Well, look around. The market is dripping in fear, sentiment is in the gutter, and traders are losing their minds.

But here’s the thing: it’s not as bad as it seems.

Actually, when you zoom out, the good outweighs the bad.

Not convinced? Let’s break it down.

The Bad News First (So You Don’t Think I’m Coping)

1️⃣ Bitcoin’s Been Brutalized

Since January 20th, Bitcoin (aka King of the Market, Bringer of Gains) has dropped 28%.

📉 From $100K to $79K.

Altcoins? Worse.

SOL: -40% from its peak.

AVAX: Down horrendous.

Memecoins: Total extinction event.

We’re officially in panic mode.

💡 But remember: This exact thing happened in 2017 and 2021—a big 25-30% pullback before the next leg up.

History doesn’t repeat, but it rhymes.

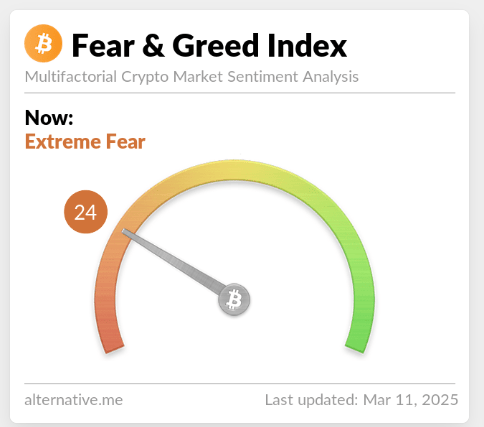

2️⃣ The Market Vibes Are At Rock Bottom

The Fear & Greed Index hit 10 recently. That’s “screaming into the void” levels of fear.

For reference, the last time we were here was May 2022, after Terra Luna self-destructed.

While F&G has rebounded to 20, anything below 20 is still considered Extreme Fear.

🤔 What happened last time we hit Extreme Fear?

March 2020: Bitcoin at $4K → 8 months later? $64K.

June 2022: BTC cratered to $17K → 1 year later? $69K.

Bottoms form in fear, not euphoria.

3️⃣ Layoffs Are Spiking—And That’s Spooking People

U.S. layoffs just hit their 4th-largest spike in 25 years.

📉 The only other times we’ve seen this?

Dotcom Bubble Crash (2000).

Great Financial Crisis (2008).

COVID Crash (2020).

Sounds terrifying, right?

But let’s look at the bigger picture.

The Good News (aka Why You Shouldn’t Panic Sell Here)

4️⃣ Layoffs Are Mostly Government Jobs (aka DOGE’s Fault)

In 2024, 50% of new jobs were federal positions.

And who’s been on a government-slashing rampage?

Elon Musk.

🚀 SpaceX, Tesla, X (Twitter)—all cutting jobs.

That means this layoff spike isn’t necessarily a sign of a recession—it's just Musk firing people at warp speed.

💡 Translation? Don’t confuse macro-level fear with reality.

5️⃣ Open Interest (OI) is Down = Leverage Cleared Out

What’s Open Interest?

OI is a measure of how much money is in leveraged positions.

High OI? Market overheated. Correction likely.

Low OI? Market cooled down. Reversal incoming.

🚨 Right now? OI just dropped HARD.

That means:

✅ Overleveraged traders got wiped.

✅ Weak hands shaken out.

✅ Market reset—ready for the next move up.

You know when OI was this low?

📉 November 2022 (BTC was $16K) → 🚀 One year later? $69K.

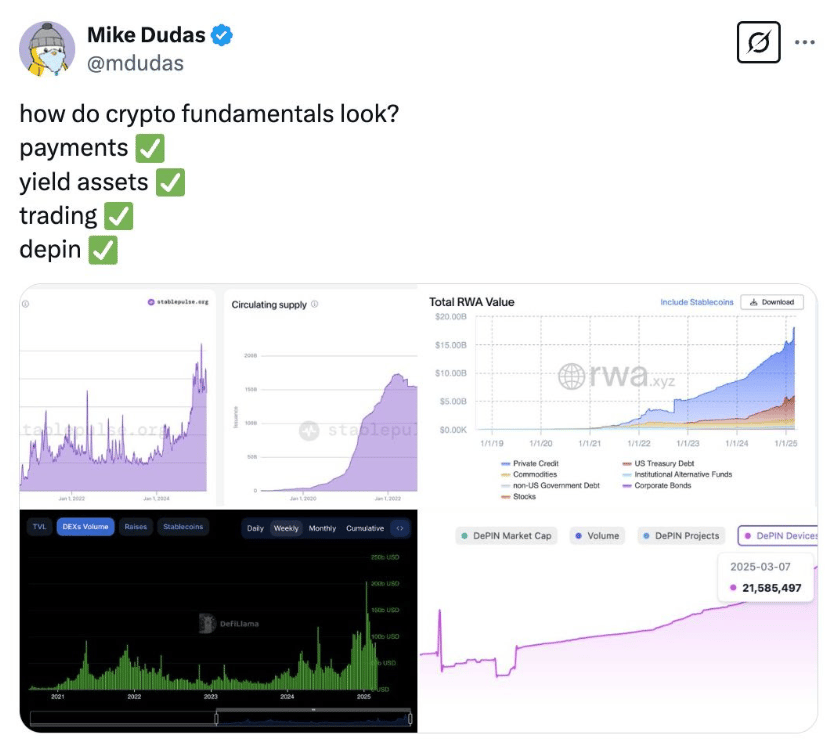

6️⃣ Onchain Data = Still Bullish AF

📊 Key Metrics:

New wallet growth? ✅ Steady increase.

