Recently, I’ve been hearing about memecoin snipers who made bank with insane returns on a few strategically sniped coins with TradeWiz.

I’m talking about:

$WIF: $1.2M from a mere $24 investment

$GOAT: $750K from $51

$GIGA: $400K from $40

#MOODENG: $350K from $54

Let’s be honest — who wouldn’t want to get in on those kinds of returns? But, as with anything in crypto, there’s a catch.

Sniping memecoins isn’t for the faint-hearted; it’s about speed, timing, and making sure you’re not jumping into a setup that drains your wallet.

Of course, do it small first, you don’t want to pour in your life savings if you are new to this.

Start small, like 0.01 or 0.1 sol.

Let’s dive in.

Here’s my guide on how sniping works, what you need to watch for, and some real-world examples of tactics to help you navigate.

What is Sniping? It’s All About Speed

When it comes to sniping, speed is everything.

A memecoin snipe is a rapid buy at the very launch of a token — often happening faster than manual buys.

A sniper bot automatically completes the transaction at a speed that’s virtually impossible to match by hand.

The first 15–30 seconds of a token’s launch are crucial, as most snipers make their big gains here.

For example, I’m currently using TradeWiz. This tool is lightning fast and, while similar to BonkBot, it has a quicker transaction execution time, which is key in a high-stakes game like this.

Token Selection: What to Look For

The first thing I do is research potential tokens to snipe. I typically stick to low-cap coins because they’re more volatile and offer higher returns for snipers who can get in at rock-bottom prices.

Here are the specific qualities I look for:

Low Market Cap: These coins haven’t pumped yet, so there’s room for growth.

Active Hype: Tokens that are trending on social media platforms or are backed by a “hype squad.”

Unique but Solid Idea: The concept needs to be fun or engaging. However, if it’s just a trend with no staying power, it’s probably better left alone.

Token Holder Growth: Check if the number of holders is steadily growing. A sudden surge could mean the hype is working, but bot-driven growth is a red flag.

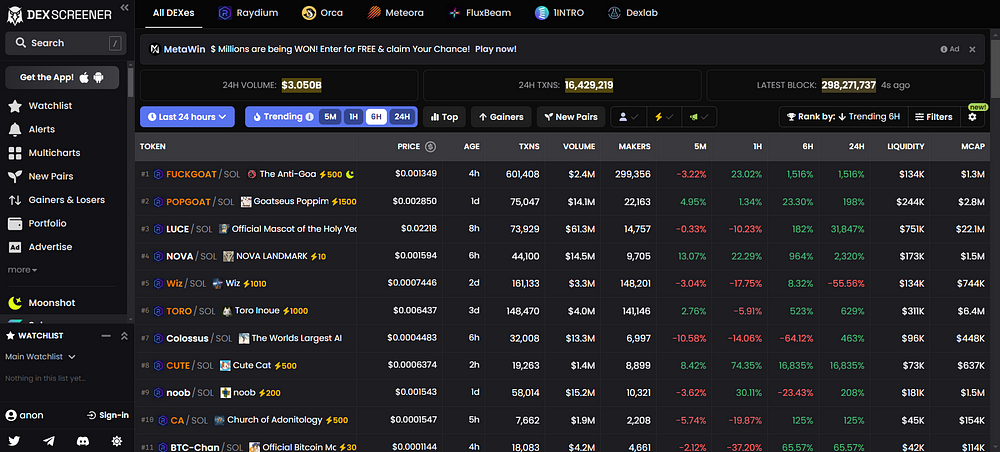

For example, AI/art meme tokens have been trending in recent months, particularly around the 10.27 mark, so I’ve been filtering for these low-cap tokens that meet the following criteria:

Market Cap (MC): At least $500,000

Fully Diluted Valuation (FDV): At least $500,000

Liquidity: Minimum of $75,000

24-Hour Volume: At least $1 million

24-Hour Transactions: At least 300

Hunting for New Pairs: Starting on the New Pairs Page

I start by heading over to dexscreener.com/solana, specifically to the “New Pairs” page.

Switching between 12-hour and 24-hour views helps track fresh tokens that might be ripe for sniping.

This approach keeps me on top of emerging tokens before they start gaining too much traction.

By sticking to low-cap tokens in the early stages, I can often capitalize on a coin that hasn’t yet hit the radar of larger investors. I then use filters to zero in on specific tokens that meet my criteria.

