Buying The Dip.

The market is red…buy the dip, they said… for the past six months…

Many got rekt by buying every dip or break out in the chop.

Let’s dive into my plan

1. Introduction: chop vs. easy periods 2. Current cycle 3. My buy plan (Altcoin and Bitcoin)

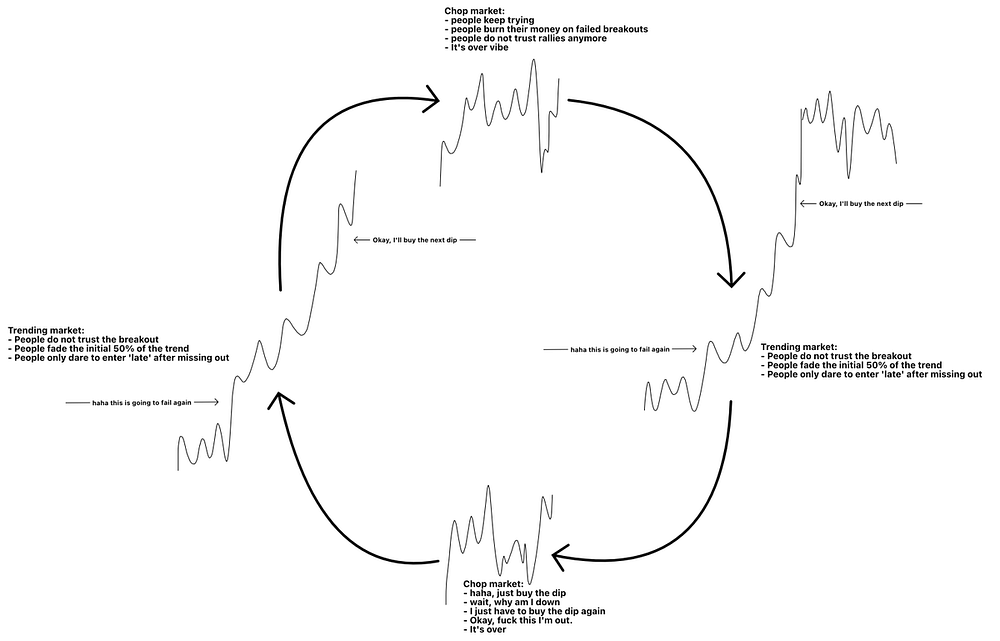

1. Introduction Bull markets have periods of easy money and more difficult periods. — Big trending periods, during which you can buy any dip and profit within 1–14 days. — Difficult periods of chop. People buy failed breakouts to sell the next dip for a loss.

The problem is that the periods of chop are so draining that it’s difficult for people to ‘just ride the easy trending market’ when it comes. They miss out on the first part to enter late again, right before we enter another crab market.

And now again, many are chasing every breakout, hoping it’s the one, and buying every dip only to see another one follow. — Portfolios are getting wrecked before the next easy market. — People are burning out mentally, making it harder to ride the easy market when it comes.

