Last issue, I talked about a scenario most people avoid thinking about.

What if 2026 is a bear market.

Not a short dip.

Not a quick scare.

But an extended environment where price chops, bleeds, and frustrates.

Today, I want to be very clear about what that means for how I’m approaching 2026.

Because regardless of whether the market pumps or dumps, the most important thing I’ll be doing next year is this:

I will be teaching options to my group.

Why Options Matter More Than Direction

Most traders only know one way to make money.

Price must go up.

That works in bull markets.

It fails miserably everywhere else.

Options change the game completely.

With options, you are no longer dependent on price going higher.

You can:

Earn income when price goes sideways

Earn income when price dumps

Reduce risk when volatility spikes

Get paid while waiting

This is not theory.

This is how professionals operate in uncertain environments.

And if 2026 turns out to be slow, choppy, or outright bearish, spot-only traders will struggle.

Options traders will adapt.

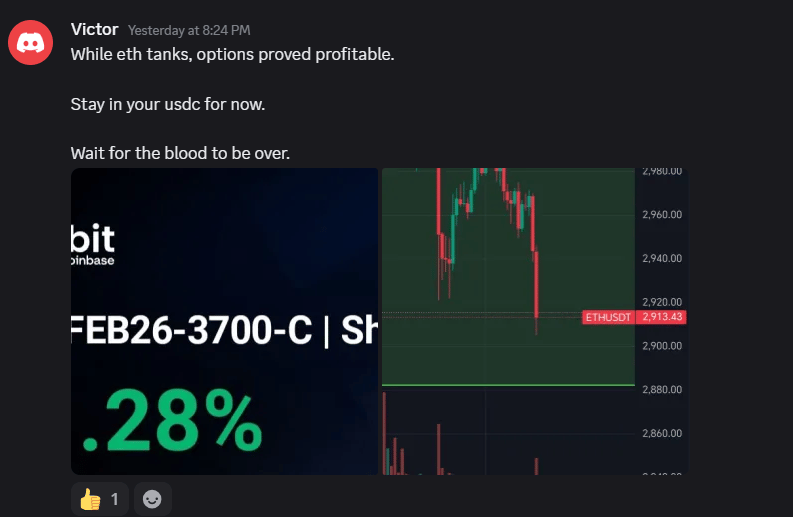

And with ETH dumping before recovering yesterday, i just closed my call option in 60% profit.

Stable Income Beats Hope

Let me say this bluntly.

Hope is not a strategy.

Waiting for price to save you is not a strategy.

In environments where:

Momentum fades

Rallies get sold

Volatility spikes unpredictably

You need tools that work without requiring perfect timing.

Options allow you to focus on:

Probability instead of prediction

Income instead of excitement

Process instead of emotion

That is why options become more valuable as markets mature.

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

This Is Not About Gambling

Whenever people hear “options,” they think of leverage and blowing up accounts.

That is not what I’m teaching.

I’m not interested in lottery tickets.

I’m not interested in YOLO trades.

I’m not interested in complexity for the sake of complexity.

What I care about is controlled, repeatable income.

Defined risk.

Defined outcomes.

Clear rules.

The same principles I talk about in spot trading:

Risk management

Position sizing

Process over emotion

Apply even more strictly in options.

Why I’m Introducing This in 2026

Timing matters.

2026 is likely to be a year where:

Directional conviction is harder

Trends are less clean

Volatility creates opportunity but punishes impatience

This is exactly the environment where options shine.

Instead of forcing trades, you let the market pay you for:

Time

Volatility

Indecision

You stop fighting the market.

You work with it.

What This Means for You

If you are spot-only right now, this is not a criticism.

Spot is still important.

Spot still matters.

Spot still builds long-term exposure.

But spot alone limits you to one outcome.

Options add a second dimension.

They give you:

Flexibility

Income

Protection

And most importantly, staying power.

Because the trader who survives the longest is the one who gets the most opportunities.

How This Will Roll Out

I’m not dumping everything at once.

This will be structured.

Clear frameworks.

Clear rules.

Clear expectations.

I will be building an Options Playbook specifically for this community.

Designed for:

Retail traders

Busy professionals

People who want consistency, not adrenaline

If you want to be on the waitlist for that Options Playbook, this is where you start.

👉 Join the free room here:

https://whop.com/digitalvault1/digital-vault-free/

That’s where I’ll share early context, mindset, and preparation before the full release.

If You Want Action Now

If you don’t want to wait.

If you want:

Spot positioning

Real-time market structure

And options concepts as I begin rolling them out

Then the main Discord is where that happens.

👉 Join here:

www.whop.com/digitalvault1

That is where:

Trades are discussed

Risk is managed

And systems are built in real time

Final Thought

Whether 2026 is bullish, bearish, or painfully sideways, one thing is certain.

Markets will not always reward direction.

But they will always reward those who adapt.

Options are not a replacement for discipline.

They are an extension of it.

And next year, that extension will matter more than ever.

If you want to be prepared instead of reactive, you know where to be.

I’ll see you inside.

Victor