This is the final piece of the puzzle.

Welcome to Part 3, the part nobody in retail even knows exists.

You’ve learned:

Part 1: Repo = emergency liquidity injection

Part 2: Reverse Repo = liquidity vacuum

Now we finish the trilogy with the most powerful liquidity lever of them all:

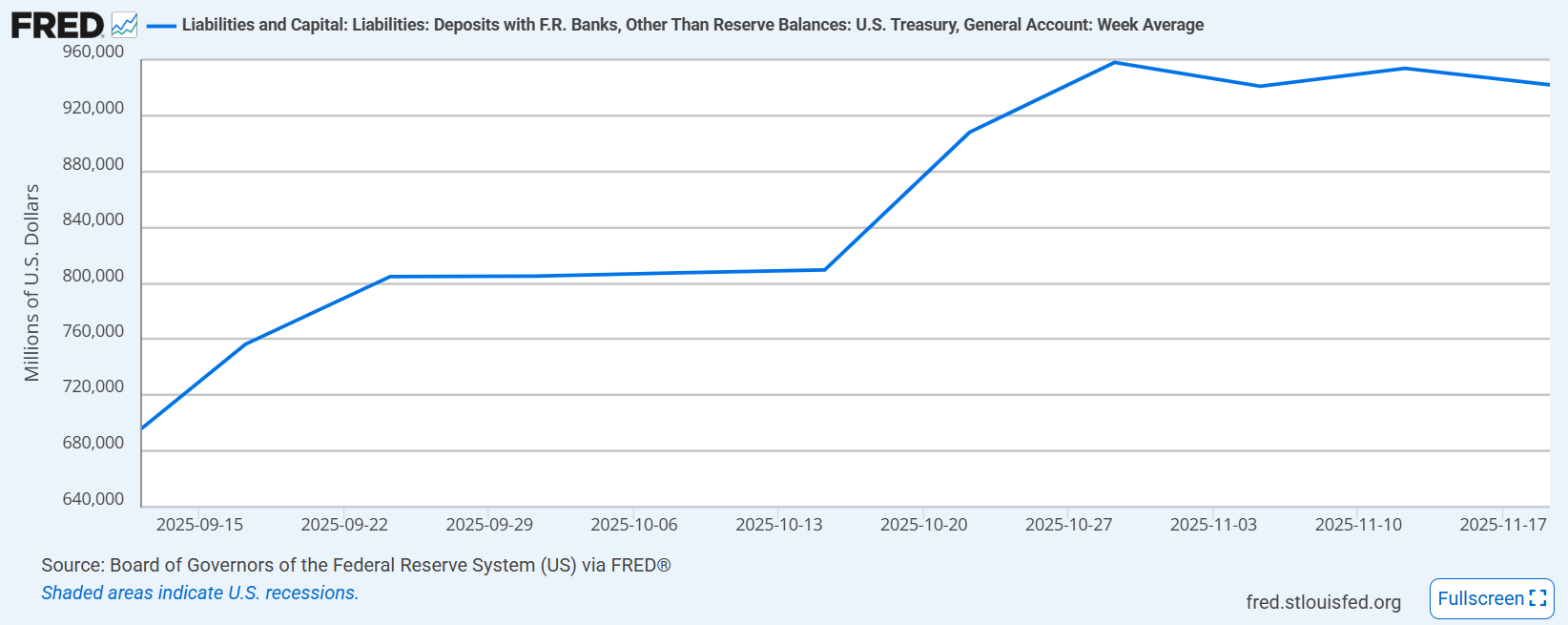

THE TGA: Treasury General Account

This is the U.S. Treasury’s “checking account” at the Federal Reserve.

And it controls how much liquidity is available to the entire financial system.

Let me tell you something simple:

When the TGA drains, liquidity flows into markets.

When the TGA fills, liquidity flows out of markets.

This single account has triggered:

the 2017 melt-up

the 2020 recovery

the 2021 bubble

the 2023 reflation

and yes… the setup we are seeing again in 2025–2026

Let’s break this down.

What is the TGA and why does it matter?

The Treasury General Account is where the U.S. government stores its cash.

