Fast red candles.

Broken supports.

Timelines screaming collapse.

That’s usually when mistakes are made.

Instead, this is where structure matters.

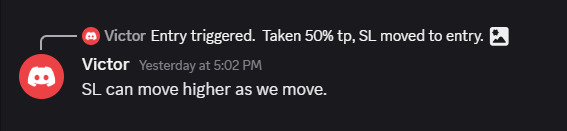

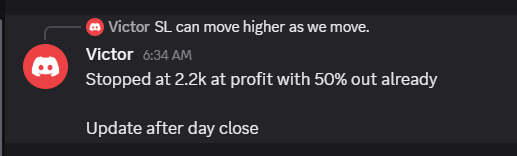

Inside the Discord, I shared an ETH trade using 3x leverage.

Nothing fancy.

No hero calls.

No guessing bottoms.

Just execution.

On the surface, the move was simple:

ETH moved roughly 7% unleveraged from the entry zone.

With 3x leverage, that translated into a meaningful gain without needing a massive price reversal.

That’s the part most people miss.

This wasn’t about predicting a new bull leg.

It was about understanding where price was, what risk looked like, and how to express that view efficiently.

Why this trade existed at all

ETH had been trending down hard.

Support levels were breaking one by one.

Momentum was negative.

Sentiment was awful.

That’s exactly why the trade was possible.

Not because it felt bullish, but because price finally reached a zone where risk could be defined.

Look at what happened structurally:

• ETH sold off aggressively into a known demand area

• Liquidations flushed late longs

• Price accelerated instead of grinding

• Volatility expanded

That combination matters.

Fast moves into support create opportunity.

Slow bleeds create pain.

When price collapses quickly, you don’t need to catch the exact bottom.

You just need price to stop going straight down.

That’s it.

The role of leverage, used correctly

Let’s be very clear about this.

Leverage is not the enemy.

Uncontrolled leverage is.

This trade was 3x, not 20x.

That’s an important distinction.

At 3x:

• A 7% move becomes ~21%

• Liquidation is far away

• Risk can still be managed

• Emotion stays under control

Compare that to most retail behavior.

People either go:

• All-in spot with no plan

or

• High leverage hoping for a miracle

Both lead to the same place. Stress.

The point of leverage is not to gamble.

It’s to optimize capital when conditions are right.

Small size.

Defined invalidation.

Pre-planned exit.

That’s how this trade was structured.

Why this matters more than the PnL

Anyone can post a green screenshot.

What actually matters is process.

This ETH trade highlights a few principles I repeat constantly:

You don’t need to be right about direction long term

You just need a tradable reaction zone.Fast downside creates better R:R than slow chop

Capitulation compresses risk.Leverage should amplify good structure, not replace it

If the setup is bad, leverage just speeds up losses.You don’t trade because price moved

You trade because risk is asymmetric.

This wasn’t a “bullish ETH” thesis.

It was a tactical response to exhaustion.

Big difference.

Trade done.

Why this never shows up in the free newsletter

This kind of trade doesn’t translate well into email.

It’s time-sensitive.

It relies on live levels.

It requires context.

That’s why it’s shared inside the Discord, in real time.

You see:

• The levels before price reacts

• The invalidation if it fails

• The reasoning as it unfolds

Not hindsight.

Not edited charts.

Execution.

By the time something like this is obvious on social media, the edge is gone.

What to take away from this

If you’re holding ETH and feeling stressed every dump, that’s information.

It usually means:

• Position too big

• No plan

• No risk framework

Trades like this are not about bravado.

They’re about control.

Control over downside.

Control over exposure.

Control over emotions.

That’s how you survive long enough to benefit when the real trend returns.

Your next step

If you want to see these trades as they happen, not after the fact:

• Free room:

https://whop.com/digitalvault1/digital-vault-free/

This is where you get context, education, and orientation.

• Paid Discord:

https://www.whop.com/digitalvault1

This is where spot and options trades are shared live, with structure and risk defined.

No hype.

No guarantees.

Just process, execution, and experience.

Markets will keep testing people emotionally.

The ones who last are the ones who learn how to respond, not react.

Victor