Everyone's saying the bull run is over. That altseason is dead. That BTC has topped.

I’ve heard this exact same story before.

In 2021, when BTC hit $64K and dumped to $30K, people thought it was over.

Then we ran to $69K—and those same people FOMO’d in at the top.

Same cycle. Same weak hands. Same mistakes.

This time, you’re going to be smarter.

Because if you actually look at the data, you’ll realize this bull run is just getting started.

🚨 11 Indicators Proving the Real Move Hasn’t Even Begun

If you’ve been in this space for more than one cycle, you start recognizing patterns.

Retail panics too early. Whales accumulate in silence. And then—when it's too late—everyone finally realizes what's happening.

Let’s break it down.

1️⃣ Fear & Greed Index: Sitting at 20 for 2 Weeks

Historically, extreme fear precedes major market moves.

The last time the Fear & Greed Index stayed this low for weeks? Right before BTC did a 3.5x pump in 2021.

When the index is this low, weak hands have already sold.

The market is literally giving us a gift-wrapped opportunity—most people are too scared to take it.

In 2018, when BTC was at $3K, the index hit extreme fear. The next move? A run to $14K.

In March 2020, after the COVID crash, the index sat at extreme fear. The next move? BTC ran from $4K to $69K in 18 months.

History tells you what happens next.

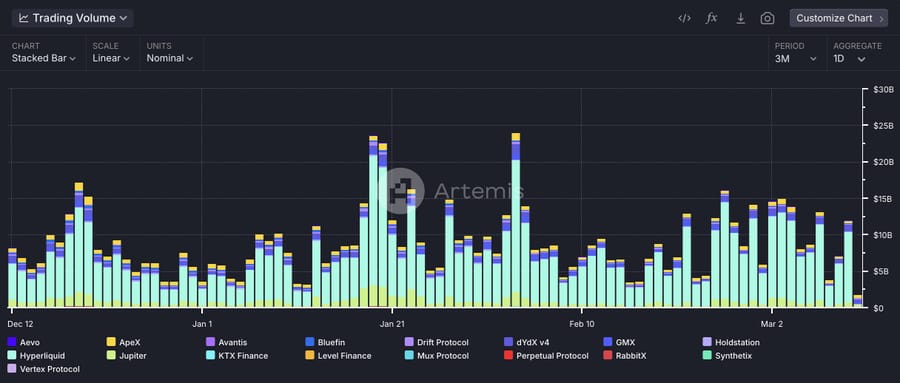

2️⃣ Trading Volume: The Quiet Before the Storm

Look at any major market rally, and you’ll notice a pattern:

First, the price increases without significant volume.

Then, as price stabilizes, volume builds up.

Finally, explosive volume confirms the true rally.

Right now, BTC has grown significantly, yet trading volume is still much lower than in 2021.

Why?

Because the real money hasn’t entered yet.

In November 2020, BTC quietly ran from $10K to $20K with low volume.

In December 2020, trading volume exploded, and BTC ran from $20K to $40K.

Same setup right now. If you wait for the volume to confirm, you’ll be too late.

3️⃣ Stablecoin Index: Liquidity is the Key to Everything

Stablecoins tell us how much fresh capital is entering the crypto market.

Right now, stablecoin supply is still far below previous cycle levels.

That means:

We haven’t even seen real liquidity enter the market yet.

When it does, the entire market will reprice higher.

Want an example?

April 2020: Stablecoin supply surged. BTC followed with a 600% rally.

Early 2021: Stablecoins flooded in. Altcoins went 100x.

Today: We’re still in accumulation mode. The big move hasn’t even started.

4️⃣ BTC Dominance (BTC.D): The Altseason Trigger

BTC dominance tracks Bitcoin’s share of the total crypto market cap.

Historically, BTC dominance rises first in a bull market.

Then, once it drops below 50%, altseason officially begins.

2017: BTC dominance peaked at 70%, then dropped. Alts went parabolic.

2021: BTC dominance peaked at 60%, then dropped. Alts exploded.