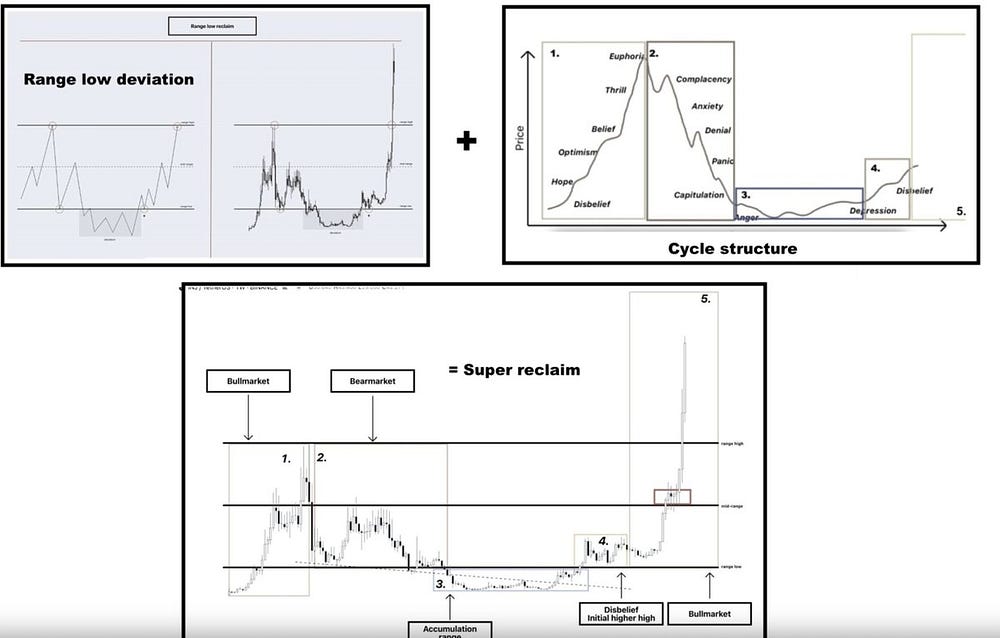

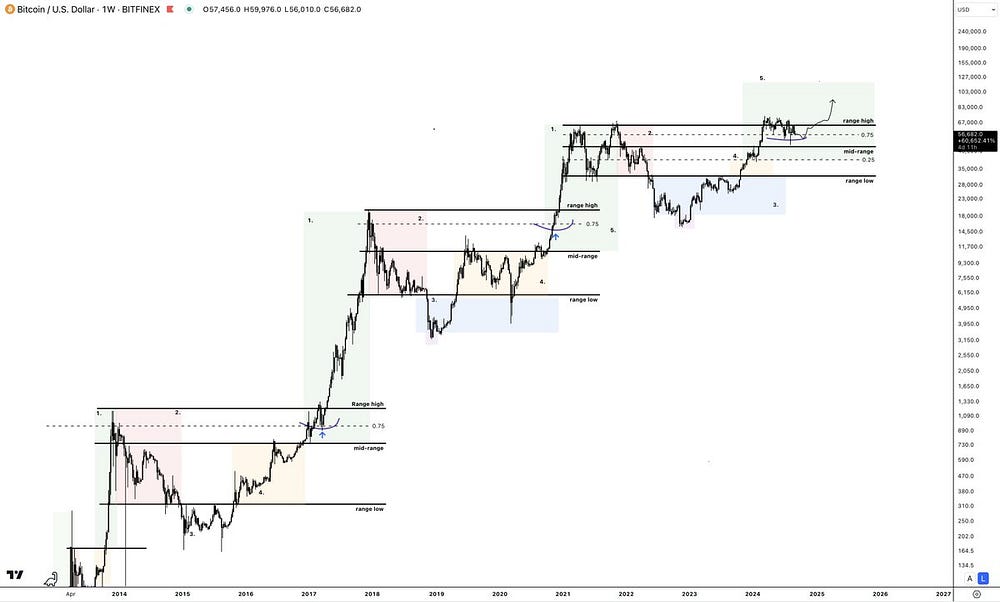

2. Current Cycle: We’ve seen a significant period of chop, below the range low resistance in 2023. I took heavy exposure once we broke out and reclaimed the range low. Maybe you can remember the sentiment; many distrusted the rally faded it. My first target was the range high, and the second still sits higher in price discovery.

I’ve kept most of my spot holdings since the range low but took some profits on the way up and reinvested in new plays along the way. I started slowing down once I noticed it wasn’t working anymore, and dips weren’t getting bought up quickly.

