Let’s cut straight to it.

The charts don’t lie. They’re whispering the next moves before retail even wakes up.

This week, it’s all about dominance metrics. They’re the compass right now. Ignore them and you’re trading blind.

BTC Dominance (BTC.D)

Two green weekly candles right above the trend line.

Bitcoin is slowly regaining its foothold. That’s undeniable.

But here’s the nuance:

If BTC dominance rises slowly while the Stoch RSI races toward overbought, that’s actually bullish for alts. Why? Because BTC is moving up, but not aggressively enough to kill alt momentum. The relative strength bleeds into ETH and mid-caps.

If dominance growth accelerates hard over the next few weeks and pushes into overbought, then alts get dragged. ETH included. That’s when you’ll see the pullbacks.

This is the knife’s edge right now: either alts get room to breathe or BTC sucks the air out of the room again.

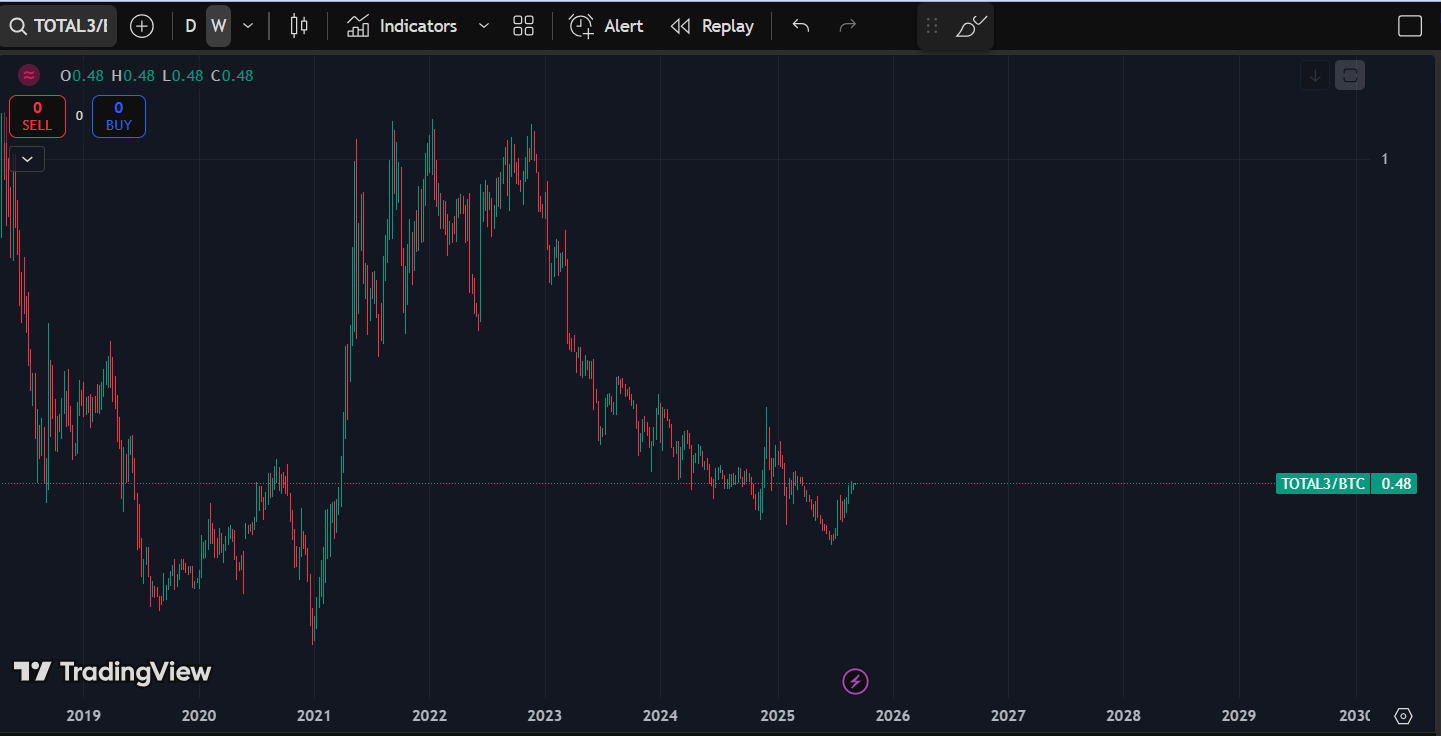

TOTAL3/BTC

The ratio is slowing momentum into a local top.

That tells me one thing: BTC dominance still has room to run.

Translation? Alts vs BTC are struggling to keep pace. When this metric stalls, it’s usually BTC season. Expect alts to bleed in BTC pairs if dominance continues north.