Checking for “Green Flags”

Before buying, I always go through a list of green flags to assess the token’s legitimacy. Here’s what I watch for:

Social Presence: Check for active Twitter, Telegram, and a website. If they only have a Twitter and Telegram, I’ll give it a pass if it looks like the CTO is genuinely engaged.

Launch Platform: Tokens launched on “pumpfun” platforms have a track record of high initial pumps.

Ownership Structure: Avoid tokens where devs hold disproportionate amounts or where wallets are “bundled” (an attempt to disguise real holdings).

Active Dev Team: Check if the dev team is actively engaged in influencer marketing. A lack of engagement can mean a planned “rug pull” is more likely.

For instance, I once noticed a coin that only had a Twitter account but had launched on a credible platform and had a notable influencer network. Turns out, it was a gem that gave a significant return because the dev team was actively marketing it and continuously engaging with the community.

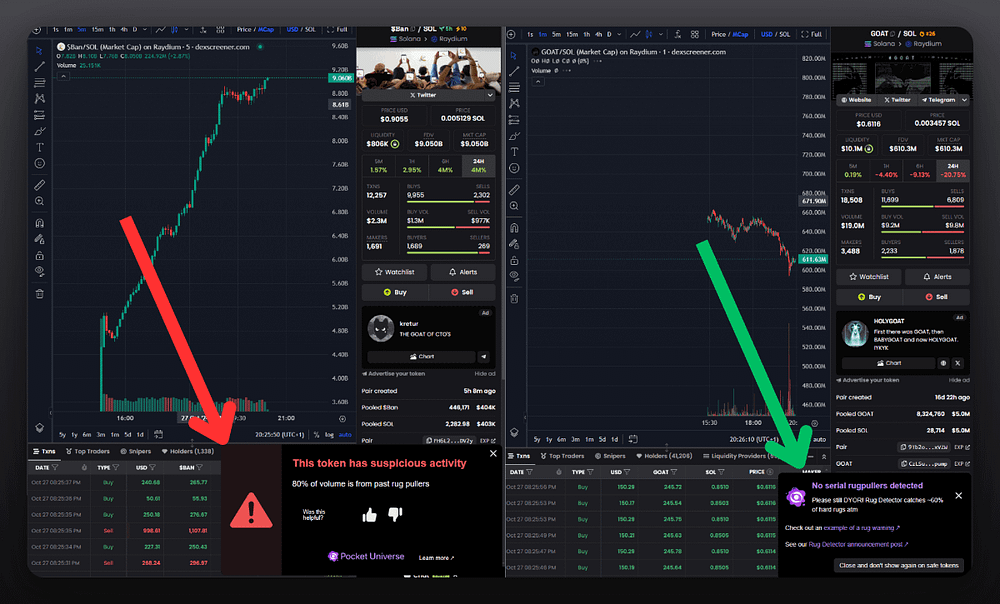

Watch Out for Suspicious Volume

It’s not uncommon for scammers to use bots to inflate trading volume. I use a browser extension called Pocket Universe to check for suspicious volumes and transaction signatures.

This tool flags unusual activity, like large transactions coming from the same wallet or strange token movements. Pocket Universe goes so far as to warn if a transaction has a suspicious signature, which can save you from diving into an exploit.

If I see high trading volume on a coin but notice the volume is clustered among a few wallets, that’s a clear sign that the volume might be artificial. One time, I almost invested in a token only to see that most of its trading volume was generated by five wallets out of thousands. Those five wallets were clearly bots, inflating the volume to trick buyers.

