The Future of the Content Economy

beehiiv started with newsletters. Now, they’re reimagining the entire content economy.

On November 13, beehiiv’s biggest updates ever are dropping at the Winter Release Event.

For the people shaping the next generation of content, community, and media, this is an event you won’t want to miss.

I told you weeks ago to stay patient.

Don’t chase strength. Don’t DCA too early.

Wait for the bottom confirmation, not emotion.

And now, it’s here.

The Game Just Changed

For months, I’ve been cautious on altcoins.

Not because I doubted them, but because the structure wasn’t ready.

We didn’t have confirmation that the market had bottomed relative to ETH and SOL.

Total3 (the total market cap excluding BTC and ETH) was bleeding against both pairs, showing money was still rotating into majors, not alts.

That’s why I told everyone: “Hold off. Wait for the retest. Then we strike.”

Now look at the charts.

TOTAL3 / SOL

The chart just printed its first higher low in over a year.

That’s your confirmation that the alt market has found a bottom relative to SOL.

The ratio bounced cleanly off the 4.6B range low, and volume’s starting to rise.

Translation? Alts are beginning to outperform SOL.

This is the earliest and cleanest sign of altseason ignition.

Not full-blown mania, but the beginning of the shift.

When this chart trends upward, it means your altcoins finally have tailwind.

Not resistance.

TOTAL3 / ETH

Same story.

We retested the range low at 1.96, held it perfectly, and are now on the cusp of a higher low.

ETH has been strong, no doubt, but when Total3 holds up this well even as ETH climbs, it signals that money’s starting to spread wider.

That’s the sweet spot.

That’s where the real multiples happen.

This is why I told my 9-5 Traders:

“Now is the time to scale in, not months ago.

The confirmation came. The structure flipped. The cycle shifted.”

When both TOTAL3/ETH and TOTAL3/SOL show bottom formations, you don’t hesitate.

You rotate with conviction.

My Positions

Let’s talk specifics.

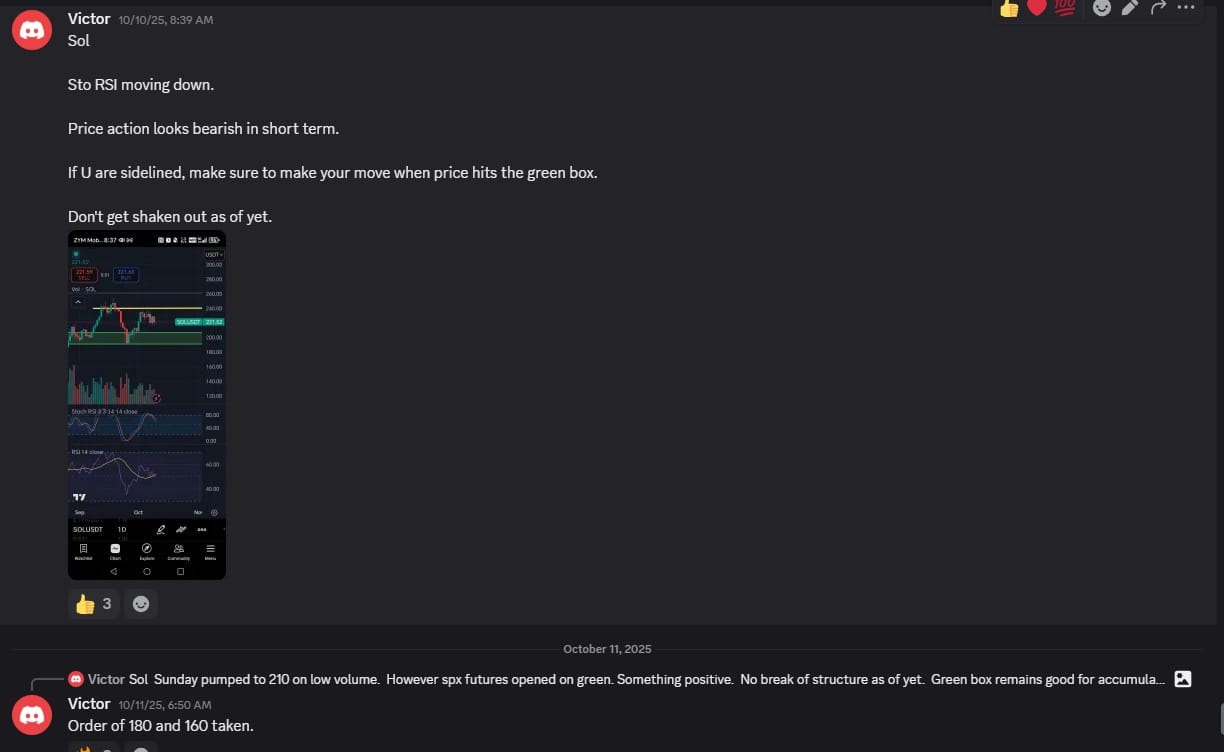

SOL I added positions at 220, 192, 180, and 160.

