Before we talk about price targets, narratives, or altseason timelines, we need to talk about environment.

Bull markets are not born from excitement.

They are born from conditions quietly improving while nobody is paying attention.

2026 is shaping up to be one of those environments.

This is not a call to go all in.

This is not a bottom call.

This is about understanding the macro pressure that slowly shifts from tight to loose, and why that matters for crypto and risk assets over time.

Let’s start with the first two factors.

Factor 1: Rates Coming Down and QT Eventually Ending

Lower rates matter. Not emotionally. Mechanically.

Lower rates mean cheaper loans.

Cheaper loans mean more spending.

More spending means more leverage and more liquidity moving through the system.

That liquidity does not sit in cash forever.

Some of it always finds its way into risk assets.

Equities first.

Then crypto.

Then higher beta alts.

This is not theory. This is how cycles have worked repeatedly.

2026 has optionality, not guarantees

There are 8 FOMC meetings in 2026.

Q1

Jan 27 to 28

Mar 17 to 18

Q2

Apr 28 to 29

Jun 16 to 17

Q3

Jul 28 to 29

Sep 15 to 16

Q4

Oct 27 to 28

Dec 8 to 9

That does not mean 8 rate cuts.

It means 8 opportunities for expectations to shift.

Markets do not wait for rate cuts to happen.

They front run them.

By the time rate cuts feel obvious, price has already moved.

That is why this matters before excitement returns.

Quantitative tightening does not last forever

QT is not permanent.

At some point, balance sheet pressure eases.

When that happens, liquidity conditions improve.

Not overnight.

Not explosively.

Structurally.

Risk appetite rebuilds slowly during that transition.

That is usually where early positioning happens and late excitement comes later.

This is not about calling a precise turning point.

It is about understanding direction of policy stress.

Stress easing is bullish over time.

Stress increasing is bearish over time.

Right now, the pressure is no longer accelerating in the same way.

That matters.

Purchasing Power Keeps Dropping

This part is subtle but critical.

The same amount of cash today buys less than it did pre Covid.

And it will buy even less in the future.

This pushes capital out of pure cash over time.

Not immediately.

Not emotionally.

Steadily.

People look for assets that can outpace debasement.

That is why BTC keeps re entering the conversation every cycle.

Not as a trade.

As a hedge against slow erosion.

You do not see this on a one week chart.

You see it across years.

Positioning Beats Timing

This is where most people get it wrong.

They try to time exact dates.

Exact cuts.

Exact pivots.

That is not how this works.

Bullish phases do not start with excitement.

They start with boredom.

Disbelief.

Under positioning.

By the time it feels obvious, most of the easy part is already gone.

That is why I care less about predicting and more about staying solvent and positioned.

Let the macro do its thing.

Let the market confirm when it is ready.

This factor is not a signal.

It is a backdrop.

