Markets are green again.

Memes are pumping.

CT is screaming “ALT SZN IS HEREEEEEE.”

Feels like 2021, right?

But that’s exactly why I’m paying attention right now.

Not to ape into the hype —

but to watch for the moment everyone gets left holding the bags again.

Because I’m not here to guess.

I’m here to exit clean while others are still celebrating.

Let me show you the one metric smart money watches religiously…

but retail has never even heard of.

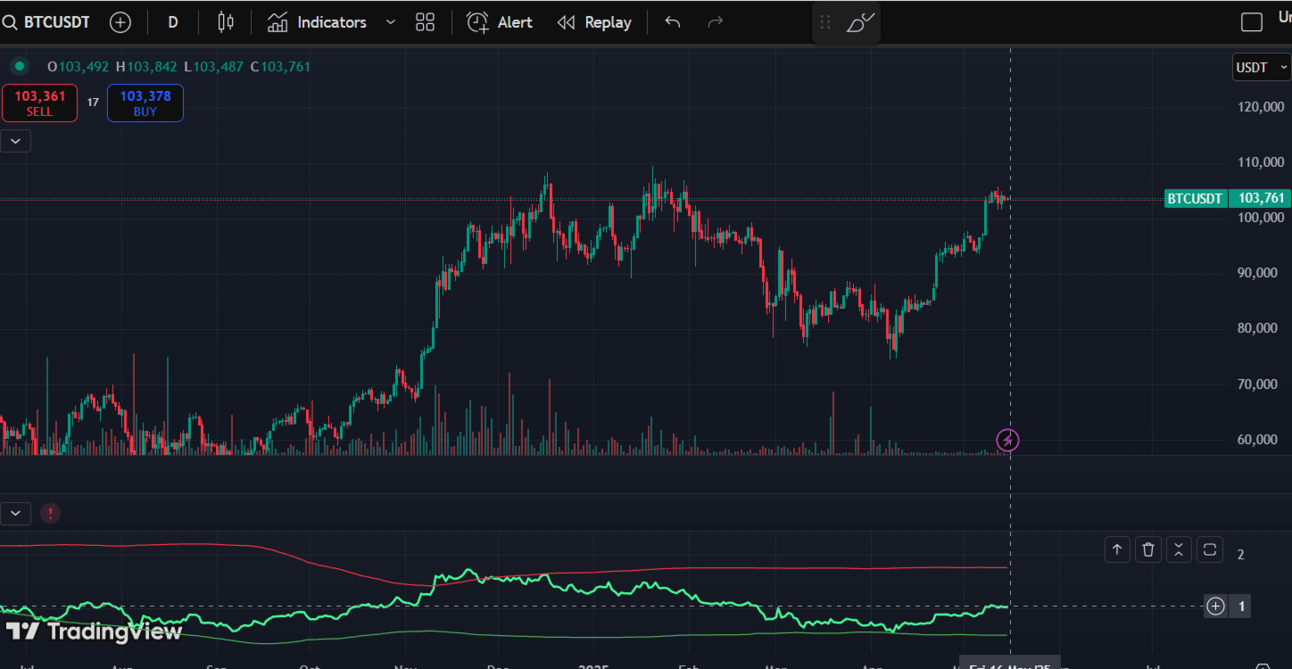

The Stablecoin Supply Ratio (SSR)

Let me break it down in simple terms:

SSR = Bitcoin Market Cap / Stablecoin Supply

In short, it tells you how much buying power is left in the system.

Think of stablecoins like dry powder:

They’re capital waiting to be deployed

Sitting on exchanges

Ready to market buy when sentiment spikes

So here’s the key:

Low SSR = Lots of dry powder = Potential upside still left

High SSR = Stablecoin supply drying up = Less buying fuel = Danger zone

Why Does SSR Matter?

Because crypto doesn’t pump forever.

Every rally is fueled by new capital.

When stablecoins flood into exchanges, that’s your early sign of accumulation.

When stablecoins start drying up?

That’s when you know the crowd is fully deployed.

And when there’s no more fuel left?

The rocket stalls.

And smart money sells.

What’s Happening Right Now?

As of this morning, SSR is sitting around 1.

That’s still low overall — meaning some dry powder remains.

BUT…

It’s starting to rise again.

And that’s the real signal most miss.

Not just where SSR is…

But where it’s going.

When SSR trends UP after months of trending down?

That’s when big players — hedge funds, whales, VCs — begin scaling out.

Quietly.

They don’t wait for “it’s over” to sell.

They start distributing when everyone else is dancing.

2021 Exit

Back in late 2021, before BTC topped at $69K…

SSR started trending upward.

Stablecoins were being used.

Fuel was draining.

The ratio crept up.

And while retail screamed “$100K INCOMING,”

smart money was already out.

What I’m Watching

I’ve got alerts set.

If SSR begins accelerating upward?

That’s when we:

Stop chasing pumps

Stop DCA’ing into altcoins

Start scaling out with discipline

Rotate into stables or less volatile plays

Because once the fuel dries up?

It’s game over for those who stayed greedy.

Here’s Your Move

Don’t get emotional.

Don’t ride vibes.

Watch what the data is whispering.

And right now?

SSR is whispering:

“Caution. Not panic. But caution.”

If it keeps rising?

That’s your early top signal — long before the headlines flip bearish.

Inside 9-5 Traders, I call these flips in real time.

📉 I called the Stochastic RSI top before $93K

📈 I tracked the Exchange Whale Ratio before the last flush

📊 I watch SSR so you don’t have to — and I tell you when to move

👉 [Join 9-5 Traders Now]

Get out before it’s obvious.

Get back in when it’s smart.

Because the winners don’t ride the trend all the way up.

They jump off right before the drop — and reload at the bottom.

—

This is the level of strategy retail never sees until it’s too late.

That’s why we win.

Victor

P.S. SSR creeping up isn’t panic. It’s preparation. And preparation beats reaction every time.