My feed has been wild lately, with everyone split into two camps — Ansem vs Zach — debating whether memecoins are good or bad for the space!

The History of Crypto Narratives

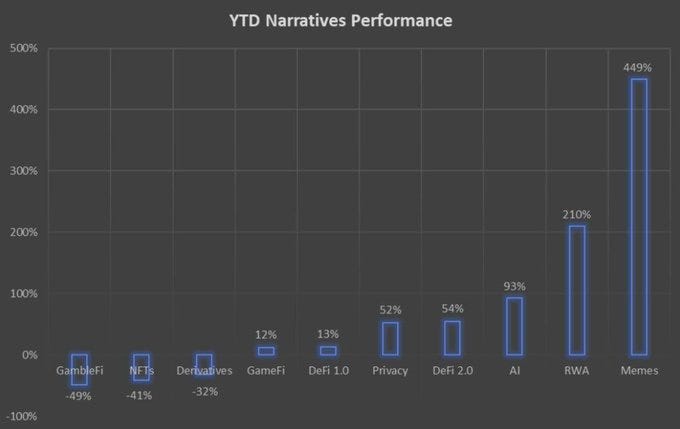

Every bull cycle, there’s always one crypto narrative that pumps the hardest.

In 2016–17, it was ICOs. A bunch of new projects and tokens launched with massive potential, and people made huge gains early on. But like any cycle, the hype cooled, and many projects faded.

In 2020–21, it was gaming and NFTs. Everyone was into metaverse projects and digital art, and some people made life-changing money during this wave. But as the market matured, the prices came down, and again, we saw the cycle play out.

Now, in 2024, we might be staring at a new narrative: memecoins.

While some are betting on other sectors like RWAs (Real World Assets), AI coins, or DePIN (Decentralized Physical Infrastructure Networks), memecoins seem to be a sector with the highest upside potential in the current cycle.

But why memecoins? What makes them the next big thing?

Why Retail Loves Memecoins

The answer is simple.

Retail goes where the opportunity for massive gains is the highest.

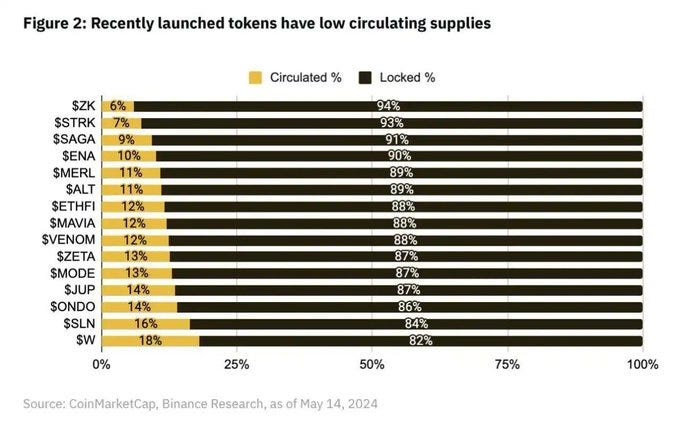

In the previous cycle, retail investors had a lot of VC (Venture Capital) coins to choose from, often at valuations below $100 million market cap. These VC coins were prime candidates for 50x-100x pumps after they launched on major exchanges. But those days are over.

VC Coins Have Limited Upside

Look at the Fully Diluted Valuations (FDVs) of some recent VC projects listed on Binance:

$XAI: $1.9B

$DYM: $5.8B

$STRK: $23.4B

$PORTAL: $2.5B

$ETHFI: $3.6B

$ENA: $11.5B

$W: $13B

$EIGEN: $7B

While some of these projects are fundamentally sound, their upside potential is very limited. Retail investors aren’t interested in holding coins that are already valued in the billions.

I’ve written threads on why retail isn’t interested in VC coins anymore (check out the highlights section), so I won’t go into too much detail here.

Instead, let’s focus on where retail is heading now.

Airdrops and Memecoins

Retail investors today are left with two main options: airdrops and memecoins.

A year ago, retail investors could make $3K-$5K from airdrops with minimal effort and small capital. But the meta has changed, and memecoins are where the action is now.

The Rise of Memecoins

Memecoins have been a part of crypto cycles for a long time.

