The THREE charts that decide whether you get rich…

Or get liquidated.**

Most people stare at charts.

They stare at candles.

They stare at funding rates.

They stare at liquidations.

But they never track the ONE force that actually controls every market:

LIQUIDITY.

Read this slowly.

If liquidity flows IN → markets go UP.

If liquidity flows OUT → markets go DOWN.

It’s not magic.

It’s not manipulation.

It’s not market makers “trying to f*** you.”

It’s liquidity.

You understand this, you immediately jump ahead of 95% of traders.

You become someone who predicts moves instead of reacting to them.

Most people trade PRICE.

Professionals trade LIQUIDITY.

Today we start Part 1 of 3: the foundation you need before we dive into Reverse Repo and the TGA.

Let’s begin.

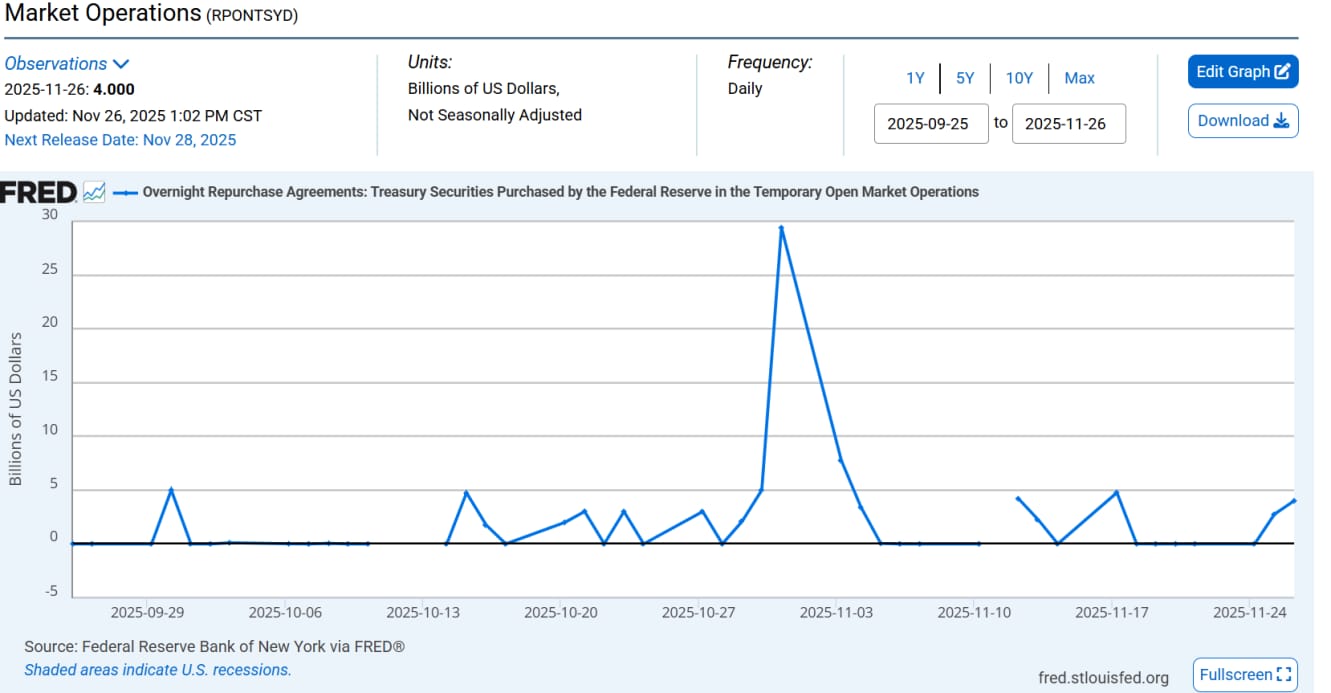

(Overnight Repurchase Agreements)

Chart: https://fred.stlouisfed.org/series/RPONTSYD

This chart shows how much overnight cash the Federal Reserve injects into the system.

Yes, injects.

A lot of you think the Fed only tightens.

Wrong.

Behind the scenes, the Fed constantly runs small, temporary injections of liquidity to prevent something from breaking.

Here’s how it works:

Institutions sometimes run into liquidity stress:

Banks need fast cash for settlement.

Dealers need overnight funding.

Bond markets get shaky.

Collateral freezes due to volatility.

Instead of letting chaos spread, the Fed steps in and says:

“Here’s cash.

Give me your Treasuries as collateral.

Return it tomorrow.”

It’s like the Fed giving Wall Street a same-day emergency loan — with high-quality collateral backing it.

Why this matters to YOU

Because Repo is one of the FIRST signs the Fed is smoothing stress behind the scenes.

This is the Fed stepping in quietly when markets wobble.

You don’t see it on CNBC.

You don’t see it on FinTwit.

You don’t hear influencers talk about it.

But you see it on the repo chart.

And that chart tells you something very important right now.

HOW TO READ THE REPO CHART

This is the part retail never understands.

Repo UP = Fed adding liquidity = supportive for risk assets

If the Fed is lending cash overnight, it means:

They are preventing cracks.

They are easing funding stress.

They are adding liquidity at the margin.

Even a small injection can shift market momentum.

Repo at ZERO during stress = bad

When repo usage is zero while markets are selling off, it means:

The Fed is NOT stepping in.

Stress is NOT being relieved.

Liquidity is NOT being added.

That’s when downtrends accelerate.

So what happened this week?

Look at the latest print:

4 BILLION.

Not massive.

Not a crisis-level injection.

But enough to signal:

“We’re here. We’re smoothing the landing.

We won’t let funding stress turn into a meltdown.”

And what happened?

Markets bounced.

Bitcoin bounced.

ETH bounced.

SOL bounced.

Altcoins bounced.

Why?

Because liquidity stepped in.

Not because of TA.

Not because of Elon.

Not because of memes.

Because the Fed injected funding quietly behind the scenes.

This is what I mean when I say:

“The market doesn’t move because of candles.

The candles move because of liquidity.”

WHAT THIS MEANS FOR CRYPTO

Crypto is not isolated.

It is a high-beta reflection of global liquidity.

More liquidity = bigger pumps.

Less liquidity = deeper dumps.

When repo ticks higher during stress:

risk assets get breathing room

forced selling slows

liquidity cascades stop

dealers reposition

volatility cools

reversals form

This is why the recent bounce was not random.

Liquidity spoke.

Why This Matters for YOU

Most of you trade emotions.

I want you to trade systems.

Most of you react to candles.

I want you to read liquidity.

Most of you chase pumps and panic dumps.

I want you to understand why they happen.

This is your edge.

This is how you stay alive in this cycle.

This is how you stop being part of the 95%.

Repo is Part 1.

Tomorrow:

Part 2 is something you will regret not following.

Learn this, and you’ll never trade blind again.

If You Want to Master Liquidity, Stop Trading Alone

If you’re tired of guessing…

If you want the full liquidity framework,

the crypto exit systems,

my altseason rotation plans,

and all the macro signals I use to position early

Join the premium.

The people who win this cycle

are the people who understand liquidity.

Everyone else is just gambling.

Part 2 drops next. Stay ready.

Victor