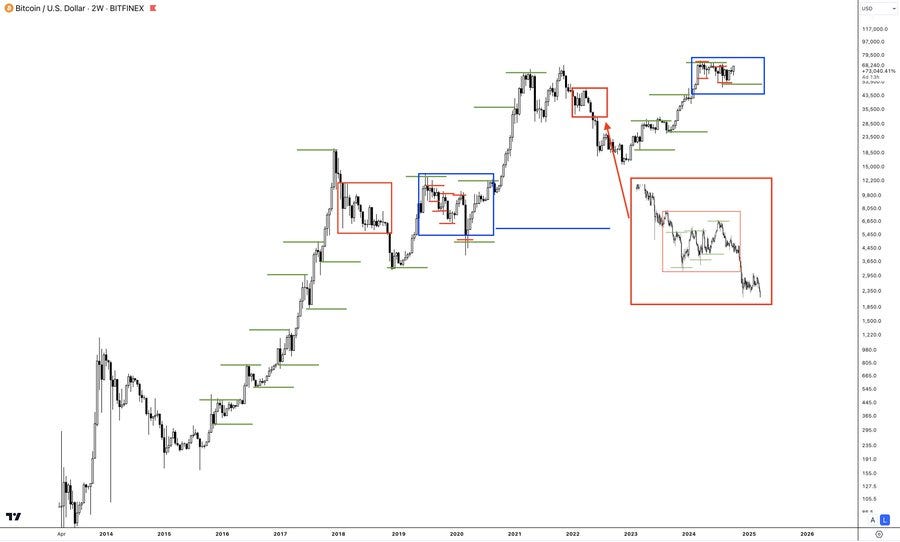

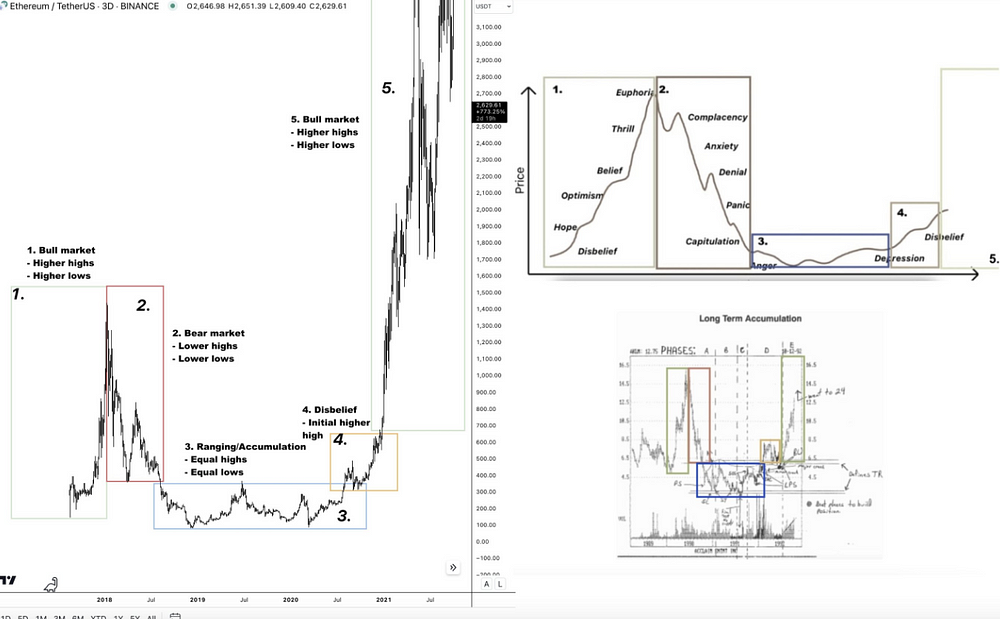

When discussing Bitcoin’s price target, I’m looking at the broader cycle pattern, which still seems intact.

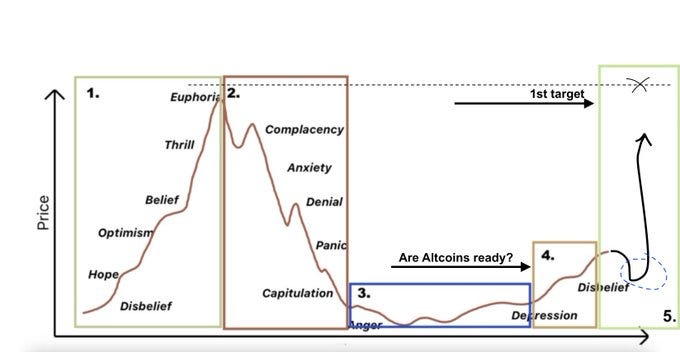

We’re in what I call stage 5 of the cycle, where consolidation is expected. I’ve seen this behavior before, where Bitcoin enters a long-range phase that typically lasts over 500 days.