All limit orders filled during that violent liquidation drop.

When others panicked, I scaled in.

Because I warned you earlier, stochastic RSI was turning down, and a flush into the green box was likely.

Now, SOL is back around 196, recovering beautifully.

The structure is clean, the higher low confirmed, and we’re holding until either SOL or ETH breaks ATH.

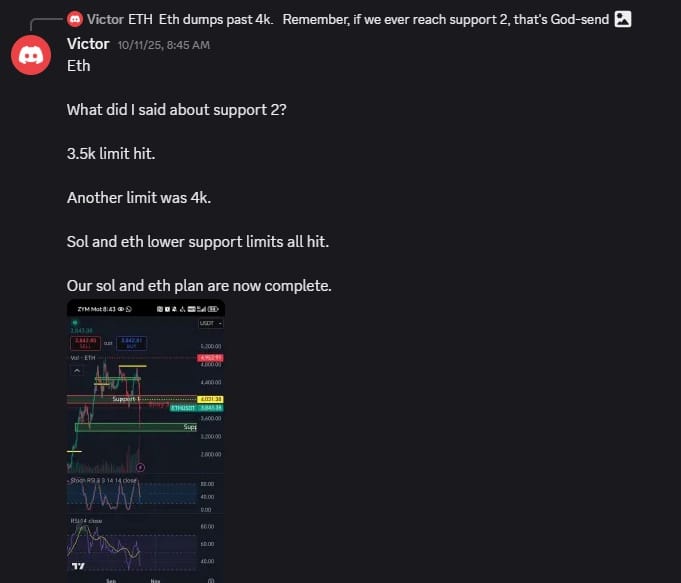

ETHEREUM – Same playbook.

Back on 25 September, I said in Discord:

“If we get the flush, 3.5k support is where I want my next fill.”

And on liquidation day, bang.

3.5k and 4k limit orders hit perfectly.

Every lower support level executed.

Now we wait.

Not for hopium, for confirmation.

I’m still holding both SOL and ETH until one breaks ATH.

That will be the signal that the next leg of this bull run is live.

What This Means

Altseason doesn’t begin when Twitter says it does.

It begins when Total3 forms higher lows while BTC and ETH hold strength.

That’s exactly where we are right now.

BTC is consolidating above 120k.

ETH just reclaimed 4k.

SOL found buyers at 180–200.

And TOTAL3 ratios are showing rotation.

You couldn’t ask for a cleaner setup heading into Q4.

And I’ll say it again, this is not the time to hesitate.

It’s the time to execute.

What Comes Next

Here’s the rotation sequence I’m watching:

BTC holds above 135k – expansion phase confirmed.

ETH/SOL breaks ATH – liquidity rotates into Layer-1s

TOTAL3/ETH spikes – altcoins start outperforming majors.

Mid-cap explosion – the main altseason wave hits.

You don’t chase step 4. You prepare during step 2–3.

That’s exactly where we are now.

Smart money scales in before dominance rolls over.

Final Word

If your portfolio is still bleeding, relax.

If you’ve been patient, congratulations, this is where it starts to pay off.

You’ve survived the hardest part of the cycle, the waiting, the fakeouts, the doubt.

Now comes the real game: rotation and conviction.

We’re entering the part of the cycle where every move counts.

You either take action with structure or spend another bull market watching others win.

That’s why I built the Altseason Playbook and Crypto Exit Manual not just for entries, but for this exact moment when the rotation flips.

I’ll be updating the modules in real time as altseason unfolds. new setups, rotation pairs, and profit-taking frameworks that mirror what I’m doing in my own portfolio.

Right now, the full access bundle (Playbook + CEM + Discord) is $117, but it jumps to $137 this October.

I’m adding new playbooks for Layer-1 rotations, TOTAL3 strategy, and capital scaling.

If you’ve been sitting on the sidelines, now is your moment.

Join us before the price hike.

Learn how to play the rotations, not react to them.

Don’t wait for the crowd to call altseason.

By then, it’s already over.

Victor