When the inevitable recession hits in 2025, it’s going to be a wake-up call for a lot of people in the crypto space. I’ve seen it before, and I’m telling you now — most of you are going to find yourselves in a tough spot.

WARNING: This is going to be a kick-ass LONG guide!

PS. If you can’t read this article because of the paywall, you can subscribe here — Wise Healthy Wealth Newsletter. — the perk is you can read all my future medium articles for free and stay ahead of the market with exclusive insights!

You see, it’s easy to get caught up in the excitement of a bull run. The market’s pumping, your portfolio is looking healthier than ever, and you start to feel invincible.

I get it — I’ve been there too. But that’s exactly when the biggest mistakes are made.

What I did in 2017

Take 2017, for example. I remember watching countless people get swept up in the euphoria of the bull market.

They were seeing their investments multiply and started to believe that the gains would never stop.

I’ll never forget the stories of those who were up six or seven figures, but instead of taking profits, they kept holding, convinced the ride would last forever.

Then the market turned.

And just like that, all those paper gains evaporated. I saw people who were on the brink of financial freedom end up losing everything because they didn’t know when to walk away.

And I’m seeing the same thing starting to happen now.

This bull run is going to have a lot of you feeling on top of the world, but if you’re not careful, you’re going to get burned.

The biggest mistake you can make is to be overexposed to crypto. It’s tempting to go all in when everything’s going up, but you’ve got to remember — what goes up must come down.

And when that crash comes, it won’t just be a dip; it’ll be a brutal wake-up call for those who weren’t prepared.

But here’s the thing — if you’re paying attention to what I’m saying, you’ll be ready. You won’t be one of those people scrambling to figure out what went wrong while your portfolio is in freefall.

Instead, you’ll know exactly when to take your profits and protect your wealth. It’s not just about making money in a bull market; it’s about keeping it when the market turns.

I’ve been through multiple cycles, and the pattern is always the same. The key to long-term success in crypto isn’t just riding the waves; it’s knowing when to step off before the crash.

That’s why I keep emphasizing the importance of having a strategy — one that isn’t based on emotion, but on proven indicators that tell you when to get in and when to get out.

I’ve seen too many people let greed cloud their judgment, and it always ends the same way.

I have 7 charts that I look at for my analysis.

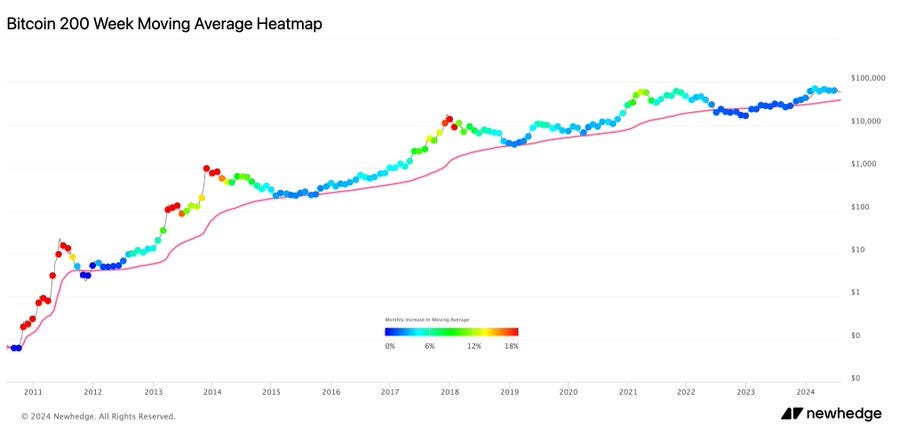

1) When To Enter: 200 Week Moving Average Heatmap

For example, back in 2019, I remember using the 200-Week Moving Average Heatmap as my guide. When the price dipped into that blue zone, I knew it was time to start accumulating.

It was a simple, straightforward signal that most people overlooked, but it’s one of the most reliable indicators out there. And guess what? We’re getting close to that point again.

The market is nearing a prime entry point where smart money starts accumulating. This is the time to stay focused, keep stacking, and live below your means, even when it’s tempting to do otherwise. That’s how you set yourself up for life.

2) When To Exit: MVRV-Z Score

Now, let’s talk about nailing the perfect exit. It’s not just about when to buy; knowing when to sell is just as crucial. In the 2021 bull run, I used the MVRV-Z Score as my guide.

It’s an on-chain metric that has called the top of every major cycle with incredible accuracy. When that Z Score hit red, I knew it was time to start taking profits, even when others were still in denial.

And every single time, it’s been spot on. The same thing happened in 2018, and it’s going to happen again in this 2024 bull run.

3. OTHERS

We NEED this higher low on the HTF to hold for the next legs of this bull market to begin in earnest. Bottoms generally take a few weeks to form as value is exchanged and a range is formed on LTFs.

[Remember — tops are usually violent whilst bottoms are boring/slow]

If/when we break $240B we have our first bullish structural MS break in price since Feb 2024 — this opens the gates to the immediate upside targets as annotated.

Each bullish leg of a secular bull market becomes progressively more aggressive, therefore the RR is greatly skewed to the upside here whilst the downside is relatively muted [barring exogenous events].

My Crypto Experience

Most influencers won’t talk about these metrics because they’re too busy hyping up the next big thing. But I’m here to give you the straight truth. These indicators aren’t about hype; they’re about strategy.

And the best part? They’re simple and take only a few minutes to understand. But simplicity doesn’t mean they’re not powerful.

These tools have consistently helped me protect my gains and avoid the devastating losses that come when the market turns.

This isn’t just theory; I’ve lived through it. I’ve seen the market crash and watched as those who were unprepared lost everything.

But I’ve also seen what happens when you have a plan. In the last few days alone, we’ve seen the $60k region get broken and reclaimed multiple times.

This kind of volatility is what shakes out the weak hands and leaves only the strongest standing. Most traders are getting wrecked right now, caught in the whipsaw of pump and dump cycles.

They’re leaving the market in droves, but the higher time frames are still painting a clear picture — a massive bullish flag that’s setting up for another leg up.

But here’s the catch — most people won’t be around to see it happen. They’ll have already given up, just in time to miss the next big move.

So what does this mean for you? It means there are only two possible outcomes: either you play this cycle right, and you make the kind of money that changes your life forever, or you miss the boat and end up stuck in a 9-to-5, wondering what could have been.

The worst-case scenario isn’t losing everything; it’s ending up where most people are — stuck in the grind, living paycheck to paycheck.

And honestly, when you look at it that way, you’ve got nothing to lose by going all in right now.

This is your moment. There will never be a more perfect time than right now to put everything on the line.

The decisions you make today are going to determine where you are in November and December. I’m not here to sugarcoat it — this is the reality.

If you want to succeed, you’ve got to be willing to take risks.

But with the right strategy, those risks are calculated.

You’re not just throwing money at the market; you’re investing in your future.

Part Of My Portfolio

So here’s what I’m telling you: invest in utility tokens like $GAU, $SOL, and $ORDI. It might sound simple, but that’s because it is.

The key to winning in this game isn’t complexity — it’s consistency.

Stay disciplined, follow the plan, and when the time comes, take your profits and protect your wealth.

I’ve been through this before, and I’m telling you — if you stick with me, you’ll come out on top.

Ignore this advice, and you’ll be left wondering what happened, just like so many others before you.

The choice is yours.

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)