Not because we’re about to explode.

Not because a headline will save the market.

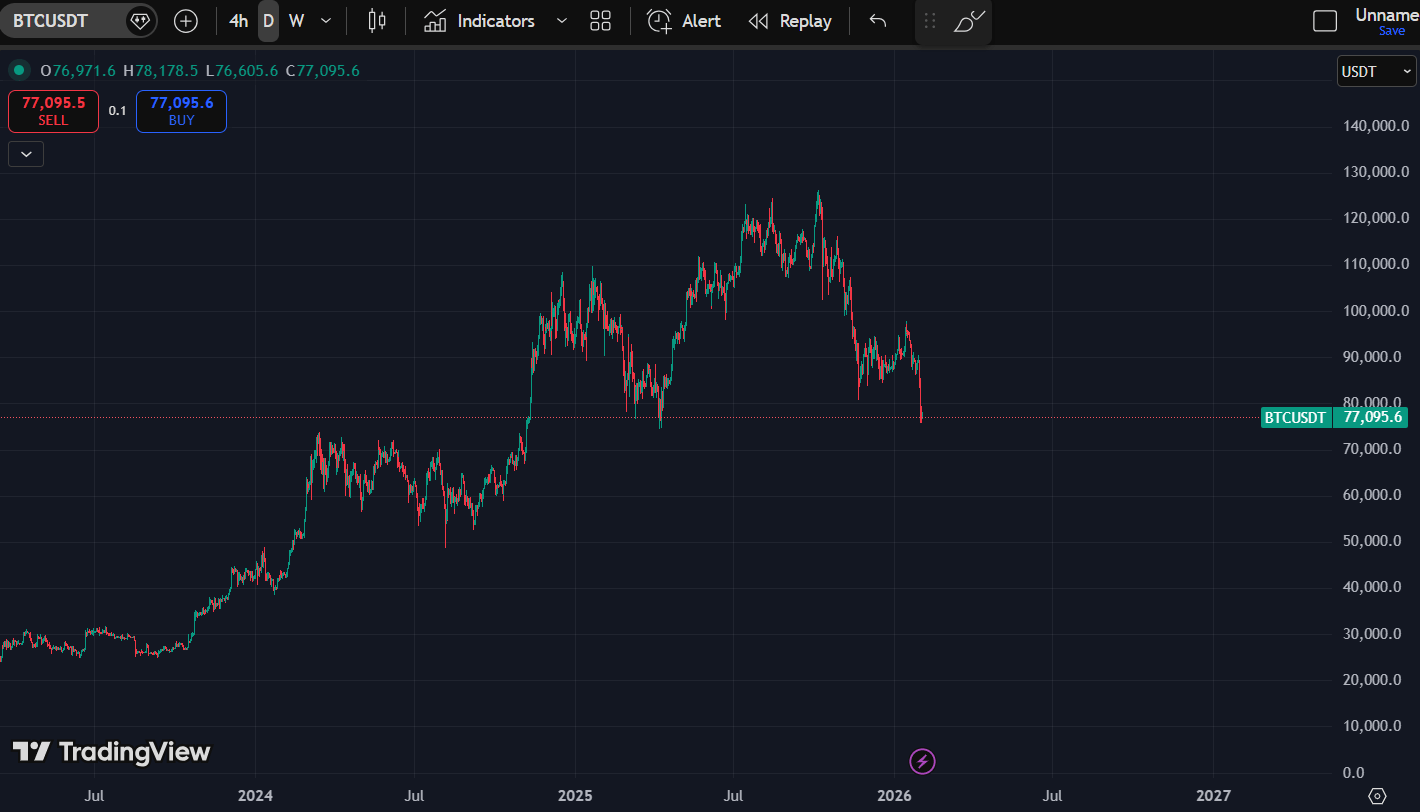

But because Bitcoin is sitting on a higher timeframe decision zone that will define how the next few weeks play out.

Right now, price is not trending.

It is not collapsing either.

It is sitting directly on higher timeframe support, where outcomes are decided quietly, not emotionally.

If you’re looking for excitement, this is not the week.

