Look.

The market liquidated half a billion on Sunday.

Makes it even clearer that if you don’t have a plan, you will lose your money again and again.

Now back to something you want it so bad - the market’

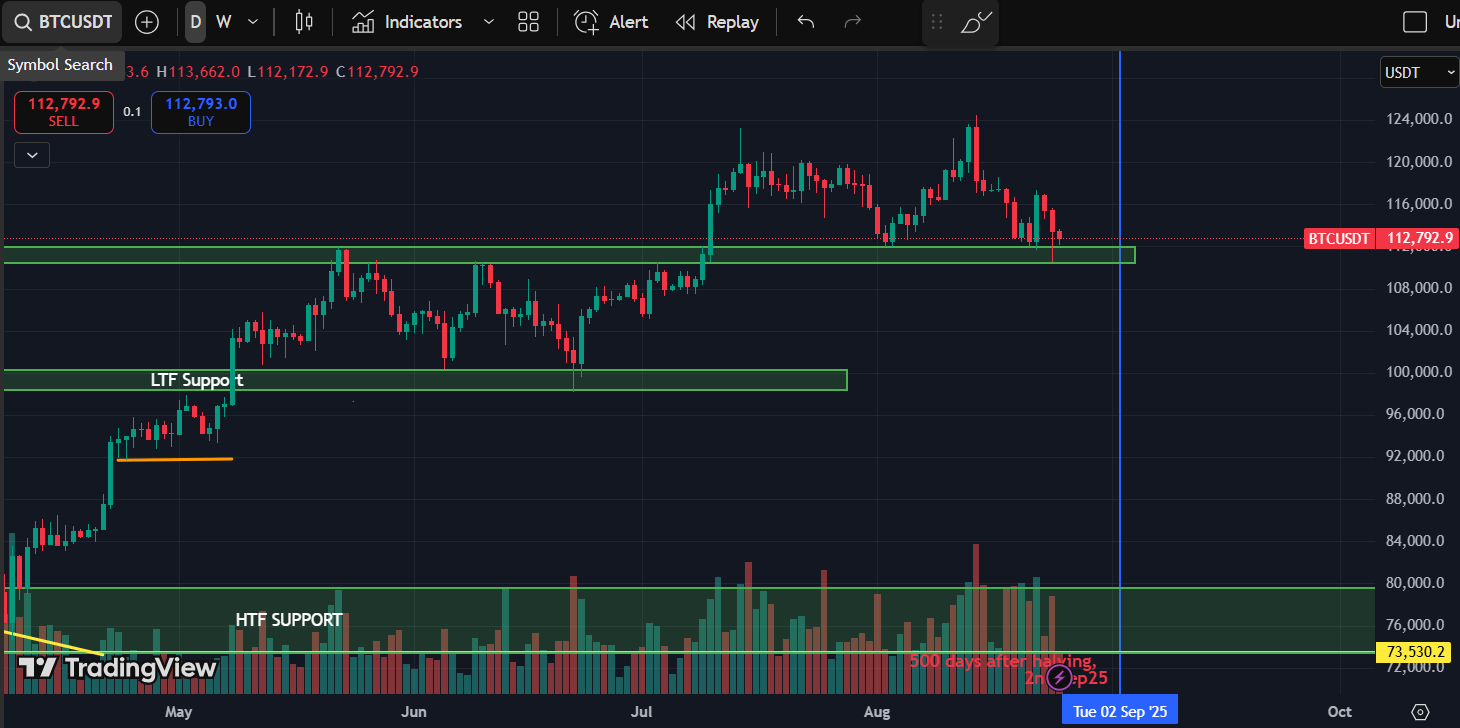

1. Bitcoin (BTC) ~$112,843

Support: $111,900–$112,000

Resistance: $115,200–$115,800

BTC is trading down roughly 2% intraday, holding near critical support. The recent high at $115.2K stands as a resistance point. If BTC breaks below $111.9K, it opens the door to deeper retracement, possibly to $110K. Conversely, a weekly close above $115K signals late-cycle continuation, though signposts suggest BTC fatigue in its dominant role.

My take

BTC leads the cycle. Right now it's in tuck-and-watch mode. A hold here keeps structure valid. A breakdown, and rotation to ETH + pockets of strength elsewhere accelerates.

2. Ethereum (ETH) ~$4,718

Support: $4,680–$4,700

Resistance: $4,950–$5,000

ETH recently hit a fresh ATH above $4.9K before pulling back to test consolidation. That puts resistance overhead, but nothing structurally major between current levels and $5K. The lack of violent retreat suggests bulls are accumulating on minor weakness rather than panic dumping.

My take

ETH is showing real strength while BTC wavers. Institutional flows, ETF action, and sheer demand are layering bids. A clean break with volume over $4.95K could fast-track continuation.

