The S&P 500 just dumped, and it wasn’t subtle.

In what’s being called the fastest reversal since “Liberation Day,” the index wiped out a jaw-dropping $2 trillion in market cap within just 5 hours.

Yes, trillion.

And like clockwork, crypto followed.

The Domino Effect

When legacy markets bleed, crypto feels it faster.

Yesterday was a perfect example of that correlation.

The S&P fell sharply, and within minutes, Bitcoin started retracing.

The risk-on narrative flipped back to fear, and liquidity vanished from alts.

But let’s talk about what’s fascinating here, this wasn’t about fundamentals.

Nvidia reported record-breaking revenue of $55 billion.

No scandals. No new negative headlines.

Just pure emotional whiplash in the markets.

The stock went from +6% to -3% in a single session.

That’s a 9% swing on one of the strongest earnings beats in history.

If you needed proof that sentiment runs the market, not data, this was it.

The Psychology Behind the Panic

Let’s zoom out.

The S&P 500 is only 5% away from its all-time high,

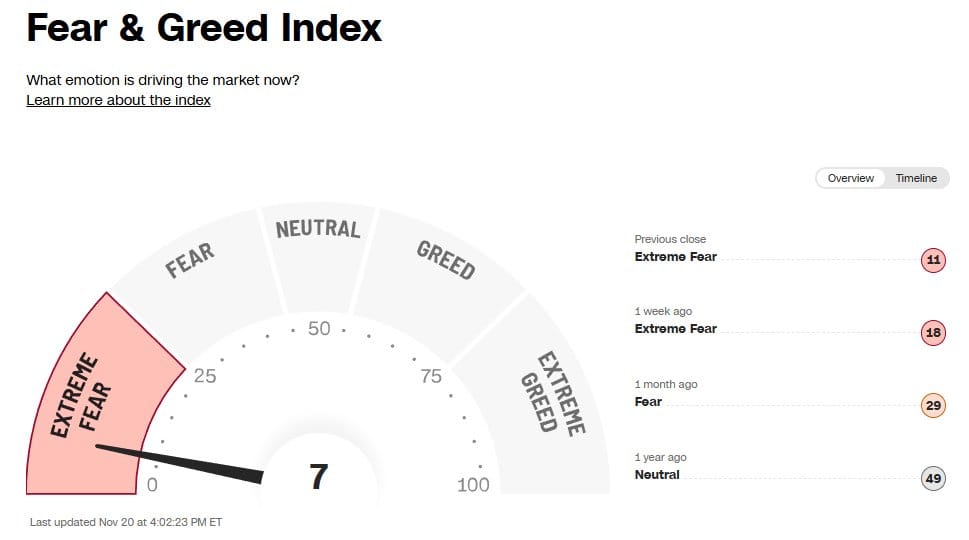

yet the Fear & Greed Index has collapsed to 7 out of 100, Extreme Fear.

That’s lower than April 2025,

when the market was 35% cheaper.

Read that again.

People were less fearful when the index was 35% lower.

That’s not logic.

That’s emotion.

It tells you one thing:

The market isn’t driven by reality, it’s driven by perception.

And perception swings faster than price.

The Sentiment Tax

Every trader pays a tax.

Not in dollars.

Not in fees.

But in emotional resilience.

You pay it when you panic sell before a rebound.

You pay it when you hesitate to buy because everyone else is scared.

You pay it when you can’t stomach volatility.

That’s what’s happening right now.

Sentiment is detached from structure.

The fundamentals are fine.

The data is fine.

The uptrend is technically still intact.

But traders are exhausted.

Emotionally taxed.

They’ve been conditioned to fear every red candle

and that’s exactly when the system rewards the patient ones.

Context: The Bigger Picture

Let’s get some perspective.

Despite this brutal 5-hour reversal:

The S&P 500 is still +11% YTD.

It’s +35% since the April bottom.

The Nasdaq is up even more.

And yes, crypto, for all its volatility, is still in a multi-year uptrend.

So why the fear?

Because humans don’t trade rationally.

They trade stories.

They trade emotion.

They trade the feeling of safety or danger, not the data.

That’s why markets don’t reward the smartest traders.

They reward the ones who can stay unemotional the longest.

The Lesson

If there’s one takeaway from this entire episode, it’s this:

Emotions and sentiment are the real taxes you pay for wealth.

The market doesn’t hand out rewards for intelligence.

It hands them out for endurance.

You’re not competing against algorithms

you’re competing against your own psychology.

Can you stay calm when the chart bleeds red?

Can you zoom out when everyone else zooms in?

Can you buy when the Fear & Greed Index hits 7?

If you can,

you’re playing a completely different game.

My Take

Every cycle tests conviction differently.

2021 tested greed.

2022 tested despair.

2025 is testing patience.

And this time, it’s psychological warfare

not just against the market,

but against the self.

If you’ve survived until now,

you’re already among the few who can handle discomfort.

And that’s half the battle won.

Don’t let the fear index dictate your moves.

When the crowd screams panic,

that’s usually where the next opportunity is born.

Final Word

The market doesn’t care about your emotions.

It doesn’t care if you’re tired, scared, or frustrated.

It only rewards those who stay long enough for the next chapter.

So take this moment,

take this S&P crash,

and learn from it instead of fearing it.

Because what’s coming next

whether it’s a recovery or another flush

will reward those who’ve already paid the emotional tax and kept going.

Stay patient.

Stay strategic.

Stay human, but don’t trade like one.

Want to learn how to manage your risk, position, and psychology when markets crash like this?

Get the Crypto Exit Manual

everything you need to navigate chaos like a pro.

Now available for $117/month

Because in this market, those who master emotion

end up mastering wealth.

Victor