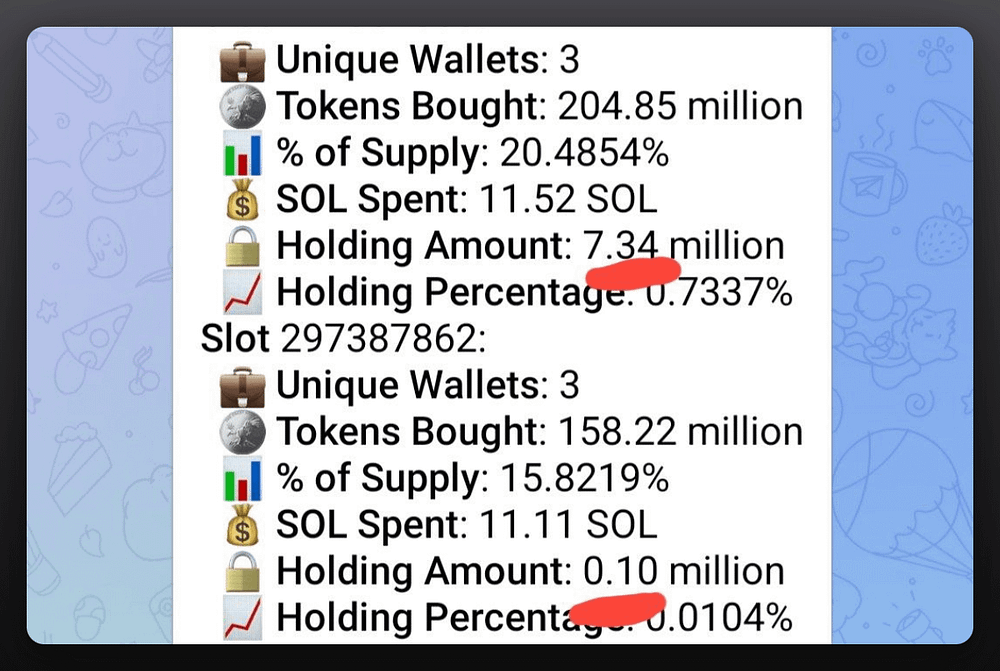

Bundle Check: Uncovering the Dev’s True Holdings

One key thing to watch out for is “bundling,” which is when a developer uses multiple wallets to obscure their true holdings. A high concentration of tokens across related wallets is often a setup for a rug pull, where the dev team dumps everything once real buyers come in.

To do a bundle check, I paste the Contract Address (CA) into a tool like TrenchRader Scanner. This lets me see if the token is bundled, and if it is — red flag. I’ve learned that when there’s bundling involved, the risk of a dev-initiated dump increases exponentially.

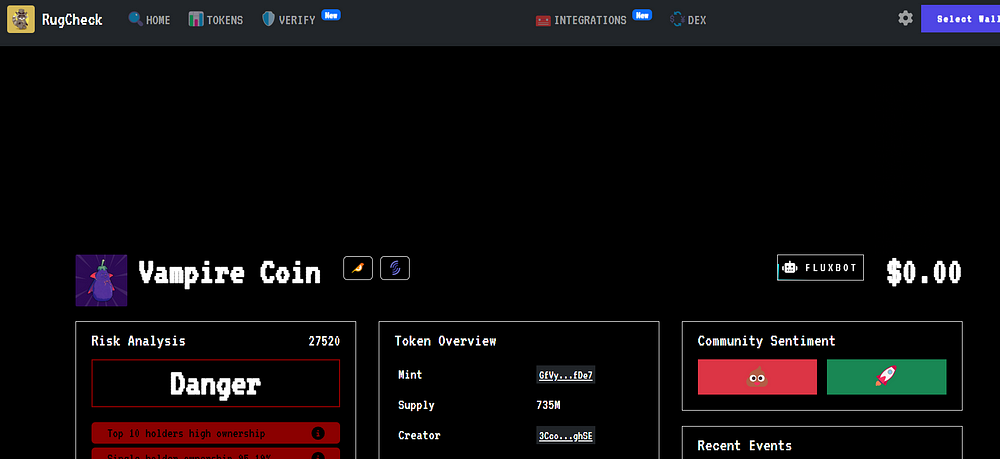

The Final Rugcheck

Even after doing all of this, I still run a final rugcheck before pulling the trigger. Using a service like rugcheck.xyz, I analyze the on-chain activity, specifically looking for an active mint function, any unusual contract addresses, or indicators that the deployer might be compromised. I’ve avoided numerous potential rug pulls by running this last-minute check.

Also read how I spot meme rugpulls here: https://medium.com/thecapital/how-i-spot-rugpull-memecoins-before-everyone-else-real-practical-guide-so-you-wont-lose-your-f68a28e3f17c

Sniping Bot Settings

Finally, let’s talk bot settings. Here’s the basic setup I recommend:

Buy/Sell Buttons: Easy-access buy and sell buttons allow you to act quickly.

Slippage: I set slippage up to 30% to ensure my transaction goes through, especially if I’m competing with other snipers.