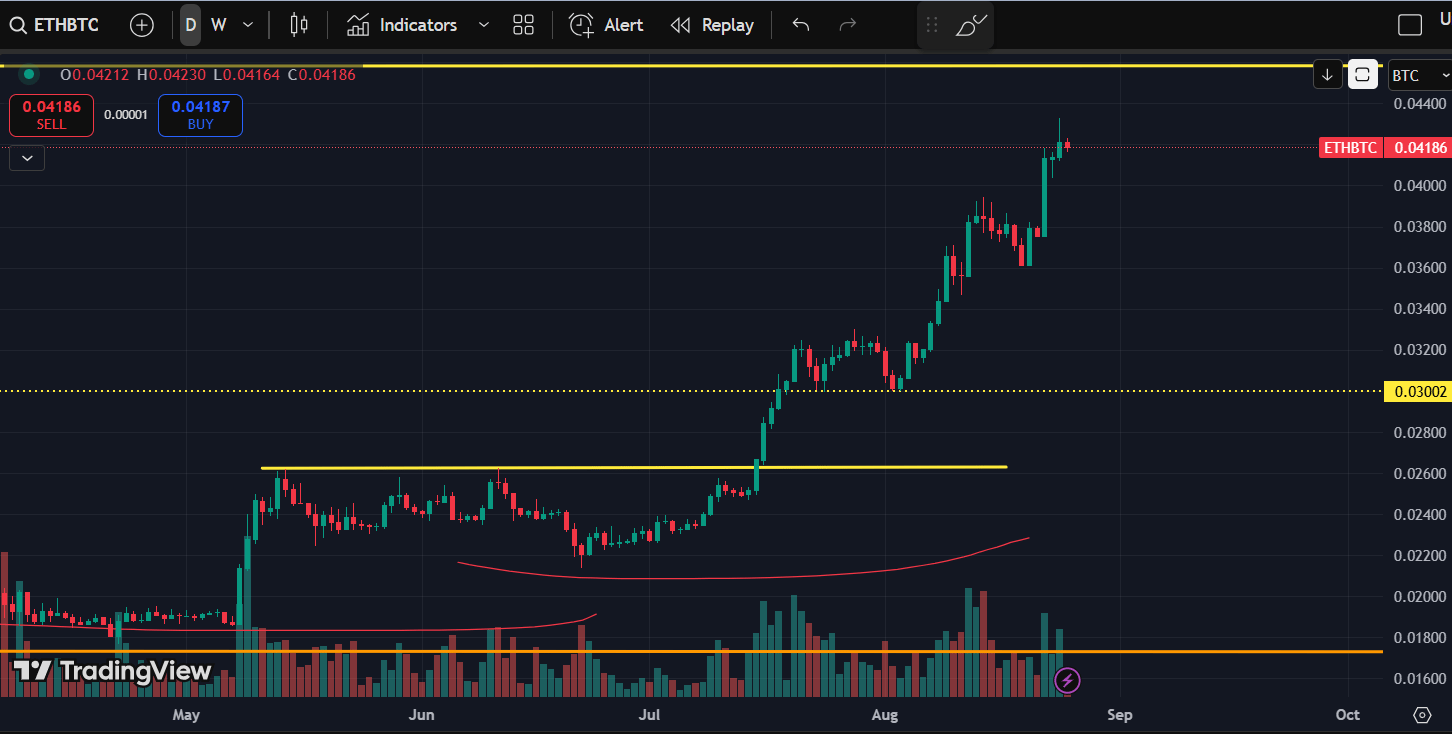

3. ETH/BTC Ratio Gently Climbing

The ETH/BTC ratio is pushing upward, signaling slow but real allocation shift in favor of ETH.

My take

This is one of the single best early signals for rotation. When ETH starts to outperform BTC structurally, and stays there, it means capital is flowing into narrative-driven plays. This is a macro shift, not noise.

4. Dollar Index (DXY) ~98.0, Holding Soft

The dollar is calm, trading just below resistance, supporting risk assets like crypto.

My take

A neutral dollar is your friend here. If it breaks lower, that supports continuation. If it spikes, be ready to hedge. Risk-on remains intact for now.

5. S&P 500 (SPX) ~6,467

Equities are flat-to-up, which structurally supports crypto.

My take

Crypto follows liquidity and risk sentiment. SPX can sustain momentum trends longer than BTC alone. As long as it holds, ETH and alts get the benefit of the lift.

6. Narrative Rotation Signals: Alt Season Loading

ETH dominance (ETH.D) quietly rising.

Total3 (altcap ex-BTC/ETH) showing signs of life, tight in consolidation.

Sol/ETH showing relative strength in narrative layer.

My take

These charts are the rotometer for altseason. When ETH.D and Total3 break structurally higher, coordinated alt performance kicks in, even if BTC holds flat.

Trading Psychology & Positioning

We’re not in hype mode. Nor is this panic zone. This is mode-shift territory. BTC steps aside; ETH steps forward. The money is not chasing NFTs or low-cap trash, it’s flowing into strength and infrastructure.

My take

If you’re still waiting for hype or basing your decisions on tweets, you’re already behind. The real moves come from watching the ratios and acting when rotation signs emerge.

Tactical Summary

Asset | Key Range | What I'm Watching |

|---|---|---|

BTC | $111.9K – $115.2K | Break below = rotation; break above = caution |

ETH | $4,680 – $5,000+ | Watch $4.95K breakout with volume |

ETH/BTC | Climbing | Continued gain = ETH-led rotation |

DXY | ~98.0 | Weakening = fuel; Strength = slow down |

SPX | Sustained above 6.4K | Risk sentiment barometer |

Alt Charts | ETH.D, Total3, Sol/ETH | Quiet signals for alt strength |

Final Thought

Crypto isn’t going vertical in the next 24 hours. This cycle trades like a rotation: phased, selective, and strategic. BTC isn’t broken, it’s just handing off the ball. Watch the recipients closely. That’s where the real opportunity lies.

⚠️ Don’t Miss This

Look.

How can you tolerate someone who is dumber than you make more money than you this cycle?

It’s moving fast, and it rewards only those with conviction and timing.

Altseason is here soon.

The window is small.

And if you’re still passive, you don’t deserve to make it.

In my premium Discord, I break these rotations down in real-time:

Which alts are holding relative strength during BTC pullbacks

ETH/BTC levels to watch for the exact rotation trigger

BTC dominance and ETH dominance signals that front-run altseason

👉 Join 9-5 Traders Premium Now

This is the frontline of altseason.

Miss this rotation, and you’ll spend another cycle watching others multiply while you chase leftovers.

Offer end in 12 hours.

The choice is yours.

- Victor