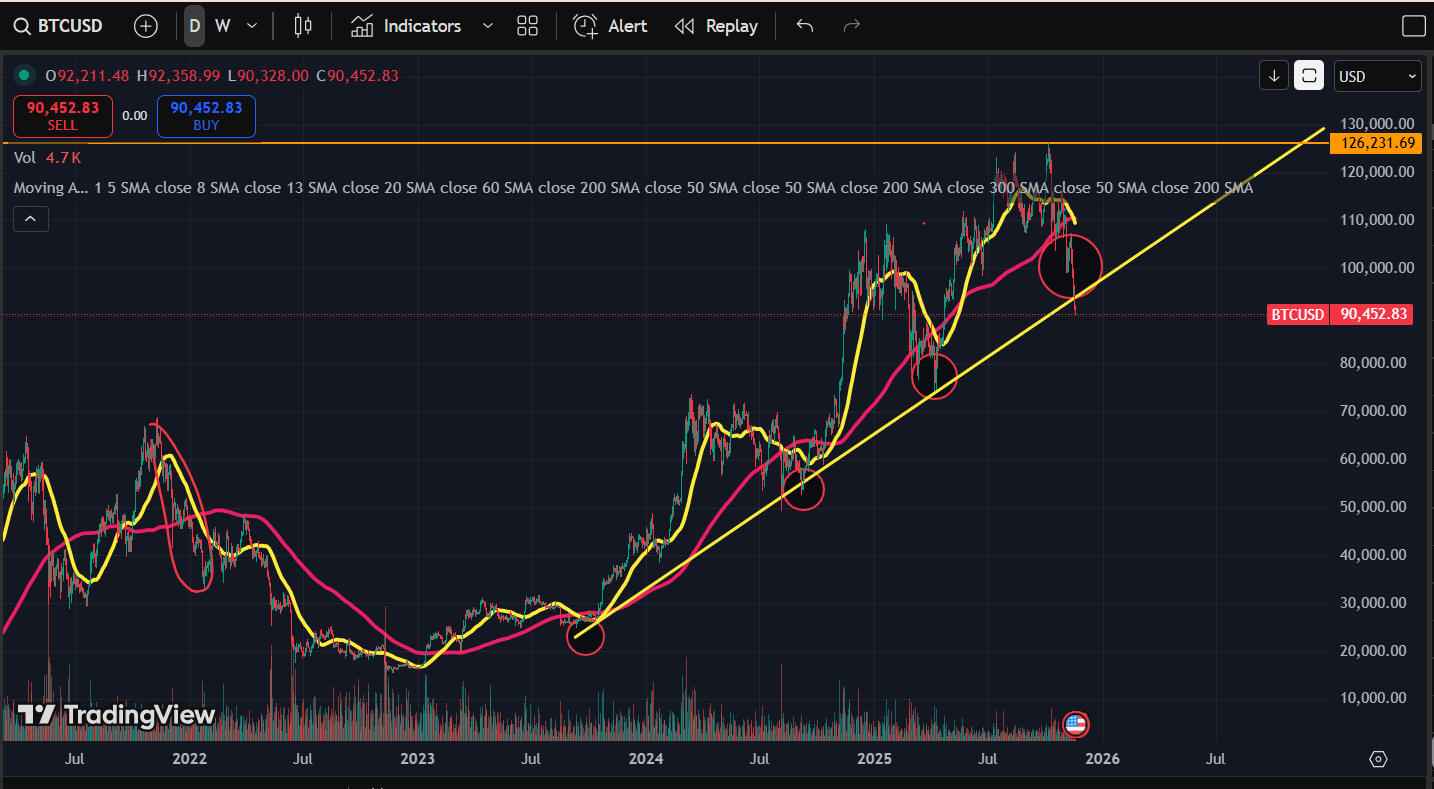

We just got a death cross on Bitcoin.

That’s when the 50-day moving average crosses below the 200-day moving average

a signal that, on paper, looks bearish.

But let’s take a step back and look at what the data actually says.

History Never Repeats, But It Rhymes

Over the last three times we saw this setup,

Bitcoin didn’t collapse afterward

it ran.

Each of those prior death crosses marked a reset point, not a graveyard.

But there’s one key difference this time:

those previous crosses all happened above the long-term trendline.

This one?

We’re right on it.

And that changes the dynamic completely.

Context Matters More Than the Signal

Let’s be real.

A death cross in a bullish macro structure often acts as a shakeout.

A death cross in a bearish structure can extend pain.

Right now, BTC is flirting with that line between both worlds.

We’ve got:

Long-term trendline support still holding (since 2023).

RSI cooling off from oversold conditions.

Momentum trying to stabilize near the 200D MA.

That’s not full-blown bearishness

that’s indecision.

And indecision, in crypto, is usually the prelude to opportunity.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

What the Chart Is Saying

You can see it clearly in the chart above:

Every touch on this ascending yellow trendline has produced a rebound.

The 200D moving average (in pink) is now being retested, just like it was after each cycle top in 2019, 2021, and mid-2023.

When the he Stoch RSI is near overbought

which is where derisking or scaling down partial exposure makes sense.

That doesn’t mean “go all cash.”

It means manage risk while letting the structure play out.

How I’m Playing It

Here’s what I’m doing, and what I’d recommend for anyone who wants to stay in the game long-term.

Derisk on strength.

When the Stoch RSI pushes into overbought,

or if we retest the 200D MA and stall

trim, not exit.

Keep capital fluid.Stay in with conviction.

As long as BTC respects the long-term trendline (currently around 90k),

the macro structure is still bullish.Don’t let noise shake you out.

A death cross is only a death sentence if you don’t manage your emotions.

We’ve been here before

same fear, same headlines, same “this time it’s over” energy.

And every single time, those moments ended up being the setup for the next leg up.

Zooming Out

Zoom out for a second.

The last time BTC printed a higher low after a cycle top

and retested the 200D MA,

that was early 2020

the exact same structure before the 2021 run.

Now, we’re here again

testing the same moving average,

same long-term support,

same emotional exhaustion across the market.

You can feel the sentiment.

People are tired.

And that’s why this matters.

Because when people stop caring

that’s when the market starts moving.

My Take

If this truly is the end of the current bull cycle,

then this is the best training ground you could’ve asked for.

You’ve learned risk management.

You’ve survived multiple liquidation cascades.

You understand structure, patience, and fear better than 90% of the market.

So even if this run takes longer to materialize

you’re ready.

Because staying long in the game isn’t about holding every pump.

It’s about surviving every storm so you’re still here when the next wave hits.

The worst traders chase tops.

The best traders prepare through pain.

The Playbook

Right now, there are only two smart moves:

De-risk near overbought signals.

Rebuild positions near trendline support or 200D MA.

Everything else is noise.

Remember:

death crosses don’t kill portfolios

poor discipline does.

If you want to learn how to navigate these cycle resets like a pro,

study what I teach in the Crypto Exit Manual,

All available for $117/month

Cycles don’t end, they evolve.

And when the next one begins,

those who survived this correction

will be the ones leading it.