Yes, $2.4 million. And before you think they’re some kind of crypto genius, let me tell you — they’re not exactly playing by the rules.

Here’s what I learned about their methods, how these memecoin farms scam you, and most importantly, how to avoid getting taken in by these schemes in the future. Let’s dig in.

1. It All Starts with Psychology: They Reverse Engineer Your Trading Mindset

First off, these memecoin “farmers” aren’t just throwing up random coins and hoping they stick. They study traders and understand that most people have a basic, almost reflexive checklist when looking for new coins. It’s like a series of mental triggers:

Funny name? Must be a good investment.

Cool website? Looks legit; let’s buy.

Followed by influencers or cool people? Social proof means it’s safe.

Big trading volume? Others are in, so I should be too.

Holder count growing? Means it’s popular; can’t go wrong.

They use these exact behaviors to lure people in. They know that if a coin is funny, has a decent website, and is backed by the right influencer, it can look like the next big thing. So, they focus on making it look that way rather than ensuring any actual value.

2. Making the Memecoin Look Legit: Tools of the Trade

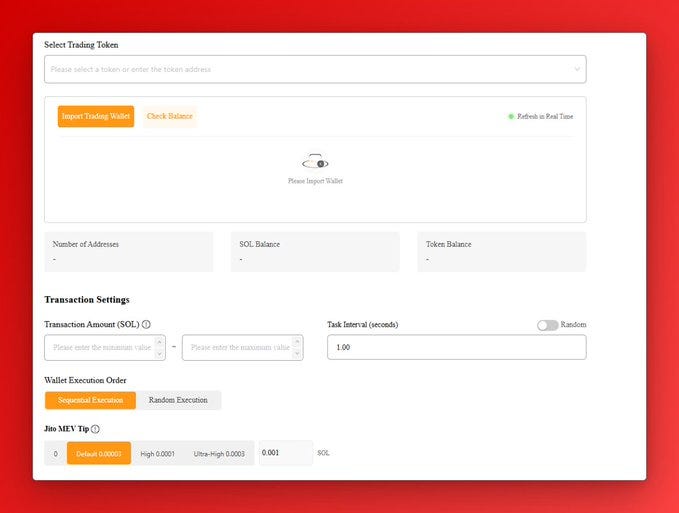

Creating a catchy coin and a slick website is surprisingly easy — anyone can do it. But this guy walked me through the main tools they use to fake popularity and “buzz” around a coin. The tools are deceptively simple yet powerful:

Sniper Bot

Transactions Bot

Volume Bot

There are other tools, but these three are the essentials. Let’s look at what they do and how they’re used to trick unsuspecting investors.

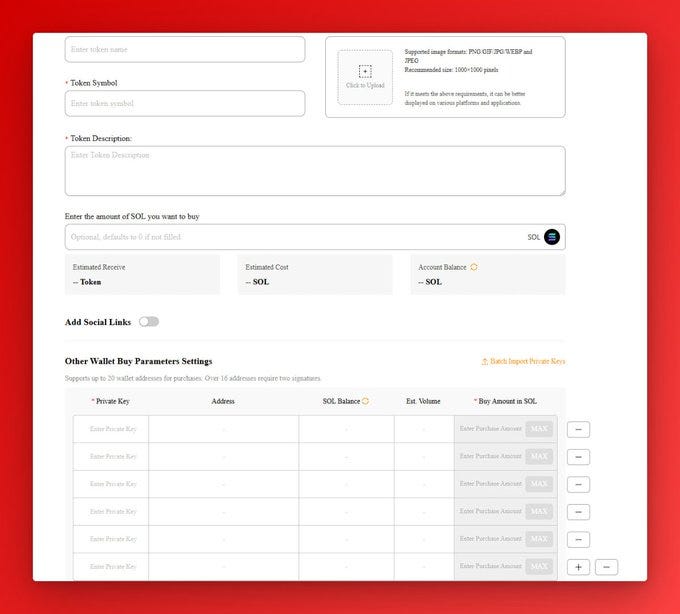

3. Sniper Bots: The Initial Grab

When they launch a coin, one of the first things they do is deploy a sniper bot. These bots buy up a huge chunk of the coin’s supply right at launch. But here’s the kicker — they do it across 5–20 different wallets to make it look like it’s a community of early investors.