Priority Fee: If I’m trading more than 1 SOL, I’ll use Jito with MEV (Maximum Extractable Value) protection to prevent frontrunning. However, this can slow the transaction speed, so I prioritize a higher fee (minimum 0.001) to ensure my transaction is prioritized.

A few weeks back, I used this exact setup on a token and managed to get in at launch while others’ transactions failed due to lower slippage and priority settings. It was a close call, but worth it as that snipe ended up being highly profitable.

What if you don’t have the time to snipe on your own?

That’s why I used a TradeWiz bot — I too don’t have the time to sit in front of my computer just to snipe coins.

TradeWiz is a professional copy trading bot on the Solana blockchain. Identify successful traders and replicate their trades in one click. Additionally, TradeWiz supports buying, selling, placing limit orders and Auto Sell.

The Best Copy Trading Bot On Solana

You can proportionally replicate trades from your chosen addresses.

It boasts a high transaction success rate.

It allows analysis of the profitability of smart money addresses.

It offers robust settings for customized copy trading

Join Community

Telegram:https://t.co/mKbuXO2tfV

Twitter: https://twitter.com/TradeWiz_Bot

Telegram bot: TradeWiz

Step By Step Guide To Using TradeWiz

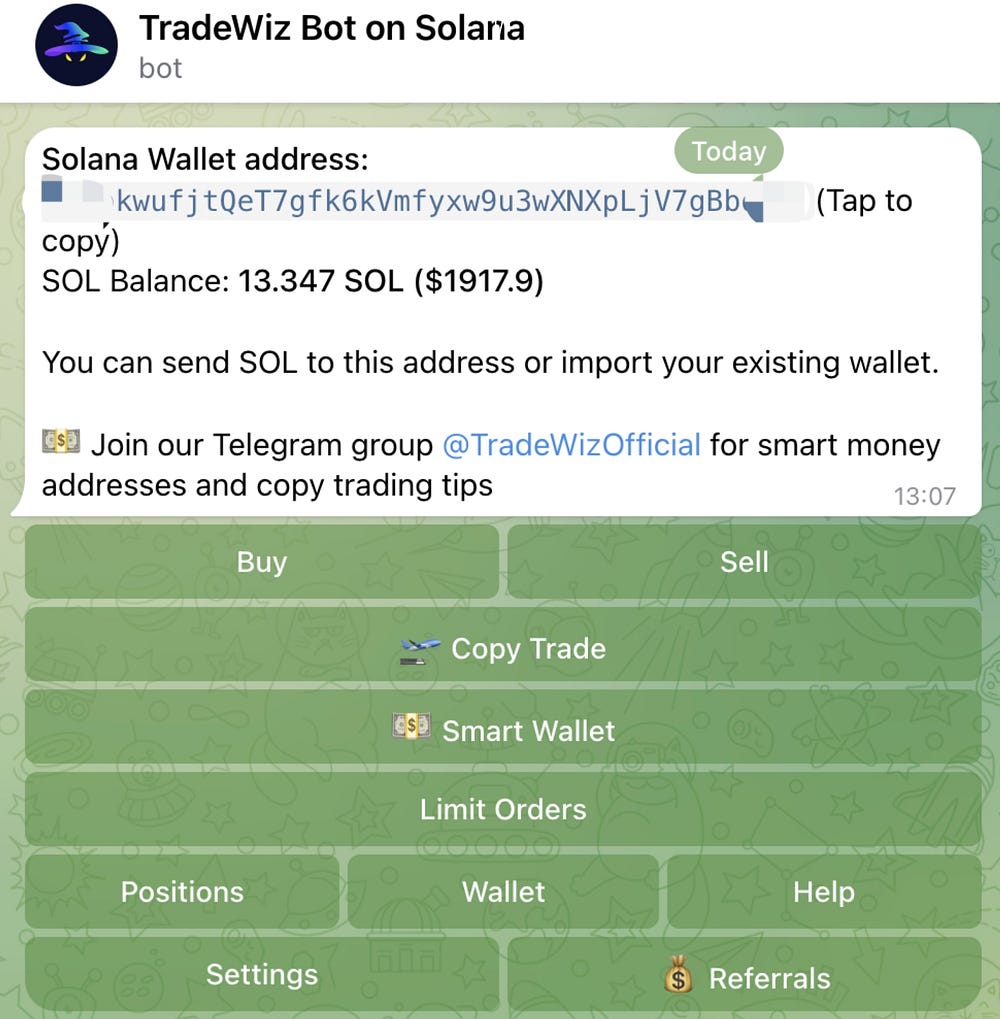

Open TradeWiz. (If you haven’t registered for Telegram, please do so first.)

