I’ll be straight with you.

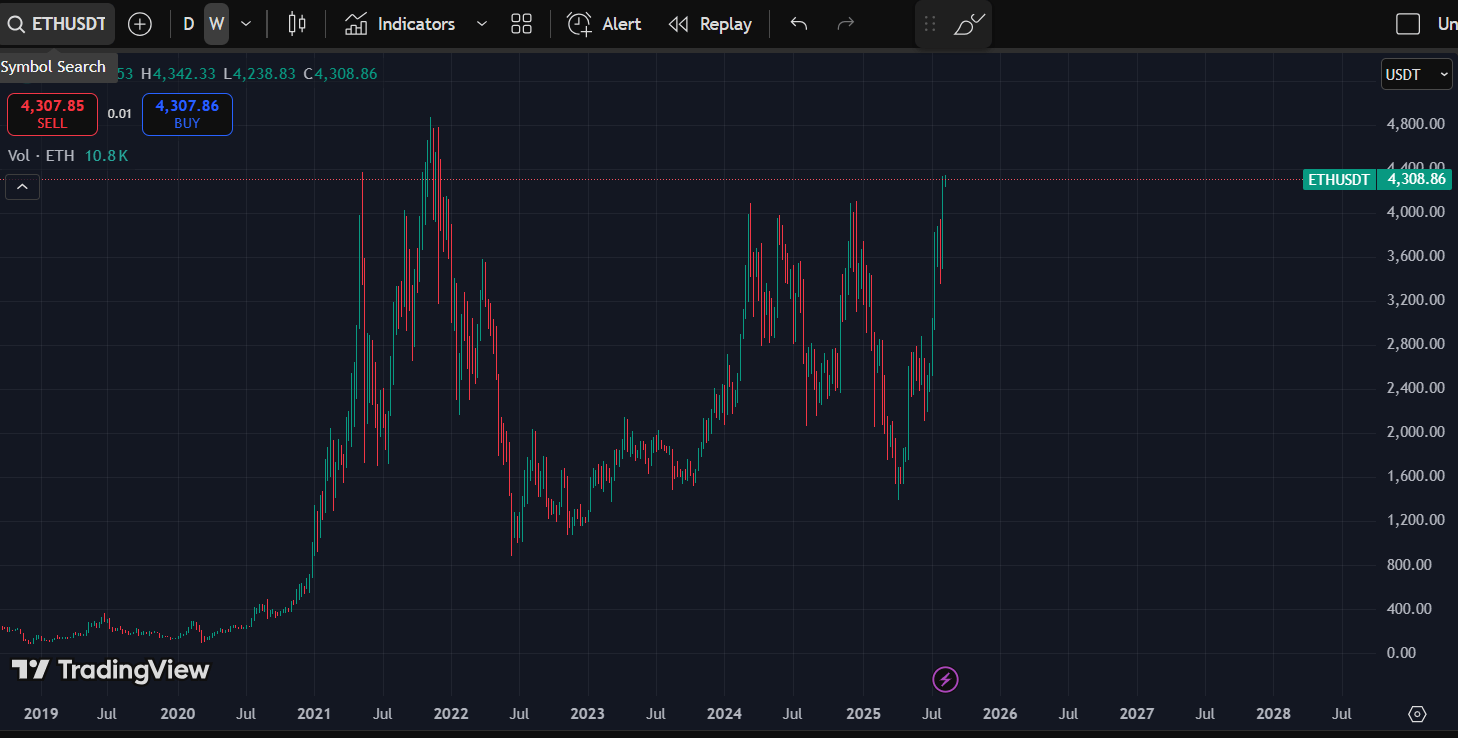

Lower timeframes this week will be noisy. CPI can make intraday charts whiplash. But when I zoom out to the weekly chart, it’s clean.

The Key Level Everyone Should Have on Their Chart

ETH is holding above 3,580. That’s the line that matters.

As long as we stay above it, the higher-timeframe trend remains bullish.

A pullback toward 4,000 is possible, that’s the obvious re-entry zone. But obvious levels often get front-run or skipped entirely. If market makers sense everyone is waiting there, they’ll push through without giving you the dip.

If we pump from here, the next real target is 4,800, the previous all-time high. Between 4,000 and 4,800 there’s no significant resistance, so when the move comes, it can be fast.

How I See the Next Phases

If ETH reaches 4,800, I don’t expect it to slice through on the first attempt. Big levels rarely break cleanly. More likely, we’ll see rejection, consolidation, or a fakeout before the next leg.

That’s where I’ll be looking at rotation charts:

BTC Dominance (btc.dom)

5 more mentioned in premium

These tell me if capital will keep flowing into ETH, rotate into alts, or retreat back into BTC. Premium members get my exact trigger levels and real-time updates when these flip.

Strategy if You’re Already In

If you’re positioned, do nothing. Lower-timeframe noise doesn’t matter as long as the higher-timeframe structure holds. You don’t want to cut early just to watch price run without you.

Strategy if You’re Sidelined

You have to accept you’re late. That means your focus now is risk-controlled entries.

Here’s how:

Decide your total ETH allocation.

Deploy 20–30% now so you’re not left out if it runs.

Keep the rest for dips , ideally 4,000 or slightly above (4,100).

Avoid chasing if it breaks out without you , have a plan for scaling in on pullbacks instead.

This way, you balance FOMO with discipline.

2 Things You Need To Know NOW

Here are two concepts you can apply now:

1. Use ETH/BTC to front-run ETH breakouts

When ETH/BTC is trending up, ETH tends to lead, and alts tied to the ETH ecosystem benefit. Watch for ETH/BTC to break recent highs , that’s often the green light for ETH-led rallies.

2. Track Total3/BTC for altseason cues

Total3 is the total crypto market cap excluding BTC and ETH. When it starts outperforming BTC, that’s your signal that risk appetite is rotating into smaller caps. This is where explosive moves happen , but only if BTC and ETH are stable or trending up.

These tools aren’t for prediction. They’re for timing , knowing when to press the gas and when to ease off.

Why Most Traders Miss It

Retail traders stare at the ETH price chart in isolation. They wait for Twitter to confirm a breakout. By then, the easy money’s gone.

The traders who catch the meat of the move are the ones watching the rotation charts in real time, anticipating where capital will flow next.

That’s the skill I’ve been drilling into my premium group: not just “what” to buy, but “when” to rotate.

If you were in premium, you’d already have:

Exact BTC.D and ETH.D levels that trigger rotation

My live ETH/BTC break alerts before they run

A shortlist of alts positioned to lead when ETH takes off

The exit strategy so you keep profits when the music stops

Instant Discord updates the moment market structure shifts

This isn’t hindsight. These are moves mapped before they happen.

The Bottom Line

ETH’s path from here is straightforward:

Hold 3,580 = bullish

Retest 4,000 = opportunity

Break to 4,800 = acceleration

Reject at 4,800 = rotation watch

You can either watch this unfold from the sidelines…

Or be in the room when the real triggers fire.

When ETH makes its next run, you’ll either be prepared… or buying someone else’s bags.

- Victor