Hodlers selling? ❌ Nope, they’re accumulating.

Exchange balances? 📉 Dropping (less BTC available = bullish).

Even with the price drop, network activity is holding strong.

This is not what a bear market looks like.

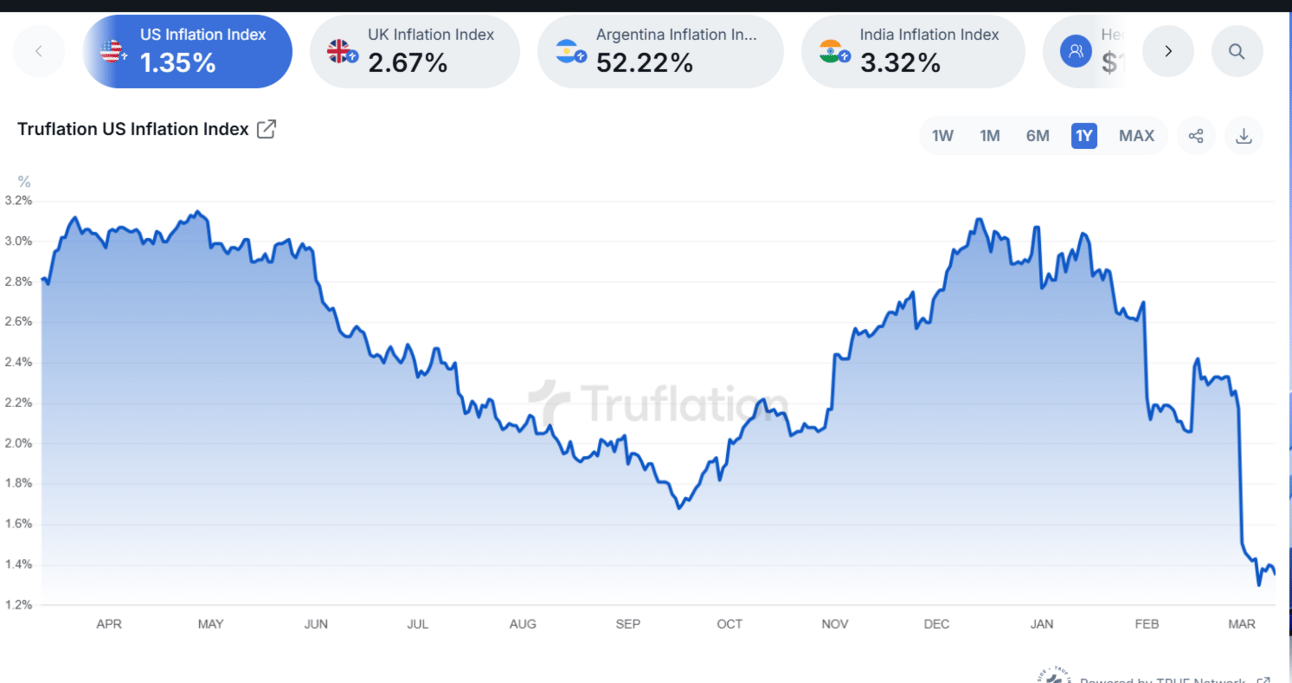

7️⃣ Inflation is Dropping (aka The Fed Might Print Again)

Inflation is the biggest market mover.

If inflation stays high, the Fed won’t cut rates.

If inflation drops, the Fed will start printing money again.

💡 Good news: Trueflation’s real-time data shows inflation is about to crater.

Why does this matter?

Because if the Fed cuts rates, it injects liquidity into markets.

And guess what loves liquidity?

👑 Bitcoin.

📅 Key Date: This Wednesday, we get February’s inflation report.

If inflation comes in lower than expected, we could see:

✅ A Fed pivot.

✅ Fresh liquidity.

✅ Bitcoin roaring back.

8️⃣ History Says We’re Still On Track

📈 Bitcoin in 2024 is tracking eerily similar to:

2017 Cycle

2021 Cycle

Every time before major new all-time highs, Bitcoin had:

✔️ A 25-30% pullback in Q1

✔️ A run to new highs in March-May

✔️ A Q4 blow-off top

If this pattern holds:

📅 March-May: Bitcoin hits new highs.

📅 Q4: Possible cycle peak.

Are we guaranteed to follow this? No.

But does the historical pattern suggest it’s likely? Absolutely.

Final Score: The Good vs. The Bad

Bad News:

❌ Markets are down 28%.

❌ Fear is extreme.

❌ Layoffs are rising.

Good News:

✅ Layoffs are mostly government jobs.

✅ Leverage has been flushed.

✅ Onchain fundamentals are solid.

✅ Inflation is falling (Fed may pivot).

✅ Bitcoin is still following historical cycles.

Final Verdict: The good outweighs the bad.

We don’t believe this is the end of the bull run.

Actually, this is shaping up to be a textbook mid-cycle dip.

🔹 Don’t panic sell.

🔹 Stay patient.

🔹 Stick to the plan.

And if you’re tired of navigating this market alone, it’s time to trade with a team that actually knows what they’re doing.

👇 Join the 9-5 Traders Community and stop trading like retail. 👇

🔗 Join Now

See you inside,