Let’s talk about how to spot the market top this cycle. I’ve seen this play out multiple times — once in 2018, again in 2021, and I’m confident we’re going to witness the same pattern in the upcoming 2025 bull run.

It’s a simple but effective process that takes just a few seconds to check. Once you know how to read the signs, you’ll be able to stay ahead of the market, spot the top, and exit before the crash. Let’s break it down.

1. Bitcoin Long-Term Holders (LTH) Supply

First, let’s dive into one of my favorite on-chain metrics: the Bitcoin Long-Term Holders (LTH) Supply. I’ll explain it in the simplest way possible so even a 5-year-old could understand.

The LTH Supply metric tracks the amount of Bitcoin held by investors who’ve held onto their coins for an extended period — usually over 155 days. Why does this matter? Because when long-term holders increase their supply, it’s a signal of strong confidence in the market, especially when the price is dipping.

Let me give you an example from July 2024: Bitcoin’s price was declining, and retail traders were panicking, but LTH supply kept rising. These long-term investors were buying more, bringing the total LTH supply up from 13.5 million BTC to over 14.1 million BTC.

This is a massive signal. It shows that these big players, who typically know the market better than anyone else, were not shaken by the price drop. Instead, they were accumulating more BTC. For me, this was a clear sign that the bull run wasn’t over. The correction was just an opportunity for long-term holders to load up on more BTC, reinforcing the idea that the market still had plenty of room to push higher.

Here’s why this matters right now:

If you’re watching the LTH supply and you see a steady increase in accumulation, it’s a signal to buy the dip because the bull run is likely still intact. But — and this is crucial — when these long-term holders finally start selling in large volumes, that’s when you need to sit up and pay attention. It means the market top is near, and you should be preparing to exit.

Example:

In 2021, right before the market topped out at $69K, we saw a massive increase in LTH selling. It was a sign that the big players were taking profits while retail was still euphoric. And sure enough, the market crashed soon after. Keep an eye on this metric because when long-term holders start cashing out, that’s your signal to take action.

I’ll be the first to tell you when this happens. No hype, no BS — just proven data that works. It’s simple, right?

2. Coin Days Destroyed (CDD)

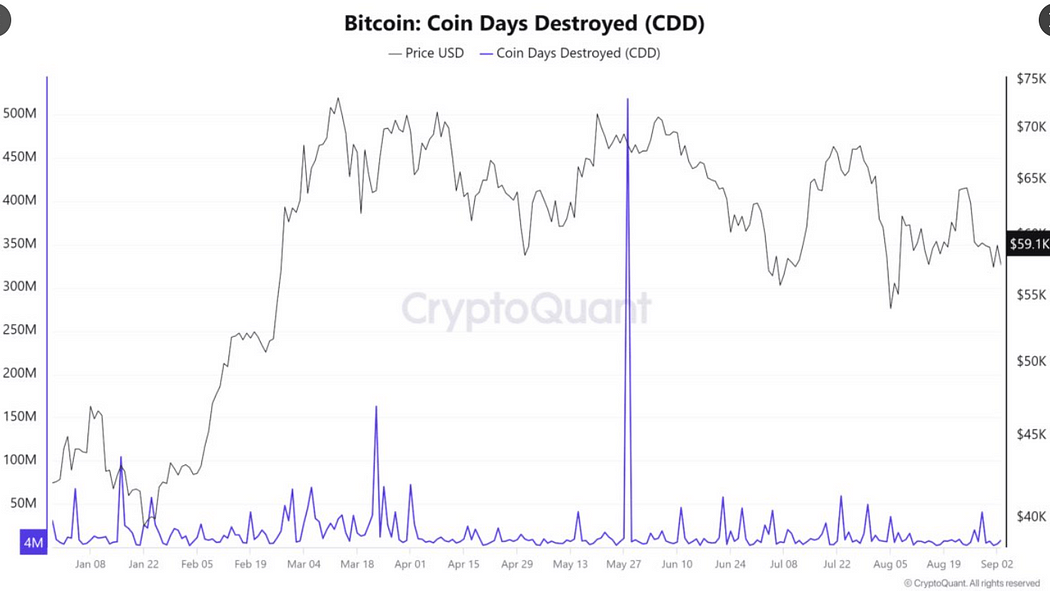

The next big indicator you need to track is called Coin Days Destroyed (CDD). Again, I’ll explain it simply so anyone can grasp it.

Coin Days Destroyed measures when older, dormant coins are moved or sold. The longer a coin has been held without being spent, the more “days” it has accumulated. When these coins are suddenly sent back into the market, it “destroys” the accumulated days, hence the name.

This metric is so important because it shows when long-term holders — those who’ve held their coins for a long time — are finally taking profits. Every time before a market top, we see a huge spike in CDD, which means the smart money is selling while retail traders are still buying.

Example:

In 2021, right before Bitcoin hit its all-time high of $69K, we saw a massive spike in CDD. It was the same story in 2017 when Bitcoin topped out at $20K — CDD spiked, and soon after, the market collapsed. In May 2024, we saw a similar spike when BTC reached a local top at $71K, signaling a temporary pullback.

Right now, we’re nowhere near seeing that same CDD spike, which tells me we’re not at the market top just yet. But when we do see it, you better be ready to take profits. I’ll be here to let you know when that time comes.