Here’s how it works in practice: Say you spot a new coin with a growing holder count — maybe 50 or 100 wallets holding it. It feels like people are jumping in, right? Except most of those “holders” are actually controlled by one person with a sniper bot. They’re creating fake demand, which makes you think, “If so many people are buying in, I don’t want to miss out!”

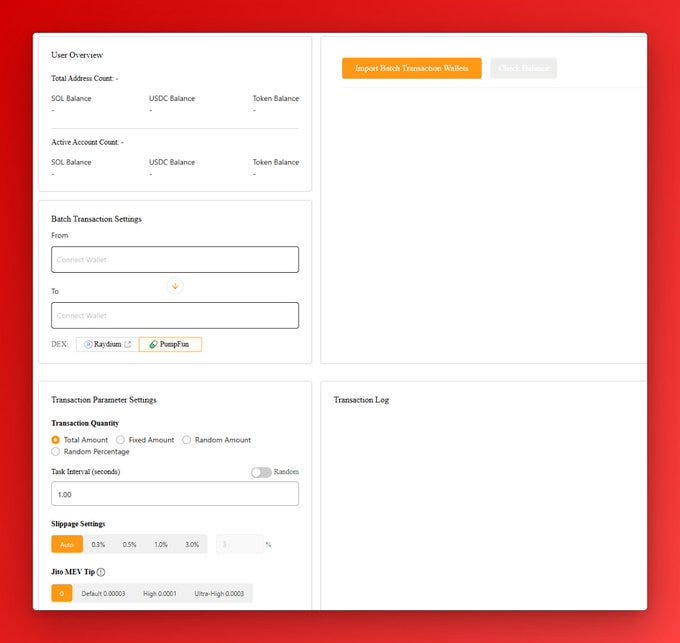

4. Pumping Volume and Faking Popularity: The Next Step

Once the coin is launched, their focus shifts to two main goals: pump the trading volume and increase the number of holders. They use volume bots to achieve this. Here’s what volume bots do:

The bot sets up multiple wallets (sometimes 10+) to constantly buy and sell the coin in small amounts. To the casual observer, it looks like there’s genuine trading activity. But in reality, this “volume” is entirely fabricated. If you take a closer look, you’ll notice that some wallets have huge buy and sell transactions with barely any profit. These bots just buy and sell amongst themselves to keep the illusion of activity high.

5. The “Growing Holder” Trick

A lot of traders look at the holder count to gauge interest in a coin. Seeing the number go up makes it seem like the coin is gaining popularity. Memecoin farmers exploit this with another simple trick. They’ll disperse a small amount of crypto, say a few SOL, across hundreds of wallets and set up buy orders for the coin at specific valuations.

These orders are tiny, but the sheer number of them makes it look like the holder count is booming. You might see 1,000 new holders pop up overnight and think, “Wow, everyone’s buying in!” when in reality, it’s just hundreds of micro-transactions designed to fake growth.

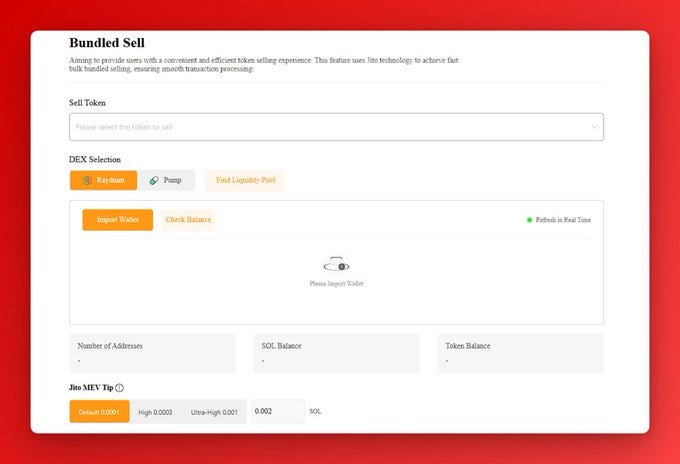

6. The Final Stage: Dumping on You

Here’s the part where they cash out. After building up enough hype and attracting real buyers, these farmers use bundled-sell bots to dump their holdings. They set high-priority settings with substantial bribes to miners, enabling them to absorb all liquidity and sell off their position in seconds.