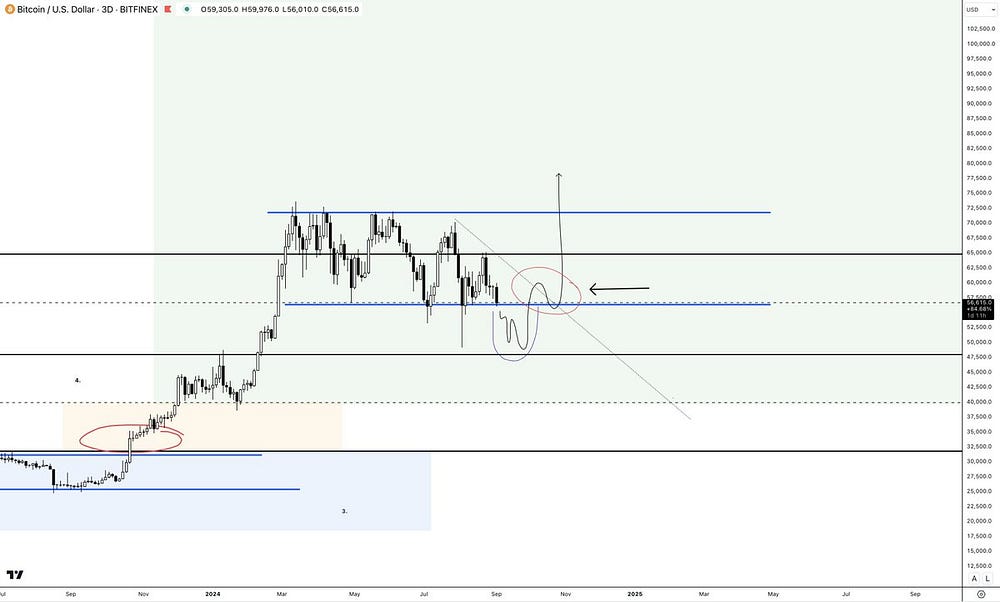

And this is key: > If you recognize a shift in the tide, slow down or stop and observe. > In this market, less is more. (I know it isn’t easy with X buying every dip) Imagine betting on price to leave this range for nearly 200 days:

I still believe this is an accumulation phase, but we could drop lower. Even so, I expect a second leg of the bull market, with easier times ahead — especially for altcoins. Now, let’s dive into my plan to increase exposure using the profits I took.

3. My Plan Fast-forward to today. I’m still preserving capital in this chop and am not interested in trying to trade or predict tomorrow’s prices. Instead, I focus on my higher time frame outlook, which I have much more confidence in. — I do think Bitcoin will eventually go higher. I am just unsure about the medium-term chop (so I don’t try to trade it) — I do think Altcoins are at a great spot to accumulate. (I still do have spot exposure since 2023)