Once you enter TradeWiz, a Solana address will be created for you. You need to transfer at least 0.1 SOL tokens to this address to start trading

Once transferred, you can buy or sell tokens of your choice.

If you wish to copytrade like I do, you can copy someone else’s trades according to the proportion of your buy amount.

You can also fix the amount by setting a maximum and minimum buy limit per trade, and you don’t need to have the same SOL as the other party.

Setting a total investment amount can control your risk. You will only lose the SOL you have set aside for copying trades. Once this amount is spent, no further purchases will be made unless the copied trade is sold.

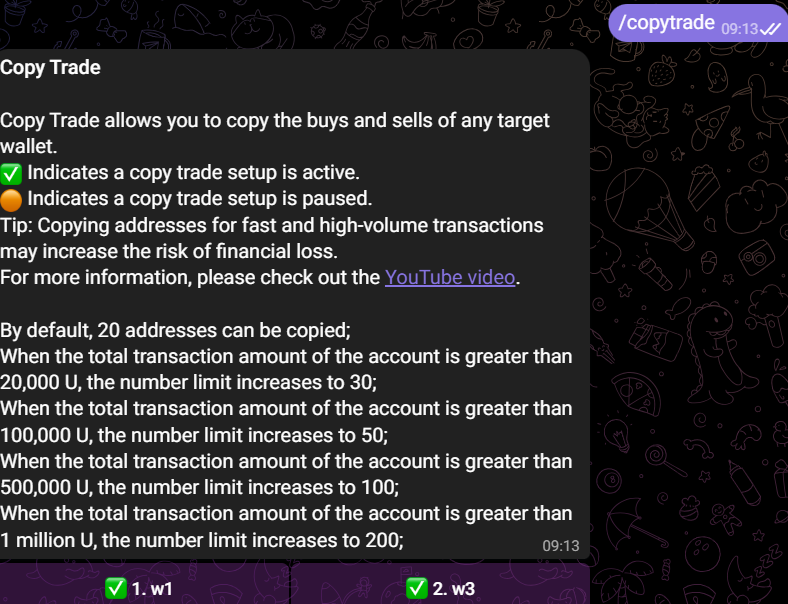

Click on /copytrade and you will see this

Enter the address that you wish to copytrade. (i will introduce 2 wallet address for your reference, I will put up a guide on identifying best wallet addresses)

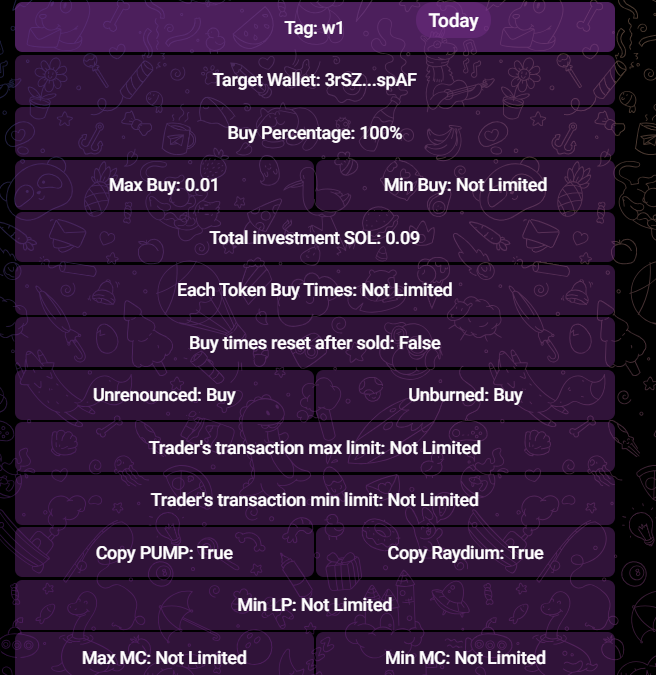

Under tag, you can input a name of your choice, like ‘w1’, then put in target wallet for address.

Buy percentage 100%, max buy is 0.01, total investment is 0.09 (up to you to configure)

Once done, you can click ‘create’ and done!

