As I delved into Binance’s recently released “Top 10 Charts” for the first half of 2024, it became clear that this 20-page report is packed with valuable insights. After sifting through the data and trends, I’ve distilled the key points that every crypto enthusiast should know. Here’s a deeper dive into what’s happening in the world of crypto and how these trends could shape the future.

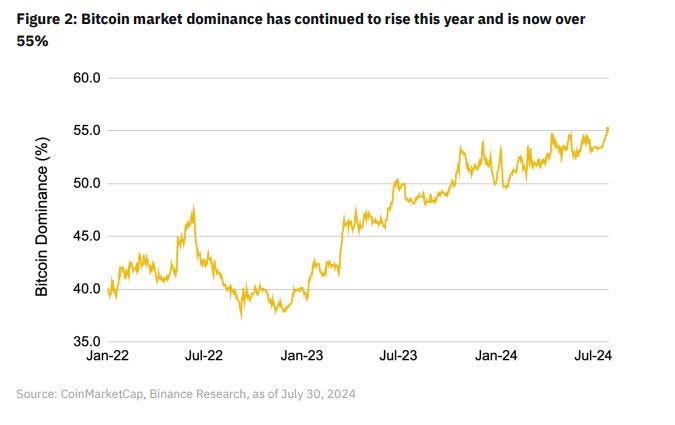

1. Rising $BTC Dominance: The King Reigns Supreme

Bitcoin’s dominance has been on a steady climb since November 2022, and this isn’t just a blip on the radar. With a backdrop of economic uncertainty, it’s fascinating to watch how Bitcoin continues to cement its position as the top cryptocurrency. If the current trajectory holds, we could see Bitcoin’s dominance hit 60% by the end of this year. For those of us who’ve been in the game long enough, this isn’t just another market cycle — it’s a reaffirmation of Bitcoin’s unmatched value proposition. As Michael Saylor, one of the most vocal Bitcoin advocates, said, “There’s no second best.” This phrase echoes louder as Bitcoin steadily distances itself from the rest of the pack.

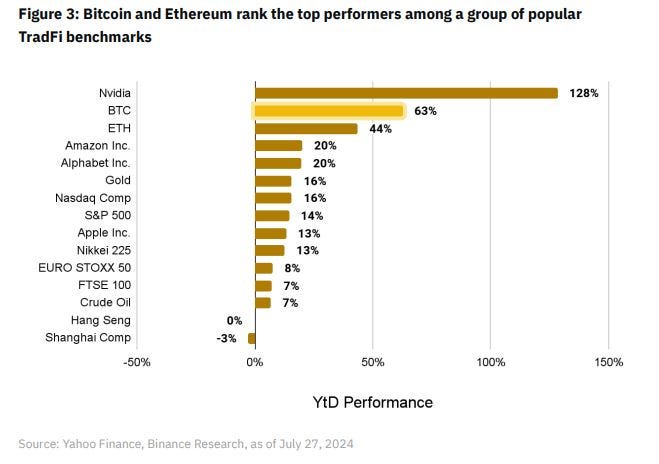

2. $BTC & $ETH: Entering the Big Leagues

Bitcoin and Ethereum are no longer just leading the crypto market — they’re starting to decouple from the broader altcoin space. This is a significant sign of maturity for both assets. As of July 27th, the performance of Bitcoin and Ethereum stood out, even against the backdrop of traditional finance. For instance, Bitcoin and Nvidia (yes, the same company leading in AI and GPUs) outperformed common traditional financial investments, signaling a potential shift where these major cryptos are being perceived as safer, more stable bets. This kind of decoupling is something I’ve been closely monitoring, as it could redefine how institutional investors approach digital assets.

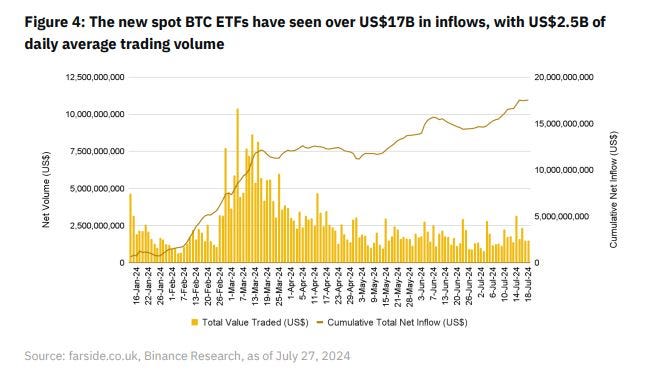

3. Spot $BTC ETFs: A Potential Game Changer

One of the biggest narratives this cycle has been the introduction of spot Bitcoin ETFs in the U.S. This move has diversified demand in ways we hadn’t seen before. With over $17.5 billion in inflows, the institutional appetite for Bitcoin is growing at an unprecedented rate. For those of us who have been waiting for the “big money” to move into crypto, this could be it. The influx of mature capital into Bitcoin is likely to bring long-term stability to its prices. This isn’t just speculation; it’s the beginning of a new chapter in the Bitcoin story, one where institutional players play a central role.

