Hi Fam.

I hope you are still with me on this newsletter, the bull run is imminent.

Stay prepared and ignore all the noise.

I’m going to introduce this strategy that is dear to my heart.

Sentiment trading.

Sentiment trading has been an absolute game changer for me — it’s helped me not only control my emotions, but also gain a deeper understanding of how the market moves based on the sentiments of the majority.

As a trader, emotions can often get in the way, causing us to make irrational decisions, but by leveraging sentiment analysis, I’ve found a way to navigate the market more strategically.

Understanding the psychology behind market movements is crucial, especially in crypto where emotions run high. In this space, fear and greed dominate traders’ actions. Sentiment trading allows me to tap into these emotions, identifying what the masses are feeling — whether bullish or bearish — and I can capitalize on their emotional reactions.

One of the main tools I use is X Sentiments, a powerful resource that aggregates market sentiment from social media platforms like X (formerly Twitter) and Reddit. By studying how these sentiments shift over time, I can position myself to profit when the crowd is wrong. Using X Sentiments, I’ve been able to consistently spot opportunities where others might hesitate — this is how we can capitalize on market moves, turning the collective emotions of others into our trading advantage!

Here is how I do it:

Website link: https://www.augmento.ai/bitcoin-sentiment/

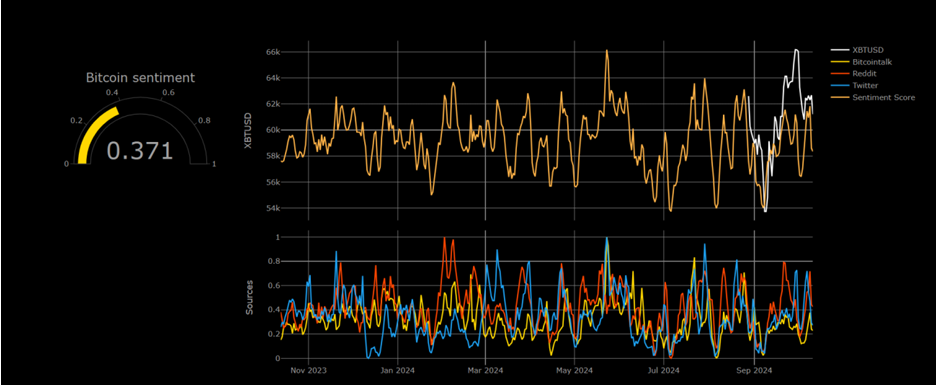

When you open the website, this is the interface you’ll see. Let’s break down each element to better understand how it works.

On the left side, there’s a meter that aggregates all the data into a single value between 0 and 1. It functions similarly to the Fear and Greed Index.

When the value is below 0.5, it indicates that most people are bearish, and when it’s above 0.5, it suggests that the majority are bullish. It’s that simple — an easy-to-read visual that quickly gives you insight into market sentiment.

Understanding Sentiment: The Pulse of the Market

This approach is key to unlocking how the market really works. Understanding sentiment allows us to see beyond price action and tap into the psychology of the crowd. When you know how to read the pulse of the market, you can make smarter decisions, avoid FOMO (Fear of Missing Out), and benefit from others’ emotional reactions. 🔑🧠

For example, when the sentiment on X is overwhelmingly bullish, I know it’s time to be cautious. Why? Because when everyone is bullish, the market is often nearing a top. Similarly, when sentiment is extremely bearish, it’s usually time to start accumulating assets, as a bottom is likely forming.

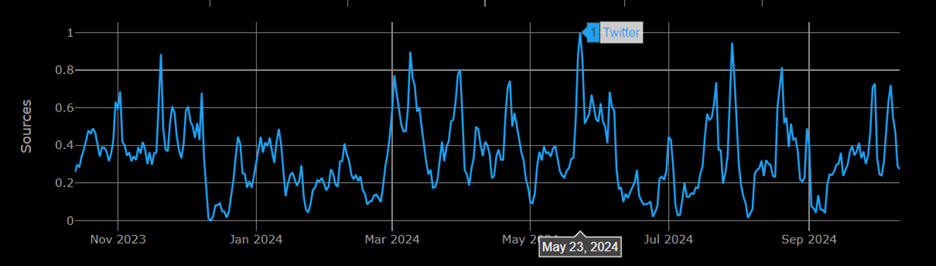

Take May 23rd, 2024 as an example. Sentiment on X was off the charts bullish, with the index reaching a full 1. This was a clear signal that a market reversal was on the horizon. Within just a few days, the market turned, catching many traders off guard. But by paying attention to sentiment, I was able to sidestep this downturn.

