I want this issue to be more than just numbers on a chart.

I want you to actually understand my thought process when I call these moves.

Before I dive in, let’s not forget, I called this bullish push from 75K all the way to this recent all-time high.

That wasn’t luck. That was structure, cycles, and reading flows correctly.

So fair to say, I know my shit.

Not just another voice on crypto Twitter talking out their ass after the fact.

Now let’s break this down properly.

Bitcoin ($BTC)

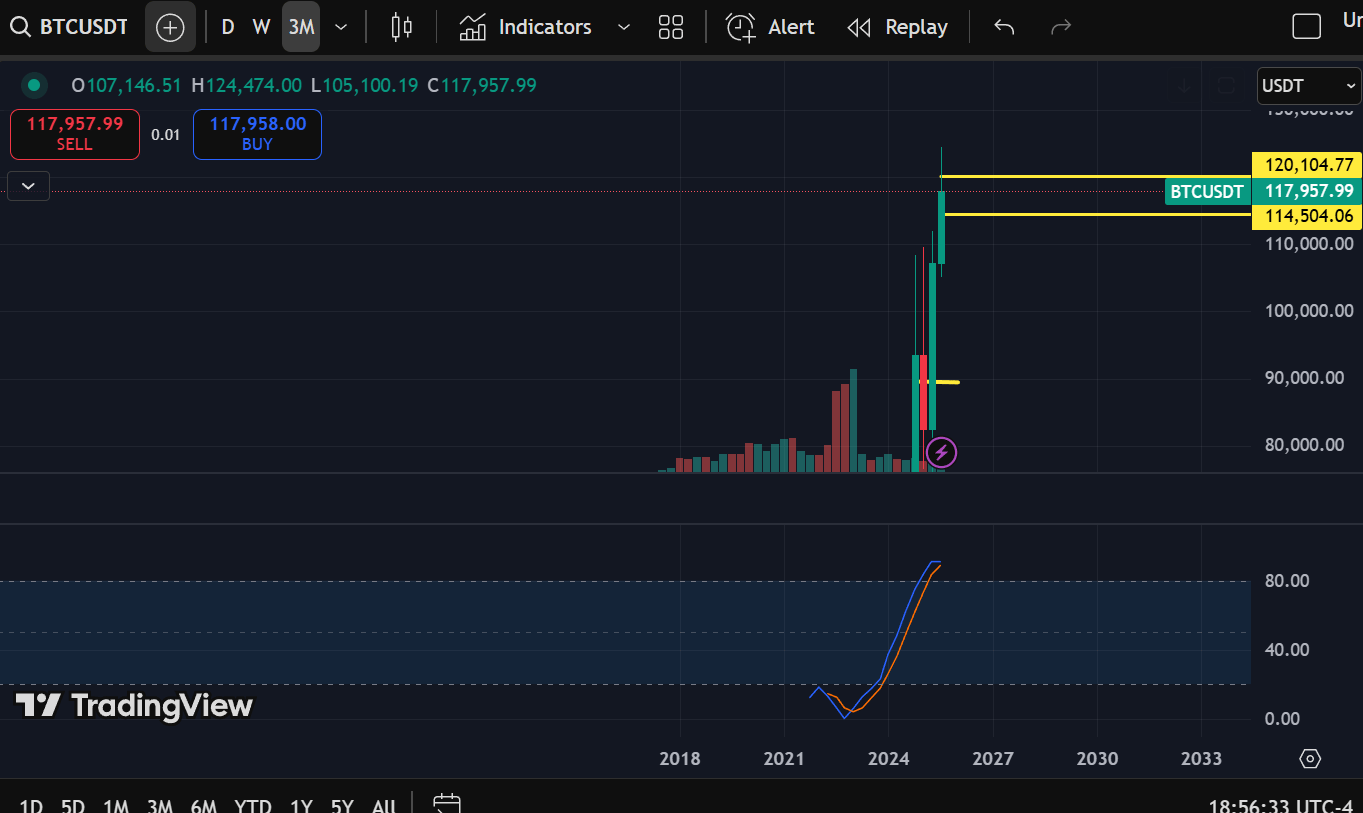

The 3-Month Chart

We are clearly in overbought territory.