Why it matters:

CDD is a perfect timing tool for spotting when the smart money is exiting. When you see a CDD spike, it’s a sign that long-term holders are moving their coins, meaning they’re likely taking profits. This is the ultimate sell signal, and it’s been accurate in every major market cycle. So when you see CDD surge, it’s time to think about selling and locking in those gains.

3. Bitcoin Dominance Decline

The third key indicator for spotting the altcoin bull run is the decline in Bitcoin dominance. This one’s pretty straightforward but incredibly powerful.

Bitcoin dominance measures the share of the total crypto market cap that belongs to Bitcoin. When BTC dominance is high, most of the capital is flowing into Bitcoin, which usually means altcoins are underperforming. But when BTC dominance starts to decline, it signals that capital is flowing out of Bitcoin and into altcoins. That’s when the real altcoin bull run begins.

Example from 2017:

In 2017, Bitcoin dominance fell from over 80% to around 40%, and during that time, altcoins like Ethereum and Ripple exploded. We saw 10x and even 20x gains across the board because capital was flooding into smaller, high-growth assets.

Example from 2021:

The same thing happened in 2021 — Bitcoin dominance dropped again, and altcoins like Solana and Avalanche saw massive gains. If you had positioned yourself early in those altcoins, you could have made life-changing profits.

Here’s why this is crucial right now:

As of 2025, we haven’t seen that massive drop in Bitcoin dominance yet. But it’s coming. And when it happens, you want to be ready. When BTC dominance starts to fall, that’s when altcoins will go 5x, 10x, or even 20x. This is the moment when ETH will hit new all-time highs, and the generational wealth opportunity begins.

Strategy Example:

In 2021, I had a clear strategy: I watched Bitcoin dominance fall below 50%, and I started rotating out of Bitcoin into top altcoins. Within months, I saw massive returns as altcoins exploded. In 2025, I’m planning to do the same — once BTC dominance drops significantly, I’ll be ready to deploy capital into the best-performing alts.

The key takeaway here? Watch BTC dominance closely. When it declines, it’s a strong signal that the altcoin bull run is about to begin.

4.Reserve Risk

Alright, let’s cut through the noise and get real for a moment.

I’m about to break down how to call the market top this cycle, and trust me — it’s ridiculously simple. So simple that even a 6-year-old could grasp it. Yet, it’s powerful enough to save you from making costly mistakes in the crypto game. The key? A metric called Reserve Risk.

Now, you might be wondering, “What’s so special about Reserve Risk?” Let me tell you why this is gold. It’s all about tracking the confidence of long-term Bitcoin holders and their behavior in relation to the current price. Think of it as the pulse of those who’ve been in the game the longest — people who don’t get shaken by volatility but know exactly when to lock in their profits.

Here’s how it works: when Reserve Risk is high, long-term holders are taking profits off the table. And when they start cashing out, that’s your red flag. Historically, every time Reserve Risk hits these high levels, the market has topped out soon after. It’s like clockwork.

Where are we now? Still in the green zone. We’re not at those high-risk levels yet, but don’t get comfortable. When we get out of that zone — and trust me, it will happen — you’ll want to be prepared. Don’t wait until the last second when everyone else is scrambling to sell. By then, it’ll be too late.

I’ll keep you updated when we start peaking, so you’re not left chasing the top like most traders do. I’ve seen it time and time again. People get caught up in the hype, ignore the signals, and give back all their hard-earned gains. My goal is to make sure that you don’t end up like them. My followers won’t be the ones handing over their profits to the market.

Let me be clear: this isn’t about hype. It’s not about some flashy new indicator that’s going to be forgotten in a year. This is about a proven, reliable metric that has kept traders ahead of the curve for years.

Now, I know there’s always chatter in the crypto world — did Murad really make $26 million? Is Satoshi Nakamoto actually Peter Todd? People get sucked into these debates. But here’s the honest truth: none of that matters. Knowing who Satoshi is or how much someone made won’t change the trajectory of your portfolio.

Let’s be real — this is all just noise. Gossip that serves no purpose. It’s there to distract you from what actually matters. And the more time you spend on it, the less time you have to focus on making real moves in the market.

I’m telling you this because I want you to win. Stop worrying about what others are doing. The market doesn’t care about rumors. It cares about data, patterns, and decisions. Focus on your strategy. Keep your eyes on the indicators that matter. Stay sharp, and when the time comes, you’ll be ready to cash out at the top.

I’ll be here to guide you, so you don’t get caught sleeping when the market flips. Stay focused, stay hungry, and don’t let the noise distract you. Let’s win together.

Conclusion: Be Prepared for the Market Top

These four indicators — LTH Supply, Reserve Risk, Coin Days Destroyed (CDD), and Bitcoin Dominance — are critical tools for spotting the market top and catching the next altcoin bull run. The data doesn’t lie, and these metrics have been accurate in every market cycle I’ve tracked.

Keep your eye on LTH Supply — when long-term holders start selling, that’s your exit signal. Watch CDD for spikes in older coins being moved, which signals profit-taking by the smart money. And finally, monitor Bitcoin dominance — when it drops, get ready for altcoins to go parabolic.

This is how I stay ahead of the market. I’m not here to hype things up, just to share real, proven strategies that will help you navigate the cycle and take profits at the right time.

Follow these indicators closely, and you’ll be well-prepared to win this cycle.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)