Imagine you bought in at what you thought was the bottom, only to watch the coin crash as soon as you buy it. This is exactly how they pull the rug out from under everyone — by dumping everything they bought (and faked) onto real traders, leaving you holding the bag.

7. The Cost of Running a Memecoin Farm (and Why It’s Scary Cheap)

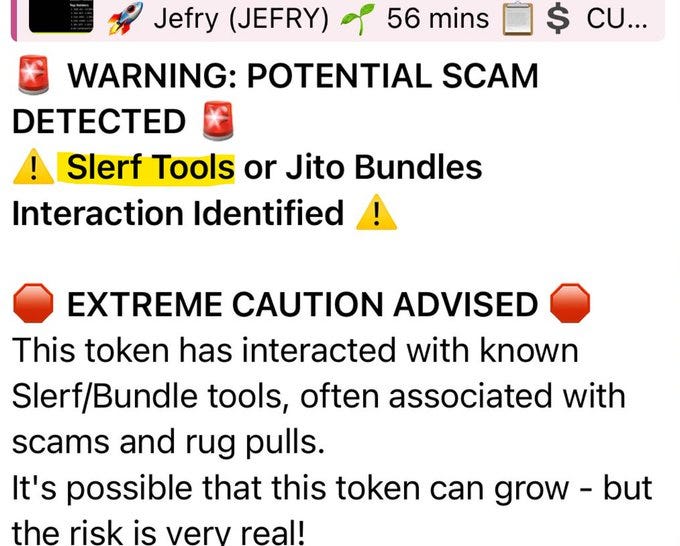

Surprisingly, running one of these farms is pretty inexpensive. Basic bot tools like Slerf, which charge a fee on the SOL used, can be obtained for as little as $2. These free bots leave a pattern on transactions that can sometimes be flagged with warnings, but most people don’t know how to check for these indicators. More sophisticated, undetectable tools cost between $3,000 and $6,000, and these are the real deal.

With just a few thousand dollars, scammers can set up a fully functioning memecoin farm, one that can generate hundreds of thousands — or even millions — before anyone realizes what’s happening.

8. How to Spot a Memecoin Farm and Avoid Getting Scammed

After diving into these methods, here’s what I’ve learned about spotting memecoin farms before they drain your wallet. Watch out for these red flags:

High Sniping or Bundling: Use a blockchain explorer to check the top holders. Are there large, early holdings funded by one or a few wallets? These could be sniper bot wallets.

Suspicious Volume: Look at the top traders. Do they have high buy and sell amounts with little to no profit? This could be a sign of volume bots.

Fake Holder Growth: If the holder count is increasing, check a few wallets. Are they new, barely funded, or only holding this one coin? If yes, it’s a warning sign.

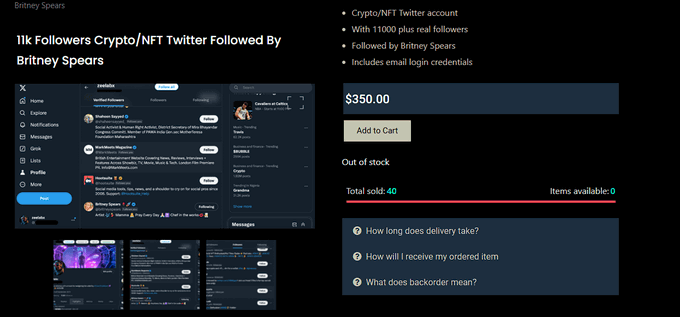

And most importantly, don’t be fooled by things like flashy websites, Twitter accounts with celebrity followers, or “influencers” hyping the coin. Many of these accounts are either purchased or paid off to promote.

Final Thoughts

After talking to this memecoin farmer, I realized how easy it is to set up a scam that looks convincing on the surface. It’s no surprise people fall for it, especially when they’re chasing the next big thing. But with a few precautions and a healthy dose of skepticism, you can avoid becoming another victim of these schemes.

In the end, the best advice I can give is to do your own research and resist the FOMO. Memecoin farming is designed to play on your emotions, but if you stay sharp and look for the telltale signs, you can steer clear of these crypto traps. Stay safe out there.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!