With the US elections just days away, we’re at a unique market moment. Historically, election years have catalyzed bullish momentum, with markets often rallying post-election. Yet, here we are, watching the markets drift downward, raising the question: what’s going on this time, and what can we expect in the weeks ahead? After studying past election cycles, here’s my take on what could be unfolding soon. Buckle up, and let’s get into it.

1. Uncertainty vs. Clarity: Why Markets React This Way

Markets have a unique trait — they hate uncertainty. In fact, they often react more negatively to ambiguity than to clear, even bad, news. This tendency isn’t new; we’ve seen it over and over, especially when the stakes are high in global superpowers like the US. The uncertainty around the election outcome has kept investors cautious, holding off on large moves until there’s a clear path forward.

To give you an idea, think back to past cycles where an uncertain event loomed. When Brexit was first announced in 2016, markets tanked. It wasn’t until the terms became clearer that they began to recover. Similarly, during election years, market anxiety rises as investors wait to see how political outcomes could impact policy, regulation, and economic growth.

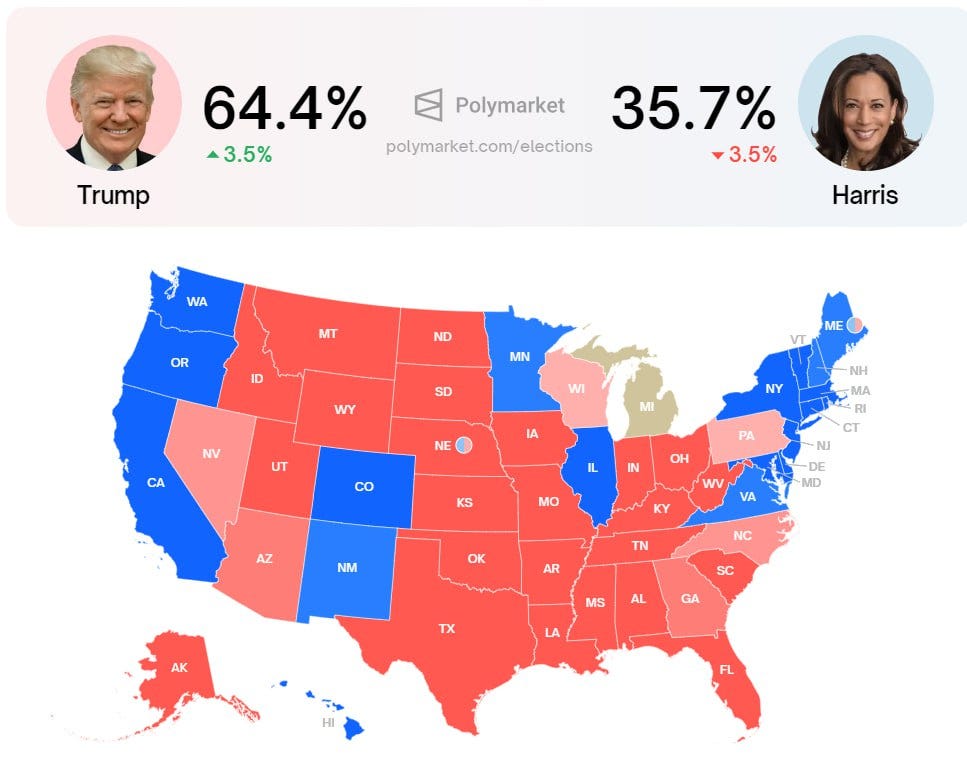

In the current election landscape, platforms like Polymarket indicate a strong lean toward Trump. Betting markets have shown to reflect sentiment early, especially when they indicate something drastic or unexpected. Still, until Election Day concludes, and the results are finalized, uncertainty will likely keep markets on edge. But once the dust settles, the market reaction often shifts sharply — either toward relief or recalibration.

2. Historical Election Patterns and Bitcoin: Deciphering the Impact

Historically, Bitcoin has seen notable growth regardless of the political party in office, demonstrating that macroeconomic factors might play a more significant role than party policies alone.

Let’s look at the data:

2012: Under a Democratic presidency, Bitcoin skyrocketed from $20 to around $1,400 — marking one of its first major bull runs.

2016: The Republican win saw Bitcoin climb from $800 to nearly $20,000, an enormous leap as crypto moved into the mainstream.

2020: Another Democratic win and another substantial Bitcoin rally, moving from $10,000 to $69,000, as the pandemic and resulting economic uncertainty drove investors toward digital assets.

The takeaway? Bitcoin’s gains have historically defied party lines, with each post-election period giving crypto markets a fresh start and often a bullish runway. The reasons behind these rallies may differ — from monetary policy to economic recovery measures — but the result has been similar: renewed interest in crypto assets. This trend suggests that regardless of this year’s winner, the stage could be set for another strong Bitcoin performance post-election.

3. A Crypto-Centric Election: What’s Different This Time?

This election is unlike any before in one important way: crypto is front and center. Since Bitcoin’s inception, there hasn’t been an election as “crypto-aligned” as this one.

Campaign contributions for 2024 have reportedly exceeded $190 million, with the bulk of these donations aimed at supporting pro-crypto candidates.

This shift signals a growing acceptance and interest in crypto among political circles, likely due to the industry’s lobbying efforts and an increase in voter interest around blockchain technology and digital assets.

