Finally.

This is the setup I’ve been waiting for.

After weeks of fear, panic, and exhaustion,

Bitcoin just printed what I’ve been watching for:

a bullish divergence right at the bottom.

Look closely.

We’ve got confluence across multiple timeframes, and that’s what makes this setup strong.

The Perfect Bounce Zone

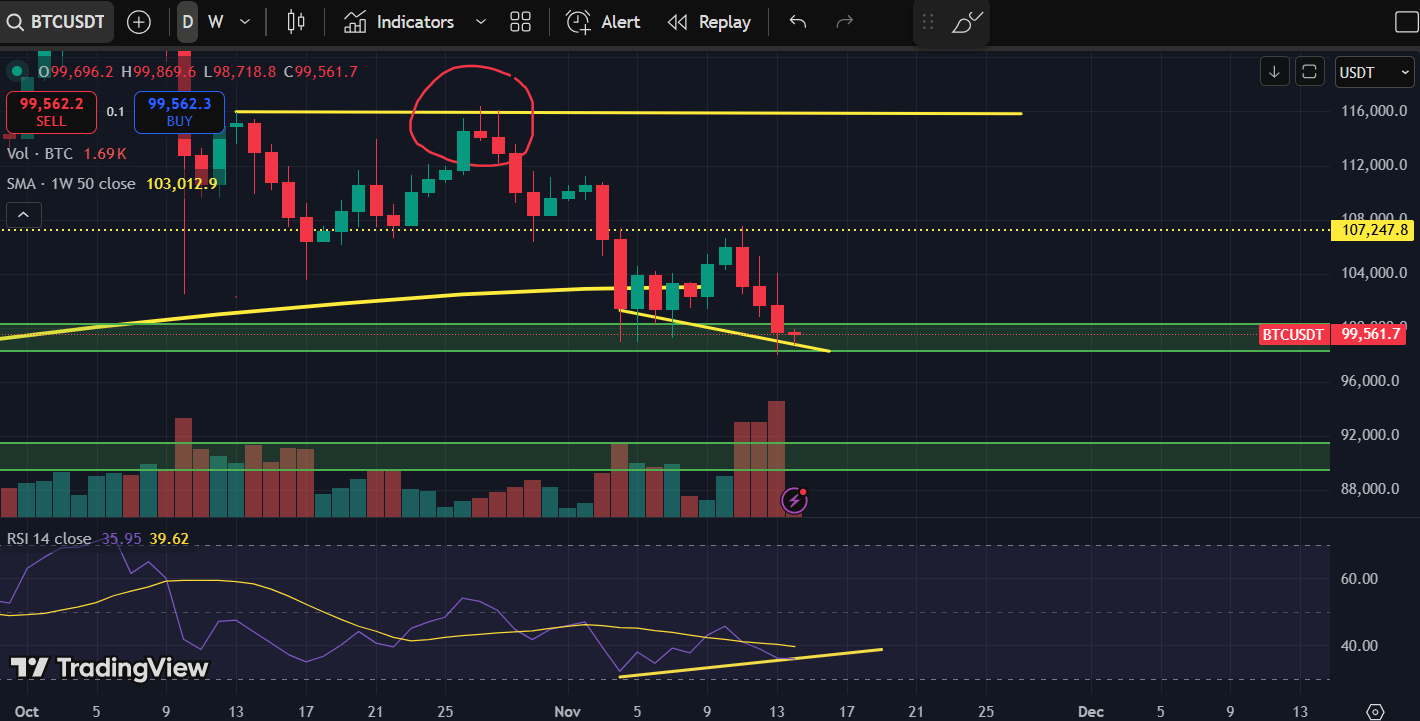

BTC is now sitting right on top of long-term support around 98k,

aligned perfectly with the 50-week moving average, the same line that’s acted as dynamic support across multiple bull market corrections in previous cycles.

This is where smart money quietly reloads.

Not at the highs, not during euphoria, but right here, when everyone else is too scared to buy.

You can see how volume has started to spike on the recent dips.

That’s not retail panic-selling, that’s accumulation.

And the RSI?

Forming a clean higher low while price makes a lower low.

That’s your classic bullish divergence.

It means momentum is shifting underneath the surface,

even if price hasn’t reflected it yet.

The Daily Timeframe Confirmation

On the daily chart, momentum indicators are curling upward from oversold regions.

It’s subtle, but it’s the first sign of strength after relentless selling.

Every major BTC rally in past cycles has started exactly like this:

Oversold RSI

Bullish divergence

Retest of the 50W MA

Everyone calling for “one more leg down”

Then… momentum flips, liquidity floods in, and the crowd scrambles to re-enter higher.

The Emotional Cycle in Real-Time

You can almost feel the sentiment right now.

Retail’s tired.

Funding rates are flat.

Open interest has been wiped clean.

This is the stage where traders stop caring

and that’s exactly when the reversal begins.

Most people only recognize the trend after it’s obvious.

But the best setups never feel comfortable in real time.

They feel uncertain.

They feel risky.

They make you hesitate, and that hesitation is what separates winners from watchers.

When Momentum Returns

Once BTC gains momentum from here, and it will,

watch what happens next.

The same crowd that’s now silent will come rushing back.

Funding will flip positive again.

Altcoins will start to wake up one by one.

And everyone will act like they “saw it coming.”

But you’ll know the truth

you saw it when nobody else did.

This is the inflection point before confidence returns.

The risk-reward here is asymmetric

because downside from 98k support is limited,

but upside once the 50W MA bounce confirms can send BTC straight back toward 107k and beyond.

Why This Setup Matters

The bullish divergence here is more than just a technical pattern.

It’s a reflection of sentiment capitulation.

The market has absorbed all the fear it can.

Now it’s resetting.

This same pattern printed:

In 2019 at $3k

In 2020 before the $10k breakout

In mid-2022 before the first post-bear rally

And each time, people doubted it, until it ran.

You’re looking at the same energy building again right now.

My Take

This is the kind of setup you dream about.

Low risk, high conviction, heavy emotional discount.

Every metric I track, sentiment, RSI, volume, 50W MA confluence,

is aligning for a bounce.

Don’t try to predict every candle.

Just understand the structure.

Once BTC confirms this move, it’ll pull liquidity from stablecoins and ETFs alike.

Then the rotation into altcoins follows, fast and brutal.

If you’ve been patient this whole time,

you’re about to be rewarded.

Position yourself before the crowd wakes up.

Learn how to manage entries like this with precision and conviction inside:

Altseason Playbook + Crypto Exit Manual + Altseason Survival Manual

for $117/month

The market rewards patience.

The divergence is here.

The setup is ready.

Now it’s just a matter of who acts first

and who hesitates again.

Victor