For the first time in many weeks, we just saw an intra-day pump that actually lasted until close.

No fakeout.

No mid-day dump.

Just clean, steady buying pressure all the way through.

That’s the first sign of strength returning, not in words, but in behavior.

The Return of Volume

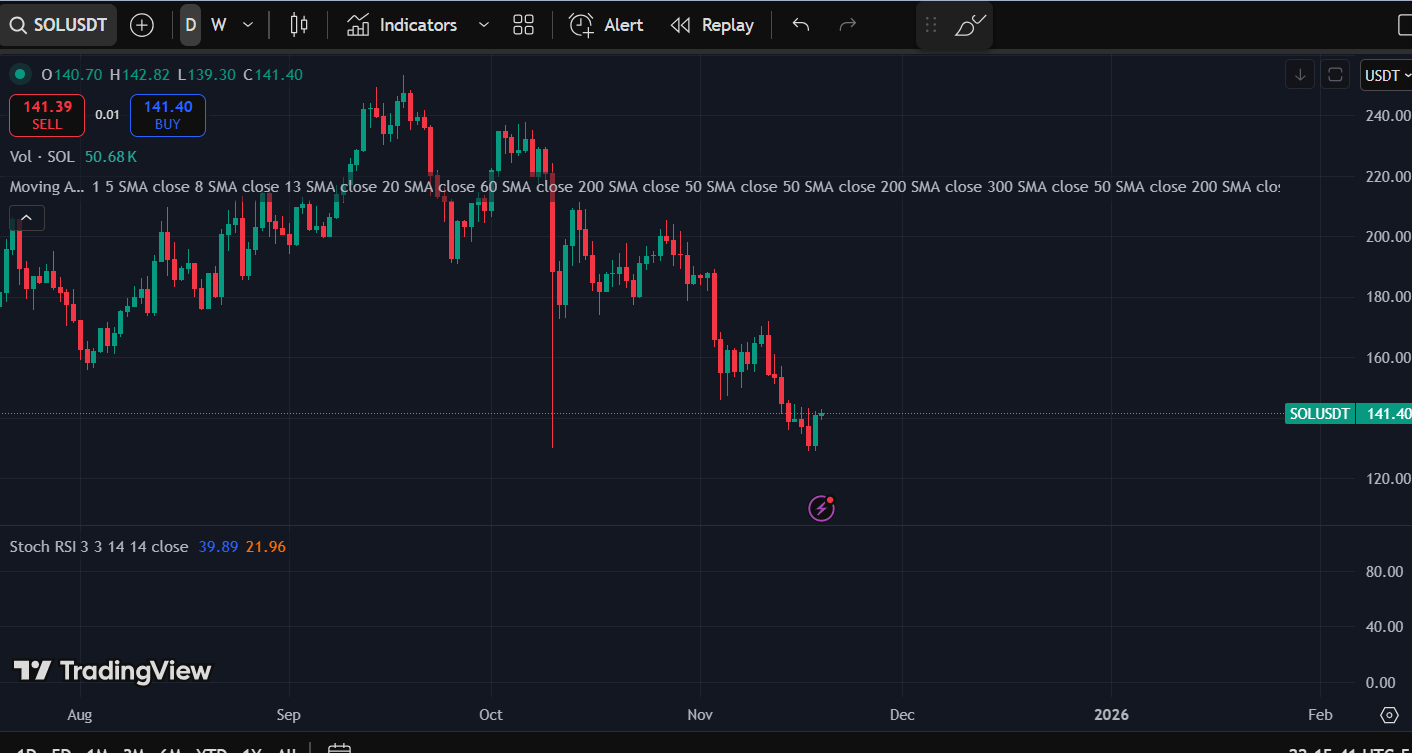

Look at the chart.

Volume is finally bigger than the previous days.

That’s not random.

Volume always precedes price.

When you see it rise like this after weeks of exhaustion,

it means someone, or rather, many someones, are starting to position early.

It doesn’t confirm reversal yet,

but it signals accumulation.

Markets turn quietly before they turn violently.

This kind of volume, paired with a strong daily close,

often marks the beginning of a relief leg.

If we get a green daily candle close,

the short-term bottom might already be in.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

The Technical Setup: Perfectly Lined Up

Now let’s zoom in on structure.

Price has been consolidating at the bottom of the local range.

We’ve broken the short-term descending wedge.

And the Stochastic RSI is curling up from oversold territory,

which often fuels the first impulsive bounce after a flush.

But let’s not forget context —

this bounce is happening right below all prior support zones,

which have now flipped into resistances.

That’s your next battlefield.

The levels to watch are clear:

$160 zone: first key resistance, previous support turned ceiling.

$180 zone: next major level, where the last breakdown started.

That’s where we’ll see whether this bounce is just a relief move

or the start of something bigger.

BTC as the Gauge

Even though this is a SOL setup,

we have to respect BTC’s structure because it controls the market’s rhythm.

Right now, BTC is sitting right at its 200-day moving average.

That’s the pivot point for the entire market.

If BTC bounces cleanly off the 200D MA,

alts will follow, and they’ll follow hard.

But if BTC struggles there or stalls,

alts will lag and consolidate longer.

So treat the BTC 200D MA as your altcoin sentiment barometer.

What to Expect Next

Here’s how this usually plays out in stages:

Stage 1 – Early Volume: Accumulation begins, strong closes start showing up.

→ That’s where we are right now.Stage 2 – Short Squeeze: Alts and majors rally 10–20%, liquidating over-leveraged shorts.

→ This could unfold over the next few sessions if momentum holds.Stage 3 – Retest of Resistance:

Price reaches prior support zones ($160–$180 for SOL, similar structure for alts).

→ Expect volatility here; the first rejection is normal.Stage 4 – Sentiment Shift:

Once people start believing the bounce is “real,”

the market begins forming a higher low.

That’s when the next sustained trend starts.

We’re still in Stage 1

but this is where the smart money starts placing quiet bets.

The Emotional Trap

If you’ve been holding through this pullback,

you probably feel numb right now.

That’s natural.

This entire selloff was designed to drain conviction.

To make you doubt your structure.

To make you hesitate right before the reversal begins.

But that’s how it always works.

People forget that before every explosive move,

there’s a period of absolute disbelief.

You can’t let emotion dictate your next move.

Stick to data. Stick to levels. Stick to the system.

My Take

This daily close matters.

If it prints green on rising volume,

we’ll likely see a multi-day rally into key resistance levels.

Watch the Stoch RSI, once it hits overbought,

start trimming or de-risking portions of your position.

That doesn’t mean “sell everything.”

It means lock in security while momentum builds.

Because once BTC reclaims above its 200D MA,

alts will start to explode back into life.

And when that happens,

you’ll want both conviction and cash ready.

The Game Plan

Here’s how to play it cleanly:

Step 1: Track BTC’s 200D MA reaction closely.

Step 2: Identify your alts’ prior supports turned resistance, those are exit or re-entry zones.

Step 3: Manage exposure as Stoch RSI approaches overbought.

Step 4: Keep sidelined USDT, flexibility is power in this phase.

Final Word

This is the first glimpse of light after weeks of darkness.

But remember, it’s still early.

Don’t overleverage.

Don’t FOMO into resistance.

Follow structure, not hype.

The bounce is coming.

The only question is, will you be ready to capitalize when it arrives?

Learn how to trade this kind of structure with discipline and precision in Crypto Exit Manual

Now available for $117/month

This is how traders turn uncertainty into strategy.

And strategy into wealth.

Victor