4. Stablecoin Supply Rises: More Capital Moves On-Chain

Stablecoin supply has surged by 25% year-to-date, a clear indicator that more capital is flowing into the crypto space. This uptick reflects a broader trend of increasing liquidity, as traditional investments become less attractive due to falling U.S. interest rates. With the market shifting towards a risk-on sentiment, we’re likely to see even more capital moving on-chain. For those of us in the crypto space, this is a crucial development — it signals growing confidence in the market’s ability to handle larger volumes of capital, which could drive further innovation and adoption.

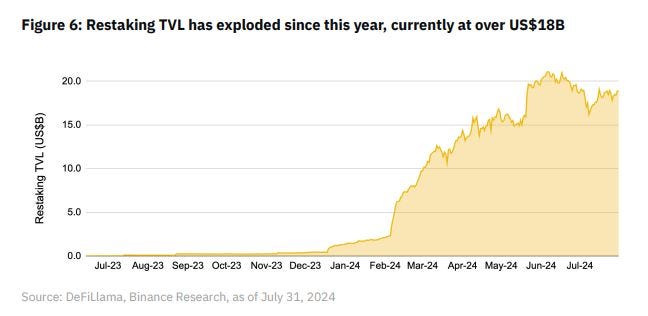

5. Restaking TVL Explosion: The New Frontier in Staking

Restaking has been one of the hottest trends in 2024, and despite some recent cooling off, the Total Value Locked (TVL) in restaking has exploded. This isn’t just about locking up tokens anymore; it’s about repurposing them to secure other applications. Leading the charge is EigenLayer, but we’re also seeing the emergence of new primitives like GPU staking. The implications here are massive. As someone who’s been following the staking space closely, I can see how these developments could lead to more secure and decentralized networks. It’s not just about earning rewards; it’s about contributing to the ecosystem in more meaningful ways.

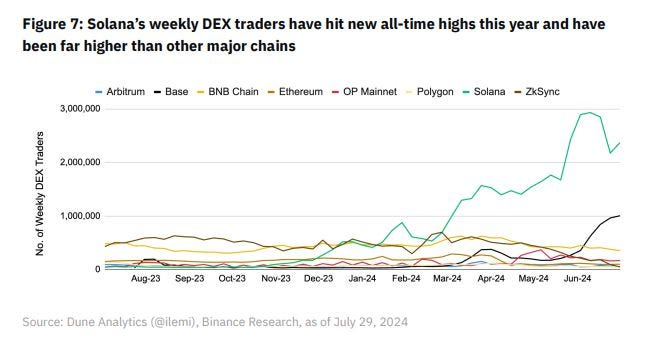

6. Solana & Base Dominance: Who’s Leading the Layer 1/2 Race?

Solana has been making waves, especially with its weekly decentralized exchange (DEX) traders hitting new all-time highs. Solana has managed to outpace other major Layer 1 and Layer 2 solutions. But, as with all things in crypto, sustainability is the big question. With the memecoin mania cooling down, it’s worth watching whether Solana can maintain its growth. At the same time, Base Layer 2 is emerging as a strong contender, showing that the race for dominance in this space is far from over. For those of us who have seen projects rise and fall, the key will be in watching how these platforms evolve to meet the demands of a changing market.

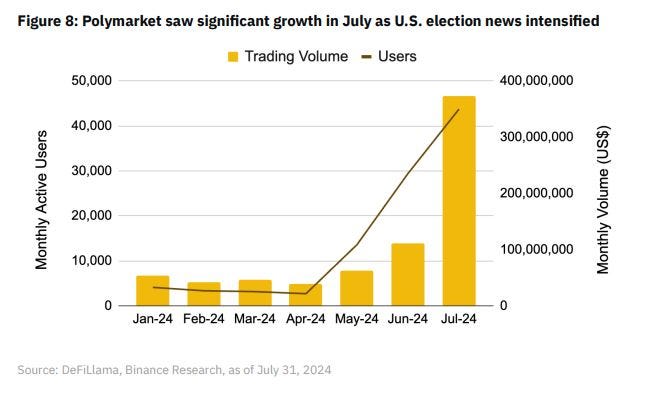

7. Prediction Markets: The Killer App for 2024?

Prediction markets have quietly become one of the most interesting verticals in crypto, with a 200%+ increase in TVL year-to-date. Driven largely by global elections, platforms like Polymarket have seen their volumes skyrocket — up 500% from January to July. This surge reflects a growing interest in decentralized prediction markets, which offer a unique way to speculate on real-world events. As someone who’s always been fascinated by the intersection of finance and social trends, I see prediction markets as a potential killer app that could bring even more users into the crypto space.

