Every successful trader understands one thing: trading isn’t about winning every trade—it’s about managing risk and maximizing reward.

That’s where the Risk-Reward Ratio (RRR) comes in.

It helps you filter bad trades, focus on high-probability setups, and ensure that even if you lose more often than you win, you can still be profitable.

Let’s dive deep into how you can use risk-reward ratios like a pro to take your trading to the next level.

1. What is Risk-Reward Ratio?

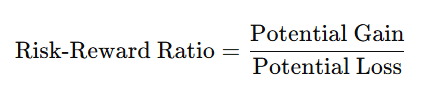

The risk-reward ratio (RRR) is a simple calculation that tells you how much you stand to gain for every dollar you risk.

Formula:

This ratio helps you evaluate whether a trade is worth taking.

A 1:2 ratio means you risk $1 to potentially gain $2.

A 1:3 ratio means you risk $1 to gain $3.

A 1:1 ratio means you risk and gain the same amount—not ideal for profitability.

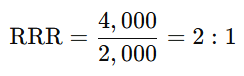

Example: Simple RRR Calculation

Let’s say you’re trading Bitcoin (BTC), and you enter a long position at $50,000.

Stop-loss: $48,000 (risking $2,000)

Take-profit: $54,000 (targeting $4,000 gain)

This means you’re risking $1 to make $2, which is an acceptable ratio in most trading strategies.

Now, let’s analyze how to use this ratio effectively.

2. The Power of Risk-Reward in Profitability

Why a High Win Rate Isn’t Everything

Many beginners believe winning more trades leads to profitability. But that’s a rookie mistake if you’re taking bad risk-reward trades.

Example 1: High Win Rate, Poor RRR

Let’s say you take 10 trades, and you win 70% of them.

Win 7 trades: Gain $100 each → $700 profit

Lose 3 trades: Lose $150 each → $450 loss

Total profit: $700 - $450 = $250

Now compare that to a lower win rate but a better risk-reward ratio.

Example 2: Lower Win Rate, Better RRR

Let’s assume you take 10 trades, but you only win 40% of them. However, your RRR is 1:3 (meaning you risk $100 to make $300).

Win 4 trades: Gain $300 each → $1,200 profit

Lose 6 trades: Lose $100 each → $600 loss

Total profit: $1,200 - $600 = $600

Even though you won fewer trades, your higher RRR made you more money.

Key takeaway: You don’t need a high win rate if you have a good risk-reward ratio.

3. Finding the Right Risk-Reward Ratio for Your Strategy

What’s the Best RRR to Aim For?

Different traders use different RRRs depending on their strategy:

Scalpers: Often use 1:1.5 to 1:2 due to quick trades.

Swing traders: Prefer 1:2 to 1:4 to hold trades longer.

Trend traders: Go for 1:3 or higher, riding major moves.

General Rule of Thumb

📌 Always aim for at least 1:2—this ensures you stay profitable even if only 50% of your trades succeed.

📌 If you find a 1:3 or higher trade, even better—this means one win can erase three losses.

📌 Avoid trades below 1:1.5 unless you have a super high win rate.

4. How to Set Stop-Loss and Take-Profit Using RRR

Your stop-loss and take-profit levels should be based on technical analysis, not just random numbers.

Method 1: Support & Resistance

Place stop-loss below support for longs and above resistance for shorts.

Set take-profit at the next major resistance (for longs) or support (for shorts).

🔹 Example: You enter Ethereum at $3,000, set a stop-loss at $2,900 (risking $100), and a take-profit at $3,200 (gaining $200).

🔹 RRR = 1:2—good trade setup.

Method 2: Fibonacci Levels

Use Fibonacci retracement levels (like 0.618) to set stop-losses.

Use Fibonacci extensions (like 1.618) to set take-profit.

🔹 Example: If BTC bounces at the 0.618 retracement, you place your stop just below it and your TP at the 1.618 extension.

Method 3: Moving Averages

Use the 50-day or 200-day MA as a trailing stop-loss.

If price bounces off the 200-day MA, it’s a good place to enter with a stop just below it.

5. Common Mistakes in Risk-Reward Trading

🚨 Mistake #1: Ignoring RRR for "Gut Feeling" Trades

If a trade doesn’t meet your risk-reward criteria, don’t take it—no matter how "good" it looks.

🚨 Mistake #2: Setting Take-Profit Too Close

If your TP is too tight, normal market fluctuations might hit it before the move really plays out.

🚨 Mistake #3: Using the Same Stop-Loss for Every Trade

Different assets and timeframes have different volatilities—adjust your SL accordingly.

6. How to Use Risk-Reward for Long-Term Success

Even if you follow a solid RRR, trading success depends on consistency and discipline.

Example: The 50-Trade Plan

Imagine you take 50 trades in a month:

You win 20 trades (40% win rate).

Each winning trade makes 2x your risk.

Each losing trade loses 1x your risk.

🔹 20 wins x 2R = 40R

🔹 30 losses x (-1R) = -30R

🔹 Net Profit: +10R

Even with a 40% win rate, you’re profitable!

Final Thoughts: Why RRR is Your Trading Lifeline

✅ RRR protects your capital and keeps you profitable—even with a low win rate.

✅ Aiming for 1:2 or higher improves your overall success rate.

✅ Stop-loss and take-profit levels should be based on technical analysis.

The difference between a losing trader and a consistently profitable one isn’t winning every trade—it’s managing risk properly.

Master the risk-reward ratio, and you’ll be light years ahead of most traders.