When it comes to altcoin season, it’s like stepping into a wild, thrilling roller coaster — the kind that’s filled with adrenaline-pumping highs and gut-wrenching drops.

For those of us deep in the crypto trenches, it’s that magical yet volatile period where 75% of the top 50 altcoins start outpacing Bitcoin over the course of 90 days.

Imagine it like Christmas, but instead of presents under the tree, you’ve got your portfolio spiking in value, and instead of eggnog, you’re fueled by pure, unfiltered market excitement.

Now, if you’ve been around long enough, you know that timing is everything in this game. The question that’s probably burning in your mind right now is, “Wen altcoin szn?”

And trust me, it’s a question worth asking because getting the timing right can be the difference between making “life-changing” money and becoming another cautionary tale in the crypto world.

So let’s dive into what’s happening right now, using a couple of key charts that can help you avoid buying the top and getting rekt like so many who came before you.

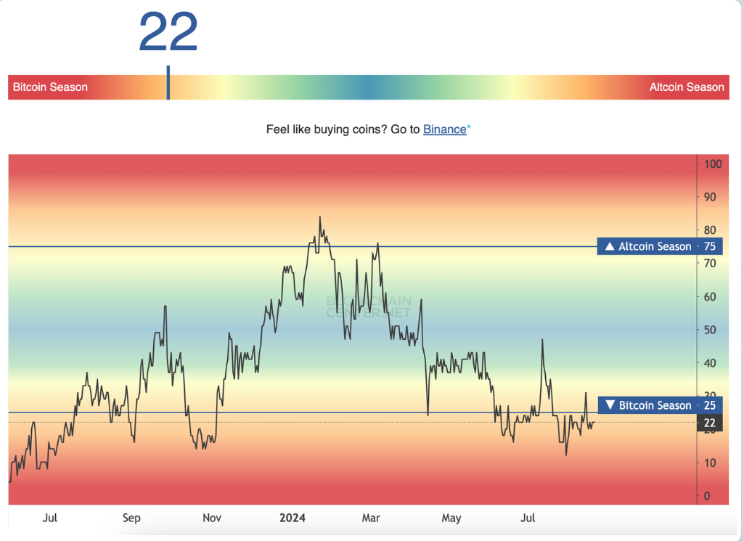

First up, we’ve got the classic showdown: Bitcoin Season vs. Altcoin Season.

Bitcoin Season vs. Altcoin Season: The Ongoing Battle

This chart is like the scoreboard of a high-stakes game, tracking the performance of Bitcoin relative to the broader altcoin market.

Here’s the deal: If the index falls below 25, it’s officially Bitcoin Season, meaning Bitcoin is dominating and most altcoins are lagging behind. But once that number climbs above 75, that’s when altcoin season kicks off, and it’s time to get excited.

Right now, we’re still technically in Bitcoin Season with the index indicator sitting at 22. It’s like Bitcoin is barely holding onto the title, and we’re just waiting for altcoins to start their surge.

What does this mean for you? It means altcoins are on sale right now, and this might be one of the last chances to grab them at these discounted prices before the season shifts.

Think about it like this: Back in 2017, I watched as some of my friends loaded up on altcoins when Bitcoin was still reigning supreme. They were early, but not by much, and when altcoin season hit, their portfolios skyrocketed.

One of them, who was deep into Ethereum and Litecoin, saw his modest investment turn into enough to pay off his student loans in a matter of weeks. Timing, as I said, is everything.

