I’ve been closely watching the charts, volume, liquidations, and order flow, and I’ve got some key insights for anyone who’s investing in crypto — especially if you’re like me, with a significant chunk of your portfolio riding on Bitcoin’s moves.

Daily Time Frame:

We’re sitting right at a major resistance point. I’m talking about the Quarterly VWAP band and the Daily Supply Zone. It’s crunch time — if we don’t flip this level into support, I’m expecting a pullback toward the $60–61k range. This is where we need to play it smart. I’ve seen this kind of setup multiple times before, and if you’re deep into the market like me, you know patience pays off.

For example, I remember in late 2022, when we hit a similar wall, I didn’t wait for confirmation. I jumped the gun and ended up losing out on some key long opportunities. This time around, I’m making sure I wait for the confirmation before loading up any further.

4-Hour Chart:

On the 4H chart, we’re at the range high + Value Area High (VaH) from the last swing down that ended on August 5th. I’m not saying to get bearish, but you’ve got to be cautious. If we roll over here and test that $61–61.5k level, I’ll be right there, gladly longing the retest. This is where experience comes into play — you’ve got to know when to enter.

And if we sweep the equal highs into supply? That’s my signal to go short. I made a similar play earlier this year when Bitcoin swept the highs around $64k in April — those who were quick to react locked in some solid gains. I missed part of that move, so now I’m watching closely.

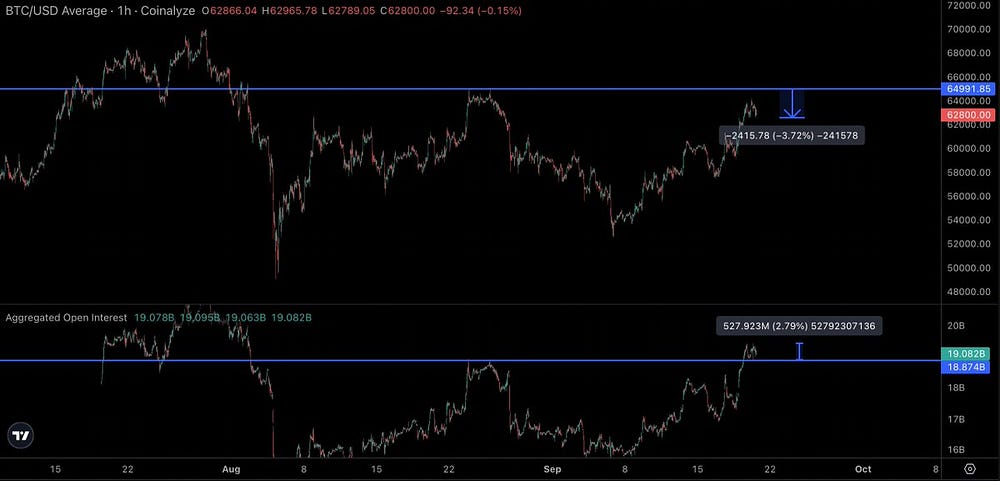

Hourly Time Frame:

The hourly chart is key for those playing with shorter time frames. Right now, we’re holding the hourly heuristic band, but it’s curling down, and we’ve retested the $63k level multiple times. If we don’t get a clear push upwards soon, we’re likely looking at a breakdown, and that’s where I start to reduce my risk.

Here’s what I’m doing with my alt positions: I’m holding partials on $FTM, $SAGA, and $ZRO, but I’ve got trailing stop losses in profit. This strategy saved me during the last correction. Back in July, I was riding high on $AAVE, and when Bitcoin started to falter, I had those stops in place. While others were scrambling, I locked in my profits and waited for a better re-entry.

Liquidations:

This is where it gets tricky. Tops in Bitcoin are notoriously hard to track, and this one’s no different. We’ve seen a couple of spikes — like the one above $70k back in May and near $65k in August — but it’s been a slow grind as the market runs out of fuel.

Here’s a lesson I learned the hard way: back in 2021, I held onto some long positions too long, thinking there’d be a big liquidation event at the top. Instead, the spot bid dried up, and I watched as leveraged longs kept trying to bid the market up all the way down. Don’t make that mistake — manage your risk before the market pulls the rug.

What I Did Right and Where I Messed Up:

Let’s be real. I turned bearish near $61k, and since then, I’ve taken 27 shorts and 8 longs with a 64% win rate. Not bad, right? But here’s the thing — I’ve still left a ton of money on the table. I got too attached to price targets, and while my macro thesis was solid (this remains a sell-the-news event until we break and hold above $62.5k), I should’ve been more flexible.

One key learning point: in the previous cycle, I got fixated on the idea that we’d hit a certain target before pulling back, and when that didn’t happen, I hesitated. This time, I’m sticking to my plan but staying nimble.