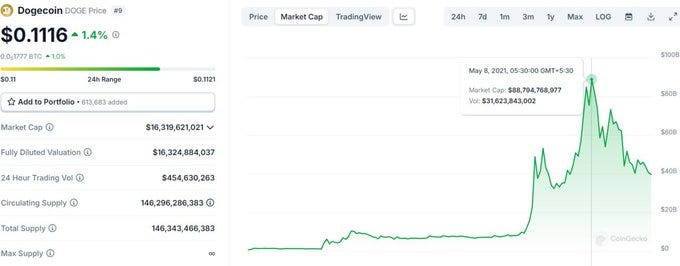

In the last cycle, we saw the memecoin hype with $DOGE leading the charge, hitting a $90 billion market cap. Alongside $DOGE, other memecoins like $SHIB and $FLOKI also performed well. But the main altseason narrative was led by gaming and NFTs.

Now, we’re seeing a shift in attention back to memecoins.

So, why is retail so interested in memecoins?

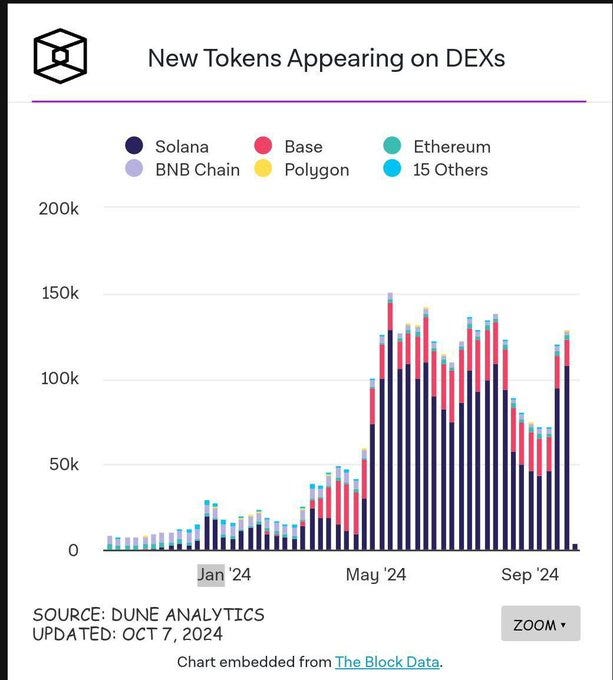

1. The Rise of Alternative Chains:

In the last cycle, Ethereum congestion and high gas fees made it difficult for retail to participate in meme trading. But things have changed.

Now, we have fast, low-cost alternatives like Solana, Aptos, SUI, and TRON, where transactions cost mere cents.

This shift has opened up memecoins to a wider audience, making it easier for retail to buy and trade without worrying about gas fees eating up their profits.

2. Celebrity Endorsement:

Celebrities have been a big driving force behind memecoins, just like they were with NFTs. In the past year alone, we’ve seen people like Andrew Tate, Jason Derulo, Lil Pump, and Soulja Boy launch their own memecoins.

Even though most of these coins have crashed 98%-99%, they still brought massive attention to the memecoin sector.

As the saying goes, “Come for the pump, stay for the memes.”

How to Spot Outperforming Memecoins

Now that we understand why memecoins are gaining traction, the next question is how do we spot memecoins that will outperform?

There’s no exact science to this, but you can maximize your chances by looking at these 5 key factors. If a meme ticks 4 out of 5, it’s worth a shot.

1. Strong Community & Cult-Like Following

A memecoin without a strong community won’t survive long-term.

Before investing, check the size and engagement of their communities on platforms like Twitter, Telegram, and Discord.

Look at how active they are — do they raid comment sections with memes? Is there a strong sense of identity, like a mascot or theme? For example, $WIF has its iconic hat, and $PEPE is famous for its frog memes.

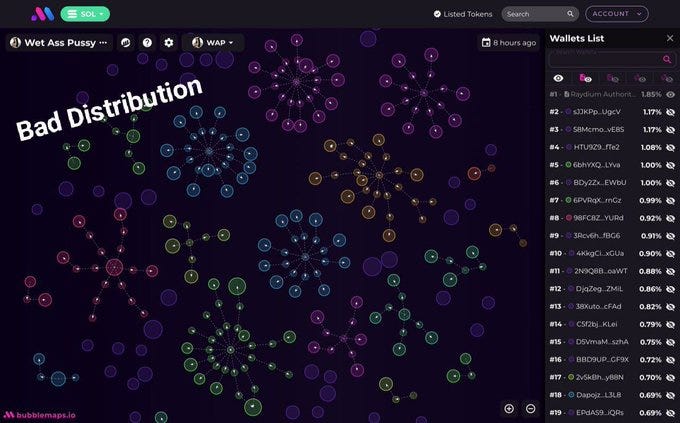

2. Token Distribution

Token distribution is crucial for a memecoin’s longevity. A well-distributed token supply reduces the chances of rug pulls or price crashes.

