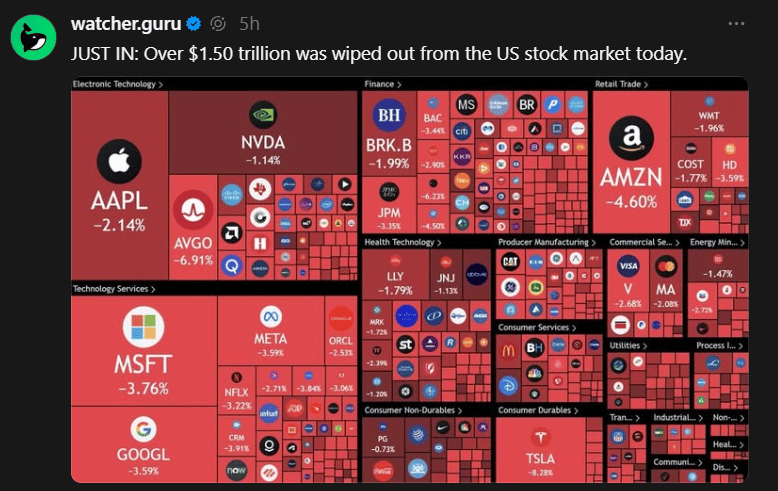

When the market dips, emotions run high. Fear, panic, and uncertainty grip traders, leading to impulsive decisions and missed opportunities. But here’s the truth: market crashes aren’t the enemy—they’re an opportunity for the calm and prepared.

Btw this current BTC dump was well predicted on 9th Dec in my discord group

Always a step ahead.

You need to think hard who to follow on social media and email, because that can totally play into your subconscious mind and rekt your trading.

I’ll walk you through how to manage your mindset, safeguard your portfolio, and seize the chance to profit while everyone else is running scared.

Read and take notes.

1. Understand Market Crashes Are Part of the Game

Markets rise and fall—it’s a natural cycle. Crashes aren’t the end of the world; they’re simply a reset.

What’s Really Happening? During a crash, weak hands sell out of fear, causing prices to drop. Smart money uses these dips to accumulate assets at a discount.

Why It’s Good for You: These downturns can create once-in-a-lifetime buying opportunities, especially for swing traders who know how to spot them.

Example: In 2020, during the pandemic crash, Bitcoin dropped to $4,000. Those who kept calm and bought in made massive returns when it surged past $60,000.

2. Check Your Emotions at the Door

Fear and greed are your worst enemies during a crash. The key is to keep a cool head while others are losing theirs.

Take a Step Back: When the market tanks, don’t panic-sell. Instead, take a deep breath and evaluate the situation objectively.

Follow Your Plan: Stick to your pre-defined trading strategy and avoid impulsive decisions.

Pro Tip: Use automated tools like stop-loss orders to minimize losses, and set alerts for potential buy zones. These tools keep emotions out of your trading.

3. Shift Your Mindset from Fear to Opportunity

Ask yourself: “What can I gain from this?” Instead of focusing on losses, think of a market crash as a sale.

Look for Undervalued Assets: Find quality coins or stocks that are temporarily undervalued.

Trust History: Markets typically recover over time. Think long-term, not just in days or weeks.

Example: When the stock market crashed in 2008, many panicked. But those who bought quality companies like Apple and Amazon at their lows made fortunes in the following years.

4. Build a Crash-Proof Portfolio

Preparation is key. A diversified and balanced portfolio can weather any storm.

Diversify Your Assets: Spread your investments across multiple sectors or trading pairs.

Hold Cash Reserves: Keep some cash on the side to buy during dips.

Set Risk Levels: Only invest what you’re willing to lose, and cap your risk per trade (e.g., 1-2% of your portfolio).

Pro Tip: Use tools like trading journals to track your decisions and learn from past market movements.

5. Turn Volatility into Profit

Crashes are volatile—but for swing traders, volatility is gold. Here’s how to leverage it:

Short-Term Opportunities: Watch for oversold assets and use technical indicators (like RSI or MACD) to time your entry.

Follow the Trend: Look for reversal patterns signaling recovery, such as double bottoms or bullish divergences.

Set Tight Targets: In a volatile market, take smaller, quicker profits rather than holding out for huge gains.

Example: During the 2022 crypto downturn, savvy traders shorted overhyped coins and bought back in once they hit rock bottom, making profits both ways.

6. Stay Connected to the Right Community

When chaos hits, it’s easy to feel isolated and overwhelmed. Being part of a like-minded group helps you stay grounded.

Learn from Others: Share insights and strategies with experienced traders.

Stay Accountable: A good community keeps you focused and motivated, especially during tough times.

Why It Matters: Traders who go it alone often panic. But those with a strong support system tend to stay calm, make better decisions, and ultimately profit.

Final Thoughts: Calm Is Your Superpower

Market crashes separate the amateurs from the pros. By staying calm, following a plan, and viewing volatility as an opportunity rather than a threat, you can turn market downturns into your personal advantage.

Ready to Profit in Any Market?

Join my 9-5 Traders Community today and learn how to navigate market crashes with confidence. You’ll get:

Proven strategies to trade in volatile markets.

Real-world case studies of traders who thrived during crashes.

A supportive community to keep you sharp and disciplined.

Don’t just survive the crash—profit from it.

Victor