Right now, we’re around 350 days in, and while it feels like it’s taking a while to break out, historically, this is relatively fast.

Examples of Previous Cycles:

In 2017, after the initial surge, Bitcoin consolidated for months before breaking out toward new highs.

In 2020–21, we saw a similar chop phase after Bitcoin hit $30k before it exploded to $60k+.

Another crucial point is the “upper quarter of the range” (the 0.75 level). Bitcoin has repeatedly tested this level during this cycle and, as long as it doesn’t break below, I see any dips as buying opportunities. Historically, this range has acted as a magnet for bullish price action.

Market Structure

Many say the recent lower lows within this range show a bearish market structure and make us bearish, but I think they’re too zoomed in. Bearish price action on lower time frames is normal within a higher uptrend. I expect this to be a small break and correction phase within the ongoing bull trend. Similar to how we had a bullish market structure in the lower time frame within a higher downtrend.

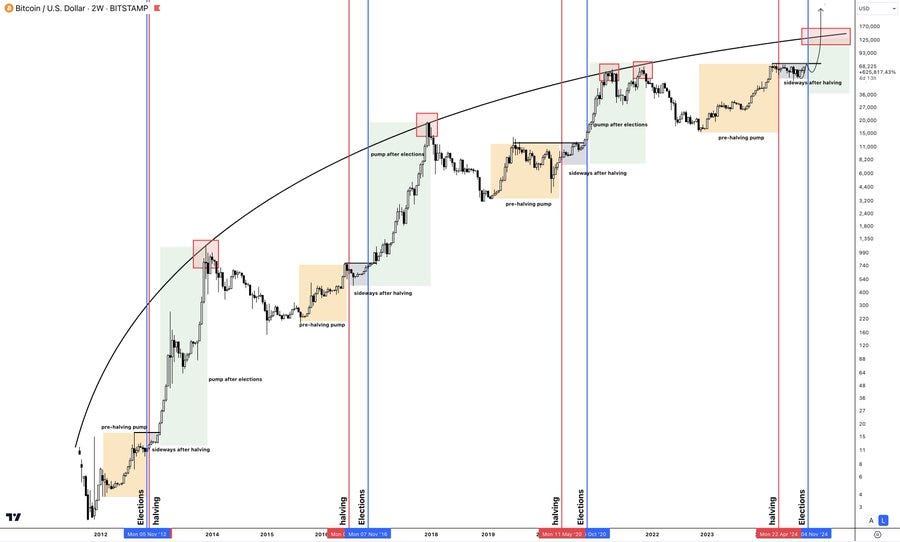

Halving & Elections

It’s interesting how Bitcoin keeps acting similarly around these two events. 1. Into the halving we pump 2. After the halving, we range. 3. This range ends around the elections, and part 2 of the cycle begins. Parabolic resistance target around $120k. (break it and we can talk about a super cycle, lmao)