When the TGA goes UP:

Treasury is collecting cash, from taxes, bond issuance, etc.

This pulls liquidity OUT of the system.

When the TGA goes DOWN:

Treasury is spending cash, issuing benefits, sending payments, funding budgets.

This injects liquidity INTO the system.

The TGA is not just accounting.

It’s a liquidity weapon.

And it moves BILLIONS, sometimes HUNDREDS OF BILLIONS, at once.

That’s enough to send crypto flying or crashing.

Why TGA moves markets (especially crypto)

Treasury spending is direct liquidity.

When the TGA decreases, cash enters:

banks

institutions

contractors

households

businesses

And that liquidity does NOT stay idle.

It flows into:

stocks

credit

commodities

and eventually, crypto

Crypto is the highest beta liquidity absorber in the financial world.

So when cash enters the system, crypto always reacts first and most violently.

And here’s the critical rule:

TGA DOWN = markets UP

TGA UP = markets DOWN

Look at any chart, this is a law.

Every major rally was triggered by TGA drainage

This is the part professionals study and retail ignores.

2017 Melt-Up

TGA drained massively → liquidity surged → Bitcoin went from $1k to $20k.

2020 Recovery

Stimulus + TGA drainage → BTC went from $4k to $69k.

2023 Reflation

TGA collapsed after debt ceiling resolution → BTC went from $15k to $40k.

2025 Setup

We are entering the SAME PHASE again.

Treasury is preparing for:

Election cycle spending

Fiscal expansion

Stimulus programs

Infrastructure payouts

Defense and foreign commitments

All of these require spending → TGA goes DOWN → liquidity goes UP.

And guess who benefits the MOST?

Crypto.

Not bonds.

Not savings.

Not the S&P.

Crypto.

This is why the next liquidity wave will trigger the final altseason rotation.

You are NOT early.

You are NOT late.

You are right on time.

How to read the TGA for trading signals

Pros use the TGA like a weather forecast.

Retail uses hope.

Professionals use liquidity.

Here’s the framework:

When TGA is RISING → liquidity is draining → expect choppiness, pullbacks, slow bleeding.

When TGA is FLAT → neutral liquidity → risk assets chop sideways.

When TGA is FALLING → liquidity is being released → rallies accelerate.

If you combine:

Repo (Part 1)

Reverse Repo (Part 2)

TGA (Part 3)

You get a SUPERIOR macro liquidity model that front-runs:

Bitcoin bottoms

Bitcoin breakouts

Ethereum rotations

Altseason triggers

Crypto tops

Recession timing

Macro risk cycles

This is how professionals trade.

This is why institutions always seem “early” and retail always seems “late.”

They’re not early.

They are reading liquidity.

Where we are TODAY

Here’s the full picture:

✔ Repo injections show stress is being smoothed

✔ Reverse Repo is nearly exhausted

✔ TGA is preparing for major spending into 2026

This is the exact liquidity recipe for:

1. A Bitcoin higher low

2. A rally back to the top of the range

3. A final euphoric altseason

4. A cycle peak between Q4 2025 – Q1 2026

The chart patterns don’t matter unless liquidity supports them.

Liquidity supports them.

This is why I keep telling you:

The market is NOT over.

The real move hasn’t even started yet.

Every time sentiment hits extreme fear, liquidity quietly positions before you notice.

It’s happening again.

What to do now

Use this knowledge to position intelligently:

Don’t overleverage

Don’t panic sell at cycle-defining levels

Don’t FOMO chase

Hold your BTC and ETH cores

Use your alt basket with discipline

Keep USDT for sniper entries

Prepare for volatility

Don’t break your psychology

Stay in the game long enough to win

Liquidity 101 is now complete.

You’re no longer trading blind.

Take This and Go Even Further

If you want:

my full liquidity dashboard

my updated altseason timing model

my BTC/ETH risk rotation map

my final top prediction zone

the Crypto Exit Manual

the Altseason Playbook

and the Altseason Survival Manual

Stop trading alone.

This cycle will reward the prepared

and destroy the emotional.

Now that you understand Repo, RRP, and TGA…

You’re ready for what comes next.

Victor