Let me tell you what happened inside the Discord.

While most people on X were chasing headlines, my premium group was quietly loading into plays before they broke out.

Here’s just three of them.

1. CPOOL - Textbook Accumulation to Breakout

We first eyed CPOOL at 0.165.

Price was holding support, volume was picking up, and the chart screamed “accumulation.”

I gave two clear entry points:

Initial entry: 0.165

DCA: 0.124

From that DCA level, we’re now sitting on +49% gains. Even from the first entry, you’d be deep in profit.

Right now, price is pressing into resistance. If we break here, the next stop is 0.20+. And when that level gives way, the run accelerates.

My take: This is the kind of setup where patience and position sizing matter. You don’t need to swing at every pitch , you just need to catch the ones with the cleanest risk-to-reward.

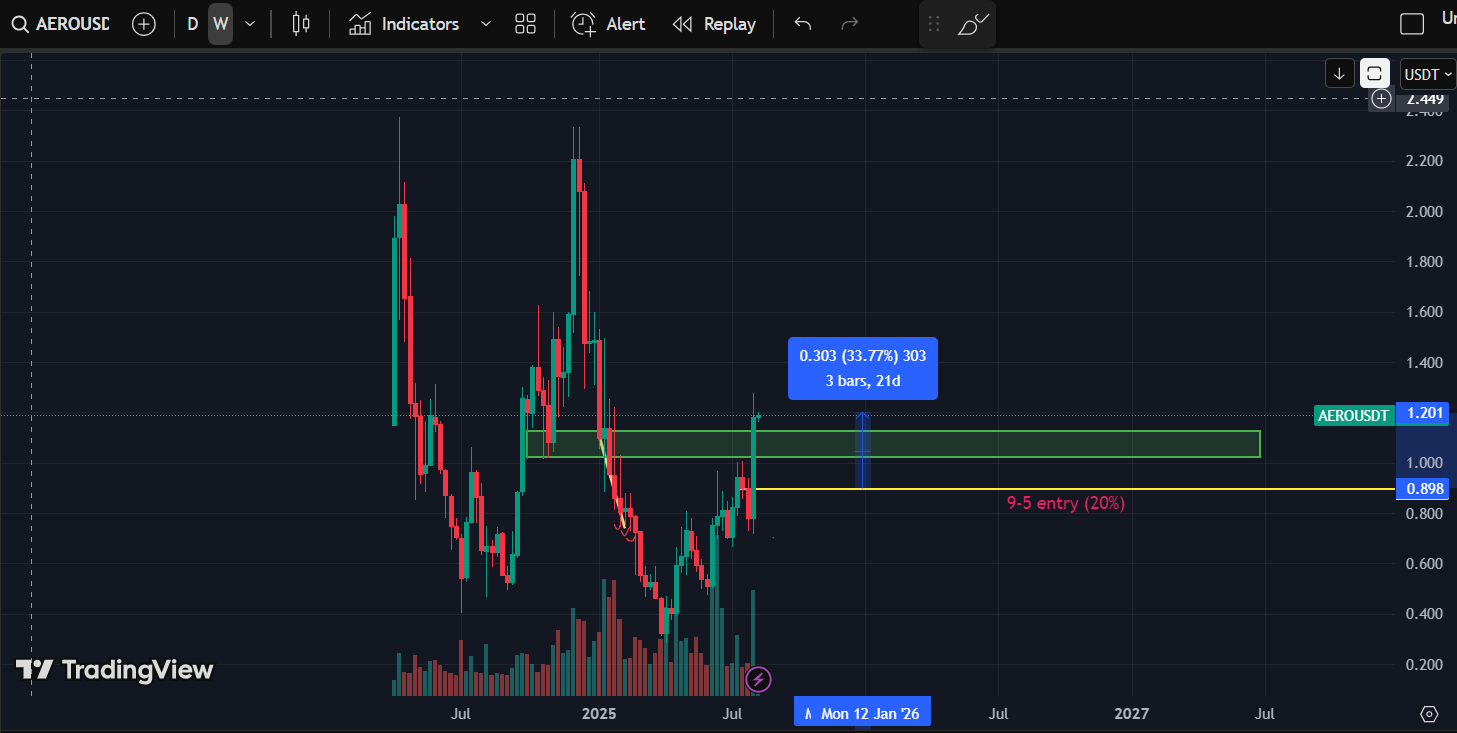

2. AERO - No DCA Needed

Entry was given at 0.898.

No need to DCA because it just took off.

We’re now +33% from entry.

It’s not always about finding bottoms. Sometimes, the right play is to catch a breakout early while structure supports continuation.

My take: Many traders get stuck waiting for “perfect” pullbacks and miss momentum plays. You need both skills , loading at support and jumping on confirmed breakouts.

3. WELL - DCA Into Strength

This one wasn’t the flashiest chart, but it was a prime example of adding into strength.

We took our DCA at 0.027. Price is now +23% higher.

It’s not about every trade being a moonshot. It’s about stacking consistent wins that compound over time.

My take: Retail often DCA blindly into weakness. The edge is in knowing when a DCA aligns with trend resumption , not just averaging down in hope.

The Part You Need to Hear

If you’re not in premium, you didn’t just miss the calls.

You missed:

The exact entry levels and why they were picked

The DCA zones that allowed us to lower cost basis and increase profits

The live chart updates as resistance levels came into play

The context behind why these coins were chosen over hundreds of others

And that’s the difference between guessing and executing.

By the time you see these coins trending on Twitter, you’re already someone else’s exit liquidity.

Trading Alpha You Can Use Right Now

Even if you missed these trades, here’s something you can apply immediately:

1. Pick Your Plays Early

Scan the market before major moves. Look for consolidation after an uptrend, rising volume, and clear support levels. This is where asymmetric upside lives.

2. DCA With Intention

A good DCA isn’t about lowering your average price randomly. It’s about reloading where the market has shown demand before , and where invalidation is clear if you’re wrong.

3. Respect Resistance

When price approaches a key resistance, you have two choices:

Lock partial profits

Stay in with a plan for breakout confirmation

What you don’t do is hold blindly, hoping for “just one more leg” without a strategy.

You can absolutely try to figure this out yourself.

You can watch charts all day, track every low-cap coin, and hope your timing is right.

Or you can get the exact setups I’m taking , the entries, the DCA points, the targets , delivered to you before the move starts.

Here’s the Truth

The market is moving.

ETH is holding strong, BTC dominance is shifting, and the early stages of rotation into alts are here.

When this next wave hits full speed, the difference between catching it and missing it won’t be luck. It will be preparation.

Preparation is exactly what you get inside premium.

Final Word

Three setups in seven days. All green. All given in advance.

If you’re not inside, you’re not just late , you’re locked out of the plays that actually move the needle.

Join 9-5 Traders Premium Now

Next week’s setups are already on my watchlist. The question is, will you be in the room when I call them?

- Victor