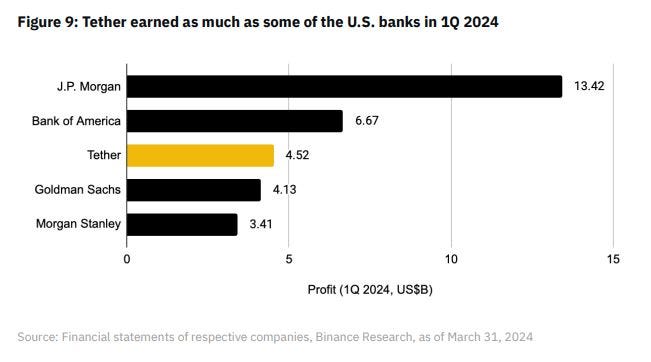

8. Stablecoins: The New Cash Cows

Tether ($USDT) continues to dominate the stablecoin market, and its performance this year has been nothing short of remarkable. With a record-high $4.5 billion net profit in Q1 alone, Tether is now rivaling major U.S. banks. Meanwhile, Circle, the company behind $USDC, is gearing up for its IPO, which could further shake up the stablecoin landscape. For those of us who have been tracking the evolution of stablecoins, this is a pivotal moment. These digital assets are no longer just a niche part of the crypto market — they’re becoming a cornerstone of the global financial system.

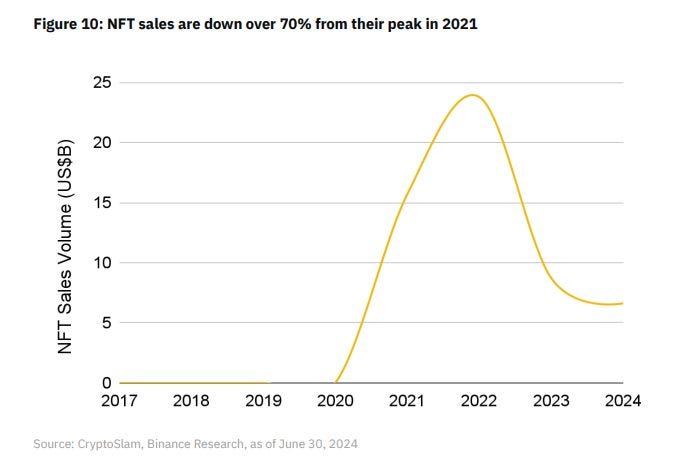

9. NFTs: A Declining Vertical, or Just a Pause?

NFTs have had a rough year, with sales plummeting from their 2021 highs of over $23 billion. The leading theory is that memecoins have offered a more liquid and accessible way to speculate, drawing attention away from NFTs. As someone who has been involved in the NFT space, I see this as a natural market correction. The hype may have cooled, but the underlying technology and potential applications of NFTs are still solid. It’s possible that we’re just seeing a pause before the next big wave of innovation in this space.

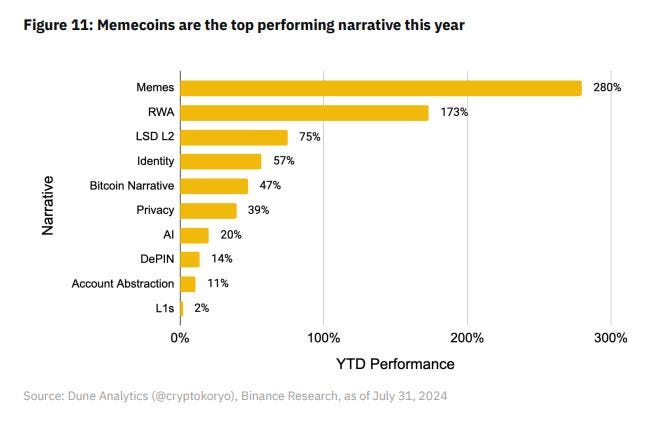

10. Memecoins: The Year’s Standout Performer

Memecoins have been the unexpected stars of 2024, delivering average year-to-date returns of 280% as of July 31st. However, with the market shifting towards a risk-off sentiment, this trend might be cooling down. The surge in liquidity that fueled the memecoin boom could spark another wave, but for now, it seems the hype is taking a breather. For those of us who have watched the rise of memecoins with a mix of amusement and skepticism, it’s a reminder that in crypto, anything can happen — and often does.

Wrapping Up

Binance’s H1 2024 report offers a comprehensive look at the key trends and shifts in the crypto market. From the rise of Bitcoin dominance to the explosion of restaking TVL, these insights provide a roadmap for what’s to come. As someone who’s been navigating the crypto landscape for years, I can say with confidence that we’re in a pivotal moment. The next few months will be crucial in determining which trends take hold and which fizzle out. Whether you’re a seasoned investor or a newcomer to the space, staying informed is key to making the most of the opportunities ahead.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)