On the flip side, December 11th, 2023, stands out as a textbook example of when sentiment analysis paid off in a bullish way. Nearly everyone on X was bearish, but I knew that this was exactly the time to start accumulating. The market soon reversed, and those who were brave enough to act when sentiment was down reaped the rewards. 🚀

Spotting Market Reversals with Sentiment Data

Let me break it down even further with examples of how sentiment data has guided my trading decisions:

July 29th, 2024: The majority of traders on X were bullish, which, based on previous patterns, meant a top was coming soon. Sure enough, the market soon began to reverse, and those who had jumped in during the bullish frenzy were left holding the bag. But I stayed patient, aware that sentiment was signaling a shift. 🌪️

July 24th, 2024: X sentiment showed that most traders were bearish, signaling an opportunity. Within days, Bitcoin pumped by 10%, proving once again how valuable this sentiment data can be for positioning oneself on the right side of the trade. 💰

September 7th, 2024: A staggering 96% of X users were bearish, signaling extreme fear in the market. I took this as a sign that a bottom was near, and it wasn’t long before the market rallied. The masses were wrong, and sentiment trading gave me the edge. 📈

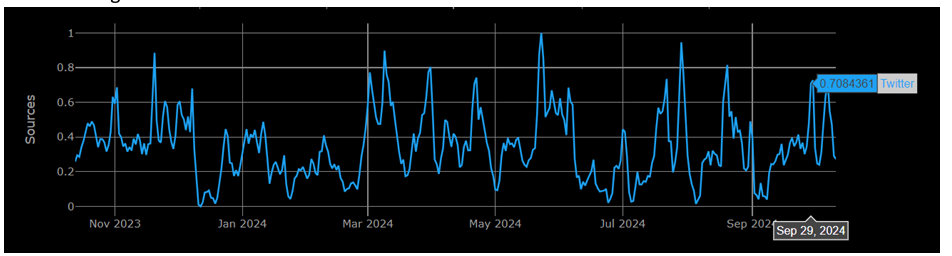

September 30th, 2024: Just a day earlier, only 30% of X users were bullish. By the end of September, this number shot up to 70%, an insane shift in sentiment in a short period. Knowing that such rapid sentiment changes are often followed by volatility, I proceeded with caution — and as predicted, Bitcoin dumped 10%. 🚨

These examples show just how powerful sentiment trading can be. It’s not just about following the crowd but learning to understand when the crowd is about to be wrong.

Leveraging Sentiment for Long-Term Success

One of the reasons sentiment trading has been so successful for me is because it helps with swing trades — those longer-term moves that play out over days or weeks, rather than hours. Day trading based on sentiment is more challenging because the market’s emotional pulse can shift rapidly. However, when you zoom out and look at sentiment over a few days or even weeks, the signals become much clearer.

For instance, when sentiment shifts strongly in one direction, it often takes the market a few days to react fully. This delay between sentiment and market movements creates opportunities for traders like us to take advantage of. By spotting when sentiment is overly bullish or bearish, we can make smarter entry and exit decisions.

Tapping into Sentiment: Your Edge in a Volatile Market

If there’s one thing I’ve learned from trading the crypto markets, it’s that emotion is a powerful force. The emotions of the crowd drive price movements, and sentiment trading gives us a window into this collective psychology. Sentiment trading is a tool that allows me to keep my own emotions in check — instead of reacting impulsively to price swings, I can take a step back, look at the sentiment data, and make more rational decisions.

I hope you find this insight as valuable as I do — it’s the secret sauce to riding the waves of the market! 🌊📈 Whether it’s Bitcoin or altcoins, sentiment analysis has helped me stay ahead of the curve. And the best part? This strategy can work for you too.

Let’s keep leveling up together, fam! 🙌 By understanding market sentiment, we can continue to grow, learn, and profit from the emotions of the masses.

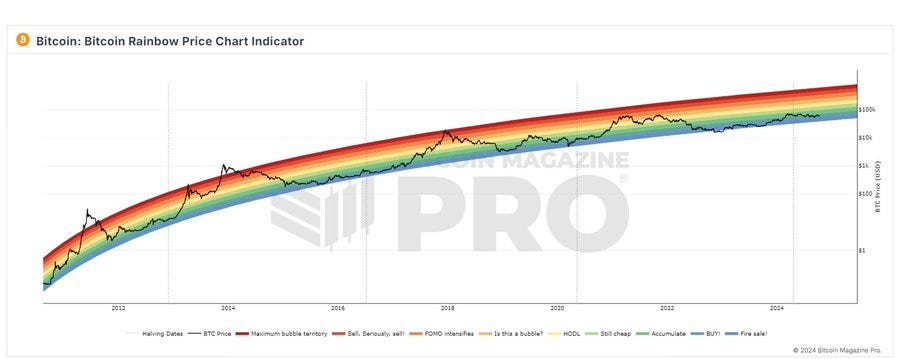

How About That $162K Bitcoin Terminal Price?

