Yesterday wasn’t random.

It wasn’t “bad luck.”

And it definitely wasn’t the market suddenly turning evil overnight.

It was structure doing exactly what structure does.

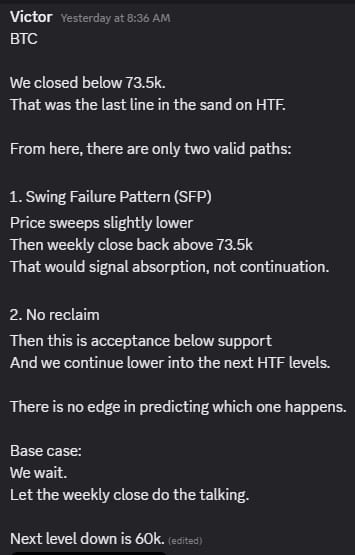

I warned before the move that BTC losing the last HTF line in the sand would open up two paths only. No third option. No hopium scenario. No guessing.

And today, price chose.

BTC broke down.

ETH followed.

SOL cracked hardest.

But because markets repeat behaviors when conditions are the same.

Let’s break this down calmly.

BTC: The Line That Mattered Is Gone

We closed below the key HTF level.

That matters more than any intraday wick or Twitter narrative.

Once that level failed, there were only two valid outcomes:

Swing Failure Pattern

Sweep lower and reclaim on the weekly close.No Reclaim

Acceptance below support and continuation into lower HTF zones.

There was never an edge in guessing which one would happen.

The edge was in knowing what to do if either occurred.

Price did not reclaim.

That is acceptance.

From here, downside magnets open up.

Those levels are [only premium + free group].

If you were emotionally long with no invalidation, this move felt brutal.

If you were structured, it was expected.

That difference matters.

ETH: Reaction, Not Reversal

ETH gave a bounce.

But let’s be precise.

This was a reaction after liquidation, not accumulation.

Here’s why that distinction matters:

Weekly structure is still bearish

No clean HTF bullish engulfing

Former supports are now overhead supply

The bounce came after forced selling, not patient buying

That means this is still a reaction zone, not a confirmed base.

Key ETH reaction and demand zones are [only premium + free group].

If ETH fails to hold these, continuation is the higher probability path.

Calling a bottom here is emotional.

Managing exposure here is professional.

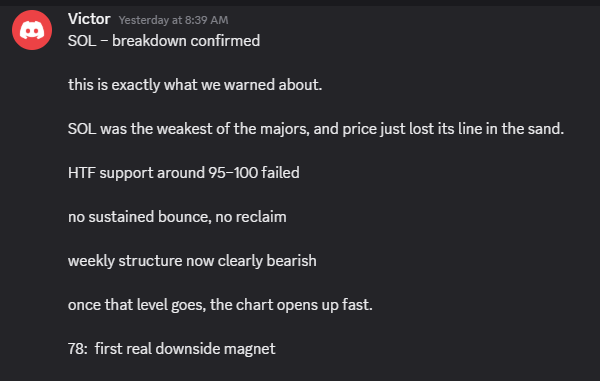

SOL: Weakest Asset Did What Weak Assets Do

SOL was the weakest major.

That’s not hindsight. That was stated before the breakdown.

Once SOL lost its HTF support:

No sustained bounce

No reclaim

Weekly structure flipped clearly bearish

When weak assets lose structure, they don’t drift lower slowly.

They move fast.

That’s exactly what happened.

The first real downside magnet for SOL is [only premium + free group].

This isn’t fear.

This is how downside expands once support is gone.

Why This Matters More Than Being “Right”

Anyone can screenshot after the fact.

What actually matters is this:

Were you prepared before the move?

Did you reduce risk when structure failed?

Did you know where you were wrong?

Markets don’t reward conviction.

They reward risk control.

The people hurting today weren’t wrong on direction.

They were wrong on process.

They held because they hoped.

They added because they felt it was “too low.”

They ignored structure because they didn’t want to accept reality.

That’s not trading.

That’s coping.

What I’m Doing Now

No hero trades.

No forced longs.

No prediction games.

Base case remains simple:

Let the weekly close speak

React to reclaim, not hope for it

Stay liquid, calm, and optional

If price gives a real HTF signal, we act.

If it doesn’t, we preserve capital.

Survival is the edge here.

Why This Matters for You

If you’re reading this and thinking:

“I wish I had seen this earlier”

That’s exactly why the real-time breakdowns matter.

These BTC, ETH, and SOL levels were shared before the move.

They do not appear in the public newsletter in full.

They’re shared live, in context, with invalidations and risk rules inside the community.

Your Next Step

If you want access to key levels, real-time warnings, and structure-based planning:

Start here. See how the analysis works before price moves.

If you want full execution, live trade management, and options frameworks that work in both bull and bear markets:

👉 Paid Discord:

https://whop.com/digitalvault1

No hype.

No prediction theatre.

Just structure, risk, and preparation.

The market just showed its hand.

The question is whether you’re watching…

or reacting after the damage is done.

Victor