Let me be blunt.

Stocks took a couple of hard red days, and crypto reacted like the over-leveraged punching bag it always is, dumping harder, faster, and with more panic.

But here’s the thing: the bleeding slowed down into the weekend. And as always, what looks like chaos on the surface is just positioning for those who know where to look.

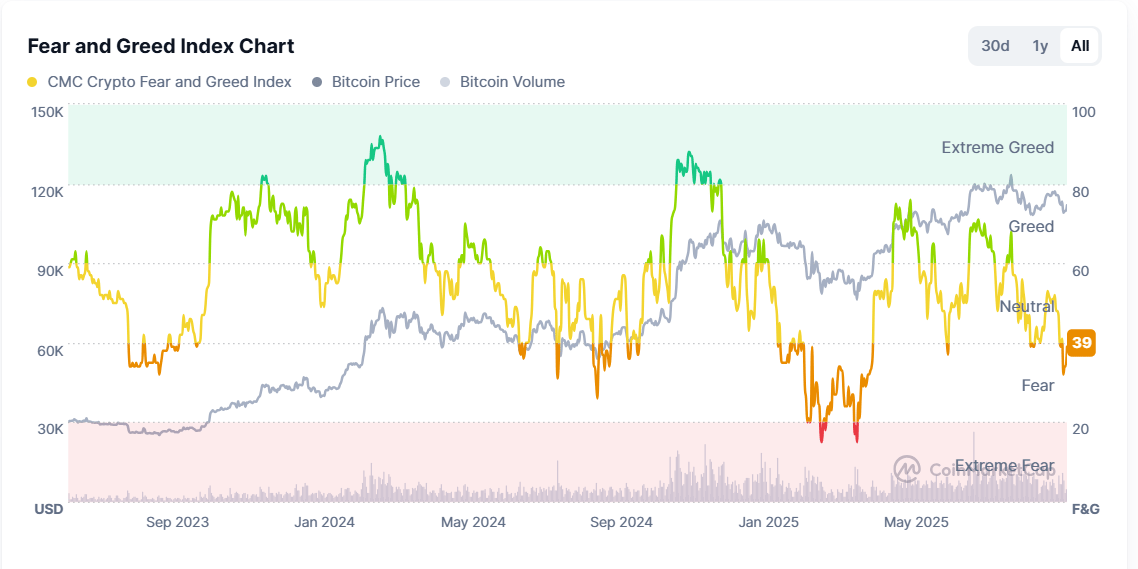

Fear & Greed Index

We’re sitting at 39/100, firmly back in Fear territory.

When stocks sneeze, crypto catches pneumonia. The panic in equities bled into BTC, ETH, and alts, and crypto’s volatility magnified it.

Here’s the real alpha:

Fear zones are where wealth is built.

When everyone panics on a few red candles, that’s when killers quietly accumulate.

But fear can also spiral. Just because we’re at 39 doesn’t mean we bounce instantly. It means the crowd is emotional, and emotions never lead to good trades.

My take: this is exactly the zone I want to be watching. Not for chasing longs, but for preparing entries.

Bitcoin (BTC)

BTC looked brutal midweek, down almost 5%. But by Sunday, we’d clawed half of it back and finished only 2.5% down on the week. That’s resilience.

Here’s the setup:

If BTC holds current support and reclaims the diagonal resistance, next week flips green.

October historically prints strong when September is green. With September closing positive, that stat is in play again.

The psychology? Retail panicked on the 5% dip. Killers saw it as noise. If BTC sweeps [premium] and holds, that’s a buy zone. Even a retest of [premium] isn’t bearish, it’s just mid-cycle accumulation.

The real danger isn’t BTC dropping, it’s traders losing conviction when they should be adding.

Ethereum (ETH)

ETH broke support hard this week and flushed under 4k. That scared a lot of people. But zoom in, ETH instantly reclaimed 4k and is now back in range.

Levels to watch:

Support 1: [premium] – reclaimed, but fragile.

Support 2: [premium]– the level I’d love to see tagged for a stronger setup.

Upside: [premium] remains resistance.

Here’s how I’m playing it: ETH looks weak near-term, but weakness is where explosive moves are born. If we get a deeper sweep into [premium], I’ll add. If not, patience pays.

Don’t pray for direction, execute when price hits your levels.

Solana (SOL)

Sunday gave us a little 210 pump on low volume. Nothing confirmed, no structure broken. But the reaction matters.

Here’s my read:

Green box accumulation zone remains valid.

Short-term support sits around [premium].

If we dip into [premium], that’s Godsend territory. That’s where you bulk up.

Remember, SOL has already shown strength this cycle. It wicked to 250 weeks ago while ETH chopped sideways. That tells me money wants to flow here.

SOL doesn’t need permission from ETH or BTC to run. When liquidity rotates, this is where I want size.

The Bigger Picture

This was a fear-driven week. Stocks red - crypto nukes harder - retail panics - Fear & Greed hits 39.

But if you’ve been with me long enough, you know how this game works:

Fear = opportunity.

Weak hands puke positions.

Smart money accumulates.

BTC is still in a healthy mid-cycle range. ETH looks bloody, but that’s exactly how supports are tested. SOL is sitting pretty in its accumulation zone.

The weak see pain. The prepared see setups.

Final Word

This is not the time to doubt the cycle. This is the time to position.

Crypto doesn’t wait for your emotions to settle. It punishes hesitation and rewards execution.

And one more thing: October is your last chance before the price hike.

Right now, access to the Altseason Playbook, Crypto Exit Manual, and 9-5 Traders Discord is just $117. In October, that jumps to $137.

If you’ve been sitting on the sidelines thinking you’ll “join later,” let me be blunt: later will cost you more. Later might cost you the whole cycle.

Join us now. Get the Playbook, get the Manual, and get inside the Discord where I break down these moves in real-time.

This is the cycle that sets you free from your 9-5. Don’t waste it.

Victor