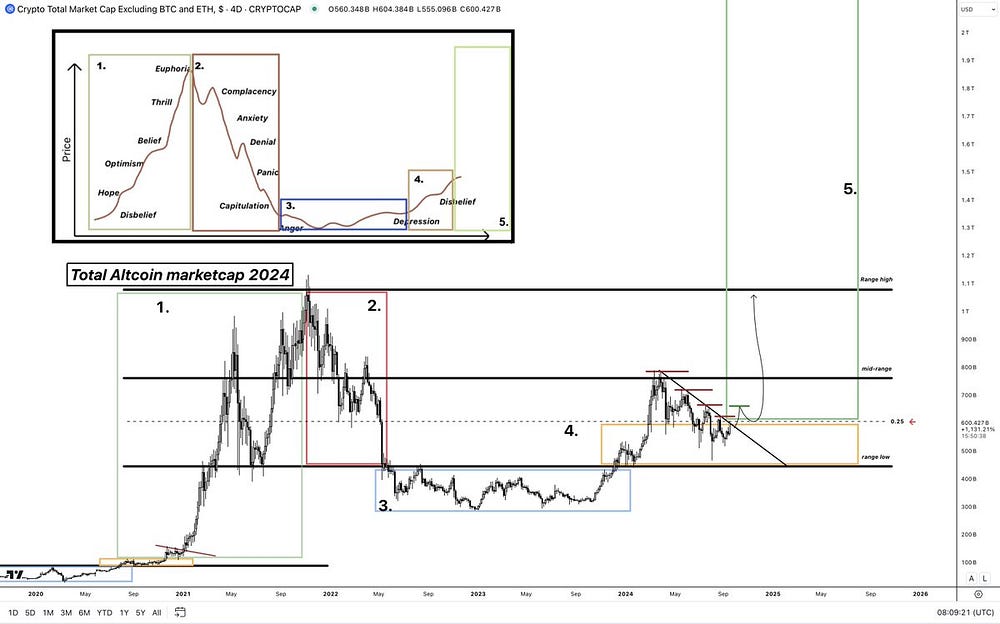

Altcoins and Macro Perspective:

Now, let’s talk altcoins. We’re at stage 4 on the Total Altcoin Market, which, if you’ve been around long enough, you know is one of those once-in-a-few-years opportunities. But we’re also at a critical resistance. If we can break through, we could see the start of the fabled “Altseason” everyone’s waiting for. But don’t get ahead of yourself — if you’re heavily invested, like me, wait for that clean break before going all-in.

Look at $SUI as an example. I’ve been following its cycle structure, and recently it broke out of its mini-range. Back in May, I suggested watching for either a sweep of the lows or a breakout above resistance, and now it’s paying off. If you’re not watching these key levels, you’re missing out on some serious opportunities.

ETH/BTC Thoughts:

Switching gears to ETH/BTC, I’ve said it before, and I’ll say it again — the bottom for ETH/BTC is likely between 0.03 and 0.04. We recently hit 0.03833, and while timing the exact bottom is impossible, I’m pretty confident we’ll carve out strong support here by the end of the year.

Here’s the thing: ETH/BTC is not the same as ETH/USD. When ETH/BTC bottoms, it doesn’t mean ETH/USD will immediately follow suit. We saw this in 2016 and again in 2019 when ETH/BTC bottomed but ETH/USD continued to fall in Q4.

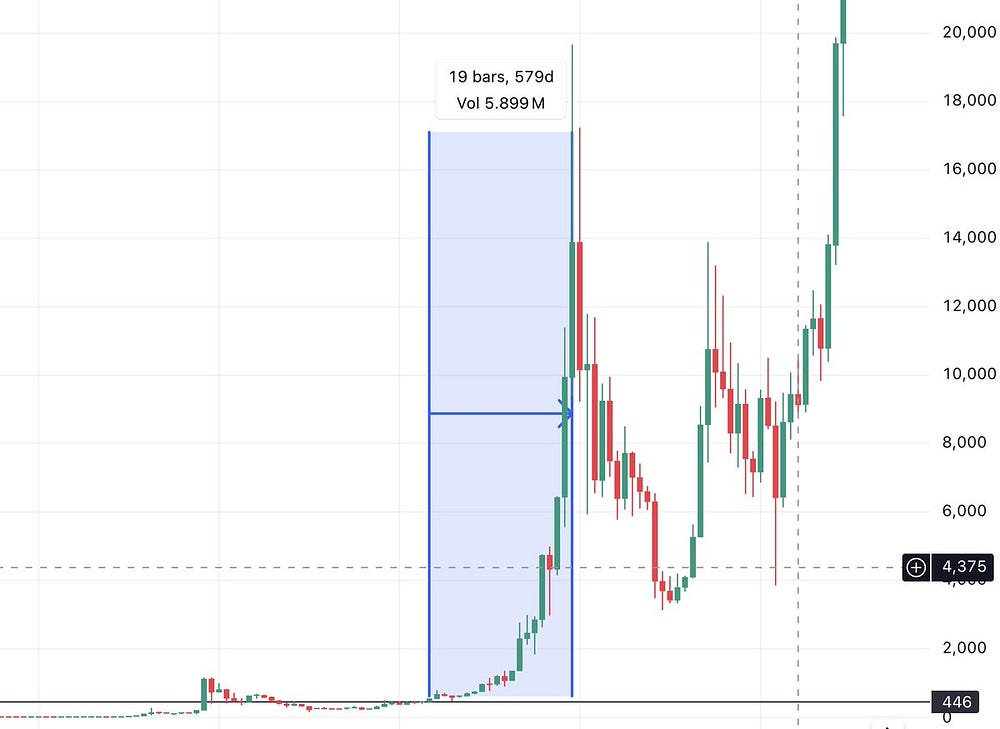

Supercycle: Reality or Trap?