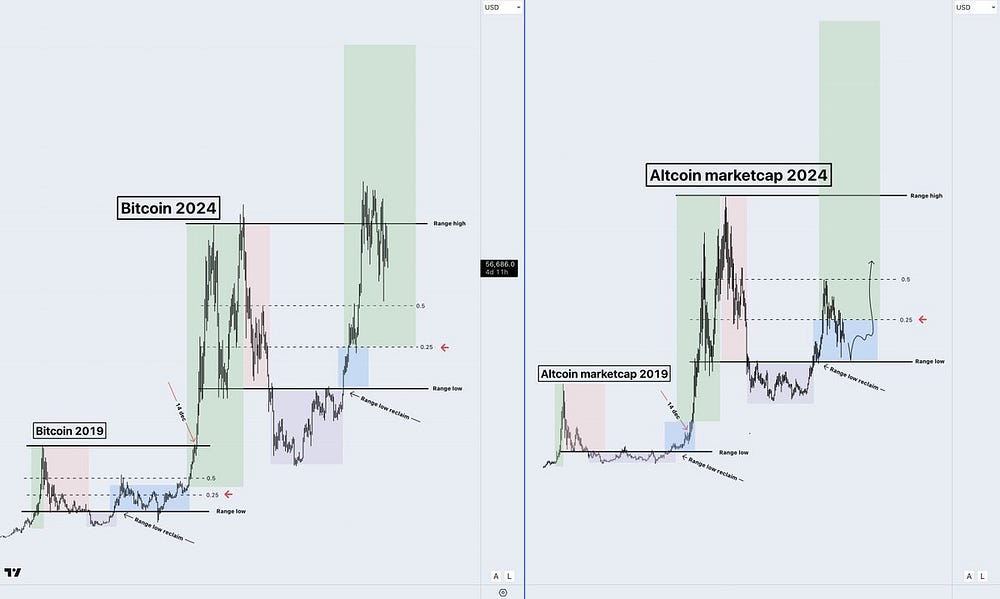

So where to add and bet on the 2nd (more altcoin-focused) bull market easy money period? Altcoin market: Last year, when I took a bet on Bitcoin and Crypto, it was because Bitcoin reclaimed the range low, and it seemed pretty obvious to me that she was in stage 4 These cycles and ranges are something I always use in my trading and decision-making: — Cycle stage 4 + Range low reclaim example.

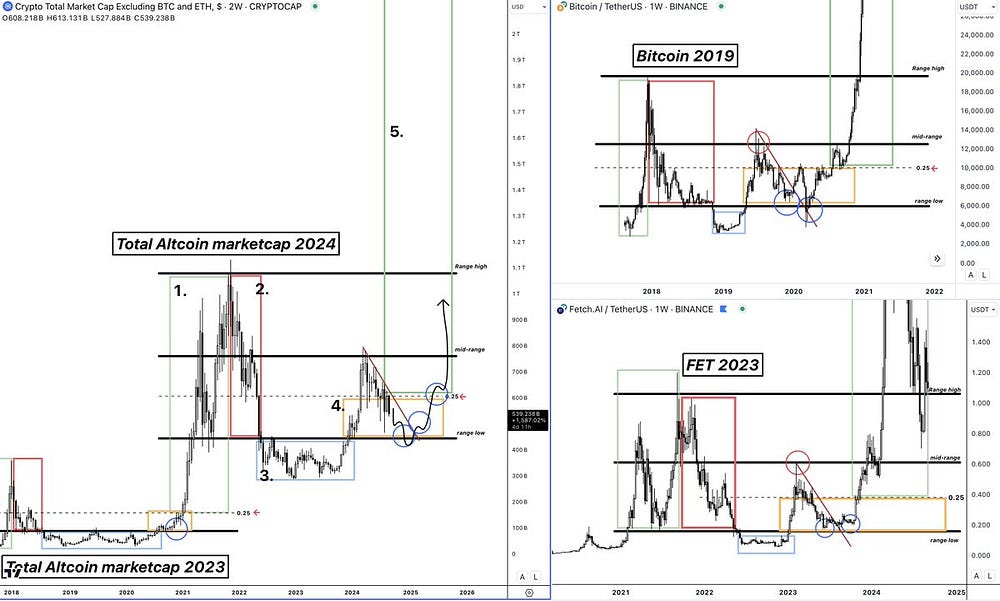

We know that BTC will always steal the show in the 1st part of the bull market, and Altcoins follow behind in the 2nd part. In the past cycles, Altcoins moved away from their stage 4 part into the parabolic stage 5, only when BTC started trading into new highs. Visible below

So once again, just like last year, when Bitcoin reclaimed the range low after a clear accumulation period in stage 3, I think Altcoins, while their total market cap sits around the range low, are a great buy. — Clear invalidation — Close to invalidation — Massive upside (great RR) (entry options below) Entry options: 1. Initial dips into the range low 2. If we violate the range low but reclaim it again (wait for the reclaim), like BTC in 2019. 3. Break of trendline 4. Second reclaim of the 0.25 resistance (often a trigger for stage 5 to start)

These take time and verge patience, but they will greatly reduce your chances of burning all of your capital in the current Bitcoin chop.