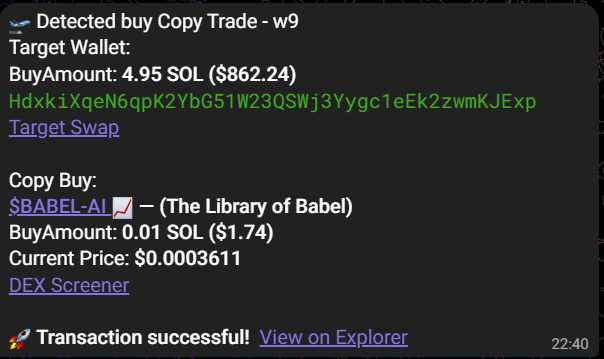

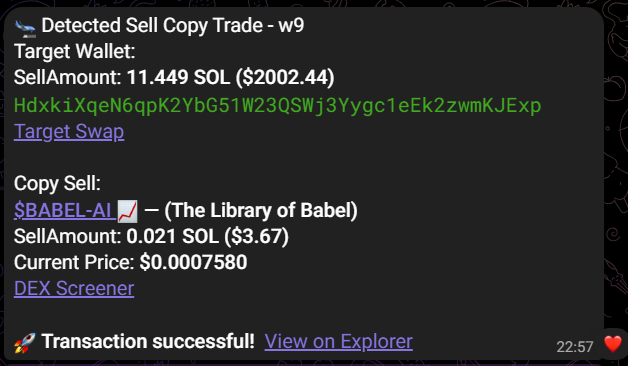

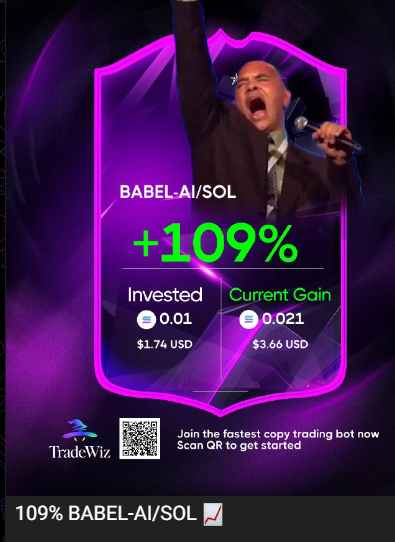

When there is a trade alert, you will automatically buy and sell.

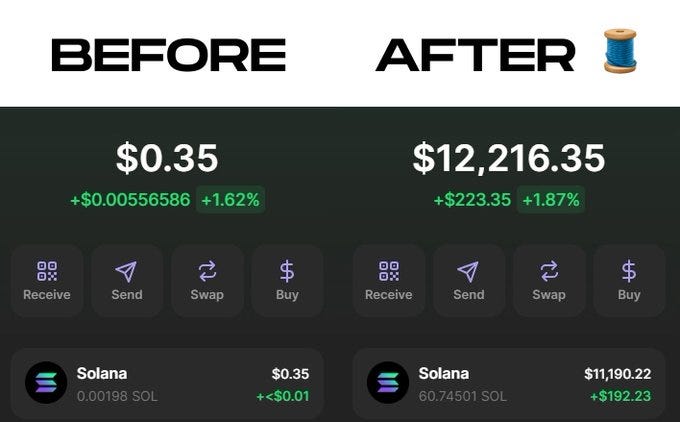

There you go! See the small amount? I started with just 0.01 Sol because this is my 1st copytrade that gained me confidence on how this is going to become.

From then on, slowly increase once you have identified the best wallet you have copy traded.

Conclusion

Sniping memecoins is risky, no doubt, but with careful research and a solid strategy, it’s possible to turn a small initial investment into a sizable gain. The trick is to stay vigilant — check for artificial volume, do a bundle check, verify social engagement, and always run a rugcheck before you buy. Using these methods has helped me avoid most scams while giving me the speed needed to act quickly when a gem pops up.

By following this guide, you’ll have the foundation to spot high-potential tokens and avoid the pitfalls that most new snipers face. Just remember, the world of memecoin sniping is all about being fast but also being smart.

Your next step

Stay tuned to my next issue, where I will continue to give my insights on crypto + entrepreneurship to financial freedom!

Give me a like or share if you like my content, much appreciated!

Follow me on twitter (@Digitalvault1)