Now, I know there’s a lot of talk about a supercycle. The last one we had was in 2016–17 when Bitcoin shot up from $232 to $20k. I remember riding that wave and thinking we’d never see anything like it again. And to be honest, we might not. The market’s matured, and Bitcoin is now a recognized asset class, so the days of insane volatility might be behind us.

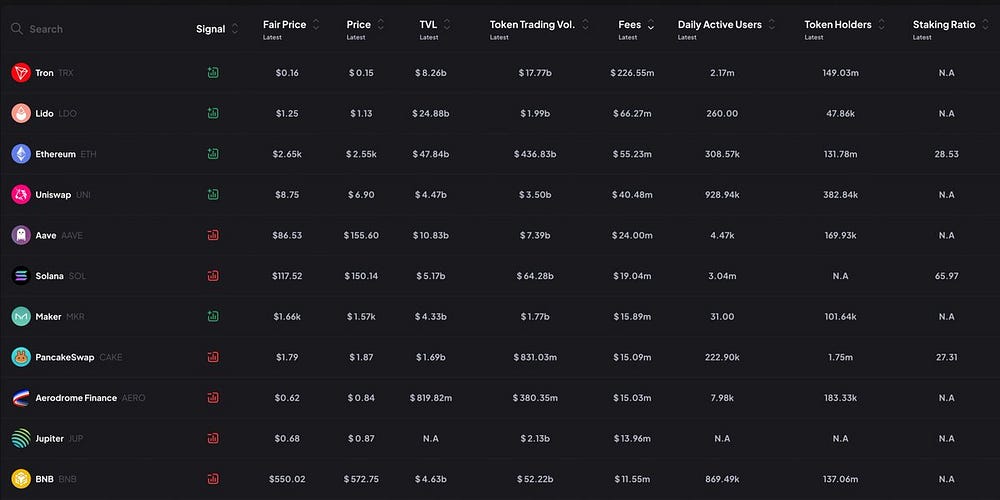

That said, I do believe we could see a supercycle for some blue-chip DeFi coins like AAVE, MakerDAO, and Uniswap. These projects have survived multiple bear markets and continue to innovate. They’ve got strong communities, and that’s key — communities that stick around through the tough times are the ones that drive long-term growth.

Final Thoughts:

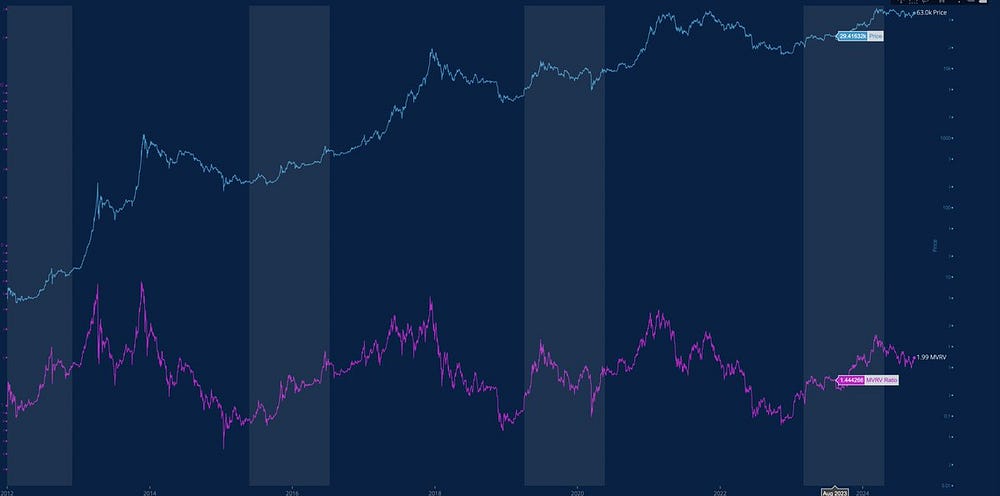

So, where do we go from here? I’m watching the MVRV ratio closely. We’re just below a 2 right now, and historically, as long as we stay below 3.5, I’m comfortable staying in the market. But if we shoot up past that level, it’s time to start scaling out and taking profits. My eyes are on Bitcoin’s next big move — if we hit $100k, expect that ratio to hit 3.5 fast.

At the end of the day, it’s all about managing your risk. The market’s unpredictable, but with a solid strategy, you can navigate these ups and downs without getting caught off guard. Stay flexible, be patient, and don’t be afraid to adjust your thesis as the market evolves.

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Follow me on twitter (@healthy_we44554) and threads (@wise.healthy.wealth)