If you’re looking for opportunity, this is exactly the kind of week that sets it up.

Where We Are Now

Bitcoin has pulled back aggressively from the highs and is now testing the HTF support zone around 73k–76k.

This zone matters because it previously acted as resistance for months before breaking.

Old resistance turning into support is how bull structures survive pullbacks.

So far, price is reacting.

Not bouncing aggressively.

Not slicing straight through either.

That’s what acceptance testing looks like.

Key Levels to Carry Forward

These are the only levels you need this week.

Everything else is noise.

Resistance

80.6k

First meaningful resistance on any bounce.

Expect reactions here, not clean continuation.

97.8k

Major reclaim level.

If price can accept above this, the structure starts to repair.

107k

Range high and previous distribution area.

This is not a level you chase into.

Support

76k–73.5k

Primary higher timeframe support zone.

This is where bulls must show up if structure is to remain intact.

A weekly close holding this zone keeps the bull structure alive.

48.9k

Deep downside liquidity.

Only relevant if higher timeframe structure fully fails.

We are not there.

But it exists for a reason.

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

What the Weekly Structure Is Saying

This is not a crash.

This is a pullback into support after distribution.

That distinction matters.

Markets don’t go straight up.

They move in cycles of expansion and contraction.

Right now, we are contracting.

The key question this week is simple.

Do buyers defend 73k–76k, or do they step aside?

If they defend, this becomes a base-building phase.

If they don’t, price searches lower for liquidity.

No guessing required.

Just watch the close.

What To Do If You’re Sidelined

If you are not in a position, that’s not a problem.

Being flat here is not weakness.

This is what patience looks like.

Your job is not to predict the bottom.

Your job is to wait for confirmation.

That means one of two things.

• A clean reaction and hold above 73k–76k, followed by acceptance above 80k

• Or a deeper sweep that resets sentiment and offers a better risk-to-reward entry

Do not buy just because price is down.

Buy when structure tells you risk is defined.

If you feel FOMO while price is chopping at support, that’s your signal to slow down.

The best entries rarely feel urgent.

What To Do If You’re Already In Position

If you’re holding BTC from higher levels, this is not the time to panic.

But it is the time to be honest.

Ask yourself three things.

Is my position sized correctly for volatility here

Do I know where my invalidation is

Am I holding based on structure, or hope

If your position is too large, reduce.

If your invalidation is unclear, define it.

If you’re holding purely on belief, that’s risk, not conviction.

For longer-term holders, the line is simple.

As long as 73k–76k holds on the weekly, this remains a pullback, not a trend break.

A clean weekly close below that zone changes the risk profile and requires reassessment.

Not panic.

Reassessment.

What This Week Is Really About

This week is not about catching a bounce.

It’s about seeing who is still willing to defend structure.

Low volume weeks like this are designed to drain patience.

They shake out overleveraged traders and reward restraint.

If you’re bored, that’s normal.

If you’re frustrated, that’s the point.

The market is not asking you to act.

It’s asking you to wait.

Final Thoughts

Bitcoin is doing exactly what a healthy market does after a strong run.

It’s testing conviction.

It’s testing discipline.

It’s testing whether participants are trading structure or emotion.

The next real move will not start from excitement.

It will start from boredom.

Stay patient.

Stay structured.

And let the weekly close do the talking.

If you want real-time BTC updates, level reactions, and positioning context as this plays out, that’s what the Discord is for.

The market will move whether you’re ready or not.

Your edge is being prepared when it does.

Want ETH and SOL Updates?

I’m tracking ETH and SOL closely, but I keep those breakdowns inside the Discord, where I can react in real time and explain positioning properly.

If you want:

• Live BTC, ETH, SOL structure updates

• Real-time level tracking

• Context around fake moves and liquidity traps

• Calm, structured guidance during chop

Join here:

👉 Paid Discord:

https://whop.com/digitalvault1

If you want a lighter version with periodic updates and psychology notes, start here:

👉 Free Group:

https://whop.com/digitalvault1/digital-vault-free/

This range will end.

The question is whether you’ll still have capital and clarity when it does.

Victor