And just like that, a new all-time high period has begun.

Bitcoin has printed the highest weekly close in history.

No more guessing. No more “maybe later.”

This is the phase where legends are made, and late buyers become liquidity.

Let’s break it down.

Bitcoin (BTC)

This was the breakout week.

We’ve officially entered a new ATH expansion zone, possibly the final major leg of this cycle.

Those who listened, who accumulated through the chop, who bought fear at 100k, who ignored the noise, are now sitting in the driver’s seat.

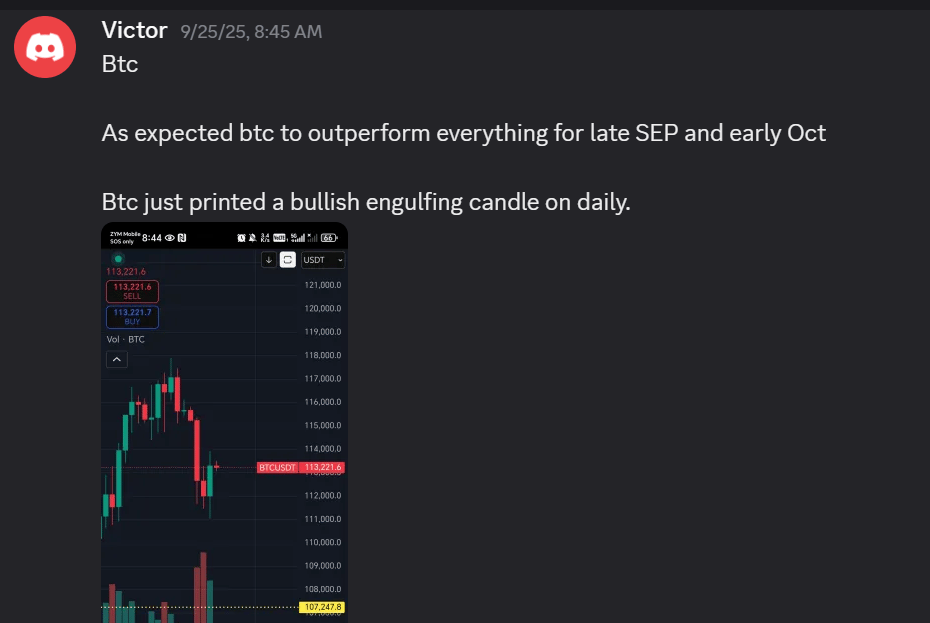

This was posted 25/9/25 - when BTC was just 113k.

Now it’s time to scale out partial profits.

Yes, I said it.

When BTC starts printing ATHs, you don’t diamond-hand everything, you secure your upside so you can rotate with power later.

We’re seeing minor profit taking at these highs, but the candle structure remains strong. If BTC holds this zone for a few weeks, we can expect an expansion phase above ATH, similar to the 2021 post-breakout rally.

However, don’t ignore the risk.

An ATH rejection is possible. If we see a retrace into the breakout zone, that’s not weakness. It’s a reload opportunity for the next leg.

Key Levels:

Immediate Resistance: 124.5k (current ATH zone)

Support Zone 1: 114–110k

Support Zone 2 (LTF Reaccumulation): 100k

Macro Invalidations: Below 96k weekly close

My take:

Stay disciplined.

Take profits into strength.

Prepare stablecoins (USDT/USDC) for rotation when dominance cools.

This is very likely the final BTC expansion leg before mid-cycle distribution begins.

Historically, BTC prints its peak structure 500–550 days post-halving. That window lands around Q3–Q4 2025, exactly where we are now.

This phase separates the killers from the tourists. The ones who bought the bottom will be selling to those who just realized we’re in a bull market.