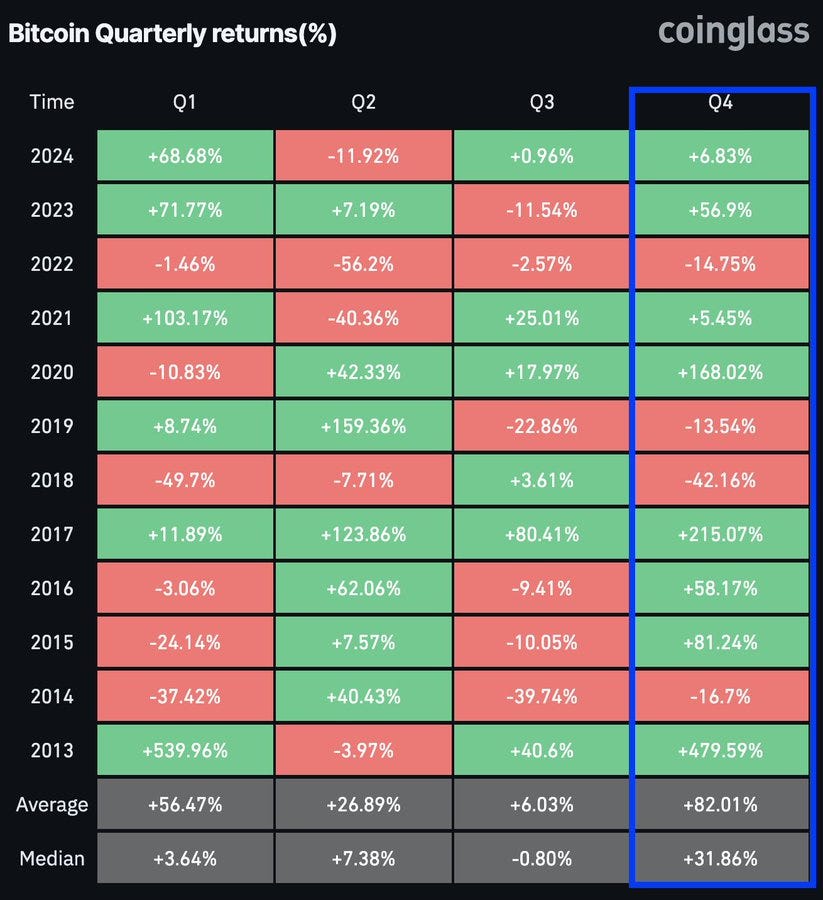

Seasonality

Q4 has always been our best-performing quarter.

My thoughts

Macro Events: The halving and elections are also critical to keep in mind. Bitcoin typically sees a pump heading into the halving and ranges afterward. In past cycles, such as 2016 and 2020, we saw these patterns play out. This time, we may see a parabolic move toward $120k after the 2024 halving if these trends hold. However, breaking that level would potentially signal a supercycle.

Short-Term vs. Long-Term: On lower time frames (LTF), we are still below the range highs and dealing with multiple trendlines. While this might delay a breakout, I wouldn’t be surprised to see another dip before we break higher. However, that dip would be an excellent opportunity to accumulate. If you over-leverage, you might get shaken out during the correction, but with a longer-term view, adding on dips has historically worked well for Bitcoin investors.

TL;DR:

HTF (High Time Frames): Bullish with a target around $120k.

LTF (Lower Time Frames): Bullish but wouldn’t rule out another flush downwards.

When Altseason?