Use tools like Bubblemaps to check distribution, and avoid memecoins where the top 10 wallets hold more than 50% of the supply.

3. Holder Growth

A strong meme project will have a consistent uptrend in its holder count over time.

Be cautious, though — some projects spread their tokens across multiple wallets to fake distribution. Make sure to check the holder count carefully.

4. Volume and Liquidity

For memecoins with market caps over $100 million, liquidity and volume are crucial indicators of their strength.

Look for coins where daily trading volume is 8%-10% of their market cap, and liquidity is 2%-4% of the market cap. This ensures whales can trade without moving the market too much.

5. Surviving a Dump

Every successful memecoin goes through massive corrections, usually upwards of 80%.

During these dumps, pay attention to:

Whether the community is still active and supportive

If whales are holding or accumulating more tokens

Whether the holder count is increasing

If the answer to these questions is “yes,” it’s likely a good time to buy the dip.

My Top 5 Memecoins for This Cycle

Here are 5 memecoins I’m keeping an eye on for the current bull run:

$WIF

Biggest memecoin on Solana

Forming higher highs and lows against BTC, indicating strong momentum

Huge community, good distribution, and top 10 in trading volume

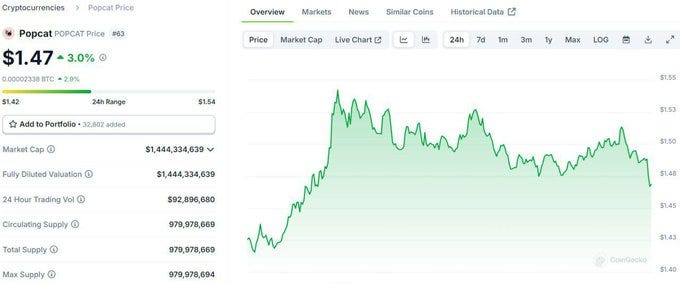

2. $POPCAT

The largest CAT memecoin

Over 50,000 holders and a significant presence on several exchanges

CAT memes have 10x less attention than DOG memes, meaning upside potential

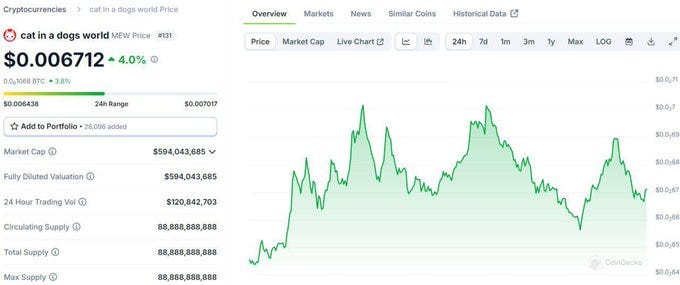

3. $MEW

2nd largest CAT meme on Solana

Listed on major exchanges like Binance Futures and Bithumb

150K+ holders, $140M daily trading volume

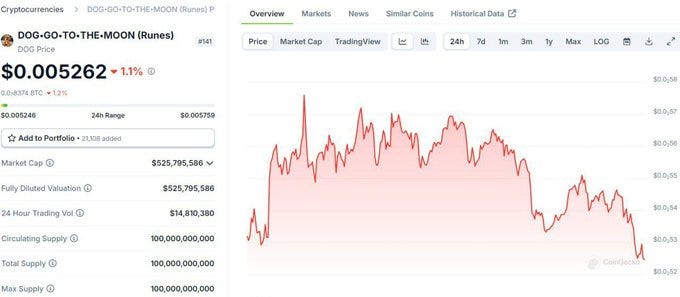

4. $DOG

Memecoin on Bitcoin

All tokens were airdropped, creating organic interest

Strong potential due to Bitcoin’s $1.3T market cap

5. $CAT

First memecoin to own its brand IP, with 30M followers and 4B views

Could trigger a meme season on BSC once listed on major exchanges

Risks of Memecoins

As with any investment, memecoins come with risks. The biggest issues are extreme volatility, KOL (Key Opinion Leaders) pumps and dumps, and liquidity being drained by new coins.

My number one rule? Take profits early.

You don’t want to be left holding the bag while someone else exits with your liquidity.

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step to financial freedom

If you resonate with this approach and yearn for more insights, a simple clap and subscribe will accelerate the release of the subsequent parts. Your support fuels my sharing of valuable knowledge.

If you found this guide insightful, dive deeper into the intricacies of crypto trading by subscribing to my newsletter. Stay ahead of the market with exclusive insights and updates.

You can subscribe here — Wise Healthy Wealth Newsletter. — you can read all my future medium articles for free!

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)