And since we’re talking about the three-month timeframe, the highest macro timeframe, it means there are no fakeouts here.

When that chart stretches, it’s telling you something real.

This is already a place where you should start being cautious.

Not bearish. Cautious.

My take: BTC has done its job leading the market. Expect slowing momentum and more sideways action. This is healthy and expected.

The Monthly Chart

This is where it gets interesting.

We now have bearish divergence on both RSI and Stoch RSI.

Price has pushed higher, but the indicators are printing lower highs.I anticipated this weeks ago. Why? Because the divergence only forms if price extends further while momentum lags.

And here we are, it’s playing out exactly.However, the monthly Stoch RSI is in a uptrend, the main momentum right now.

My take: Divergence on the monthly doesn’t mean collapse tomorrow. It’s a roadmap. BTC strength is fading, but that doesn’t mean end of cycle. It means rotation.

The Weekly Chart

Here’s where the near-term read comes in.

The weekly Stoch RSI has already started to roll down.

Momentum is shifting.

But notice: price hasn’t broken down. It’s consolidating.

That’s your clue, BTC is preparing to step aside and let ETH and alts run.

My take: The weekly signals consolidation. This is not bear market structure. This is rotation structure.

What Happens Next

So, does this mean the bear market is here?

Absolutely not.

What I expect:

BTC ranges, consolidates, and stops being the headline leader.

ETH takes momentum.

Alts begin to separate, the strong from the weak.

Watch for alts that hold up well during BTC pullbacks.

That’s how you identify strength.

If BTC drops 3–5% and an alt barely moves or even trends higher, that’s your canary in the coal mine.

The Bullish Scenario to Watch

Now, don’t ignore this.

If the weekly Stoch RSI curls back up from here, BTC can still push higher.

All those “overbought” metrics? They can stay extended and go even higher, just like we’ve seen before.

Especially if the monthly Stoch RSI breaks the bearish trendline and rises back into the overbought region.

That would give us another surge higher, potentially dragging ETH and high-cap alts with it before the real rotation phase.

My take: Keep both outcomes in mind. The market is designed to trap the impatient. Don’t lock yourself into one narrative. Track the signals, not your feelings.

Trading Alpha for This Week

Here’s how I’d approach it:

BTC is no longer the easy trade. That’s where retail will stay stuck. We’re moving to the next leg.

ETH is the pivot. Keep an eye on ETH/BTC. If it continues climbing, that’s confirmation that capital is rotating.

Strong alts will reveal themselves in pullbacks. Use BTC dips as stress tests. Which alts hold structure? Those are your rotation winners.

Don’t overextend. If you missed BTC’s run, don’t FOMO full size into ETH at the highs. Use scaling. Enter partial, wait for dips, add slowly.

Watch volume. Breakouts without volume die fast. Alts breaking resistance on strong volume are the ones that carry momentum.

This is how you build conviction without gambling.

The Bigger Picture

Rotation is starting.

This is the phase where the money is made.

BTC has already proven itself. The easy trend trade is over. Now it’s about identifying the leaders of the next leg.

ETH is showing signs.

Some alts are holding strength.

But the window is small—if you wait for Twitter to tell you which coins are pumping, you’re already late.

Don’t Miss This

In my premium Discord, I break these rotations down in real-time:

Which alts are holding relative strength during BTC pullbacks

ETH/BTC levels to watch for the exact rotation trigger

BTC dominance and ETH dominance signals that front-run altseason

My private watchlist of alts positioned before the crowd

Three setups last week alone ran 30–50%. If you’re not inside, you missed them.

👉 Join 9-5 Traders Premium Now

This is the frontline of altseason.

Miss this rotation, and you’ll spend another cycle watching others multiply while you chase leftovers.

The choice is yours.

- Victor