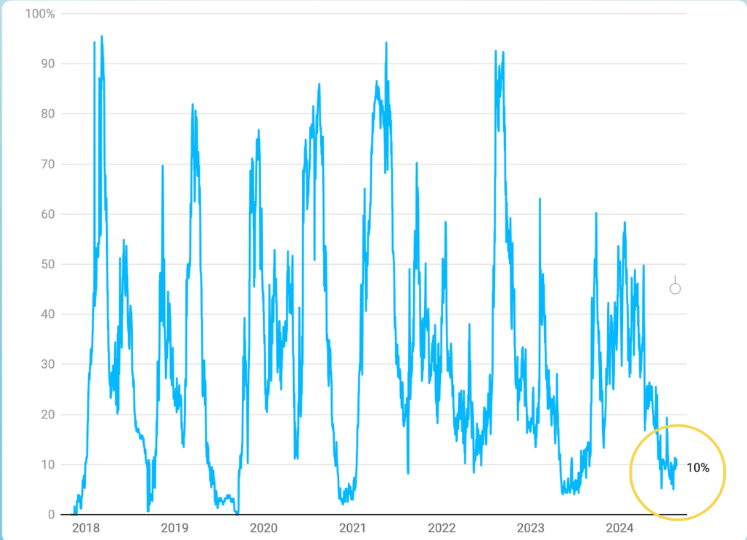

Now, let’s talk about the Speculation Index. This metric is essentially a big neon sign flashing “BUY ALTCOINS!” but only if you know how to read it. It shows what percentage of altcoins are outperforming Bitcoin on a 90-day average.

The lower the percentage, the less money is being thrown into altcoins, which means they could be undervalued and primed for a rally.

When I first started in crypto, this was the kind of data I ignored because it wasn’t sexy. I was more focused on hype and price action than on the underlying metrics.

But after getting burned in a few cycles, I learned that these “boring” indicators are where the real money is made. At 10%, it’s like the market is screaming that altcoins are undervalued. I remember during the last cycle, a similar scenario played out, and those who listened to the Speculation Index saw massive gains when altcoin season finally hit.

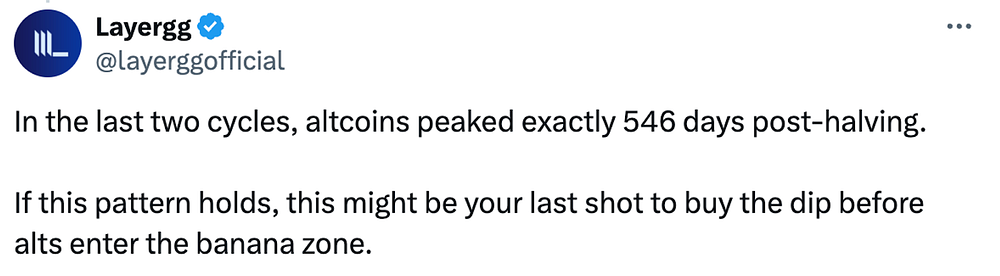

Post-Halving Altcoin Trends: History Repeats Itself

Now, let’s zoom out a bit and look at post-halving altcoin trends. We’re currently about 125 days past the latest Bitcoin halving, which historically has been the calm before the storm for altcoins.

If you’re new to this, let me break it down for you: After every halving, Bitcoin usually has a significant run-up, but it’s in the months that follow where altcoins tend to shine the brightest.

Back in 2017, about a year after the halving, I watched in awe as the altcoin market exploded. Coins like XRP and ADA went parabolic, turning early investors into millionaires overnight.

Fast forward to 2021, the same pattern emerged. Those who understood the post-halving dynamics and loaded up on altcoins early were able to ride the wave all the way to the top.

Right now, we’ve got around 421 days of potential altcoin growth ahead of us. It’s not going to be a smooth ride — expect dips, loops, and sharp turns — but if history is any guide, the ride will be worth it.

The key is to buy into the bleed, during those moments of doubt when everyone else is running for the exits. This is where the seasoned investors make their moves while the rest sit on the sidelines, paralyzed by fear.