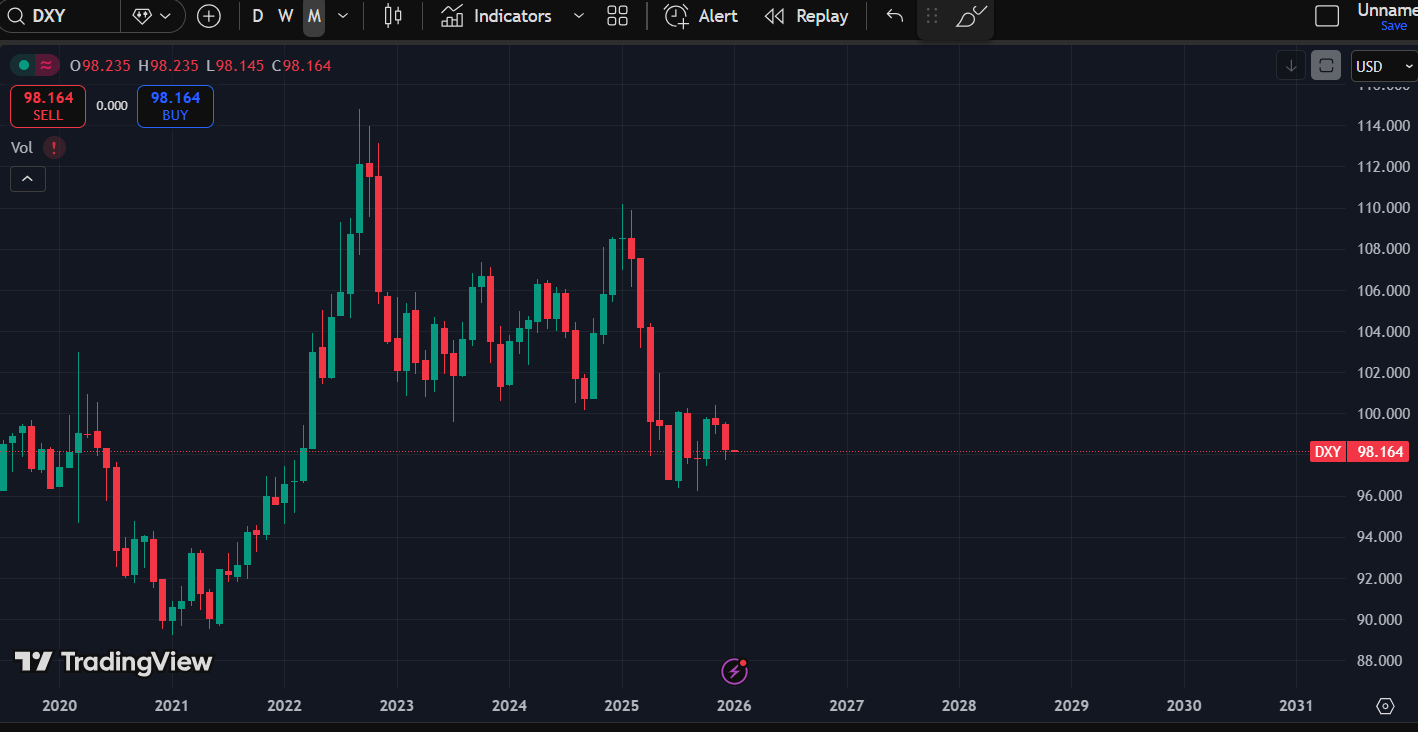

Factor 2: The U.S. Dollar Index (DXY)

This is an oversimplified explainer, but the relationship matters.

When the U.S. dollar weakens, holding dollars becomes less attractive.

Capital looks for better purchasing power and higher returns.

That money does not disappear.

It rotates.

Historically, when DXY trends down:

BTC tends to move first.

Then ETH.

Then altcoins.

The lower the DXY goes, the more risk investors are willing to take.

That is usually when capital starts leaking further out the risk curve.

Why the current range matters

Right now, DXY is still stuck in a range.

That matters.

As long as DXY respects this range, alts stay capped.

Liquidity stays defensive.

Risk appetite stays controlled.

If DXY breaks below the current support zone and trends lower, that removes a major headwind.

It does not mean alts pump immediately.

It means conditions improve.

And improving conditions are what bullish phases are built on.

Putting It Together

Rates easing.

QT eventually ending.

Purchasing power eroding.

DXY potentially weakening.

None of these are trade signals by themselves.

Together, they form a tailwind.

Not for tomorrow.

Not for next week.

But for the environment we are moving into as we step through 2026.

This is why I focus on preparation, not prediction.

In Part 2, I will cover Factor 3, which most traders completely ignore but institutions watch closely.

In Part 3, I will tie everything together with Factor 4, and explain why the market rarely rewards people who wait for certainty.

Keep this framework in mind.

Cycles are not loud at the start.

They are quiet.

And quiet is exactly where we are right now.

As we step into 2026, I will be sharing real-time structure, levels, and decision-making inside my Discord.

No noise.

No pretending.

No hindsight.

If you want to start the new year with clarity and a solid framework instead of guessing alone, join us.

Close the chapter.

Step forward.

See you in 2026.

Victor