Why does this matter? Politicians often shape policies around industries that financially support their campaigns. Therefore, regardless of who takes office, crypto could benefit from favorable regulatory moves, supporting everything from clearer regulatory classifications for altcoins to new approvals for ETFs. To give an example, consider sectors like energy or healthcare that receive large political contributions — these industries have often seen favorable legislation post-election.

Some possible outcomes post-election include:

Government-held BTC Reserves: We could see a strategic shift toward BTC as a reserve asset if the government moves in a pro-crypto direction.

New ETFs and Regulatory Approvals: ETFs drive institutional investments, which could add significantly to crypto demand.

Regulatory Clarity: This could include rulings on altcoins, clarifying which tokens classify as securities and which don’t, providing transparency to the industry.

In short, this election’s outcome could help secure regulatory clarity, further legitimizing crypto and potentially unleashing new institutional and retail demand.

4. Increased Government Spending and the “Crypto Boost”

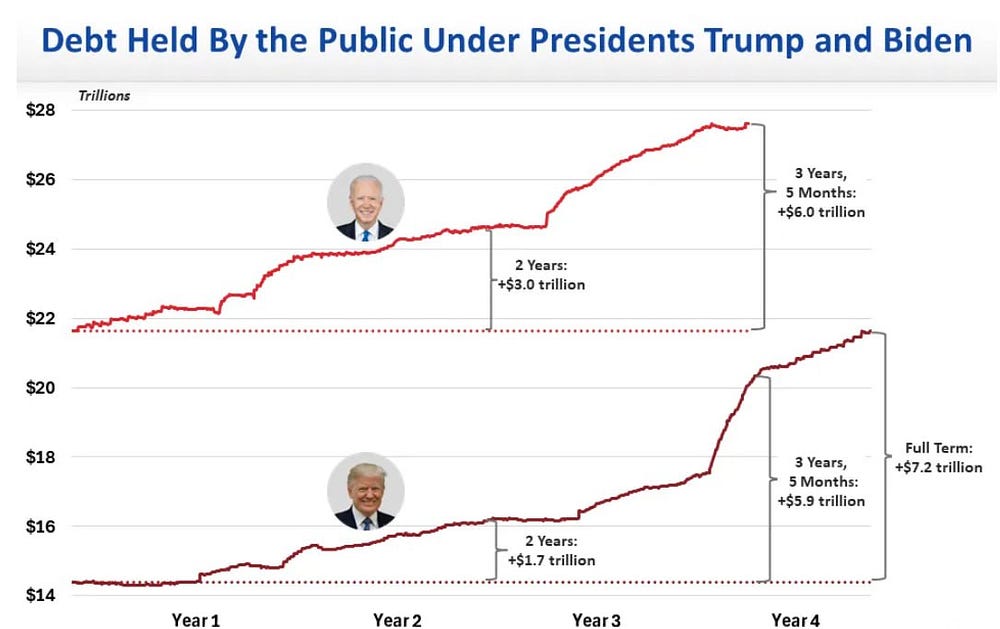

Election seasons typically come with promises of increased spending. To attract voters, candidates often pledge economic stimulus and financial aid programs, from tax cuts to funding projects that require additional government spending. This practice fuels demand, and historically, it has led to “easy money” policies post-election, often characterized by low-interest rates or Quantitative Easing (QE).

For crypto investors, increased spending and potential QE are good news. More government spending can lead to dollar devaluation, a phenomenon where the purchasing power of the dollar declines as the money supply increases. In such situations, assets like Bitcoin — which are inherently scarce — tend to appreciate. It’s similar to how hard assets like gold reacted during the 2008 crisis when QE drove demand for assets outside the traditional financial system.

For instance, during the 2020 post-election period, Bitcoin surged significantly as global markets were flooded with liquidity. The “flight to safety” narrative saw institutional and retail investors flock to Bitcoin, seeking a store of value amid currency devaluation.

5. Bitcoin Price Potential Post-Election: Could We See Another All-Time High?

Let’s talk numbers. If past cycles are any indicator, Bitcoin has achieved eye-popping gains following elections. Here’s a quick look at historical pumps:

After the 2012 Election: Bitcoin soared 11,336%.

After the 2016 Election: Bitcoin surged 2,733%.

After the 2020 Election: Bitcoin climbed a still-impressive 450%.

These gains reflect a combination of increasing adoption, growing institutional interest, and the broader economic landscape. With Bitcoin currently trading around $67,500, a conservative estimate would suggest a post-election increase of 100–150%, potentially putting Bitcoin in the $140K-$160K range.

A surge of this magnitude could be fueled by a mix of macroeconomic policies, a renewed focus on digital assets, and the ongoing demand for inflation-resistant assets. For long-term holders, these potential gains highlight why holding through election cycles can be rewarding. It’s not about timing the market but understanding that major global events can trigger substantial shifts in asset values.

In Closing: Preparing for the Election Aftermath

While market uncertainty may cause short-term jitters, it’s essential to focus on the big picture. The combination of macro factors — from rising spending to potential regulatory clarity in crypto — could mean a significant rally post-election. As we’ve seen in previous cycles, Bitcoin and crypto markets often thrive in these environments. The election isn’t just a political event; it’s a catalyst that could ignite the next big crypto bull run.

So, as the election approaches, keep an eye on how it unfolds, but remember that this cycle, like others before it, offers a unique opportunity. Regardless of who wins, the months following the election could bring clarity to the markets, boost crypto, and potentially set the stage for new all-time highs. Stay informed, stay engaged, and keep your eyes on the prize. 🚀

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)