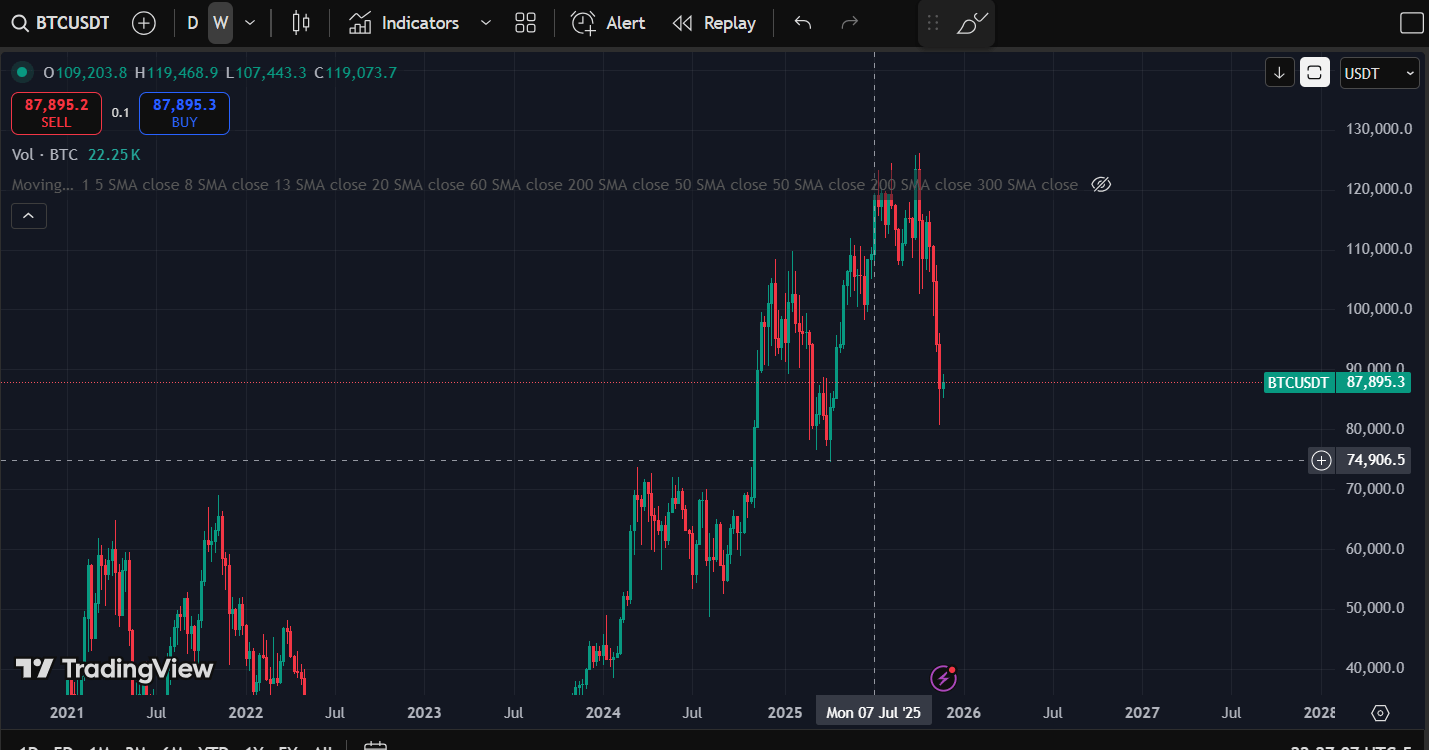

We’re now heading into the second week where BTC has failed to close above the 50-week SMA, and that’s a critical point in every macro cycle.

It’s not confirmed yet, but it’s starting to look like a lower high formation is printing.

This is the part of the market where uncertainty breeds the biggest opportunities.

Retail is panicking, leverage traders are wiped out, and everyone on social media is fixated on one number: 73k.

You can almost feel it.

Every influencer’s chart, every analyst’s line, they all point to the same support zone.

And when everyone sees the same level, that’s when the market usually does something different.

BTC: The Trap Is Set

Last week’s dump scared a lot of traders out of their positions.

