Yesterday we broke down SOL/ETH.

Today, let’s talk SOL/BTC.

And let me be clear: if you’re only looking at SOL/USDT, you’re playing the game half-blind.

Because the real signal isn’t in dollars. It’s in how Solana is performing relative to Bitcoin. That’s where the truth about rotation lives.

Why SOL/BTC Matters

When SOL/BTC goes down, Bitcoin is the stronger asset. Solana bleeds.

When SOL/BTC goes up, Solana is gaining strength versus BTC, and that’s when altseason narratives start to gain traction.

This chart is one of the cleanest ways to track whether Solana is truly ready to outperform, or just pumping in USD terms while bleeding against BTC.

The Big Shift

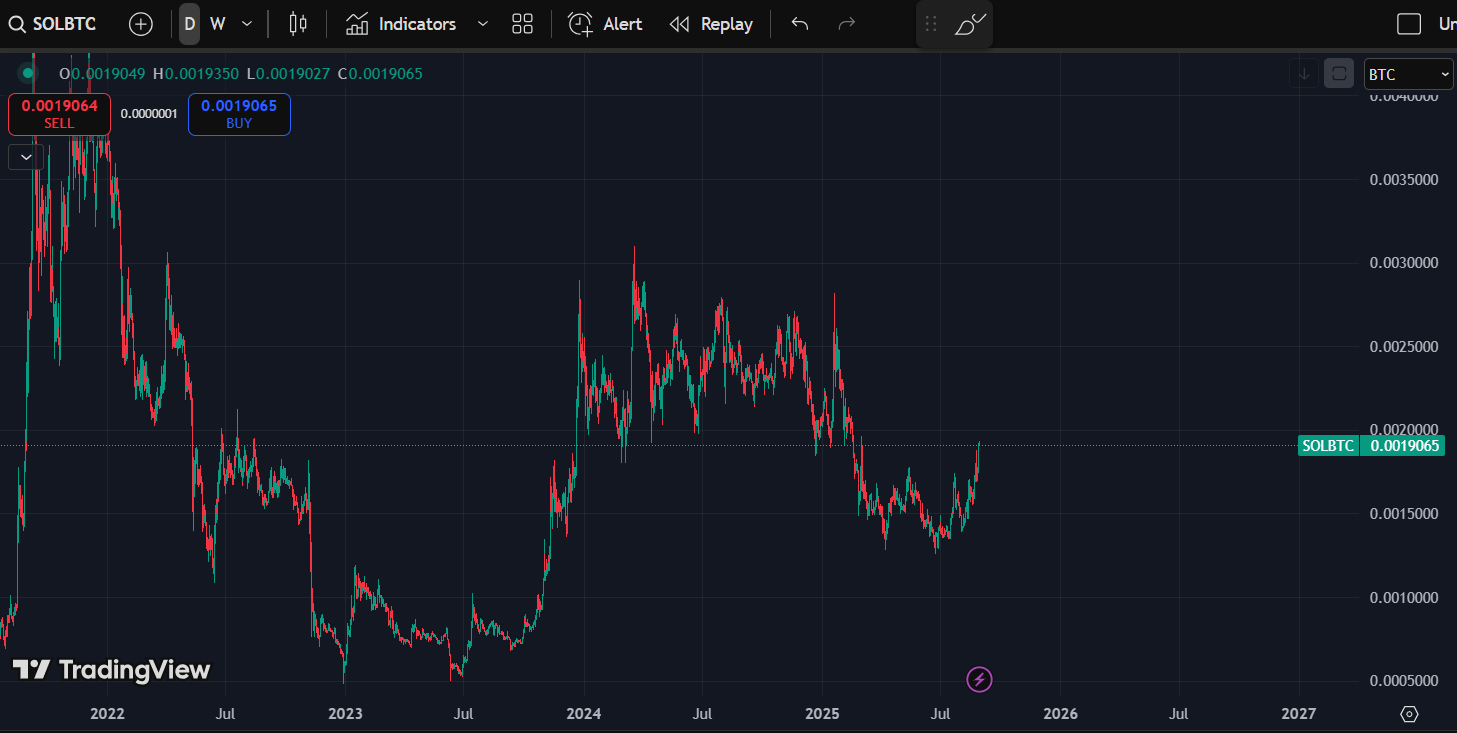

Since the second week of January, SOL/BTC has been in a steady downtrend. Bitcoin dominated. Solana lagged.

But this week, that changed.

Sunday night’s weekly close confirmed a higher high. That officially breaks the downtrend. It’s the first real structural signal that SOL has bottomed against BTC.

This is exactly the kind of moment where smart money pays attention, not after the candles have already run 50%.

What the Chart Is Saying

Look at the structure:

SOL/BTC bottomed in the green accumulation zone.

It’s now flipped resistance into support around the 0.0019 region.

Above us, there are two major resistance levels, both are profit-taking zones where sellers will show up.

When SOL/BTC trends higher, it’s not just Solana that benefits. It signals a rotation phase where liquidity moves into higher-beta alts. That’s when things start flying.

What Most Traders Will Do

Most people won’t touch SOL until it’s already halfway to the next resistance. They’ll FOMO in when the headlines say “Solana breaking out.”

Then they’ll hold too long, refusing to take profit when resistance hits.

And when SOL/BTC retraces, they’ll round-trip their gains back into nothing.

Why? Because they don’t have the roadmap.

Inside today’s premium breakdown, I laid out:

The exact accumulation zone (the green box) where I’ve been buying SOL against BTC.

The first major profit-taking level above, where I’ll be trimming heavy.

The final take profit target for this cycle leg, where I’ll be unloading most of my position.

The invalidation point that kills this setup, so you never end up bagholding.

How this SOL/BTC move fits into the bigger cycle rotation between BTC, ETH, and alts.

If you’re only reading this free issue, you know the trend has flipped.

But you don’t know where to buy, where to sell, or how to protect yourself if the setup fails.

That’s the edge premium members already have.

The Bigger Picture

Metrics charts like SOL/BTC and SOL/ETH aren’t optional.

They’re the tools that let you trade cycles with conviction.

SOL/USDT shows you number-go-up.

SOL/BTC shows you whether Solana is truly outperforming Bitcoin.

And in every past cycle, the biggest USD moves for alts came after they bottomed on their BTC pairs.

That’s why this chart is so critical right now.

Stop Trading Blind

If you’re still guessing, you’re behind.

I don’t trade hopium.

I trade structure, metrics, and conviction.

That’s what I teach inside the 9-5 Crypto Exit Manual, the complete framework for buying at the right times, selling at the right times, and compounding your stack without gambling on memecoins.

And it’s what I deliver daily in the premium 9-5 Traders Discord, where members already have the exact zones and strategy for this SOL/BTC setup.

The rest of this breakdown with the accumulation zone, profit-taking levels, and invalidation is already live inside.

👉 Get the 9-5 Crypto Exit Manual + premium Discord access today: www.whop.com/digitalvault1

SOL/BTC has bottomed.

The rotation is here.

Tourists will notice it late. Killers are already positioned.

-Victor