Today, BTC is flirting with the $70k mark, which leads to the big question:

Is BTC heading for $100k, and are we about to see a massive alt season?

PS. If you can’t read this article because of the paywall, you can subscribe here — Wise Healthy Wealth Newsletter. — the perk is you can read all my future medium articles for free and stay ahead of the market with exclusive insights!

Let’s dive into the current landscape.

BTC has been trading within the range of $68.7k and $69.5k, and Bitcoin Dominance (BTC.D) is sitting at 58.44% — with a slight downward trend. Over the past week, BTC’s price has surged by around 10%. Naturally, everyone’s buzzing about a possible alt season, and with good reason. Historically, when BTC begins to stabilize at high levels, we see altcoins explode, creating huge opportunities for those paying attention.

Just yesterday, the market lit up with green. Altcoin holders across the board rejoiced as big green candles shot up across almost every project. But here’s the real question:

Will BTC keep pumping? And when will we see the true bull run begin?

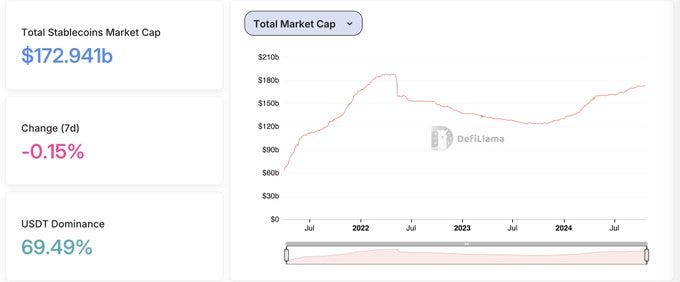

1. Stablecoins Market Capitalization (MC): Why It Matters

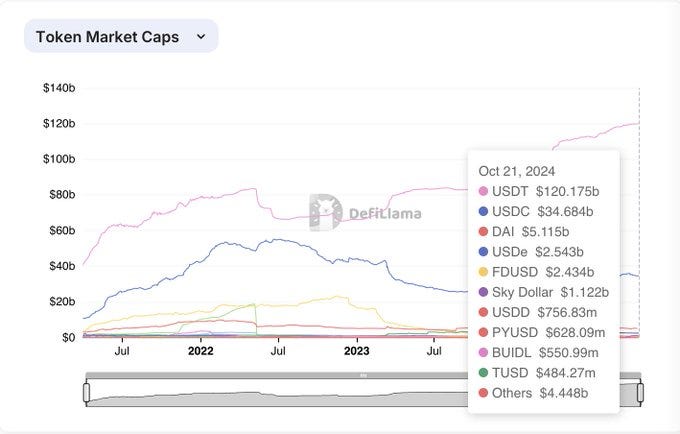

Stablecoins have always played a pivotal role in the crypto ecosystem. Right now, the total stablecoin market cap stands at $172.9 billion, according to DefiLlama. This is the highest it has been since the collapse of Terra’s UST.

The largest player in the stablecoin space is USDT (Tether), with a dominant 69.5% market share, which is a staggering $120 billion.

Following Tether, we have USDC at $34.6 billion, DAI at $5.1 billion, and USDe at $2.5 billion.

Now, why does this matter? Stablecoins address one of crypto’s biggest challenges: price volatility. While crypto is great for decentralized transactions and financial transparency, it’s also notorious for wild price swings. This makes people skeptical about its use as a reliable investment vehicle.

For traders, moving in and out of fiat is slow and complicated, and businesses accepting crypto are faced with the possibility of a 20–30% price fluctuation within a day. That’s hardly ideal for planning financials, right?

Stablecoins, however, offer a solution by providing a stable store of value within the volatile crypto market. The fact that stablecoin market capitalization remains high is a key indicator that the market is maintaining its liquidity and stability, which is crucial for sustaining further growth, including a potential bull run.

2. Trading Volume: The Push and Pull

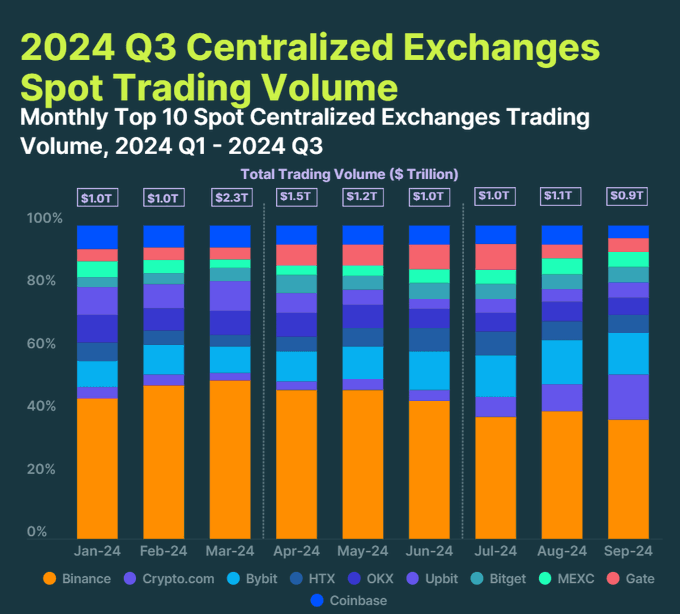

2.1. Spot Trading Volume

Spot trading volume has been taking a nosedive recently. In fact, we’ve seen a 36.8% drop compared to Q2 this year. It feels like the entire market is holding its breath, waiting for the next big move. Think of it as the calm before the storm.

But what does this low spot volume mean? It’s a signal that investors are in a “wait and see” mode. They’re holding onto their coins, possibly preparing for a significant shift in the market. Historically, we’ve seen low spot volume right before major price movements.

