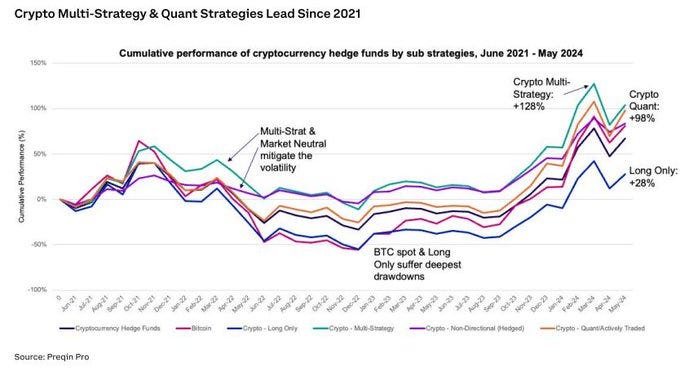

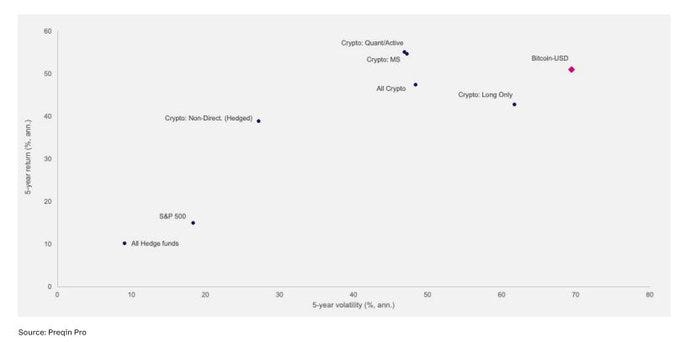

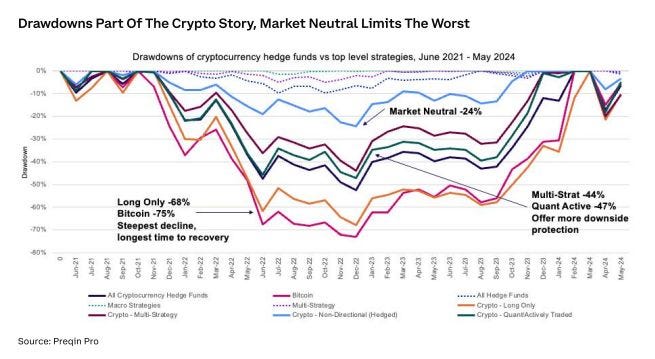

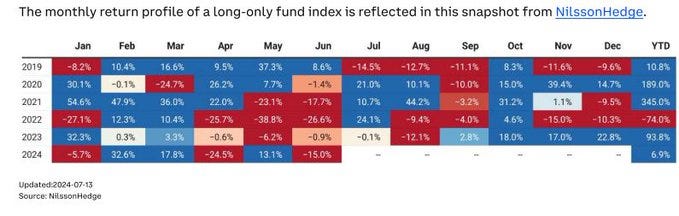

So, do hedge funds really outperform $BTC? The report says yes, but with a caveat — risk management and hedging are key. The data shows that, on average, actively managed crypto hedge funds outperformed a passive spot $BTC position in specific years like 2017, 2018, 2021, and 2022. But not all strategies are created equal. Some funds, particularly those using quant-active and multi-strategy approaches, have shown the best long-term performance potential.

For example, since the market low in June 2021, multi-strategy funds have led the pack with a 128% return. Quant-active strategies weren’t far behind with a 98% return. Meanwhile, long-only strategies, which just hold assets without any hedging, significantly lagged with only a 28% return. I’ve personally dabbled in quant-active strategies, and while they require more technical know-how, the potential rewards are worth it.

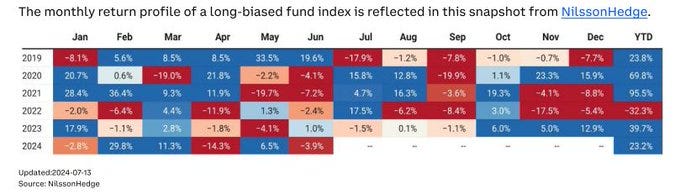

Custom Hedge Fund Index

Coinbase created a custom index from over 50 hedge funds trading on Coinbase Prime. This index shows that the median fund outperformed Bitcoin but with lower volatility. However, there’s a bit of a warning here — the data set is limited, and there might be some survivorship bias. It reminds me of when I used to cherry-pick my best trades to show off to friends, conveniently ignoring the losses. The takeaway? Look at the full picture before making conclusions.