Crypto total market

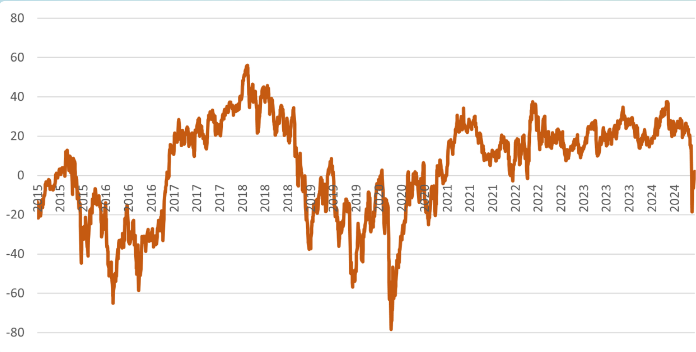

Risk Appetite Is Down… Time to Get Greedy?

Here’s where things get interesting. Market psychology is a hell of a drug. The instructions couldn’t be simpler: buy low, sell high. Yet, 95% of traders lose money.

Why?

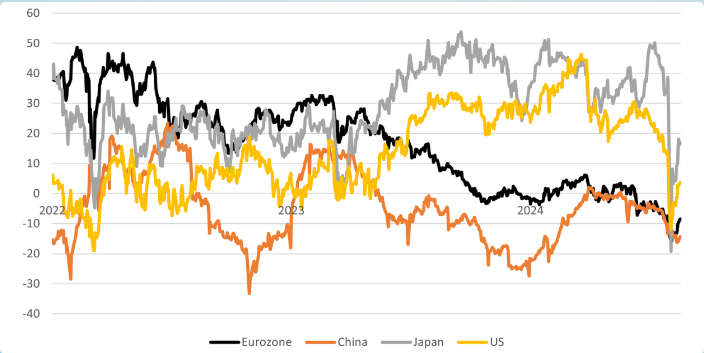

Investor exposure to global risk assets

Because when prices are low and the market is bleeding, fear takes over. It’s hard to press that buy button when everyone around you is shouting that the sky is falling.

But here’s the thing — by rewiring your mindset, you can set yourself up for success.

Right now, we’re seeing global investors go risk-off for the first time since early 2022. This is crucial because it’s during these moments of fear and uncertainty that the biggest opportunities arise.

I remember back in early 2020, just before the pandemic hit full force, I was watching the markets closely. As fear gripped the world, the stock market plummeted, and so did crypto.

I saw my portfolio drop by over 50% in a matter of days. But instead of panicking, I remembered the old adage: be greedy when others are fearful. I doubled down on my investments, buying into the fear.

Fast forward to the end of 2020, and that decision paid off massively as the market rebounded and then some.

The same principles apply today. If we don’t go into a recession, those who stayed out of the market will find themselves underexposed to risk when positive macro headwinds push liquidity into the system.

That’s when the FOMO kicks in, and you don’t want to be the one buying the top alongside the retail crowd.

Investors’ exposure to major global risk markets

The US Dollar Weakening = Crypto Strengthening

Finally, let’s talk about the US dollar. When the dollar is strong, it’s like a black hole, sucking in wealth from all corners of the globe.

DXY VS Total Crypto Cap

But when the dollar weakens, that money flows out into riskier assets — like crypto.

Right now, the DXY (which measures the value of the dollar) is breaking down, and at the same time, the M2 money supply is on the rise.

DXY VS M2

This combination is like pouring gasoline on a fire. A weakening dollar, coupled with an increase in money supply, has historically been a recipe for a crypto boom.

If you were around in 2017 or 2021, you saw how a similar setup led to massive gains in the crypto market. The challenge, though, is that most investors won’t recognize these catalysts until it’s too late.

In the end, the choice is yours. Do you wait for confirmation, risking missing out on the early gains?

Or do you take the plunge now, while the market is still showing signs of fear?

Personally, I know where I stand. I’ve seen these patterns play out before, and I’ve learned that fortune favors the bold. But don’t just take my word for it.

Look at the data, study the charts, and make an informed decision.

Because in this game, it’s those who prepare and take calculated risks that come out on top.

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)