Let’s reset and start the week properly.

There’s a lot of noise right now about alts.

Rotation talk.

Altseason hope.

Relative strength charts everywhere.

But before we get ahead of ourselves, we need to anchor back to something simple:

Bitcoin still matters.

Every cycle, people forget this.

And every cycle, the market reminds them the hard way.

BTC: The Line in the Sand

Even with all eyes drifting toward alts, Bitcoin must continue to show strength for anything else to work.

Right now, [premium] remains the key level.

We have tested this zone multiple times.

Each rejection matters.

If BTC continues to get rejected here, the path of least resistance shifts lower.

This does not mean panic.

It means structure.

BTC is still the liquidity anchor of the entire market.

If BTC fails to reclaim and hold key resistance, alt momentum will struggle to sustain.

That is just how this market works.

For now:

Acceptance above [premium] supports continuation

Rejection here increases odds of another leg lower or extended chop

Do not ignore this just because alts look interesting.

BTC leads. Always.

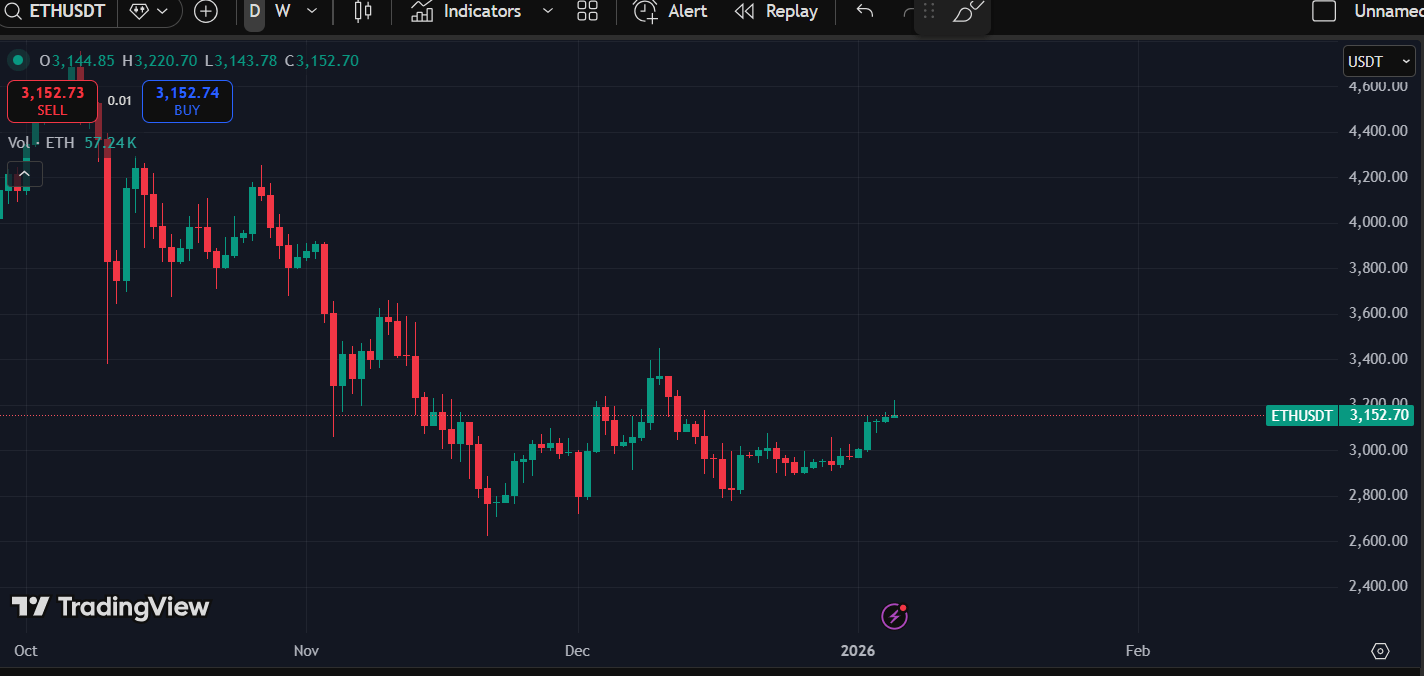

ETH: Structure Still Intact

ETH continues to behave cleanly.

The 2850 entry zone remains valid.

That level did its job.

I announced it during 20 November 2025

On the lower timeframes, [premium] is the next important level.

Why this matters:

A reclaim and hold above [premium] opens up continuation

Failure there keeps ETH in range behavior

ETH does not need to explode immediately.

What matters more is that it:

Holds structure

Builds higher lows

Does not lose momentum relative to BTC

ETH is still the bridge asset.

As long as ETH structure holds, alt rotations remain possible.

If ETH breaks down, that narrative pauses.

Simple as that.

SOL: Good Breakout, But Timing Matters

SOL is the most interesting chart right now, but also the most dangerous to misunderstand.

The good news:

SOL has broken out of the downtrend line.

That is real.

That matters.

We are also still above the last key support, which keeps the bullish structure intact.

The bad news:

Daily Stoch RSI is overheated.

This creates a very specific condition.

When momentum indicators are stretched, price has two options:

Move fast and expand

Or stall and roll over

Sideways consolidation while momentum is overheated usually resolves to the downside.

That is the risk here.

This is why [premium] is the key level.

As long as SOL holds above 147 and pushes higher quickly, momentum can sustain.

If price stalls too long and Stoch RSI rolls over, downside pressure increases.

This is not bearish.

It is conditional.

Momentum assets require momentum.

Context Matters More Than Bias

This is where many traders mess up.

They fall in love with one direction.

Bullish?

They ignore resistance.

Bearish?

They ignore support.

Right now, the market is giving us conditional setups, not certainty.

BTC must show strength.

ETH must reclaim higher levels.

SOL must move with urgency.

If those conditions are met, continuation makes sense.

If not, patience matters.

What Not to Do This Week

Do not force trades just because it is Monday.

Do not overreact to single candles.

Do not assume alt strength can exist independently of BTC.

This week is about confirmation, not prediction.

Let the market show its hand.

Big Picture Reminder

We are still in a phase where:

Momentum exists, but is fragile

Structure is forming, not resolved

Sentiment can flip quickly

That means discipline matters more than conviction.

You do not need to be aggressive.

You need to be prepared.

Final Notes

Watch BTC at [premium]

Watch ETH at [premium]

Watch SOL at [premium]

Those levels will tell you more than any narrative.

If the market wants higher, it will show you.

If it does not, step back and preserve capital.

There is no rush.

The goal is not to trade every move.

The goal is to stay aligned when the real move comes.

Let’s see what the week gives us.

This is where the magic happens.

See you inside

Victor