Let’s talk about the terminal price of Bitcoin reaching $162K — it’s starting to sound more conservative, right? But $162K isn’t just a number, it’s a reflection of the longer-term trajectory of Bitcoin’s value and adoption, a figure that more and more of us in the crypto community are coming to see as realistic.

I had a fascinating conversation with my whale friend tonight, and let me just say — there are some serious insights you need to take home from this discussion. Whales, the big players who control a significant portion of the market, have a level of insight and access that can truly give us a glimpse into what’s coming. Here’s what stuck with me:

Altcoin Tops Are Unpredictable: He mentioned how trying to predict the top of altcoins is like chasing shadows — impossible to time perfectly. Still, he expects to make 6–10x on average across his entire altcoin portfolio. Think about that. Imagine you invest $10K into a basket of altcoins and, over the course of a bull run, you see that turn into $60K to $100K. That’s the kind of explosive growth we’re talking about. But the key is knowing when to get out and cash in on those gains before the tide turns.

1 BTC = 1 BTC: We don’t touch that cold storage, fam. Bitcoin is the rock of your portfolio, the asset you hold through thick and thin. You stack, you HODL, and you resist the temptation to sell off when emotions are running high. In times of market euphoria, it’s easy to get swept up in the excitement and want to convert your BTC to chase the next big altcoin move, but seasoned traders know better. Bitcoin is the anchor, the asset you trust no matter how wild the storm gets.

Market Manipulation: The Reality We Don’t Talk About

Let me share something that no one wants to admit. From the bottom of my heart, let me be real with you: this market? It’s manipulated. Whether we like it or not, the big players — the whales, the institutional investors, and yes, even the exchanges — are pulling the strings behind the scenes. They don’t just participate in the market; they control the narrative.

Retail traders, the ones like us who are trying to make it big, often dance like puppets while these bigger players make their moves. And the exchanges? They’re not just passively providing a platform — they’re in the game too, ensuring that they’re benefiting while many of us are the liquidity. Every time we chase a pump or panic sell, we’re playing right into their hands.

Here’s the truth no one tells you: They want you chasing pumps. They want you to FOMO into the top, and when it’s time to dump your bags, you’re often doing it too late — because they’ve already taken their profits. Most people don’t even realize this is happening, but that’s the cold, hard reality.

But trust me, while everyone else is getting burned, I’m watching the moves you don’t see. And when the time comes to exit, you’ll know because I’ll tell you. And you’ll be ahead of them all. Because this isn’t just about chasing gains — it’s about understanding how the game is played and staying one step ahead.

Fear: The Secret Ingredient to Success

Now, let me get real with you about something else: If you’re not constantly afraid of messing up this bull run, you’re probably not pushing yourself hard enough. In fact, if you don’t feel that constant pressure, you’re setting yourself up to fail. And I’m not saying this to discourage you — quite the opposite. Fear is your friend in this game.

We’ve been taught to think of fear as a weakness. Something to avoid. But that’s a complete misunderstanding of how fear works in trading. A pinch of fear keeps you sharp. It makes you double-check your research, it keeps you awake at night thinking about your positions, and it ensures that you’re constantly refining your strategies. That little bit of fear forces you to stay focused.

Take it from me — if you’re too comfortable, you’ll get rekt. If you’re feeling too sure of your positions, it might be time to reassess because that kind of overconfidence can lead to costly mistakes. But if you’re too afraid, you’ll freeze, unable to make a decision, and that’s just as dangerous. You’ve got to strike a balance. Fear is fuel. Use it wisely, or you’ll get left behind.

Example Time: The Whale’s Game Plan

Let me break it down even further with some clear examples of how fear and manipulation work in this market.

Think back to 2021 when Bitcoin reached its then-all-time-high of $64K in April. The market was euphoric. Everyone was talking about Bitcoin going to $100K by the end of the year. What happened next? A brutal crash that sent Bitcoin tumbling down to $30K. The whales took profits, while retail traders were left holding the bag. Those who were too comfortable lost big. But those with a little fear in their gut, who took caution when the market was euphoric, had the opportunity to buy at the bottom.

Or consider the 2017 bull run, when Bitcoin reached almost $20K. People were taking out second mortgages to buy Bitcoin, FOMO was everywhere. But again, that fear? It could’ve saved you if you knew how to harness it. Being afraid of getting rekt forces you to take profits when everyone else is screaming for higher highs.

The takeaway here is simple: Fear isn’t something to run from — it’s something to embrace. It’s what keeps us from making emotional mistakes, from getting swept up in the crowd. And if you listen to your gut and trust the right sources, you’ll navigate this bull run without getting burned. Trust me when I say that you’ll be ahead of them all when the time comes.

So, let’s use this fear. Let’s stay sharp. Let’s make those moves that keep us in the game. And let’s listen to the whales, because they’ve been here before, and they’re watching every move.

We’re all in this together, and the future is looking bright — if you know how to play it.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@Digitalvault1)