The Power of Quant-Active and Multi-Strategy Funds

Quant-active and multi-strategy funds stand out as the top performers. These funds use advanced data models and diverse approaches to navigate the volatile crypto market. This is not just theory — I’ve seen this in action. One time, I followed a quant strategy that used machine learning to predict short-term price movements. The result? My portfolio saw gains that were far less volatile than just holding Bitcoin.

Long-only strategies, which might seem easier to manage because they don’t involve complex hedging, often underperform. Why? Because they lack flexibility and are heavily exposed to market downturns. During the June 2022 bear market, only quant-active strategies managed to outperform Bitcoin, proving that adaptability is crucial in this space.

Managing Volatility

One of the report’s key messages is that controlling volatility is essential to maximizing long-term returns. Crypto hedge funds that manage to keep volatility in check often see greater upside potential. This isn’t just for hedge funds — it’s something every investor should consider. For instance, using stop-loss orders, which I’ve incorporated into my strategy after some painful losses, can prevent catastrophic downturns in your portfolio.

The report also talks about “structural diversification,” which means spreading your investments across different asset classes to reduce risk. Crypto markets trade 24/7/365, and they’re driven by unique factors at different times. I’ve diversified my own portfolio by not only investing in crypto but also in traditional assets like stocks and bonds. The result? A much more stable portfolio that can weather crypto’s notorious volatility.

Personalized Strategies: Finding What Works for You

The report outlines several strategies, but the key takeaway is that your strategy should fit your personal goals and risk tolerance. Here’s a quick rundown:

Directional Strategies (Long-Only): These focus on holding assets that are expected to lead the market. Think of this like investing in tech stocks before the dot-com boom.

Quant-Systematic: These strategies use data and automation to balance risk and reward. I’ve found that automating parts of my trading strategy takes a lot of the emotion out of the equation.

Hedged Strategies (Market Neutral): These aim to make money regardless of market direction by capturing returns within the crypto economy. They’re great for those who want to minimize risk, but they do require a deeper understanding of the market.

Diversified Strategies (Multi-Strategy): These combine different approaches to manage risk and harvest returns. It’s like having a diversified portfolio within a single fund.

One example from my experience: I once followed a market-neutral strategy that focused on arbitrage opportunities between different exchanges. While the returns weren’t as explosive as with directional bets, the steady gains and low volatility made it a reliable part of my portfolio.

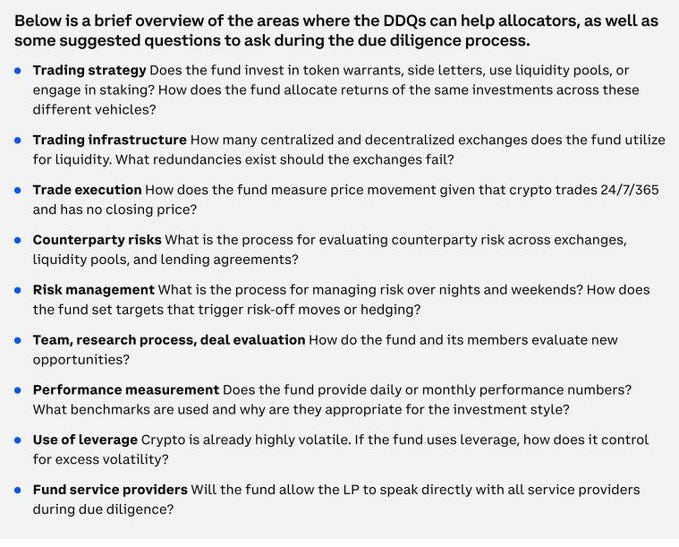

The Final Step: Due Diligence

Finally, the report emphasizes the importance of due diligence. Once you’ve chosen your strategy and built your portfolio, make sure to do your homework. This means continually evaluating your investments, keeping an eye on market conditions, and being ready to pivot when necessary. I learned this the hard way when I held onto a losing position for too long, hoping it would turn around. Now, I regularly review my portfolio and make adjustments as needed.

Conclusion

Coinbase’s report is a goldmine of insights for anyone serious about crypto investing. Whether you’re managing your own portfolio or considering hedge fund investments, the key takeaways are clear: manage your risk, stay adaptable, and always benchmark your performance against Bitcoin.

And remember, the strategies that work best aren’t always the most complex. Sometimes, the simplest approach — like consistent DCAing into Bitcoin — can be the most effective, especially if you’re not ready to dive into the deep end of active management.

So, whether you’re a seasoned investor or just starting out, take these insights to heart and tailor them to your own goals. Happy investing!

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)