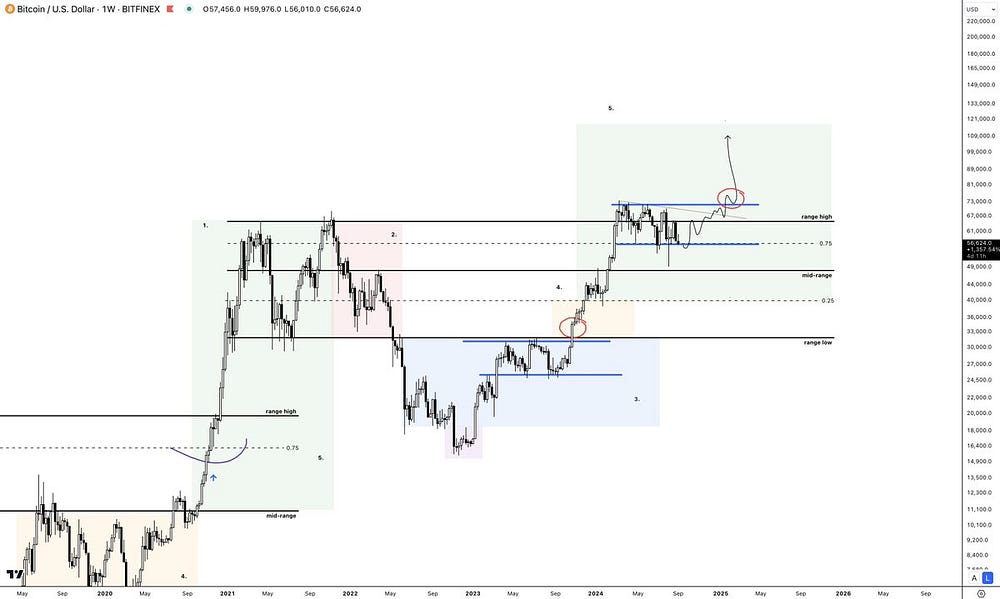

Bitcoin: I think there’s a good chance that this current range we formed holds for Bitcoin. Bitcoin always retested and held the 0.75 (range quarterly level) in every bull market. I bought some Solana at $117 in April when we started to retest it.

The key for me here in this chop is that: — I bought a small portion and am happy to take it down if we take another dive lower. — I won’t flip-flop in and out and try it repeatedly. I have finished my work here.

If we don’t break down lower but head higher, I am waiting for the break out above the current and macro range high. This is similar to how we entered in 2023 after reclaiming the macro range low and breaking out of the local range.

While not expecting it, I’m open and prepared for a scenario where we break down lower. If this is the case, I won’t be acting like a hero knife-catching, but instead wait for either: A) A reclaim of the local range:

or B) A mini-cycle to form within the bigger cycle:

The mini cycle above is from AGIX, but could look something like this on Bitcoin: — I’ll not knife catch, or try to predict stage 3 (blue). I will wait for a break in structure, within this mini cycle and stage 4 (yellow) at form at a key level — Range key levels to watch (besides the reclaim) are the mid-range, 0.25, and range low.

If we V-shape somewhere before this could form, I’ll wait for a reclaim or sit happily on the spot I’ve owned since 2023. This thread is purely to add exposure and show people that: — You don’t need to overtrade the chop. But you have to make a plan. Less is more. You can stop trading once the direction becomes difficult to predict and get the f in once it’s in easy mode again. — React vs. predict. Stay open-minded to multiple outcomes, and let the market show you the direction.

Oh, and if we eventually get into easy mode again, take profit on the way up, gradually, not all at once aiming for the top.

This approach has allowed me to minimize risks and maximize returns, ensuring that I stay on course even in the most volatile of markets.

By following these principles, you too can develop a thoughtful approach to crypto investing that goes beyond the typical pitfalls and helps you achieve long-term financial success.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)/