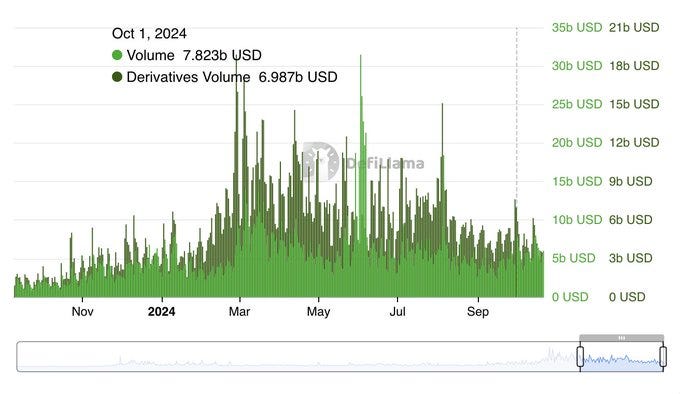

2.2. Derivatives Trading Volume

On the flip side, derivatives trading volume tells a different story. There was a time when derivatives accounted for over 80% of the total trading volume, and we’re still seeing strong activity here. For example, on October 1st, 2024, derivatives trading hit $6.98 billion, while the total trading volume was $7.82 billion.

This suggests that traders are hedging their bets more than ever. Instead of simply betting on price direction, they’re preparing for any possible outcome, whether that’s a continuation of the bull run or a sharp correction.

Why is this important? Derivatives trading shows us that market participants are taking risk management seriously. It’s a sign of a maturing market and something I’m keeping a close eye on as a possible indicator of how much confidence traders have in the next big move.

3. The Fed’s Role: Interest Rates and Crypto Liquidity

Let’s talk about the Fed for a moment. The Federal Reserve’s actions ripple across global markets, and crypto is no exception. When the Fed tightens its monetary policy and raises interest rates, it reduces liquidity. For high-risk assets like crypto, that’s usually bad news, as investors pull out in search of safer investments.

But here’s where it gets interesting. History shows that after the Fed starts cutting rates, inflation bottoms out roughly three years later. Based on previous cycles, this suggests a bottom sometime in 2027. What’s more, in the last two cycles, we saw GDP drop significantly (in 2008–2009 and 2019–2020), which hints at a possible economic slowdown for the U.S. between 2025 and 2026.

Now, looking further ahead, there’s also the possibility of inflationary pressure building up again around 2029. After the 2008 crash, interest rates stayed below inflation for years, and we could see something similar play out.

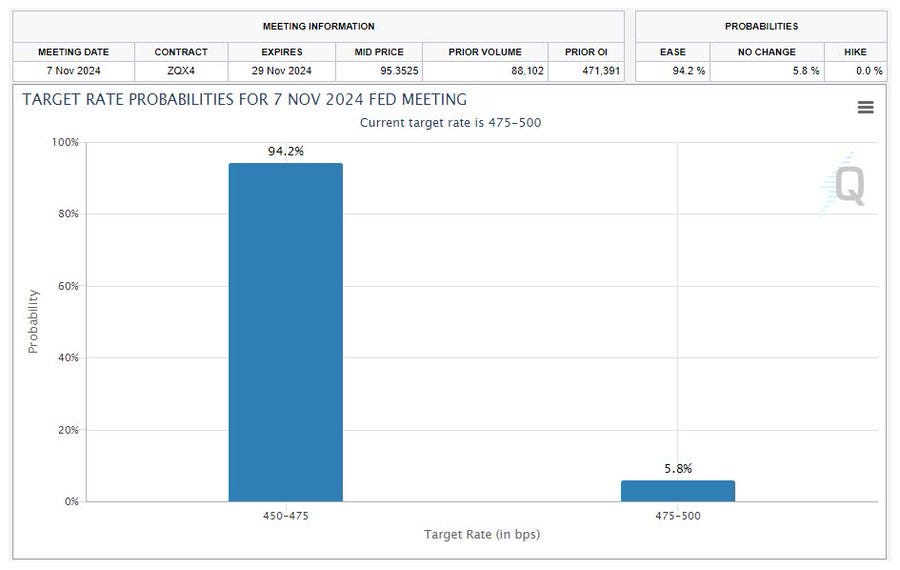

Here’s why this matters for crypto: Lower interest rates mean more liquidity. When the Fed cuts rates, it encourages investment into riskier assets like crypto. So if we see a rate cut in November (which FedWatch currently gives a 94.2% chance of happening), it could trigger an influx of capital into the market, pushing BTC and altcoins higher.

Will Jerome Powell deliver that 25bps rate cut? If so, expect liquidity to flood back into the market, creating a perfect storm for a new crypto bull run.

The Final Word: Is a Bull Run Imminent?

BTC has surged nearly 10% over the last week, and stablecoins are holding strong at record levels. While spot trading volume is down, derivatives trading suggests that big players are positioning themselves for a significant move. Add in the potential for a Fed rate cut, and we have all the ingredients for a new bull run.

But as always, there are no guarantees. The key is to stay prepared, keep an eye on liquidity events like the Fed’s decisions, and monitor stablecoin movements as they will give us critical insight into the health of the overall market.

In short, we’re at a tipping point. Whether we’re about to see BTC hit $100k or a massive alt season take off, I’ll be watching the liquidity and key events to guide my next moves.

Stay sharp, stay informed, and let’s see where this market takes us.

If you’re serious about building wealth, especially in the crypto space, I encourage you to follow a proven strategy, stay disciplined, and avoid the hype. The road to financial freedom isn’t paved with shortcuts — it’s built on solid foundations. And I’m here to help you lay those foundations, one step at a time.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)