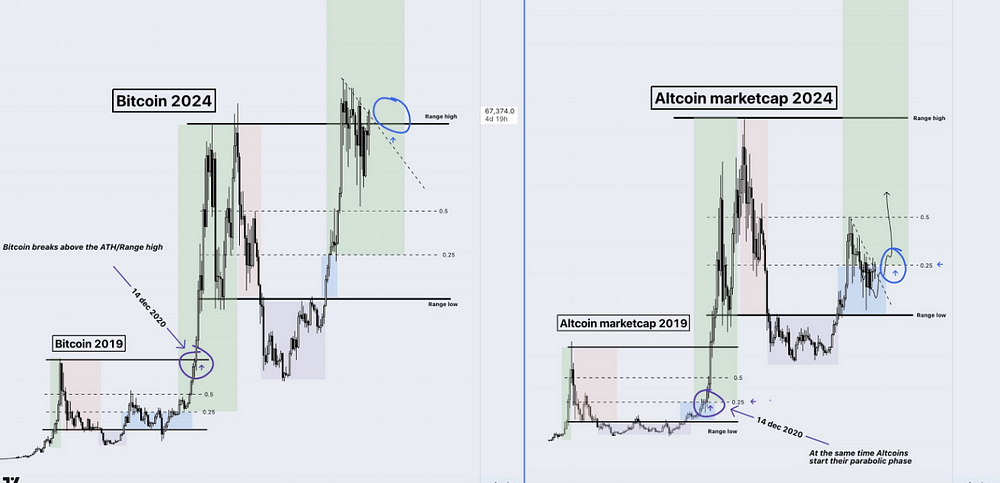

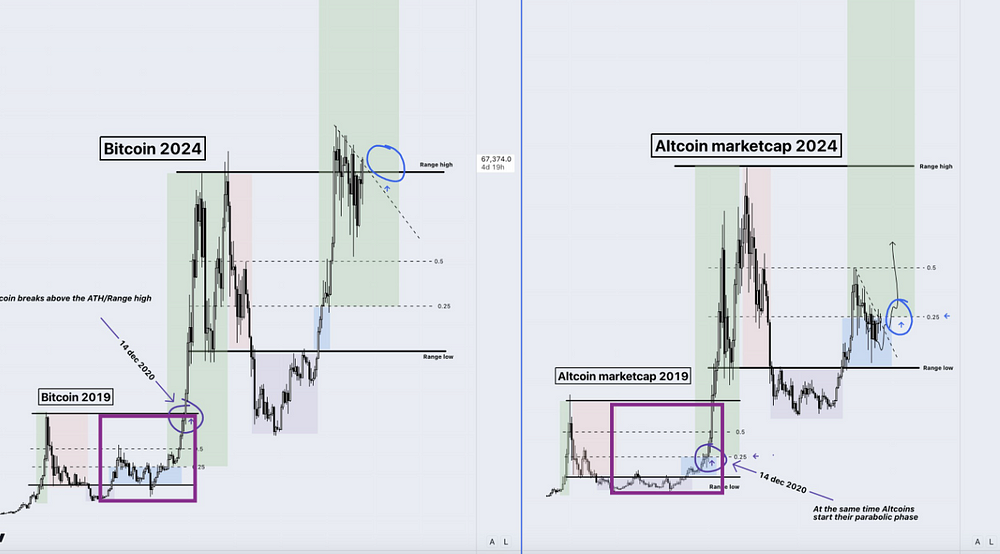

In the crypto market, I always split the cycle into two parts: Part 1, where Bitcoin rallies toward its previous all-time high (ATH), and Part 2, when it finally breaks above that ATH and enters price discovery mode. Understanding these two phases is crucial for timing Altseason, as they guide the flow of capital between Bitcoin and Altcoins.

Part 1: Bitcoin Dominance

During Part 1 of the cycle, Bitcoin is the center of attention. This phase is when Bitcoin is rallying hard, usually heading toward its previous ATH. As this happens, Altcoins tend to lose value against BTC — money flows predominantly into Bitcoin, leaving Altcoins lagging behind.

How this unfolds:

Bitcoin Dominance Pumps: When Bitcoin surges, its dominance in the market increases. This is evident in the Bitcoin dominance chart, which often rises in Part 1 of the cycle. Most investors shift their capital into BTC to ride the wave of the rally.

ETHBTC Drops: Ethereum and other major Altcoins typically lose ground relative to Bitcoin during this time. In 2020, for example, ETHBTC dropped significantly while Bitcoin surged from $10k to $40k.

PvP Market in Altcoins: Altcoins become highly competitive with limited capital flowing into them. Only a few sectors, like DeFi in 2020, manage to outperform during this phase.

An example of this pattern is the early 2021 run, where Bitcoin pushed from $20k to $60k, and Altcoins underperformed. Projects like Chainlink and Uniswap didn’t start their real rallies until Bitcoin had established itself at new highs.

Altcoins in Stage 4 Disbelief:

While Bitcoin is in its final push, Altcoins start to print what I call their stage 4 disbelief higher high, where they begin to recover slightly but remain within a broader range. This is not the full-blown Altseason — just the beginning. Historically, during this phase, ETHBTC bottoms, indicating a future rise in Altcoin dominance. Altcoins reclaim their range lows, signaling potential buy opportunities, but major moves are still ahead.

Part 2: Bitcoin Breaks ATH

Part 2 is when things get exciting for Altcoins. Bitcoin breaks through its previous ATH and enters price discovery, leading to massive gains. This is also when Altseason truly begins.

How this unfolds:

Bitcoin Breaks ATH: The moment Bitcoin shatters its ATH and continues climbing, Altcoins explode. This happened in late 2020 when Bitcoin finally broke above $20k and hit price discovery at $30k+. Ethereum followed shortly after, and other Altcoins, like Cardano and Polkadot, entered massive parabolic runs.

Altcoin Parabolic Rally: Once Bitcoin’s dominance drops, capital starts flowing into Altcoins in a big way. In the past cycles, projects like Uniswap and DeFi protocols started to rally after Bitcoin’s surge. The dominance of Bitcoin falls, and Altcoins reclaim their stage 5, which is the parabolic phase.

ETHBTC Bottoms and Dominance Falls: A key signal that Altseason has started is the bottoming of ETHBTC and the decline in Bitcoin dominance. In 2020, for instance, when Bitcoin’s dominance dropped, Ethereum soared from $600 to $4000 within months.

Examples from Previous Cycles:

2017: After Bitcoin crossed $10k and surged to $20k, Altcoins like Ethereum and Litecoin entered their massive bull run, with Ethereum rising from $300 to $1400 in a matter of weeks.

2021: Once Bitcoin broke $20k and entered price discovery mode, the entire market rallied. Projects like Polygon (MATIC) and Solana (SOL) exploded as retail and institutional money poured into Altcoins.

The pattern is consistent: Bitcoin leads the charge, and once it’s firmly in price discovery, Altcoins follow in an explosive fashion.

Total Altcoin Market Cap:

The Total Altcoin Market Cap is another essential indicator I monitor closely. Like Bitcoin, it moves in cycles, and I typically break it down into ranges and stages.