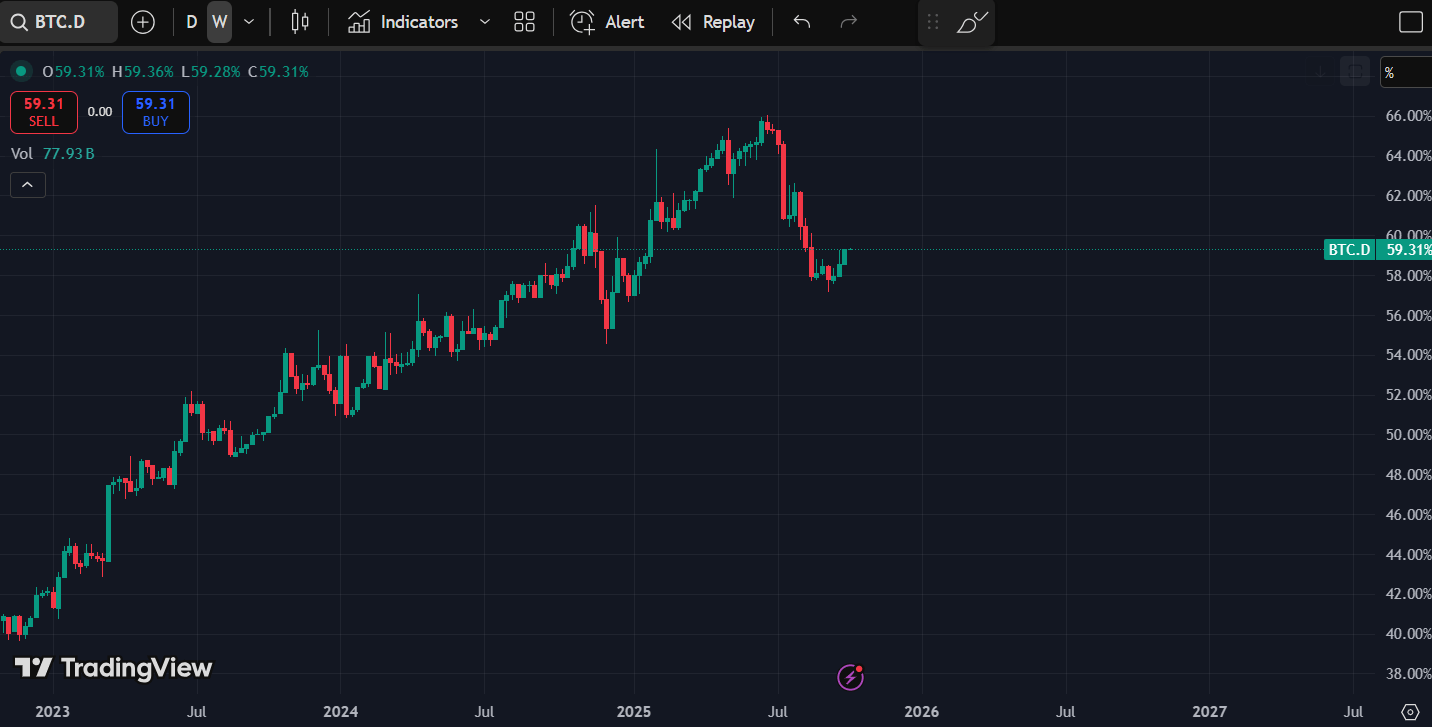

BTC Dominance (BTC.D) – Approaching Peak Zone

Dominance is sitting around 59.3%, just shy of its 62% resistance zone.

This is where BTC historically peaks before liquidity starts cascading down to ETH and mid-caps.

If BTC continues climbing faster than ETH for another 2–3 weeks, expect dominance to retest 62%, followed by:

A potential double-top structure.

RSI divergence signaling exhaustion.

The start of the altseason ignition sequence.

How to Read This:

As BTC.D climbs into overbought, alts lag.

Once it stalls, ETHBTC and TOTAL3BTC rise, signaling the start of risk rotation.

This isn’t hopium. It’s structural.

Every cycle, alt rotations begin 2–4 weeks after BTC sets new ATHs and dominance peaks.

We are right on schedule.

Ethereum (ETH)

ETH printed a bullish engulfing weekly candle, the strongest signal we’ve seen in weeks.

The grind up continues, and with every candle, the probability of retesting 3.8K decreases.

For those who entered around 4k with me, you’re positioned perfectly.

Now the focus shifts from accumulation to execution.

Set your partial profit targets around the ATH region. Don’t get greedy. The next major move isn’t just about ETH/USD, it’s about ETH rotation into alts.

Once ETH dominance stabilizes, capital flows downstream. That’s when the altcoin phase begins, and you want to have your USDT ready.

Key Levels:

Support 1: [premium]

Support 2: [premium]

Resistance: ATH

If ETH can break ATH, it will officially rejoin BTC in price discovery.

But even before that, we’re seeing early signs of ETH.D stabilizing, a precursor to capital rotation.

My plan:

Let ETH push into the [premium] zone.

Secure partial profits.

Begin gradual rotation into high-conviction alts as BTC dominance stalls.

Patience pays more than prediction.

Solana (SOL)

SOL is grinding towards its ATH resistance zone.

We hit 193-220 bottom entries, exactly as planned.

Now, as we approach resistance, I need to warn you, this is where emotions get traders wrecked.

If you’re not breakout buying, this is the time to take partial profits.

Don’t assume SOL will instantly enter price discovery, even though odds favor it.

Remember:

[premium] = partial take profit region.

Rejection here could trigger a pullback.

A higher low would still be bullish.

Sunday’s low-volume push suggests some early profit taking, but the overall trend remains intact.

The playbook from here:

Take partials near resistance.

Keep exposure in case SOL breaks through.

Re-enter on pullbacks if structure holds if you want SOL exposure.

We’ve already done what most traders dream about, entered at the bottom while everyone else doubted. Don’t give it back by getting greedy now.

The Bigger Picture

BTC just printed its highest close ever.

ETH followed with a bullish engulfing candle.

SOL is knocking on its all-time high door.

This is close to the rotation moment, the point where smart money scales out of strength and prepares for the next move down the chain.

You’ve been waiting for this cycle for years.

Now it’s here, and the difference between walking away with life-changing gains or just stories will come down to execution.

Here’s what I’m doing:

Taking profits on SOL and ETH near resistance.

Rotating gradually into high-conviction alts (from the Altseason Playbook).

Holding stables to buy the pullbacks most won’t have the courage to touch.

The market is entering its most volatile and profitable phase, and if you’re not trading with structure, you’ll get wiped by emotion.

Final Word

We’re standing at the edge of history.

BTC is in price discovery. ETH is reclaiming power. SOL is leading the charge.

But here’s the truth: the next 3–6 months are not for tourists. It’s for killers, those who plan, execute, and rotate with conviction.

If you’re still winging it, still “trying to figure it out,” you’re already behind.

This is the final call before the price increase in a few hours.

Access to the Altseason Playbook, Crypto Exit Manual, and 9-5 Traders Discord is $117 now, but it jumps to $137 tomorrow.

I’ll be adding more modules and updates into the discord and Altseason Playbook, Crypto Exit Manual as altseason unfolds, covering live rotation setups, portfolio balancing, and the next batch of large-cap entries.

If you’re serious about turning this cycle into your exit plan, now’s the time to join.

Don’t wait until you’re chasing green candles.

Join us now. $117 today, $137 next month. After that, regret.

Victor