Stoch RSI is overbought.

It’s starting to curl down.

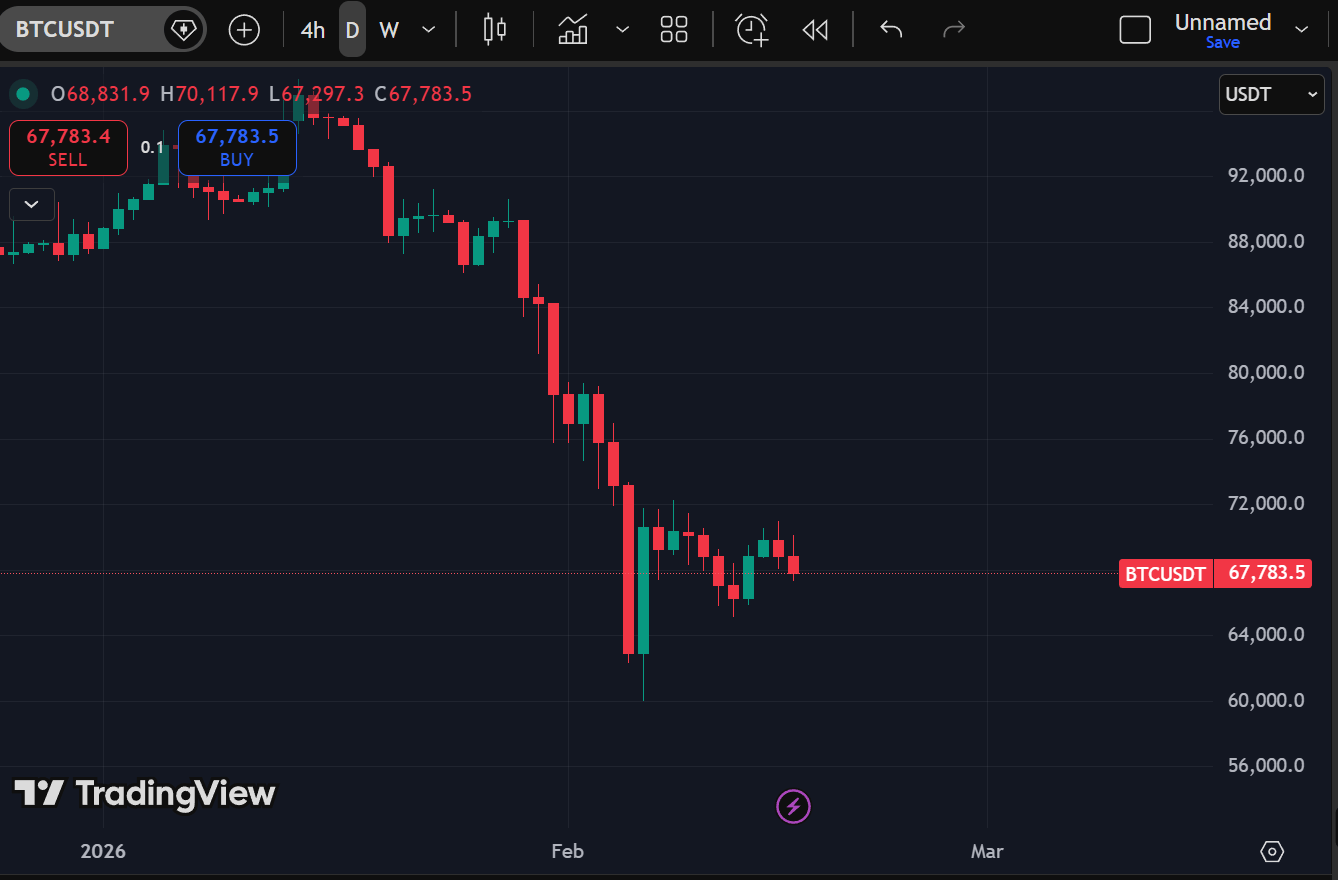

And what did price just print?

A wick.

Followed by a lower high.

Let that sink in.

Everyone got excited over the inflation cooldown headline.

Risk-on tweets everywhere.

“Bottom is in.”

“Macro pivot.”

“Send it.”

But price?

Still inside the 60k–80k range.

Still below 73.5k.

Still printing lower highs.

Momentum spiked fast.

Price barely moved.

That’s not strength.

That’s relief.

What Most Traders Miss

Oscillators don’t signal direction.

They signal velocity.

When Stoch RSI rockets to overbought inside a downtrend and curls down near resistance, it usually means one thing:

The bounce is losing steam.

We just had:

• Overbought Stoch RSI

• Curling down

• Wick rejection

• Lower high

• No reclaim of 73.5k

That’s not a breakout setup.

That’s range resistance doing its job.

Structure > Narrative

Let’s strip emotion out.

We are:

• Inside 60k–80k macro range

• Below prior breakdown pivot

• Printing lower highs on daily

• Failing to build acceptance above mid-range

As long as 73.5k is not reclaimed cleanly, rallies are suspect.

Simple.

If this was real strength, we would see:

• Impulsive candles

• Volume expansion

• Strong closes near highs

• Momentum holding above 50

Instead, we’re seeing:

• Weak pushes

• Upper wicks

• Indicator cooling

• No structural shift

That’s not bullish.

That’s distribution inside a range.

What Happens Next?

Two high-probability scenarios:

1. Rejection and revisit [free room and paid discord]

If momentum rolls over and price breaks local support around [free room and paid discord], [free room and paid discord] gets tagged again.

And the second test of support is always more dangerous than the first.

2. Chop and bleed

We stay stuck between [free room and paid discord]

Oscillators reset again.

Retail gets chopped.

Capital slowly transfers from impatient to patient.

Breakouts in ranges are traps.

Real moves come after compression.

Let Me Be Honest

Most traders don’t lose because they’re wrong.

They lose because they’re early.

They front-run breakouts.

They front-run bottoms.

They front-run narratives.

Right now, the edge is not prediction.

It’s positioning.

If you’re sidelined, you’re winning.

If you’re trading the middle of this range, you’re donating.

Key Levels

Resistance:

73.5k – must reclaim

[free room and paid discord] – range high

Support:

[free room and paid discord] – local structure

[free room and paid discord] – range low

Below [free room and paid discord] and [free room and paid discord] opens

That’s the map.

Everything else is noise.

Don’t Marry the Oscillator

Stoch RSI overbought curling down doesn’t mean crash.

It means momentum is cooling.

If price confirms weakness, then it matters.

If price reclaims [free room and paid discord] strongly, then this reset becomes bullish.

Indicators are secondary.

Structure is king.

The Real Game

The ones who win this cycle don’t trade every candle.

They:

• Wait for acceptance levels

• Preserve capital

• Scale at extremes

• Attack only when odds shift

Generational wealth isn’t made in the middle of ranges.

It’s made in the doubt.

And right now, doubt is everywhere.

Which is good.

But structure still hasn’t flipped.

If you’re still guessing, you’re already behind.

My free room gets daily structure updates without the Twitter noise.

And inside the paid Discord, we break down:

• Exact invalidation levels

• Options positioning strategies

• Risk frameworks for range environments

• How to size when volatility compresses

We don’t trade headlines.

We trade structure.

All levels above are available to view in free room:

👉 Free Room: https://whop.com/digitalvault1/digital-vault-free/

If you want to know my thoughts on SOL, ETH and other alts,

Then step into the paid Discord if you’re serious about playing this cycle like a professional.

👉 Paid Discord: www.whop.com/digitalvault1

Stop reacting.

Start operating.

Victor