Today: BTC dominance is still in an uptrend, meaning altseason hasn’t even started yet.

5️⃣ Crypto YouTube & Retail Interest: No Euphoria Yet

You can’t have a market top without euphoria.

How do we measure that? Crypto YouTube.

At $70K BTC in 2021, daily crypto YouTube views were 4M per day.

Today? BTC is again near $70K, but views are just 800K per day.

If you think we’re at a top, where’s the hype?

Where’s the NFT madness?

Where’s the media attention?

It’s nowhere—because this isn’t the top.

6️⃣ Coinbase App Rankings: The Euphoria Indicator

Every cycle, we see one major signal before the market peaks:

Coinbase jumps to the top of the app store.

2017: Coinbase ranked #1 right as BTC hit $19K.

2021: Coinbase again ranked #1 when BTC hit $69K.

Where is it now?

Nowhere near the top. Meaning? Retail is still asleep.

7️⃣ Google Trends: Search Interest is Still Lagging

In 2021, Bitcoin search volume exploded 3 months before the cycle peak.

Today?

Search volume is 2.5x lower than at the last bull run top.

People aren’t Googling "how to buy Bitcoin" yet.

Meaning we haven’t hit peak retail interest.

8️⃣ Token Unlocks: Massive Supply Incoming

Right now, $200M per day is being unlocked in token supply.

That’s 5x higher than 2021.

More new projects = More attention = More liquidity in the market.

9️⃣ FED & Global Liquidity Trends

Every major BTC rally has aligned with liquidity expansion.

In 2020-2021, the Fed expanded its balance sheet → BTC 17x’d.

In 2022-2023, the Fed contracted → BTC dropped 75%.

Now, the Fed is starting to shift.

When liquidity floods back in, Bitcoin follows.

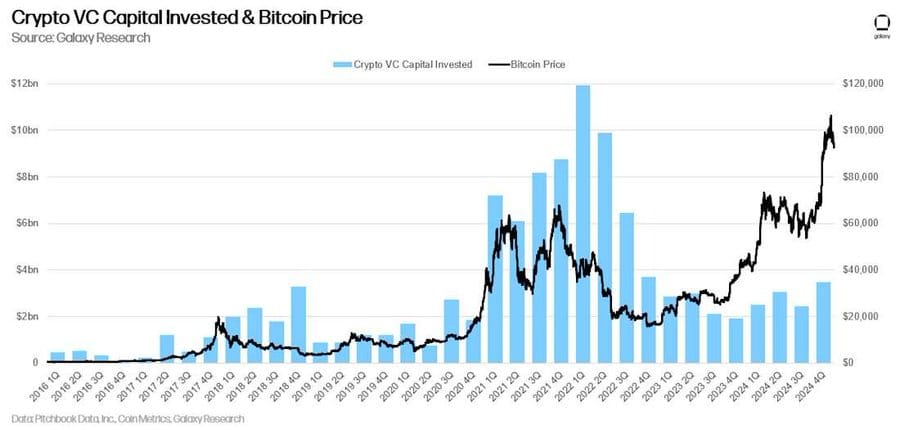

🔟 VC Funding: The Confidence Signal

Big money doesn’t guess.

In 2021, crypto saw record VC investment—right before the biggest rally.

Today?

VC funding is down 75%.

But the moment it surges again? It’ll be a confirmation that the market is about to explode.

1️⃣1️⃣ OTHERS/BTC Chart: The Altseason Trigger

This chart tracks altcoin performance relative to BTC.

Right now, it’s LOWER than in December 2023.

Meaning? The biggest altcoin moves haven’t even started.

🚀 Smart Money is Accumulating. Are You?

Look—I’m not here to convince you. The data speaks for itself.

But I’ll ask you this: Are you going to trade like retail, or position yourself like smart money?

This is your chance to get ahead before the rest of the market wakes up.

If you’re serious about making real money in this cycle, join 9-5 Traders Community.

See you inside.

Victor