Let’s get straight to the point.

If you’re in crypto right now, trading, investing, or just watching

you need to understand how the market moves with time.

I’m not talking about short-term candles.

I’m talking about seasonality —

the predictable flow of months that shape crypto’s emotional rhythm every year.

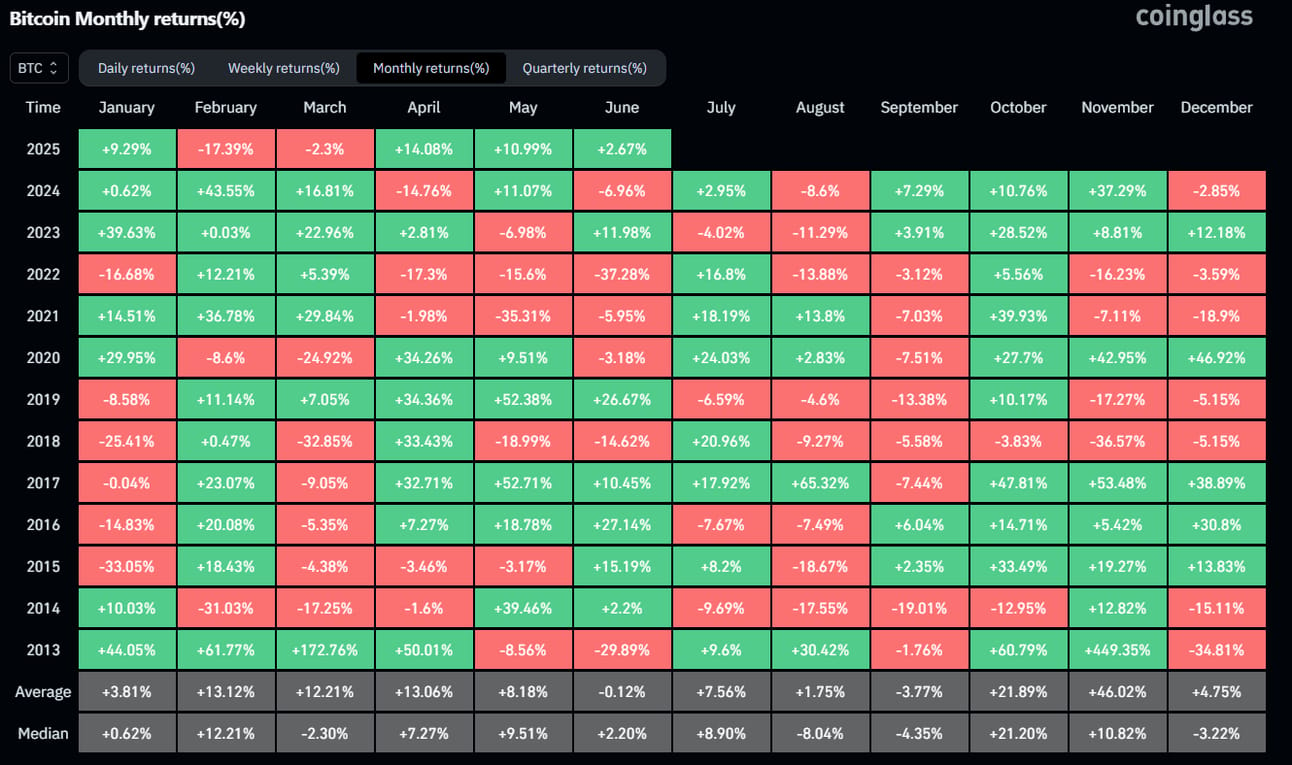

Let’s zoom in on the calendar:

June has always been a “cool down” month.

No fireworks. No meltdowns.

Just sideways, low-energy price action.

That’s exactly what we got this year.

Bitcoin chopped around.

Alts underperformed.

Volume was low.

Nothing exciting.

But that’s not a bad thing.

Because smart money doesn’t chase when it’s quiet.

They prepare.

And now?

We’re entering the next phase.

July — Where momentum builds quietly

Historically, July is decent for crypto.

Not euphoric, but often green.

It’s the month that sets the stage for what’s coming.

It’s when risk appetite returns in small doses.

It’s when BTC starts testing range highs, but doesn’t usually break them yet.

This is where positioning starts — for those who have the patience.

August & September — The trap, and the opportunity

Here’s what most don’t tell you:

August and September are where the flushes happen.

Why?

Because this is where:

Traditional finance takes a break (summer low volume)

Traders get complacent after a slow July

Market makers pull the rug for maximum liquidation

We’ve seen it before:

In 2021, BTC dropped from $53K to $39K in early September.

In 2022, BTC lost 25% in August.

In 2023, ETH dropped 19% in September — after a solid July.

Every time, the crowd panicked.

But what happened next?

Q4 rallies.

Because those dips weren’t the top —

They were the entry for the next leg higher.

Here’s the playbook if you’re serious:

Don’t overtrade July.

Use this time to build your watchlist.

Focus on accumulation strategies.

Don’t chase random pumps.

Anticipate the August flush.

Not every dip is buyable — but the right ones are.

Look for LTF (lower timeframe) support levels forming.

Track daily & weekly momentum signals.

Start preparing for October.

Most of the real rallies happen when the market is worn out.

If you wait until it’s “obvious,” you’re already too late.

Real talk:

You’ve probably been in crypto long enough to feel the FOMO,

and the panic,

and the regret of not being ready.

But what if this time, you prepared before the headlines?

What if you stopped reacting and started playing the bigger timeframe?

What if you had a system that told you:

When to enter

When to wait

And when to sell into strength?

That’s what we do inside my 9-5 Traders Community.

It’s not just a Discord.

It’s a battle-tested strategy lab for traders who want to win.

You’ll get:

Exact levels I’m watching on BTC, ETH, and major alts

Weekly market breakdowns

Timing strategies for cycle tops and bottoms

Emotional mastery tools (because mindset is 80% of this game)

🚨 Ready to stop guessing?

👉 Click here to join 9-5 Traders and get my weekly breakdowns, live charts, and market cycle updates.

Crypto isn’t just about price.

It’s about timing, conviction, and execution.

And July is the calm before the real storm.

Let’s position smart — before the crowd even sees it coming.

— Victor

Timing > Talent. Stay sharp.