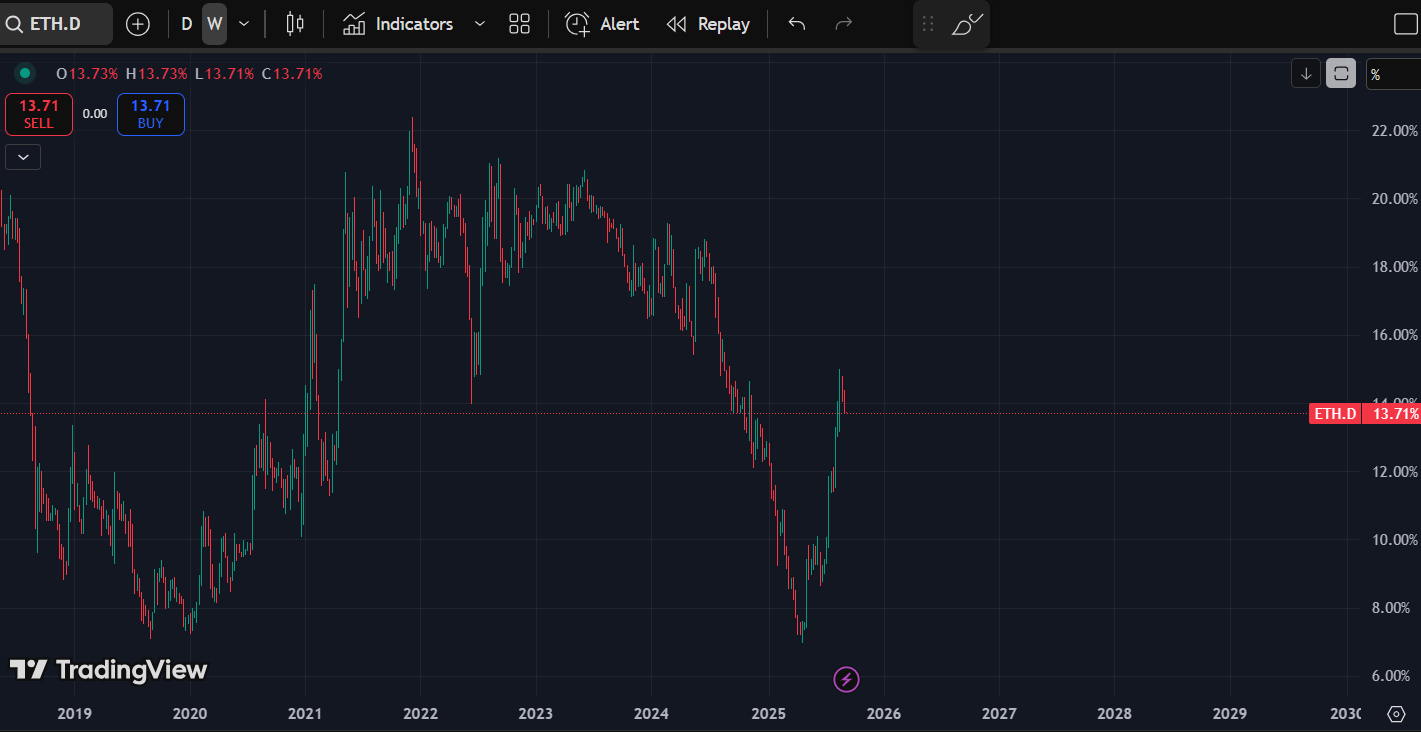

ETH Dominance (ETH.D)

Two weekly red candles. Clean rejection off the 14% mark.

ETH dominance is now hanging below resistance, that’s weakness until proven otherwise.

My read:

Likely chop between here and the 12% support.

If ETH.D finds strength on that support, ETH can keep outperforming the field.

If not, ETH bleeds while BTC eats first and the majors get pushed back.

Right now, ETH is caught between trying to prove itself and fighting BTC’s rising tide. Keep that in mind if you’re overweight ETH.

Swap, Bridge, and Track Tokens Across 14+ Chains

The Uniswap web app lets you seamlessly trade tokens across 14+ chains with transparent pricing.

Built on audited smart contracts and protected by real-time token warnings, Uniswap helps you avoid scams and stay in control of your assets.

Whether you're discovering new tokens, bridging between chains, or monitoring your portfolio, do it all in one place — fast, secure, and onchain.

TOTAL3-USDT-USDC vs ETH

This is the one that retail isn’t watching.

Two green weekly candles are in. The metric is testing the yellow line.

Break above? That confirms a local bottom → Total3 outperforms ETH short-term. Doesn’t mean they beat BTC, but it’s where rotations start.

Rejection here? Expect the downtrend to continue, meaning ETH keeps outperforming and the smaller alts stay crushed.

This metric is the litmus test for when real altseason rotations can even begin. I’m watching it like a hawk.

SOLETH

The chart’s bouncing off a local bottom. Looks promising, but no confirmation until a higher low forms.

One reminder: SOLETH can pump even if both SOL and ETH are dumping. It just means SOL is dumping less than ETH.

That’s why I always tell you, don’t just look at absolute USD pairs. Relative strength tells the real story.

What This All Means

BTC dominance regaining traction - alts need to wait for confirmation before the next leg.

ETH losing 14% dominance - rejection makes it vulnerable unless it defends 12%.

TOTAL3 metrics mixed - short-term opportunity if the yellow line breaks, but no clean reversal yet.

SOL vs ETH pair showing resilience - could be a leading signal if it confirms structure.

This is where most traders lose the plot. They only chase what’s pumping in the moment. They don’t zoom out to see why money is flowing where it’s flowing.

Generational wealth isn’t made buying green candles. It’s made reading these rotations and loading when the doubt is loudest.

My Bias This Week

BTC continues to grind dominance higher.

ETH trades defensively unless dominance finds support.

Alt rotations (TOTAL3) hinge on breaking that yellow line, otherwise, more bleed.

SOL showing strength vs ETH is worth tracking closely.

Here’s the hard truth:

If you’re still treating this like a hobby, you’re going to get left behind. The next 12–18 months are where exits are made. Not in 2030. Not in the next bear. Now.

Most of you reading this are still juggling your 9-5 while trying to trade the most brutal market in the world. That’s exactly why I built the Crypto Exit Manual (CEM), it’s the framework I wish someone handed me when I was in your shoes.

Stop guessing. Stop winging it. Start trading with conviction.

Get inside the 9-5 Traders framework and make this cycle your last cycle working for someone else.

Victor