Those who got chopped during the 99k–110k zone are now sitting on the sidelines, waiting for the “safe” entry at 73k.

That’s the setup.

Because the moment everyone agrees that 73k is the level to buy, the market will move first.

Either it front-runs the level and reverses early, or it sweeps through it violently before bouncing back up.

The chart structure shows it clearly:

We’ve got major liquidity resting at both ends, downside around 73k, upside around 92k–103k.

On Kingfisher, you can see this distribution of leverage clusters.

Massive stop orders sitting above 92k, and a liquidity wall forming just beneath 85k–73k.

That’s a perfect setup for market makers to play both sides.

Here’s what I’m watching:

Below: 73k sweep would liquidate late longs, trap shorts, and trigger a reversal setup.

Above: 13 billion in short liquidation sits near 103k, if we squeeze up there, it’ll melt faces.

So what happens next?

If I had to bet, MMs will hunt both sides before picking direction, shakeout phase.

But notice how the upside liquidity (red zone) outweighs the downside volume.

That’s where the higher probability move lies, a wick reclaim above 92k, then rotation upward into trapped shorts.

Sentiment Check

We’re in Extreme Fear (19) on the Fear & Greed Index.

You don’t get these readings often, only at macro bottoms or during forced resets.

When you combine that with heavy liquidation data, it paints a familiar picture:

Markets are clearing weak hands, not collapsing.

If you panicked last week, remember, this is why I always say:

“You don’t overleverage in red zones.”

Price is just hunting stops.

That’s all.

It’s not about good or bad fundamentals right now; it’s about positioning.

The same leverage that pushed us to 125k earlier is now being used to flush the opposite way.

But when that process ends, it flips hard, and fast.

This is where experienced traders stay in the game while others rage-quit.

Technical View

HTF Support remains around the 85k–88k region, exactly where BTC bounced this week.

The RSI on the weekly chart is flattening at 30, right at oversold levels not seen since the 2022 cycle bottom.

That’s why I still believe risk-reward is better being in than out.

If BTC closes this week back above 90k, we get confirmation that the current move is just a stop sweep, not a breakdown.

But if we continue to close below 50W SMA for another week or two, that confirms a bearish mid-cycle where lower highs form and we likely range longer before continuation.

Either way, both setups are tradeable.

You just have to stop guessing direction and start reading reaction.

My Plan

Simple approach this week:

De-risk partials into strength, especially near 92k–95k-103k where liquidity gets heavy.

Re-accumulate only if we sweep below 85k and reclaim quickly.

No chasing. Let volatility trigger the liquidity pockets.

That’s the beauty of playing structure instead of emotions, you don’t need to be right, you just need to be positioned correctly.

If BTC confirms a lower high and the weekly closes weak again, I’ll start trimming alt exposure.

But for now, I’m staying patient, BTC, ETH, and SOL remain core holds.

I’m not here for perfection; I’m here for conviction.

The Bigger Picture

When everyone’s looking for the same entry, the market rarely gives it.

73k might come, but if it does, it’ll be violent, a wick, not a range.

Meanwhile, liquidity above 92k–103k is calling the shots.

And when 13 billion in shorts are lined up, all it takes is one impulsive move to trigger a squeeze that runs 15k higher in days.

This market’s still a chessboard, not a slot machine.

If you play emotionally, you get liquidated.

If you play structurally, you survive every phase.

Final Thoughts

Fear is loud right now, but fear is temporary.

Structure, data, and liquidity tell the real story.

We’re not out of the woods yet, but we’re also not in freefall.

What happens over the next 2–3 weeks defines whether this is just another mid-cycle flush or the start of a macro reset.

Until then, keep your stops clean and your mind clear.

Let the market do its thing, and when the smoke clears, you’ll know exactly which side you were supposed to be on.

If you’ve been trading blind through this volatility, now’s the time to fix that.

Inside 9-5 Traders Premium, I post my live entries, rotation plans, and liquidity maps before the moves happen.

Join now, $137/month for full access to Crypto Exit Manual, Altseason Playbook, and private Discord breakdowns.

If you think this volatility is scary, wait until you see what happens when those 13 billion shorts get liquidated.

Stay sharp.

Stay ready.

Victor