Range Low Reclaim Setup: I like to accumulate Altcoins when they reclaim the range low after a dip. This strategy has paid off in past cycles. For example, during the 2020–2021 bull market, the Altcoin market cap bottomed at the range low in Q1 2020 and steadily rose until the blow-off top in May 2021.

Stage 4 Disbelief and Stage 5 Parabolic: My focus is on positioning during stage 4 (disbelief) when Altcoins print their first higher highs and begin reclaiming their range lows. Stage 5 is where the big gains happen — this is the parabolic rally.

What’s Happening Now?

Recently, we’ve seen Altcoins print a higher high on higher time frames, reclaiming the range low. This is a clear signal that we’re likely entering stage 4, where Altcoins start showing signs of strength after months of accumulation.

On the short-term time frame, the local downtrend has broken, and key levels like the 0.25 quarterly level have been reclaimed, setting the stage for a potential Altseason. As long as we hold above this level, I remain bullish on Altcoins.

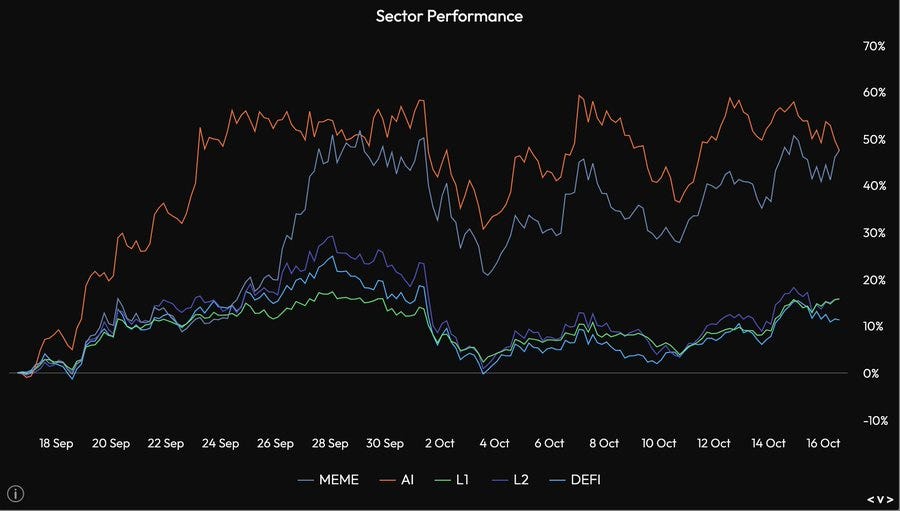

Meme Coins or Utility Tokens?

In every cycle, certain sectors outperform others, and right now, I’m closely watching both meme coins and utility tokens.

Meme Coins:

Meme coins have always had a strong presence in the market, driven by community hype and viral movements. In 2021, Dogecoin and Shiba Inu were prime examples of meme coins that delivered massive returns. With celebrity endorsements and social media momentum, meme coins can outperform in short bursts.

Current Outperformers: This cycle, meme coins like $WIF and $POPCAT are gaining traction, and I’m watching them closely for potential entries. They are driven purely by speculative hype, but with the right timing, they can deliver massive gains.

Utility Tokens:

Utility tokens, on the other hand, derive their value from their technology and real-world use cases. Projects like Ethereum and Solana have consistently performed well due to their strong ecosystems. AI tokens like FET are also catching attention, driven by real-world applications in AI and machine learning.

In the last cycle, DeFi and NFTs dominated the market during Altseason. This time, I expect AI tokens, metaverse projects, and DeFi to continue leading the charge.

Why Both Matter:

Meme Coins for Short-Term Gains: Meme coins are speculative but can deliver explosive short-term gains. I treat these like high-risk, high-reward plays and enter only after they reclaim critical levels.

Utility Tokens for Long-Term Value: Utility tokens have staying power and can weather the volatility of the market. I accumulate these during dips and focus on projects with strong fundamentals, like Solana’s ecosystem or AI projects that have real-world use.

Conclusion:

Altseason comes in two parts — first, Bitcoin rallies and dominance increases, and later, as Bitcoin breaks its ATH, Altcoins enter their parabolic phase. Based on historical patterns and current market behavior, I believe we are approaching the second part of the cycle where Altcoins will start to shine.

Meme coins will offer short-term, speculative opportunities, while utility tokens provide long-term value. Combining both strategies allows me to maximize my gains, no matter which sector performs best.

How are you positioning yourself for the upcoming Altseason?

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)